Aallon Group was founded in 2018 as the culmination of the desires of six long-running accounting firms coming together to form a larger group. In terms of size, Aallon is one of the largest firms in Finland.

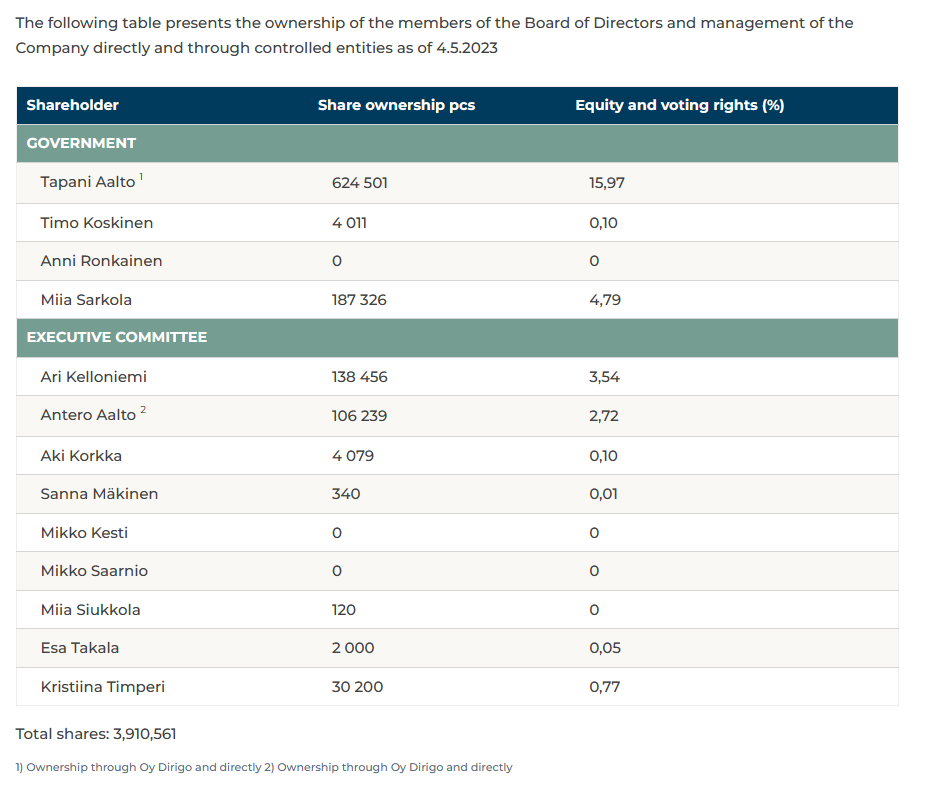

Insider ownership is high with members of the board owning in excess of 20% of the company and executive team over 6%.

Its service lines are shown below:

Notably, the vast majority of the company’s services are billed electronically, on a monthly and recurring basis to over 6000 customers now. Given it generated some €29.3m in turnover during 2022 but given part year M&A contributions may well have a run-rate of €30m+ it generates >€5,000 per customer, or >AUD$8,000. This is substantial given that the company’s primary customer is SME’s. For reference, Kelly Partners generates in the range of AUD$5,000-6,000 per customer, but importantly does not offer bookkeeping services on a daily basis, like Aallon does.

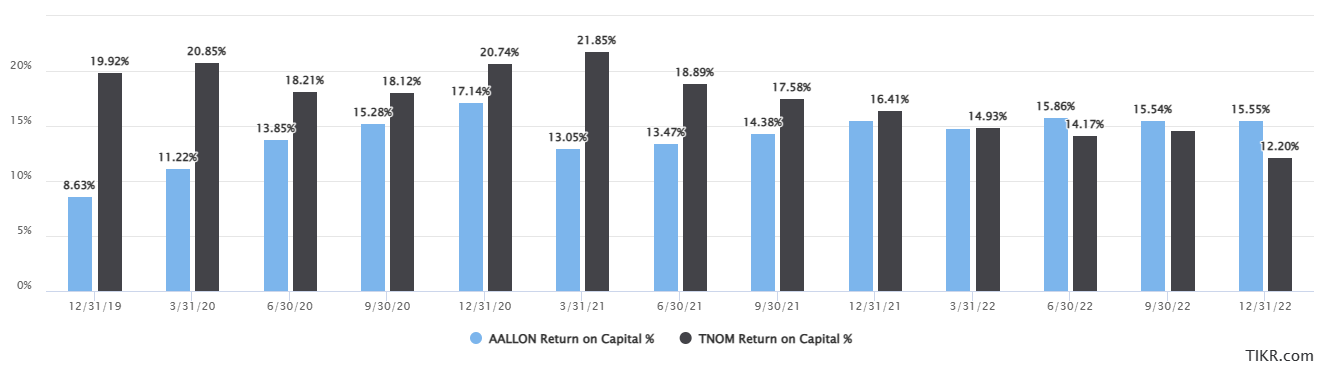

Bookkeeping being the additional service, is typically low margin and low value, and in the future more prone to automation. However, this strikes me to resembling the likes of Talenom (HEL:TNOM), a competitor firm in Finland which is further along its growth trajectory. Similar to Talenom, Aallon has created its own digital platform called ‘Aallon Porti’, albeit this was only just launched at the start of 2022. Naturally, it is already being used by a significant part of Aallon’s customer base. When Talenom started doing this, it’s internal returns on capital took a drastic decline as it was intent on development spend, as shown below. We haven’t seen this yet for Aallon, but it remains worthwhile to consider the trend.

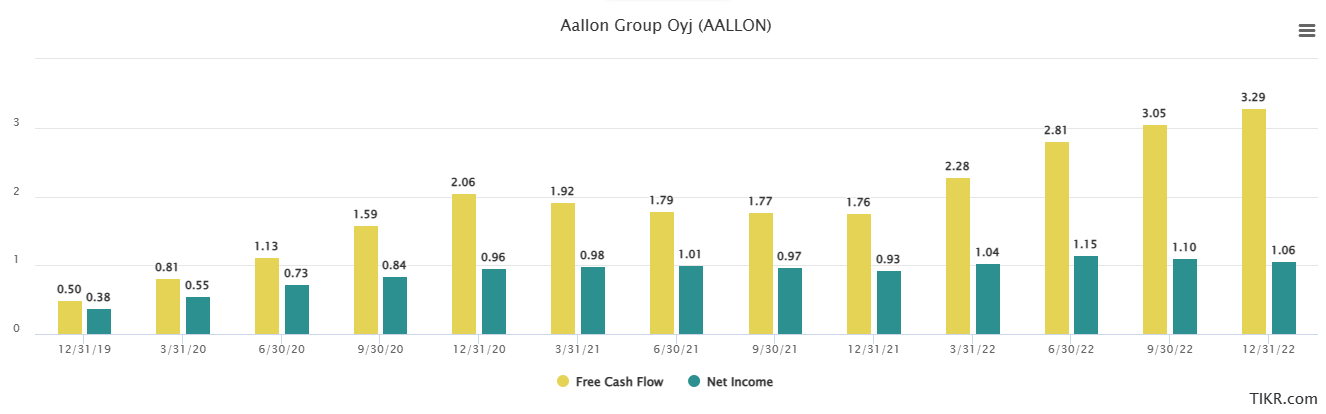

Digging further, these are accounting basis returns on capital rather than free cash returns. Which is very important to note as we have a very impressive cash conversion rate with Aallon. Note, that the Finnish accounting standards don’t put lease costs into financing cash flows, so TIKR free cash flow is correct as a result.

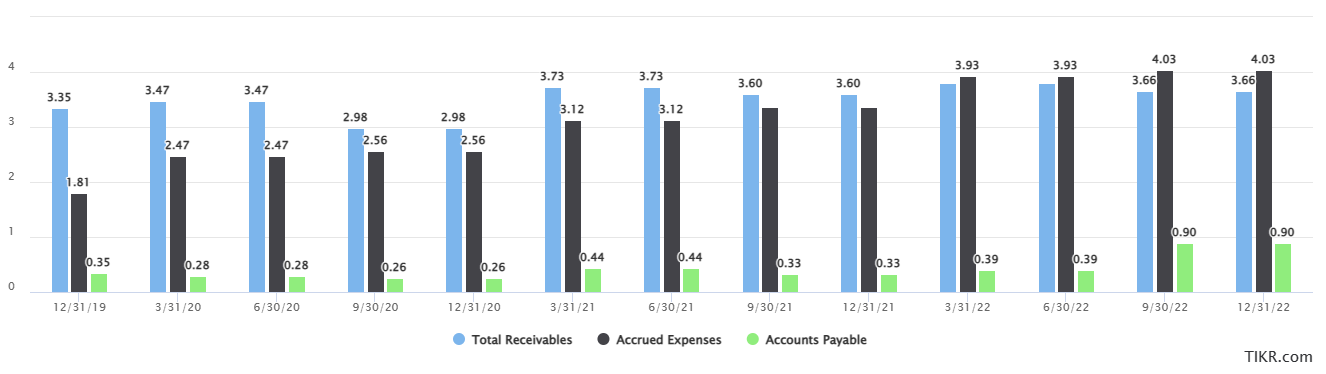

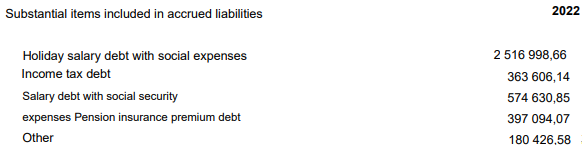

The core reason behind this is a very substantial component of goodwill amortisation on the books, despite these entities having long term client tenure, the goodwill is amortised over a 10 year period. Further to this, there has been a consistently declining amount of working capital in the business, bolstering cash conversion every single reporting result since it listed

A very substantial amount of this is coming from “accrued expenses”, which notably in 2019/20 there was no tax accrual due to carried forward losses. Furthermore, the group’s component of goodwill amortisation has offset a growing cash flow stream. But importantly, this has resulted in an increase in headcount and henceforth employee entitlement accruals. A comparison of the accrual amounts between 2019 and 2020 is shown below.

Equally impressive is a largely flat trade receivables account despite more than doubling it’s revenue over this period. This has resulted in what is basically a halving of it’s debtor days/DSO.

In terms of it’s margin, it’s FCF margin is ~11%, which on a cash conversion cycle of ~1 month, is a tangible ROIC of >130%. An excellent figure, and should the working capital cycle and/or margins continue to improve, this figure should also continue to improve.

Lastly, speaking to it’s growth strategy has been maintained since it’s founding which is fairly rudimentary and common across many accounting firm consolidator’s I’ve seen.

Briefly, on acquisitions, taking a random sample of some of their announced transactions, the group seems to pay 4-6x EBITDA for its acquisitions, which when you consider the conversion rate of EBITDA to free cash flow due to amortised goodwill, is an appealing price.

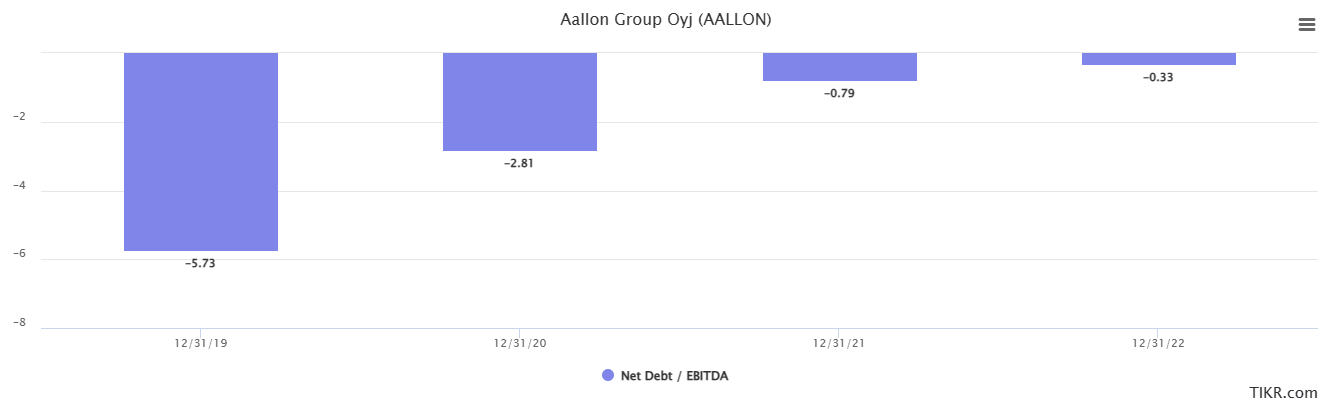

Taking all of this into account, the business is trading at an EV of €39m, which compared to its growth target of 15-20% and the intention to grow its margin and the dividend, is a compelling price. It’s 3-year growth in FCF has been bolstered by an improvement in working capital, so I think most appropriate here may be its Revenue & EBITA per share growth which have been 27% and 52% CAGR respectively. Although again, these have also been bolstered by the deployment of it’s IPO capital as indicated with the Net Debt/EBITDA ratio.

The dividend policy is 50% of its statutory profits, which soaks up all the above-mentioned amortisation, so the yield is only c.2% on the stock price. Going forward, if you align with the management targets, an ~11x FCF multiple, and high teens to low 20’s growth + Yield gets you pretty close to a 0.5x PEGY, indicating potentially good value.

Thank you for reading

Thanks for sharing. I did not know there is a gem in my backyard, haha.

I am reading through the financial statements and in your write up you said the acquisitions were done at 4-6x EBITDA. Can you point me to the right direction as to where to value those deals?

A good friend of mine is an accountant here in Finland and he charges a lot for his service. AAlloon paid a lot for those tiny practices (100-200K per person). I don't doubt the valuation here, but from the experience of looking at dental practices consolidator, I wonder what kind of relationship Aalloon has with those entrepreneurs. It looks good on paper, but those revenue streams could be gone in a few years.

Aalloon issues quite a few shares in the acquisitions so IFRS transition is obviously to boost the stock price.

Aallon released a notification yesterday that they are changing to an IFRS-accounting starting next year. I believe the change will highlight better their underlying profitability? (Amotization of acquisitions.) Furthermore, it enables them to access main listing on the Helsinki Stock Exchange.