The Abak SA Group specialises in Accounting, tax preparation & payroll services to small and medium sized businesses, which constitutes more than 90% of companies in Poland as a target market. The group services represent services that I am highly familiar with, despite the differences in tax law, accounting standards (Accountants Act instead of IFRS) etc. Although the core service is much the same.

The Business is predominately owned (~77% of the register) by polish capital advisory firm Profescapital, an experienced firm that has been rated as the top NewConnect Authorised Adviser for 13 years straight. Some other notable companies they assisted are Grodno, JR Holdings & Blackpoint, the former which readers may recognise.

Another 14% is owned by insiders, leaving just ~250k shares on the floatation. Which at a price of 3.70 PLN / 1.20 AUD is a liquid float of just 925k PLN / 300k AUD. This is exceptionally small!

The company bills on a retainer basis, that is, on a agreed upon amount over the year which is split in equal monthly payments. This ensures consistent cash inflows and removes seasonality through the year based on lodgement dates etc. the cost base is quite similar to a regular accounting firm but given the businesses typical service includes bookkeeping and payroll, wages tend to make up a larger % of revenue, that being ~60% over the past few years. The gap between the gross profit margin and EBITDA margin of ~30% of sales is largely made up by them using outsourced services

The group has the intention to grow through office expansion, either through organic greenfield means or by acquisition. In recent years the group has focused mainly on rightsizing it’s cost base before presumably moving to a more acquisitive model.

The group has enacted consistent acquisitions and has capitalised goodwill as a result. The good thing about the polish Accounting Act is that it allows for tax deductible amortisation of goodwill which in this case, is a 10 year straight line method. Therein the group benefits from a tax shield when deploying capital to acquisitions, and a depressed statutory profit despite consistant economic earnings power. Under GAAP Accounting asset sales allow for a similar treatment where you can amortise goodwill over a 15y period, the US-based RIA Acquirer Focus Financial Partners (NASDAQ:FOCS) is an example of a company that takes advantage of this.

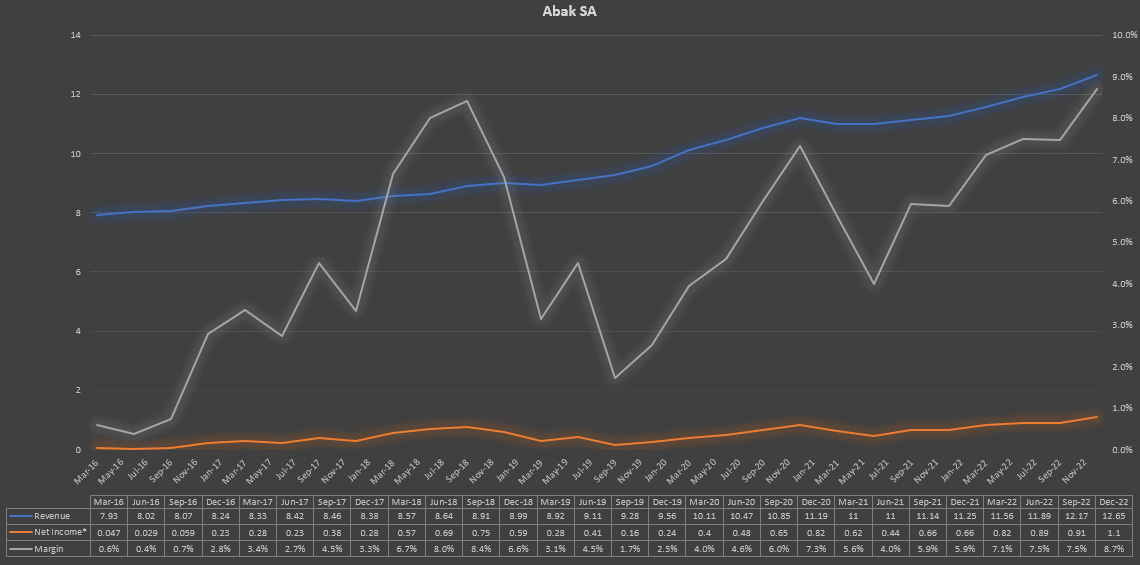

When adding back the amortisation and tax effect of the deductible goodwill, the company trades on a TTM P/E Ratio of 7.9x and when excluding the excess cash held by the company trades on a multiple of 5.7x. Comparing this to a TTM dividend yield of ~3% and a 5Y revenue and earnings growth rate of 16% and we get a PEGY of 0.42x and 0.3x with and without cash included. In addition to this, the company had a +2.6m increase in cash on hand over these past 5 years. which is additional capital available for future growth.

Just looked at Business Brain Showa-Ota, similar business. All about management when it comes to these smaller, service oriented businesses I think