Allcore (formerly Soluzione Tasse) is an italian tax consultancy business for SMEs in Italy, founded in 2015 by Gianluca Massini Rosati. Gianluca owns a majority share through the parent company Dolphin S.r.l, a software business founded by Gianluca in in 1995, which developed a number of VMS solutions specifically for niche industries. Allcore listed in late 2021, meaning it has been listed around the same length of time as DSW Capital for example. The reasons for listing were to simply assist the group with it’s growth strategy.

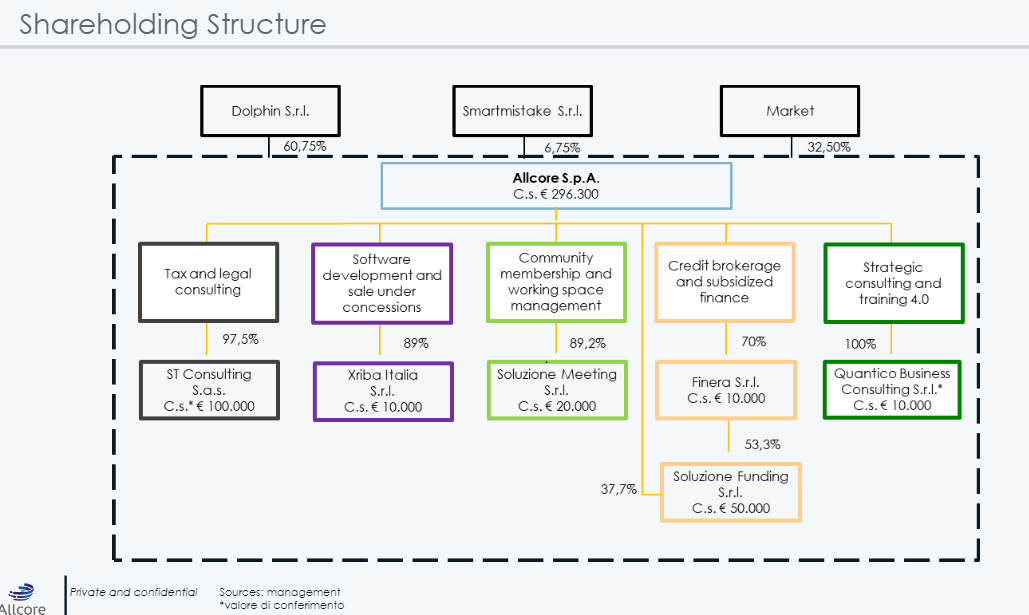

The group initially started with tax planning and typical accounting data processing utilising professionals, before expanding vertically and today has 5 subsidiary companies. This expanded offering is deliberate with each capable of covering a specific service, with the aim of having a group of complementary services to encourage and benefit from cross-sell. This continuous expansion of service lines is nothing particularly new, with many professional services firms having delved down this path, some successful, some not.

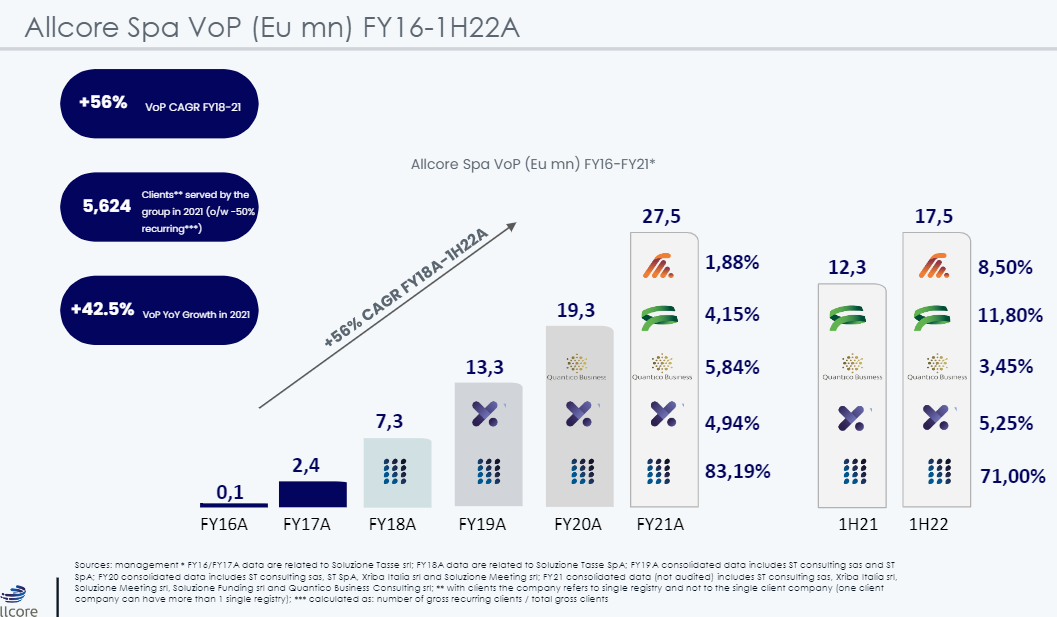

Although, as you can see here the group has grown rapidly it’s revenue (VoP) over the years. and through provided financial statement data, furthermore the group has a wonderful focus on optimisting it’s working capital, with various cash collection models through it’s subsidaries. To top it off, the group does not pay any dividends and we have seen several years of net profit expansion for a 63% CAGR in a period where revenue grew at a rate of 44% CAGR, therefore net margin expanded to 5.5% from 4.1%. For those of us with a mind of capital efficiency, on my figures, I estimate a return on incremental capital generated since the IPO has been about ~22%, which lags the above figures due to a low base of invested capital the group has expanded off and it’s cash conversion cycle falling from 54 days in advance to 5. Put another way, the group has seen it’s ROE and ROIC figures fall from 67% and 148% in 2020 to 15% and 47% in the 12 months to June 2022. The former of which is due to a large cash weighting on equity.

Speaking of, the group has yet to really spend it’s capital raised from the IPO, besides on buying back it’s shares recently, which given they raised capital is odd to see within the first 1-2 years. At the time of listing the TTM PE (ex cash) was ~24x including the proceeds of the offer. Currently the business is trading for a TTM PE of ~12x ex cash. Given the CAGR above, which it achieved without a capital increase, it is trading on a PEGY of 0.19x, the cheapest we have seen to date. Beware though, as the company has just 1/3 of it’s AUD50m mkt cap on floation, or about AUD17m in tradeable free float.

Hi, I did a deep dive on this one. If you want to know the results, reach out to me

In twitter @JaniLepojarvi