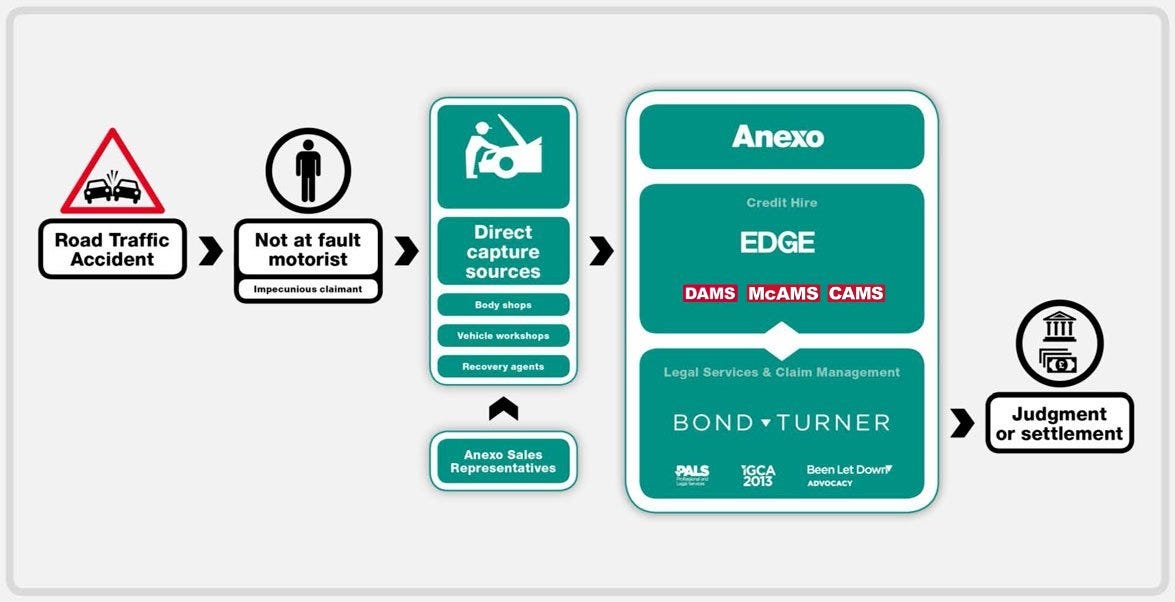

This week we cover Anexo, a London-based specialist integrated credit hire and legal services group focused on providing replacement vehicles to consumers who have been involved in a non-fault accident.

The origins of the Group were the establishment of a standalone credit hire business in 1996 which relied on a panel of law firms to recover costs from insurers.

The Group was founded and is led by Alan Sellers. Alan is a qualified barrister and has played a key role in the development and management of the Group's business since inception.

The current Group emerged in 2006 with the incorporation of Armstrongs Solicitors, since renamed Bond Turner, enabling the provision of a complete litigated claims process, principally to support the recovery of credit hire costs and repair disbursements. EDGE (trading as DAMS, McAMS and CAMS) operates the Group's credit hire business. EDGE has a team of experienced claims handlers responsible for the collation of initial information and assessment of the validity of the claim, supported by Bond Turner, as required. The integrated, direct capture proposition is essential to the Group providing a complete managed service whilst managing its risk.

Their clients typically do not have options to access a replacement vehicle which allows the Group to charge credit hire rather than spot hire rates, recovering these charges from the at-fault insurer at no upfront cost to their clients.

If you would like an explanation of the business by Nick Dashwood-Brown (Head of IR) there is a video shown below.

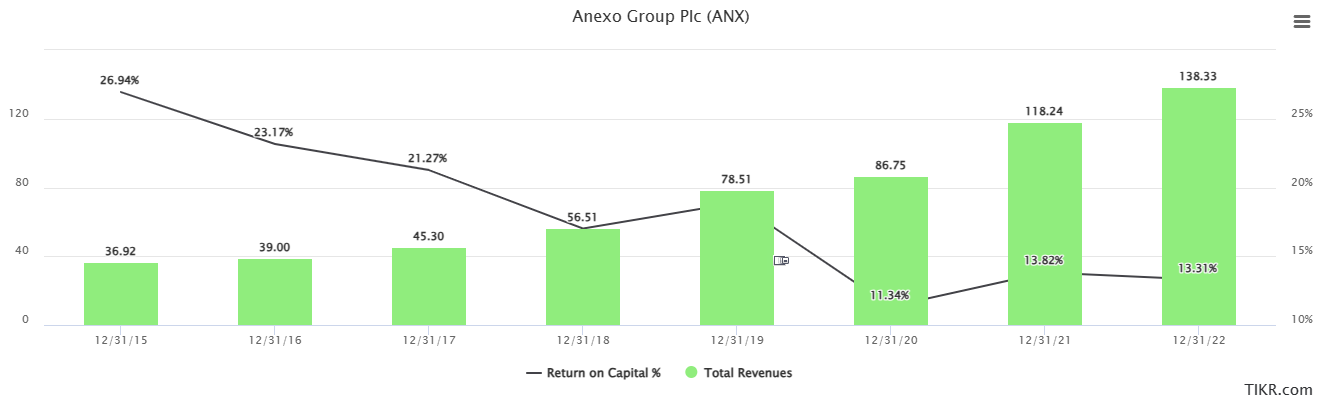

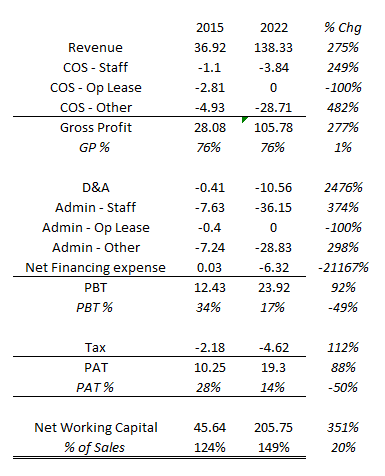

Financially, Anexo has had a stellar growth in it’s top line earnings, but at a declining rate of capital efficiency, with statutory ROIC declining from ~27% in 2015 to ~13% in 2022.

The cause for this declining return has been the result of declining margins mainly and a slight deterioration in their capital turns to a lesser extent.

With margins halving it explains the Accrual ROIC declining to the extent it has (also halved), but we can also observe given NWC has increased as a % of sales, the balance sheet required to run the business has grown faster than the business income stream itself. This has led to them taking on significant amounts of debt which isn’t always ideal, to the extent that they have grown their Net debt/EBITDA from 0.6x to 1.8x over the same time period.

Favourably, the group has intent to focus on improving their cash generation in lieu of profit growth as indicated in this excerpt from the 2022 Annual Report.

“Since year end the Board has conducted a Strategic Review and has concluded that the interests of the Group and its shareholders will be best served by concentrating on cash generation.”

“The implementation of the strategic review means that profit growth for 2023 is likely to be constrained but there will be an increased return on capital employed. If appropriate, the Group intends to emphasise the progressive dividend policy adopted at flotation.”

~2022 Annual Report

Nevertheless, the group has grown it’s EPS at a rate of +9.2% over the past 5 years and has a current dividend yield of +2.3%. These may seem like low figures, but the group trades at an LTM P/E of just 3.3x, and when including net debt in the equation, a P/E of 7.6x. Analyst estimates have them pegged to grow their cash flow substantially faster than their earnings over the coming 3 years and grow EBITDA at a rate of ~12% p.a. This could result in deleveraging into reasonably high interest rates, leading to an increased pace of growth below the EBITDA line due to declining interest expenses.

Anexo is an interesting business model, but seems to be playing around with it’s status as a going concern, which gives context into it’s optically cheap valuation. There is a fair amount of solvency risk in play here, but should they effectively improve working capital and deleverage, the investment case seems to be quite strong.

Thankyou for reading.

This is a reminder that currently, the Hurdle Rate Substack is offering subscribers a 50% discount through to 30 June 2023 on an annual subscription at a rate of AUD $75 per year (USD $50), down from AUD $150 per year (USD $100).