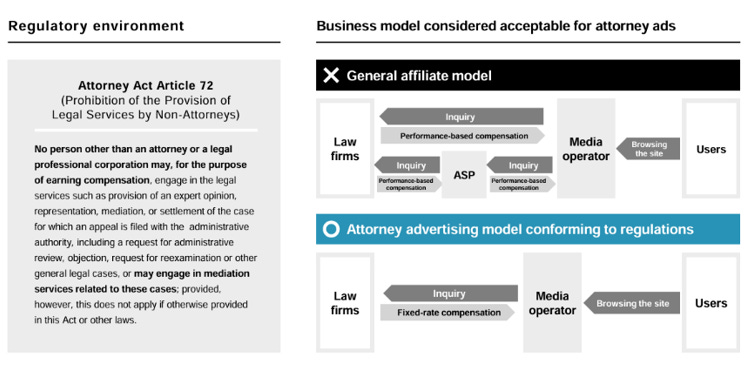

ASIRO (TSE:7378) is an internet media business which predominately operates websites which match individuals with attorneys across the various areas of law, with each area being its own respective website. The business has also expanded into more traditional media such as HR targeted at both lawyers and accountants. The business also operates mainly through direct sales, which has created a rather significant barrier to entry due to the inability of an affiliate to even try to act as it breaches the Attorney Act in Japan. Overlaying customer satisfaction such as reviews onto a direct sales model is a strong network effect for the business which reduces firm churn rates.

If you are wondering if this sounds familiar, it is quite like ZIGExN (TSE:3679) which many of you may recognise as a previous holding of mine which I moved on from due to it being outside of my circle of competence. I was quite happy when I found ASIRO as it is a similar model in an area, I am familiar with. Furthermore, Japanese attorneys transitioning in-house which increases the possible number of companies which can post on ASIRO, although may decrease the size of the average law firm. ASIRO has reacted on this by starting a job-posting site, which is non-recurring in nature. Nevertheless, ASIRO only has a small market share in all its segments with plenty of room to grow. ASIRO was founded by 40-year-old Hiroto Nakayama (Shown below) in 2009 who has 25.5% of the company’s shares. The CFO Satoshi Kawamura was appointed in 2018 and owns another 2.5% of the company.

The legal industry is a curious one in Japan, where the number of lawyers has almost doubled in the past 15 years, despite a declining population. This is in part due to a relaxation of the barriers to becoming a lawyer several decades ago as the government raised the number of those who passed the annual bar exam to roughly 2,000 from about 500 prior to address pockets of Japan with low lawyers/capita. This has not translated to an increase in cases, so there has been lobbying to reduce admissions to some extent. The abundance of lawyers has created fierce competition and fostered strong innovation in the industry as lawyers look to differentiate themselves.

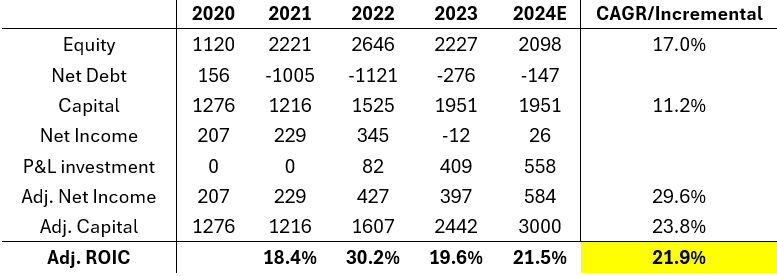

Doubling back to ASIRO, the group has a 2023-2025 management plan in place to reach ¥5.5b in annual revenue by 2025 and an indicative target (subject to change) of ¥10b by 2028. The group is aggressively investing into itself with the expansion of new businesses such as the HR business through aggressive advertisement and labour expansion. This was a planned investment with current operating margins of c.5% down from 22% in the year prior, despite a 45% increase in revenue YoY. The group intends to invest through the course of the existing plan and return to >20% operating margins from 2025 onwards. To demonstrate their confidence, they maintain a 30% dividend payout ratio based on a constant 20% operating margin. The market appears to show significant disbelief that they can turn the tap off ‘growth investments’ and return to such a margin in short order, as evidenced in the countless questions about it in this transcript.

Of note is that the company has made minor acquisitions in new areas of business which appear to be (I hate to say it) attempted ‘spawners’ with a recent acquisition of Bikkore for example being a FX demo trading app which is explained as ‘granting users points that can be exchanged for bitcoin on certain conditions set by the advertiser are met. Bikkore has a business model in which it does not hold an inventory of bitcoin and is not subject to the price fluctuation risk’. The company spent (wasted?) ¥226m on this business. Another example is the Kailash Short Term Insurance business which has much more synergy with the core business as a legal fee insurance business. The company spent ¥175m on this business, it remains to be seen if these can be material contributors to results in the future. To support the best of management capital allocation discipline, the company repurchased 400 thousand shares (5.7% of shares) for ¥301m (~¥750/share) last year.

ASIRO is valued at an EV/Sales of 1.5x the LTM revenue. When you consider that current revenue is ¥3.2b and there is a target to triple it in 4-5 years, with a EBIT margin more than 20%, the financials look compelling (especially given their history of upward revisions). If the business had a 20% EBIT margin right now, it just over 10x earnings, for a founder-led internet media business with a solid track record and ambitious growth targets.