Summary

Aspire Global is pursuing a vision as a leading supplier to iGaming worldwide.

Aspire Global is heavily overlooked, with just ~25% of the shares tradeable on Stockholm’s NASDAQ Nordic exchange.

Recently, the business divested their B2C division, unlocking EUR€60m in cash to allocate towards further product expansion and geographic growth. In addition to this, there is an additional EUR€14m in unutilised net cash on the balance sheet.

Lower Regulatory risk due to a focus on White/Regulated markets

Demonstrable Moat with ownership of 1-2 dozen gambling licences allowing them to operate across 4 continents and 30 regulated countries.

High Integrity management with a clear focus on sustainability with a healthy corporate culture.

Past M&A has been highly accretive with capital to do more.

Very undemanding entry valuation with an 8% earnings yield

Business Profile

Aspire Global is an iGaming supplier founded in 2005 as Neopoint Technologies by current Board member Barak Matalon. Since spinning out the initial iLottery business and listing it on the NASDAQ, Aspire has focused on their Player Account Management (PAM) business since and has expanded through the value chain with recent acquisitions of Pariplay (Gaming Aggregator), BtoBet (Sportsbook platform) and partial ownership of End 2 End (Bingo).

What drove my intial interest?

Firstly, this idea was suggested to me by a fellow investor whom I respect and upon looking into it myself found myself very interested in the investment case.

In October of 2021, Aspire Global announced a divestment of their B2C business Karamba to Esports Technologies. The terms of this deal were to receive a total consideration of EUR€65m inclusive of EUR€50m in cash, a EUR€10m promissory note and EUR€5m in Esports shares. In addition to this, the business was to offer Esports Technologies a 4 year contract for use of the Aspire PAM+Managed Services with an estimated value of EUR€70m. This sale resulted in Aspire poised to become a pure B2B business, a designation that in-of-itself should make Aspire a much more valuable business.

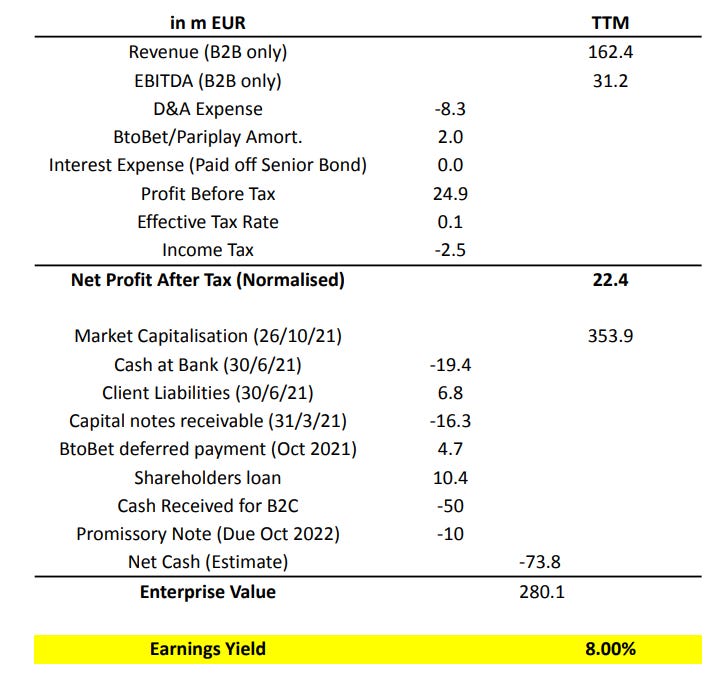

After accounting for this sale, the business was initially trading at an enterprise value of EUR€280m and a run-rate B2B FCF of EUR€23m, indicating an entry EV/FCF of 12x, a multiple i deem to be well below average. Couple this with the capital light nature of the business, potential for huge revenue growth and stable or expanding margins, and an investment opportunity arises.

Why is this overlooked?

The Aspire Global business firstly, is listed in Stockholm on the NASDAQ Nordic exchange, a swedish exchange which is over-representative of multi-baggers in the past, as evidenced by Alta-Fox Capital’s “The Makings of a Multibagger” research.

Besides this, Aspire Global itself lacks a free-float that allows significant institutional interest with some 75% of the total shares outstanding locked up by insiders (namely Founder Barak Matalon) and strategic shareholders such as Pini Zahavi and Eli Azur who jointly own Charlton, which owns the broadcasting rights for football matches in Israel. This leaves just 100m or so in tradeable free-float, an amount many investors simply can’t access.

Furthermore, Aspire Global owns the Gambling License in the majority of Jurisdictions it operates in and henceforth from an accounting perspective, the gambling profits flows through the Aspire business, before being paid to the operators as a partner royalty. This results in optically lower margins than peers despite if adjusted to reflect this, Aspire would have industry competitive margins with EBITDA margins of 50%+. Furthermore, the B2C segment, which had been consolidated previously, included marketing expenses, further diluting margins. Whereas the B2B business benefits from having the operator take care of marketing. This is just some of the reasons I believe Aspire Global is heavily overlooked.

iGaming as an industry

The IGaming Industry is one characterised by a combination of rapid adoption and consequently regulation as states and countries alike legalise online gambling globally. Due to the apparent lack of legalised gambling worldwide, there is the existence of operators that run their operations in unregulated markets. The type of jurisdictions can be classified into three general categories:

White markets: Where gambling is legalised.

Black markets: Where explicit prohibitions exist.

Grey markets: Where the lack of clearly defined laws causes ambiguity.

Operators that choose to run their business in a grey market, benefit from an untaxed environment however run the risk of intervention by local governments. Luckily, Aspire Global has chosen to partner with Operators almost exclusively operating in regulated markets, equating to about 80% of revenues, eliminating much (not all) of the risks associated with regulatory concerns. Comparatively, other suppliers such as Evolution Gaming having ~40% from regulated markets and even accusations of their operators doing business in Black markets have surfaced, leading to an elevated regulatory risk in my opinion, despite the incredible profitability

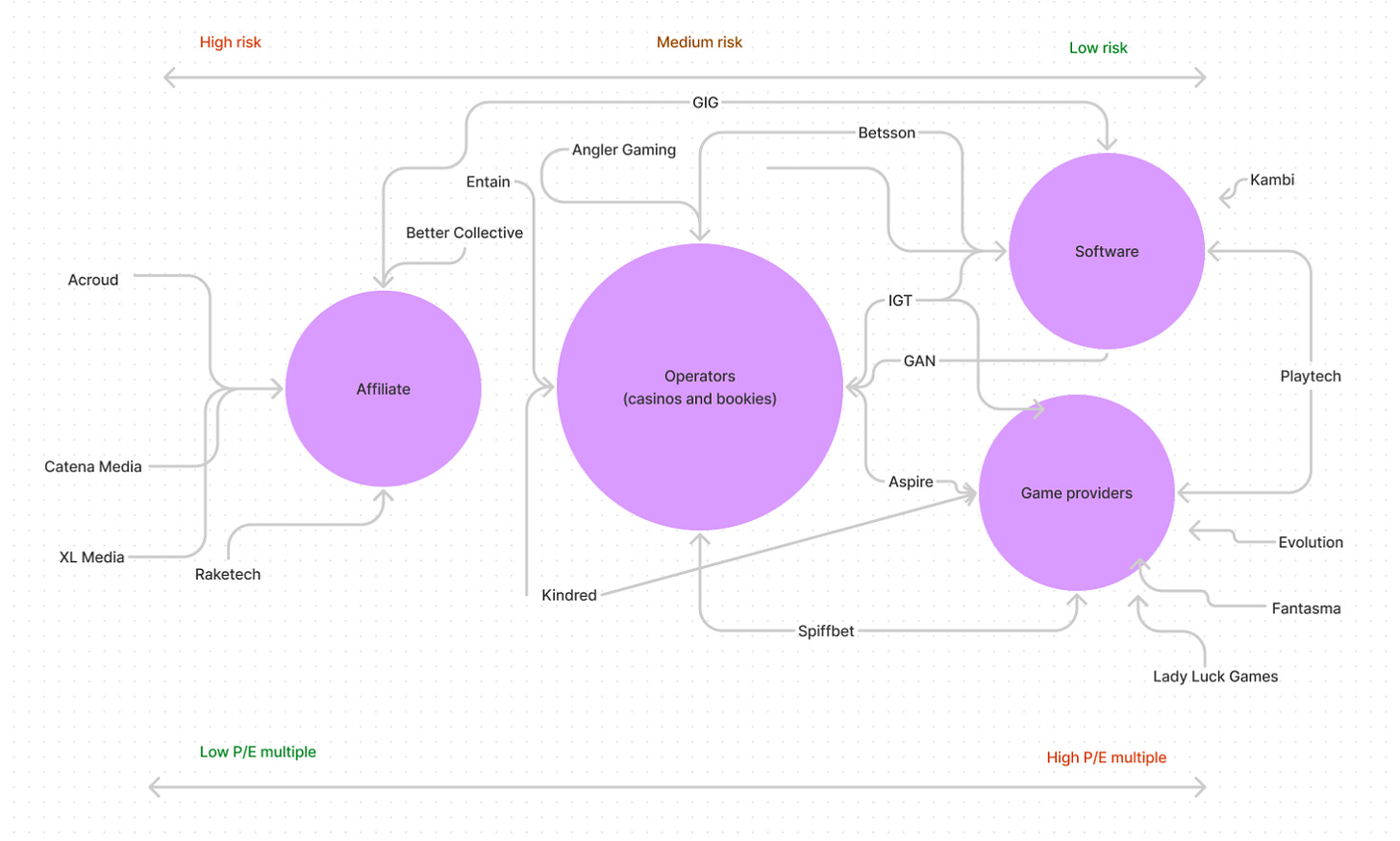

Back on Aspire Global, It is their intention to cover the value chain as an IGaming supplier, but what does this entail?

This handy graphic by Silja outlines where the profit pools lie in the iGaming industry, which I share the belief that this is in the lower risk software providers that facilitate online gaming through the use of platforms and provision of games, either directly or through aggregation. These are offered to operators for a % of their GGR (adjusted for jackpots). This as the author suggests results in an unlimited upside due to their ‘participation’ and limited downside due to the lack of capital intensity.

Licensing as a Moat

What Aspire Global boasts in addition to an attractive financial profile, is Gaming Licences spanning 30 regulated markets globally. Aspire allows operators to access the use of this licence, and pays a royalty to the operator, whereas peers do the opposite. It’s an interesting value proposition especially for smaller operators looking to grow but without economies of scale to compete effectively which seems to be working since to date Aspire Global has not had a single partner leave them over the past 7 years.

As of the current time, Aspire is still acquiring new licences as new jurisdictions move to a licensed model as opposed to a local monopoly. Furthermore, Aspire is positioning themselves to appeal to smaller operators aligning with their stated US Growth strategy which I will outline below.

US Market Growth

Aspire Global, despite operating predominantly in European markets to date, does recognise the explosive opportunity that is on offer in the US, and as such has obtained some licences through the acquisition of Pariplay, as well as applying for new jurisdiction licences as they open up. To manage this, recent hire Quincy Raven was hired to lead as Managing Director of the US operation, to supplement this please consider watching a recent interview with Quincy below:

Aspire estimates the US to be generating USD$15b in GGR in their serviceable addressable market by 2025, which is inclusive of sports betting and gaming. Of this, Aspire Global expects 80% of the market to go to an oligopolistic structure where the top ~10 or so operators do the lion's share of GGR. Aspire expects these to consider using their platform in-house, as such not requiring services of Aspire. Aspire Global intends to focus on the remaining 20% of smaller operators that don’t have the economies of scale to develop their own offering cost effectively.

Management

Running the show on a group-wide basis is 43 year old CEO Tsachi Maimon since 2013. Previously, Tsachi worked in sales and marketing roles and has received a lot of Linkedin endorsements related primarily to advertising and marketing. Integrity is a highly desired trait for management and I believe after listening to Tsachi talk on various panels/interviews, seeing employee reviews and his Linkedin activity as well. Similar to the above, I would like to encourage readers to listen to the below interviews with Tsachi to get a feel for his personality and business sense.

Another trait that I like to see is for management to have a Growth mindset, that is, the ability to think opportunistically, make mistakes and exhibit the ability to develop their talents rather than be set in their ways. If this is strong enough, it can permeate from leadership into the rest of the business, encouraging innovation and collaboration within the group.

One such example of innovative thinking is the Aspire solution to the recent regulation in Germany. Recently, Germany imposed a 5.3% turnover tax on German casino games, resulting in a reduction in operator profitability, leaving them to either adjust the return to players (RTP) or accept lower margins. To combat this, Aspire created a unique solution to go live on the Pariplay Fusion platform called “BuyWin” which involves taking advantage of a unique bet contribution on transactions and maintaining an industry leading RTP whilst lowering the effective tax rate for operators.

Mergers & Acquisitions

Aspire Global, until 2019 was operated as just a Player Account Management (PAM) offering, growing organically at a CAGR of ~16% over the 4 years 2015-2018 on the top line without any M&A. More recently, the company has been pursuing vertical integration to capture the value chain of products in order to become one of the largest iGaming Suppliers globally. This has resulted in them expanding into new categories via. M&A. Of note here is that M&A is not in a programmatic or horizontal fashion as opposed to the likes of Kelly+Partners and ZIGExN which I own. Instead, Aspire seems to solely do M&A in order to expand their business vertically and expand for channel access and gain revenue synergies through operators share of wallet.

Speaking of this M&A, the crucial component to M&A to me is doing it in as low-risk fashion as possible. This usually means a low entry price, but can also mean a clear and easy post merger integration process, the main component is really just a fast payback time.

The first deal Aspire carried out was to acquire Games Aggregator “Pariplay”. This deal was highlighted by Aspire in relation to a peer being acquired with a seemingly worse competitive situation but some 16x the valuation of aspire on an EV/EBITDA basis. This presumably is to highlight the value that the Pariplay acquisition has created for shareholders, and rightly so as it was an amazing deal. Please take a look at the optics below.

In addition to this deal we have their Sportsbook offering “BtoBet” for an upfront cash payment of EUR€15m and another EUR€5m payment in the 12 months afterwards, lastly two years after closing Aspire agreed to pay 7x the TTM EBIT minus the purchase price of EUR€20m. The TTM EBITDA is ~EUR€2.5m so this payment is as of right now not likely to be paid, unless BtoBet realises more growth over the next ~10 months. To date, this deal seems optically decent with an entry multiple of just ~10-15x post tax earnings (estimate) whilst the BtoBet business is likely to be generating 2x the revenue at acquisition on a run-rate basis later this year.

Last month, a 25% stake in Bingo supplier “End 2 End” was purchased for USD$1.75m in cash with an option to acquire all of the shares in 3-5 years time, however, this can not be assessed due to lack of information at the time being.

To close this review on M&A, Aspire Global has ~EUR€70m in cash to deploy (Probably more now), which perhaps could result in a future Live dealer acquisition or even a special dividend. However it may be, I am confident in the prospects of good capital allocation in the future with their demonstrable competence in this area.

Valuation

On valuation, Aspire Global is not one that is difficult to see, which just post tax TTM profits alone resulting in an entry P/E multiple of just 17x. Once you account for amortise customer lists on acquisition and the overcapitalised balance sheet (Post acquisition) the valuation is incredibly conservative, to the extent I don’t feel particularly inclined to stretch the imagination here. Please take a look at some estimates below:

Compare this to their growth over the years and likely growth in the future and I believe this is an incredibly asymmetric bet capable of >30% returns over the next 5-10 years or whatever holding period I decide is appropriate. This has potential for high growth, both through volumes and operational efficiency along with very high re-rating potential, should the market come to light.