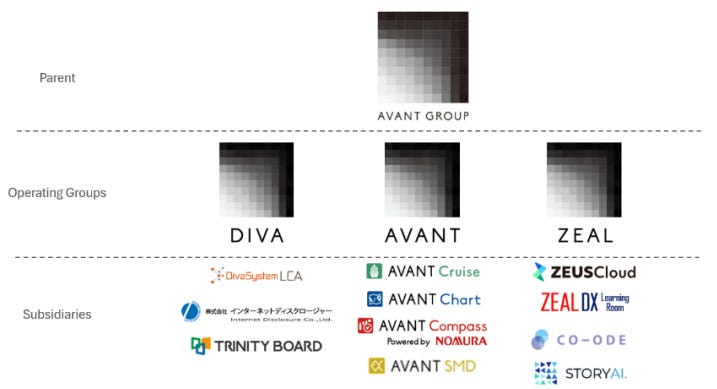

Avant was founded in 1997 by the current CEO Tetsuji Morikawa and is a Japanese holding company of financial and non-financial software which have the collective goal of assisting its clientele to increase corporate value. This includes ‘Diva’ as Japan’s foremost (43% market share) consolidated accounting software and board meetings platform in addition to ‘Avant’, a management system for corporate value enhancement through consolidation of information (Avant Cruise) , charting (Avant Chart) , and corporate value enhancement (Avant Compass). Lastly, there is ‘Zeal’ which includes several non-financial platforms that help organise and integrate (with Avant Cruise) from external sources. And interestingly, Avant also owns and operates Internet Disclosure Co, which runs Kaijinet, a site I have frequently visited over the years.

Diva is the company’s mainstay product having over 1,200 customers using the system at the end of June 2023. These customers are large corporations with over 70% of them having 11 or more consolidated subsidiaries and 50 of the top 100 and 97 of the top 200 companies on the TSE using the system. Its business model is under subscription and license fees, but also has a maintenance fee element to address customisation for its client base. In 2020 the system transitioned to the cloud hosted on AWS, has changed to a monthly pricing model, and has alleviated the need for customisation by incorporating templates and standardised accounting. By doing this it aims to further extend it’s lead over incumbent competitors by reducing upfront investment for slightly smaller companies with the aim of 70% market share by June 2028, or over 2,000 customers. Trinity Board is a very recently created (Oct 2023) cloud software which aims to focus on systematic setting of the agenda, leveraging outside director knowledge, digitisation, and consolidating department info.

The Avant subsidiary is particularly timely enabling customers to improve corporate value. Avant Compass in partnership with Nomura Securities specifically assists companies address these changes. All parts of the Avant business intelligence offerings allow for projection and optimisation of KPI’s and ROIC simulation with multi-axis data points such as products, customers, locations, and even non-financial information. In November 2023 it also entered into a partnership with Fluence Technologies to further improve the Avant product-suite.

The Zeal subsidiary includes firstly, ZEUSCloud, is a bit beyond my depth but in short involves the input of structured data with a graphical output. For you nerds out there it has a data warehouse, data lake. ZEAL DX Learning Room is more straightforward as an online training service to learn data utilisation and BI skills. Lastly, CO-ODE is a service for open data issued by governments to use for various types of data analysis, forecasting and even cross-comparison with internal company data. I hope you all get the idea about how deeply integrated Avant can be with not only a broad suite of products of its own, but also various BI & accounting integrations such as SAP, Oracle, IBM, and so on.

Avant has an exceptional track record having compounded TSR, Revenue, and EPS at rates of 13.7%, 14.3% and 18.1% since its initial TSE listing in 2007 at high levels of capital efficiency with mean ROE and ROIC of 18.5% and 17.5% respectively. Speaking to this further, the company takes ‘corporate value’ literally with a strong focus on EVA (Economic Value Added) beyond just growing free cash flow. There is also deliberate attention on reducing its cost of equity (no debt = no cost of debt). This goes so far as to reducing beta by putting emphasis on recurring revenue and extensive feedback from shareholders of various backgrounds on what they value from a quality investment. If you would like to read more, I would highly recommend reading the company’s 2023 integrated report and share price conscious management.

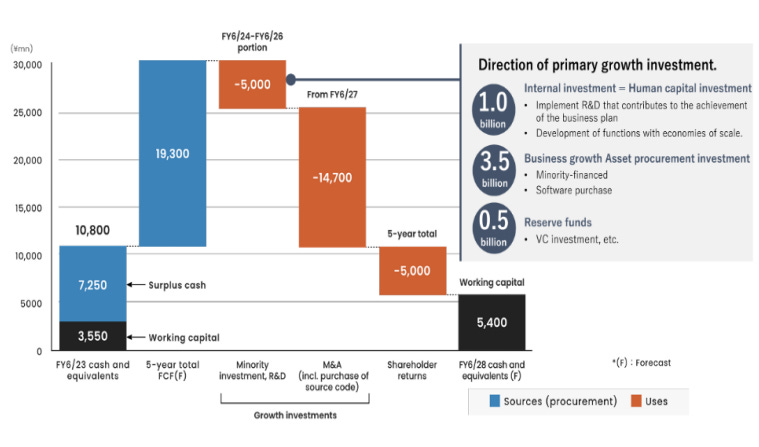

Looking forward, the company has laid out its plans to double and triple revenue and net income over the June 2023 – June 2028 period at ROE above 20% and 7% average DOE (35% payout). Directors and employees also own 35% of the company with an interesting dynamic whereby domestic ownership is declining and foreign ownership is increasing. Furthermore, the company has a significant cash surplus of ~¥7.3bn (17% of Market Cap) which arose due to the accumulation of cash in the past, meaning their historic growth is almost all organic. It intends to deploy this excess in addition to cumulative free cash flow over the coming 4.5 years remaining in the medium-term management plan. The company trades at an undemanding EV/NOPAT of ~16x today, and ~14x adding back ‘investment costs’ (p10).