Bravura is an Australian domiciled software business, specialising in providing fund administration & wealth management software in addition to professional consulting services to the financial services industry. It works predominately with larger companies, having 52 customers (44 wealth, 8 Funds Admin) across the globe (Not including Midwinter and Delta SaaS products). The business operates predominately across both Australia and the UK, with minor operations in New Zealand and the rest of the world.

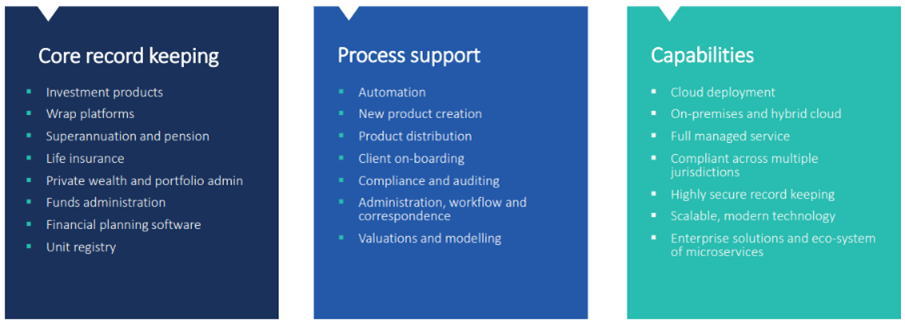

I don’t have the space to discuss each individual product under the business as it is what I believe to be a rather complicated business with many high-end software packages. I have shown to the right their core offerings and the functions that they provide for reference. I would also suggest simply browsing their website one product at a time to understand the breadth of the service here. Its products span multiple global pension systems, reach into niches such as employee pensions and defined benefits, and allows for the administration of investments across asset classes and countries for fund management.

It doesn’t take a long-time browsing Bravura’s announcement to realise that it’s not just me that finds this business complicated, but clearly there is a revolving door of management, who when they arrive demand to be remunerated greatly for their contribution with a remuneration report ‘strike’ in 2022. Up until EOFY 2019 the group had a relatively stable c-suite, but, from then through to EOFY 2023 the group went through 9 executives (3 CEOs, 3 CFOs, and 3 COOs), with most of that occurring in 2022-23. As you would expect, investors did not take to the stock kindly through this time, with an investor on the 1 July 2019 having just 20% of his invested capital remaining today (including the minor impact from dividends). At the same time, whilst the company’s revenue did not decline much at all, the profitability evaporated, with the net margin declining from ‘low teens’ to ‘non-existent’ today. As you can imagine the dividend is also gone and the company diluted massively earlier this year to save itself from demise by investing resources into ‘organisational change’, an endeavor which if managed incorrectly, could destroy further value.

So, all of this doesn’t paint a pretty picture, and I wouldn’t blame you for thinking so… the business is clearly in drastic need of a turnaround. Enter substantial shareholders Pinetree Capital Management (since October 2022 they have accumulated a stake amounting to 21.6% of the company. Furthermore, Pinetree’s Chief Investment Officer Shezad Okhai, jumped ship from Pinetree to Bravura as a newly appointed ‘Chief Commercial Officer’ (CCO) as of the 15th of August 2023. Shezad previously was Vice President at the Volaris Group, a part of Constellation Software. His duties as CCO involve working with executives to improve the business and engage with customers. It is a fixed term contract which is scheduled to end on the 30 June 2024. Further to this, Damien Leonard, President of Pinetree and son of Mark Leonard of Constellation Software was admitted the board and importantly, to the HR committee as well.

On another note, Andrew Russell was appointed as Group CEO in July, replacing Libby Roy with Andrew having acted as interim CEO last year up until Libby’s appointment. I have a history with Andrew as he was the one which was responsible for the sale of my beloved Class Ltd (ASX:CL1 – no longer listed) to Hub24 (ASX:HUB) back in 2021/22 and prior to that a bit of an acquisition spree and in my view ‘diworsification’ at Class. Nonetheless, he was strongly incentivised to generate a >25% CAGR in TSR over a 3-year period from his 2019 appointment which he delivered through the sale. Either way, I have mixed feelings about Andrew. Prior to class he was an executive of the finance subsidiary at REA Group (ASX:REA).

Before her departure, Libby had raised capital and outlined an operational change program which had targeted $25m in cost reductions (predominately employees) once fully implemented, spread predominately over a 3-year period. This was implemented quite rapidly as can be seen by the LinkedIn employee numbers shown.

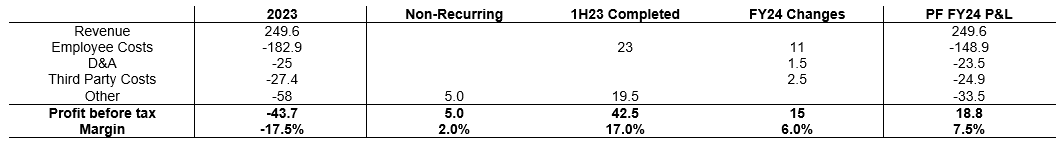

The implementation costs have largely been expensed now and the group is planning to announce a new 3-year plan on the 2nd of November, which by the time you read this will likely have been announced. In the FY2023 results they alluded to targeting $40m of cost savings, which in addition to the cost savings already secured, will make Bravura quite a profitable business, and more importantly a reasonable cheap one. I expect them to be able to achieve further margin accretion and am keenly interested in what they can pull together in the plan announced. The group currently has ~$76m in net cash and it is expected that FY24 will incur an additional $30-35m in cash burn, therein leading to a net cash balance of $41-46m in FY24 assuming stable working capital. My crude numbers on the development of the P&L are shown below, bridged from the FY2023 results and based on what has been announced prior to this plan (note I have added back the organisational change expense of $19.5m and ignored the incremental cost in FY2024 they will require).

The group has ample tax losses, so will end 2024 at an EV/EBIT of ~13x. I expect that by FY2026 a free cash flow margin of 15%+ is achievable and a return to revenue growth. I have assumed that revenue of >$300m in FY2026 with a drastically improved cost base is achievable and am basing my investment on this target.

Information on contracts is very hard to come by given contracts are typically quite long term and RFP processes for new vendor selections can take years. The one to watch is where GROW, which recently won HESTA can entice more funds away with their contemporary technology offering. IRESS are in arguably a stronger position but have been slammed recently, which highlights how difficult it is the make money in this space.

Bravura's other challenge was a large portion of their revenue from major customers was in professional services (implementing/consulting) rather than SaaS from products. They may continue to struggle to flip this as new client contracts will be hard to come by when the business appears unstable. To compound this, competition in all the businesses in which they operate is incredibly fierce.