Bridge Consulting Group (‘Bridge’) is a Japanese corporate finance business that played a hand in supporting more than 25% of Japanese IPOs in the 2023 year. Beyond this the company provides a wide range of accounting support functions including internal control audits, Japanese subsidiary management for overseas parent companies, IFRS implementation, consolidated/non-consolidated discloures, cloud accounting implementation, M&A advisory and even post-merger integration (PMI).

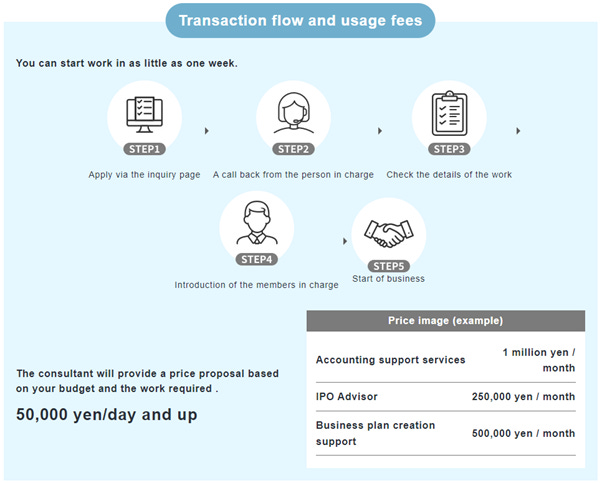

But perhaps of most interest to me is that the company owns the largest accounting job website in the country, “accountant.job” which is more geared towards freelance/contracting type roles. These roles are for qualified CPA’s as opposed to entry level work and tend to be quite specific project-based work such as the work above. Thus, Bridge is largely acting as the intermediary between companies and accountants and charges the company a recurring fee as shown below:

Looking in the rear-view mirror, Bridge was founded in 2011 as an IPO support business with the jobsite having been conceived in 2014. In the first 11 years it only operated in the Tokyo Metropolitan and in just the last few years has decided to branch out of this prefecture to other areas including Osaka, Nagoya, Sapporo, Hiroshima, and Fukuoka. In 2022 the company listed on the Tokyo Pro Market segment before uplisting just 1 year later onto the Tokyo Growth Market segment.

The face behind the business is Ryoichi Miyazaki, the founder and largest shareholder (46% shareholder) of the business. Miyazaki joined as an auditor within Deloitte in 2007 specialising on IPOs. After a shocking experience with the collapse of Lehman Brothers Deloitte started to decline and despite Miyazaki’s best efforts, he ultimately chose to leave the organisation in 2011. The inception of Bridge was rushed because he was about to marry his now-wife and did not want to look unemployed. Over the coming years Miyazaki stated he is the type to never say no to work and had to progressively ask more people for help and eventually this formed the ‘professional sharing’ model now known as accountant.job. As the business grew Miyazaki felt the eventual IPO was originally aspirational before believing the presence would help grow the business. If you want to know more about Miyazaki’s story, please read this article.

Other than Miyazaki the company has made several capital alliances with prominent listed companies including Pronexus (TYO:7893), Persol (TYO:2181), Freee (TYO:4478), and es Networks (TY:5867). The company also has a cornerstone investor in the form of the WM Growth No.4 Investment Limited Partnership which owns 10%. This LP has a investment time frame stated to end in September 2025 on their website so it will be interesting to see what happens next year with this shareholder.

Financially the company is very impressive, having compounded its revenue from ¥657m to ¥1974m in just 3.5 years, a rate of 37% p.a. This was done whilst experiencing expanding profit margins and the use of no debt or equity (the equity raised in the 2 listings have not been used). Furthermore, the Accountant.job site has grown from 1,500 members in August 2019 to more than 4,700 in June 2024, a rate of 27% p.a.

Today the company is valued at just ¥2.75b and has over ¥1.04b in net cash. The company generated ¥1.97b in revenue and ¥0.16b in net income but has somewhat volatile profit margins from period to period. In the medium to long term the group is targeting ¥10b in revenue through the continued onboarding of clients through the pro-sharing model and expansion of consultant CPAs. At 10x LTM EV/NOPAT Bridge is highly appealing.

Thanks, much appreciated 👍

Thank you for sharing the idea in a concise article.

According to TIKR, the number of shares keeps increasing the past 2 half year periods . I understand that prior to that, probably shares were increasing bc of the IPO. However, TIKR doesn't show any SBC, so I am not sure where the continuous increase in shares comes from. More specifically, I wonder why for the half year periods ending March '24 and Sept '23 number of weighted diluted shares increased 2% and 3% respectively given that they are consistently profitable.

Do you have a view on that?