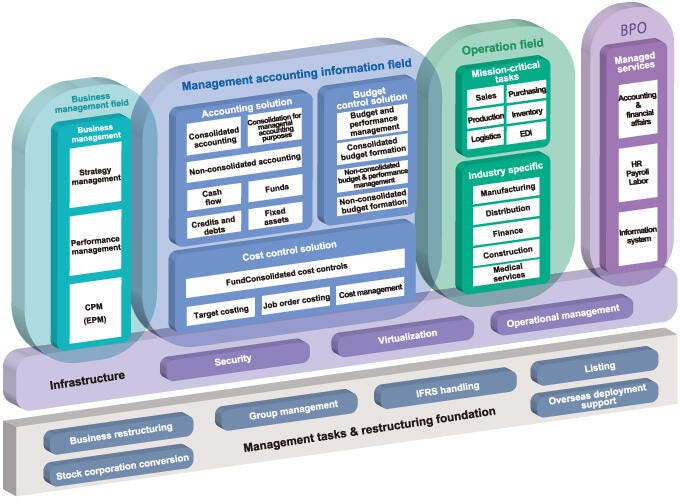

If you read the above tweet, you’d know I wrongly stated a TSE listed Japanese Software company whereas Business Brain Showa-Ota Inc (BBS) is actually an outsourcing company for various business processes, the majority of which (~60% of revenue) is management accounting related, but also extends into HR, payroll, labour and IT services, the full suite of which is succinctly summarised below.

And before we continue I would like to make a special shout-out to

for bringing this business to my attention. Besides his substack you may also find him on twitter as @fritz844.In the interest of keeping this to a single page, the company makes money through engaging through the different service lines as shown below.

Consulting & System Development offers what is effectively a sales pitch on a prospective customised accounting solution for it’s clients, and BBS also extends on this through actual system development in addition to this. Furthermore, the company can continue to extend the functionality of it’s system into HR, finance, payroll etc. which is where it get’s it’s upsell. The charging model here is a project based model where an estimate is provided based on estimated headcount and man-hours, resulting in an accrual working capital cycle. Lastly, it also can also extend the same staff outside the company under labour hire arrangements to bring in low-margin work when there is capacity available.

Business Process Outsourcing (BPO) is the traditional part of the business and is effectively providing payroll and accounting. Much like most accounting operations, Senior Accountant’s (CPA’s) are in more of a managerial role whereas lower standing accountants do more of the legwork. This keeps operations cost effective and quality review high due to CPA oversight. Due to language barriers with overseas delegation, the company performs most of it’s operations domestically, meaning that margins are limited comparatively speaking due to working wages being higher. Lastly, typically these are arranged on an annual contract basis with a monthly retainer, meaning a comparatively low working capital cycle compared to the consulting division where projects can span several months at a minimum to a year. The blended result of the division is debtor days of ~2 months. Perhaps a point you may find interesting is that in my current managerial role we outsource to an Indian BPO firm, who’s work I personally review for quality.

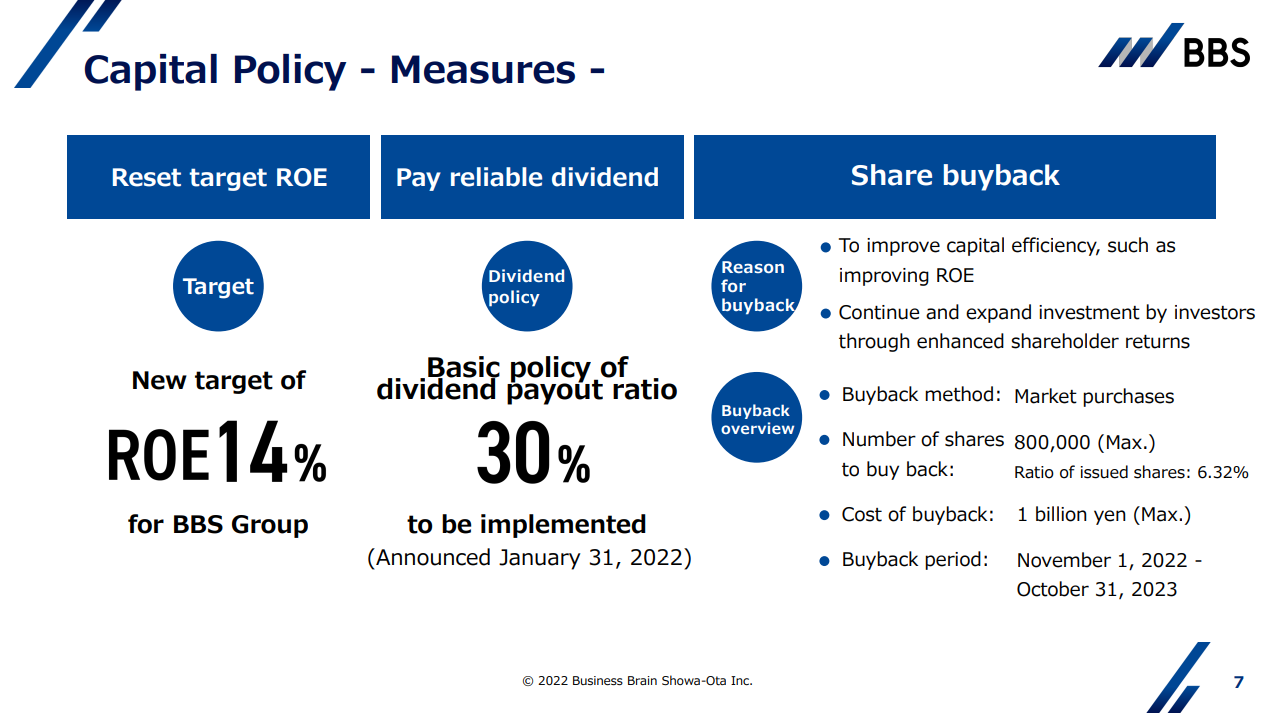

On company tenure and management personnel, the company was founded in 1967 where it started with data entry services from which it moved to system development for prefectural hospitals. What the company does appear to lack however is any significant insider ownership, instead there is an employment trust which owns ~6.5% as a whole and then several strategic stakes with the rest being institutionally owned. Nevertheless, there is a clear capital policy outlined with the company targeting a high ROE of 14%, despite holding some 75% of their equity in liquid cash and securities which if backed out indicates a current state after tax ROIC of ~45%.

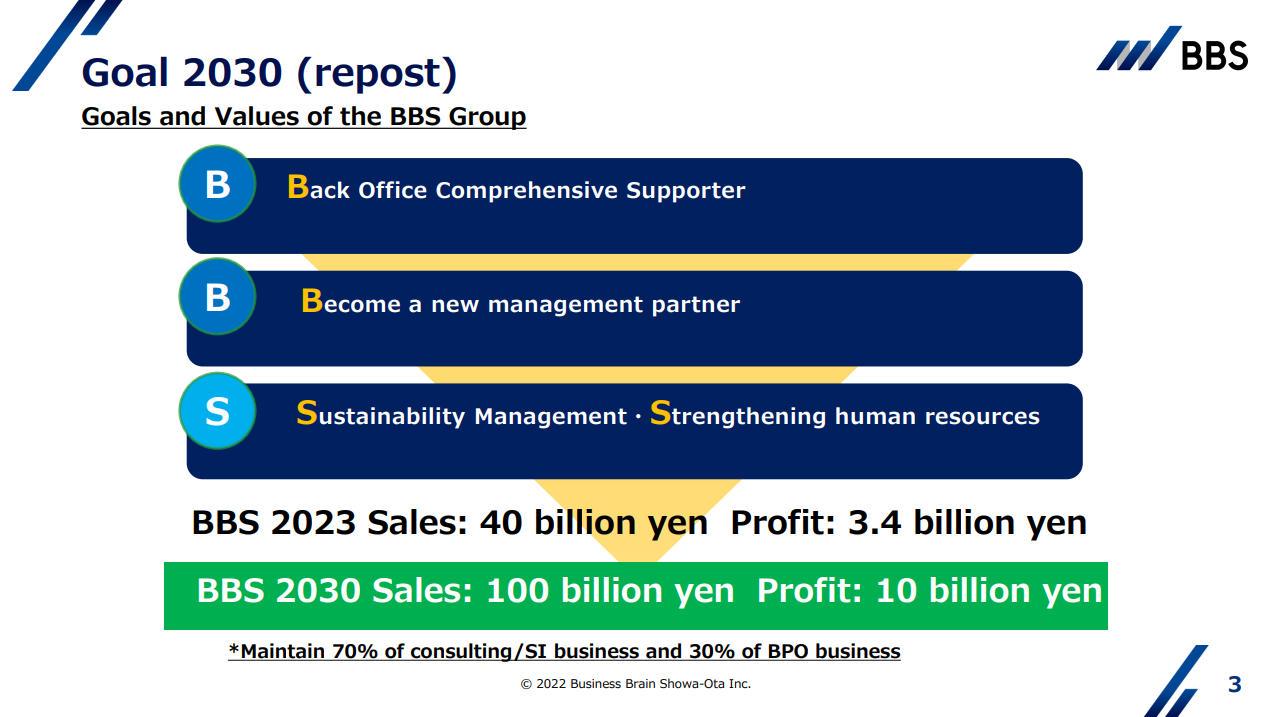

Regarding the financial goals, the group is intent on growing their profts (EBIT) to ¥30B by 2030, a CAGR of ~17% from 2023 to 2030, which when combined with a Dividend yield of ~3% is forward hold returns of 20% p.a. Given the company currently trades on a PE (exc. Cash) of ~9x, this equates to a PEGY of 0.45x if the management plan plays out as according to forecast. Over the past 7 years the EPS have compounded at a rate of 18% CAGR with a similar payout ratio as above, so both the forward and backward PEGY is the same. Nevertheless BBS is curious and seems to be worth more of my time.

Thank you for Reading

Tristan

Isn't the value here as a stub trade? They have a listed subsidiary whose stake is pretty much the parent's market cap and the parent is doing a large buyback...

hey, how do they grow, how big is their market?