Business Model

Provides support and investment services to Licensees of Financial advisers, accountants and mortgage brokers in Australia.

Pricing Model Change

Old Rebate Product-based revenue

Revenue earned through the provision of funds management services to its customers.

Fee is charged as a fixed % of FUM

Revenue is recognised provided the customer is using the service and consuming the benefits as provided by the group. Centrepoint acts as an agent for advisers, receiving a rebate on each product sold from product manufacturers.

Therefore, there is incentive to place the highest yielding products in the Authorisedproduct list for advisers.

The commissions on these products are paid on a monthly basis.

Important to mention that these fees, whilst grandfathered now, are regulated by the Australian Financial Complaints Authority with a complete ban to occur on the 1st January 2021.

New Fixed-fee Subscription Model

Response to AFCA Rebate ban is to replace with new pricing arrangement. Majority of firms have been moved to this model with 86% of previous firms taking up the shift.

Fee is for the use of AFSL by authorised rep on a monthly basis. Performance obligation as per terms of the contract.

Similarly, software provided with a monthly/quarterly revenue which is for education and admin services

Legacy Claims

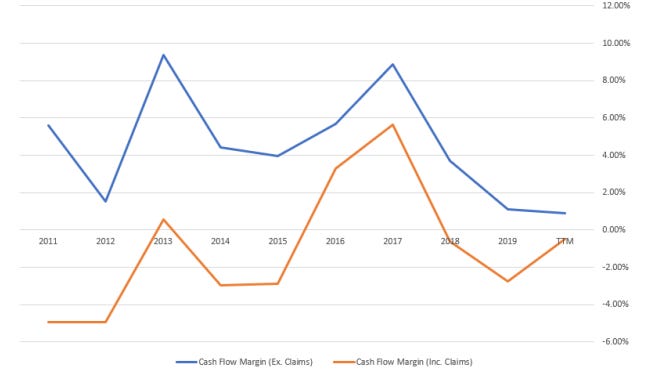

Claims from advice provided prior to 1 July 2010. This has plagued the company for a decade. They do create Balance sheet provisions for these claims, but the impact has caused their cash flow to be subpar for quit a long time. These claims are expected to be reported and resolved in full by 2021. Below is the Cash earnings margin of the group with and without the claims. As can be seen, without the claims, the business is sustainably profitable. This gives potential for margin inflection as the claims roll-off.

Balance Sheet + Off-Balance Sheet Tax effects

As of 31 March 2020 the group has a cash balance of $8.4m with no debt. There is also ~$6m of Receivable loans providing additional cash flow. $51m of tax losses of which ~60% relates to assessable income, with the rest being capital losses. $17.5m or 12c per share of Franking credits available. Low-impact of claims should keep the business running at a profit or a slight loss.

Capital Allocation

The business conducted a buy-back of 4.6m shares in March ~3% of the float. 10% is authorised so potentially could buy back another 7%.

Franking credits mean potential for franked dividends.

Due to the FASEA Education standards, many advisers are leaving the industry as they do not desire to get the required education standards. Centrepoint says this industry consolidation provides significant inorganic growth opportunities. From my perspective while this is great, I'm afraid of their diligence on price. I will monitor this going forward.

Conclusion

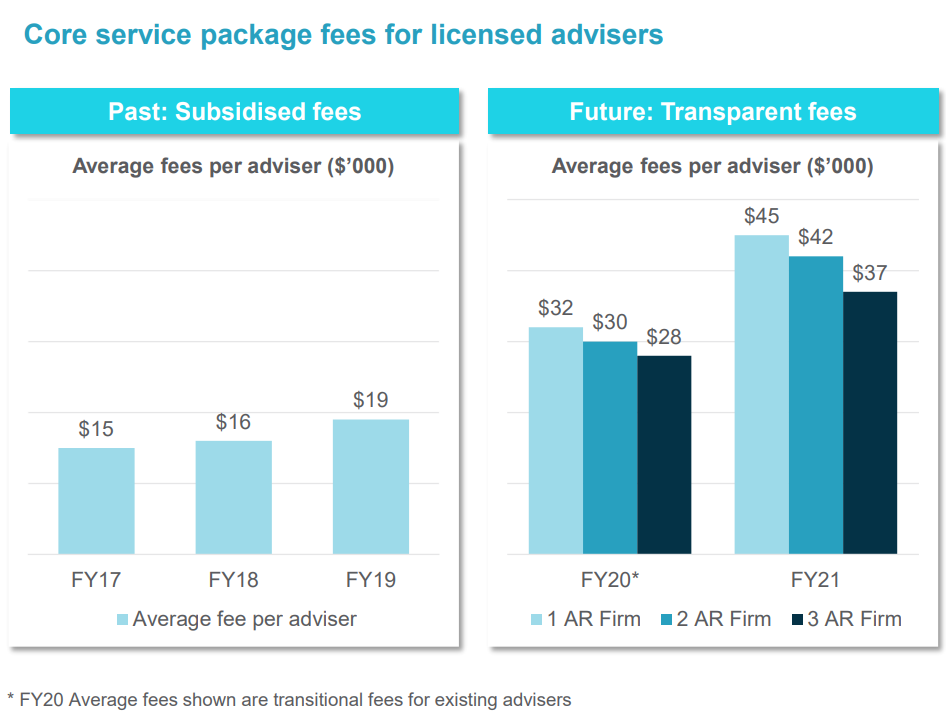

Where the claims are relieved, the reduction in unsustainable but profitable rebate revenue has caused a strong reduction in revenue over the last few years. The group plans to remedy this impact by aggressively levying price increases on the new pricing model. Of which there was a 37% increase. What allows for this price increase. It's simply that in the past, licensed adviser fees were subsidised by commission payments, however, now with the absence of those product fees, Licensees collectively have to levy their own price increases to remain viable. This is not unique to Centrepoint, it's an industry-wide phenomenon.

However, these pricing levies have come to a halt, breaking my conviction to rush into this position just yet as the business Continuity plan for COVID-19 has waived fee increases and capped the current fees for 2 years from the 25th of March 2020. This means, this company might not truly wind up profitability for another few years, giving us time to observe the business, potentially waiting for a price below Net-cash. Currently trading at 1.3x Net cash