Charles River Associates (CRA), founded in 1965 is a global consulting business focusing on 2 main areas of Legal consulting and specialised sector consulting (such as its life sciences consulting division). Their headcount exceeds 900 with more than 75% of senior staff holding advanced degrees.

In their own words:

We are often retained in high-stakes matters, such as multibillion-dollar mergers and acquisitions, new product introductions, major strategy and capital investment decisions, and complex litigation, the outcomes of which often have significant consequences for the parties involved.

These matters often require independent analysis and, as a result, the parties involved must rely on outside experts. Our analytical strength enables us to reach objective, factual conclusions that help clients make important business and policy decisions and resolve critical disputes.

Clients turn to us because we can provide highly credentialed and experienced economic and finance experts to address critical, tough assignments, with high-stakes outcomes.

This has led to an envious client base where none account for over 5% of the groups fees as shown below. I would highly recommend reading their 2019 Investor Day presentation.

In 2015 & 2017 there were separate Value Investors Club posts by zach721, an investment which would of gone on to see him make >4x on his investment over the next 8 years to today or ~19% CAGR. Breaking this down the business saw a slight decline in the statutory P/E multiple, shares outstanding fall from 10.2m to 7.4m (~4% CAGR) and Net income compound at ~16% CAGR with an average dividend yield of 1-2%.

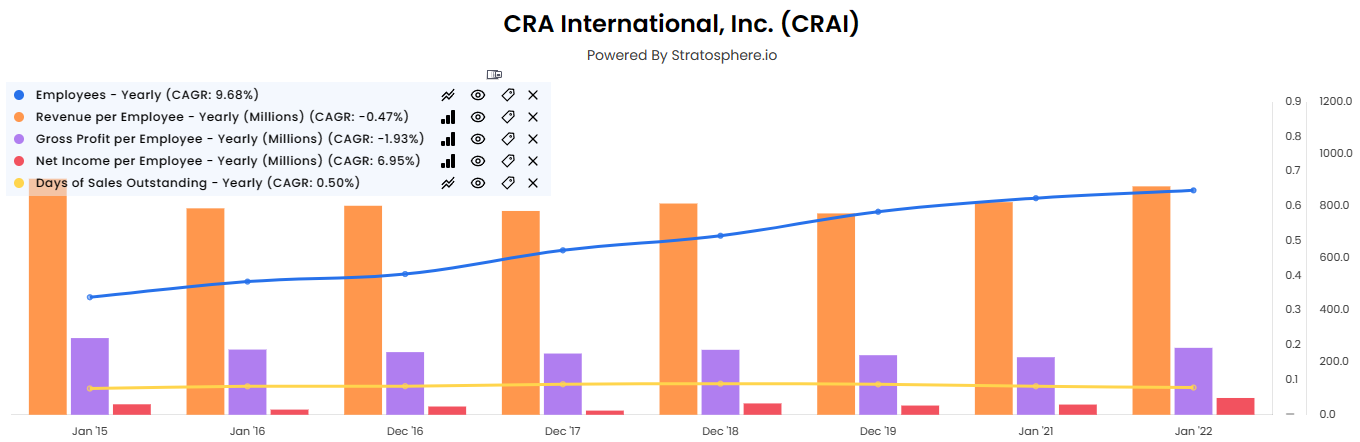

Diving deeper into their financial economics, it’s a standard professional services business where the primary importance is keeping lockup low and keeping profit/employee high. The primary methods to do this are to keep utilisation high (billable time/total time) and to have high value staff. notwithstanding this obviously it is important to grow the number of staff as well.

Thanks to Stratosphere I was able to break this down and we can see that over the past 8 years the value has come predominately from a growing employee base and overheads rather than the profit/employee indicating steady pricing per hour and utilisation. So then the question is, why is this so? Well, there is a few things which we can touch on by looking at the change in the margin profile as shown below.

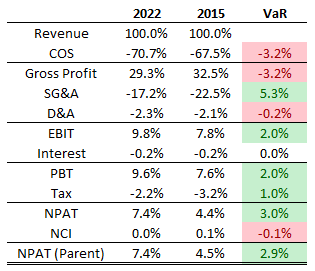

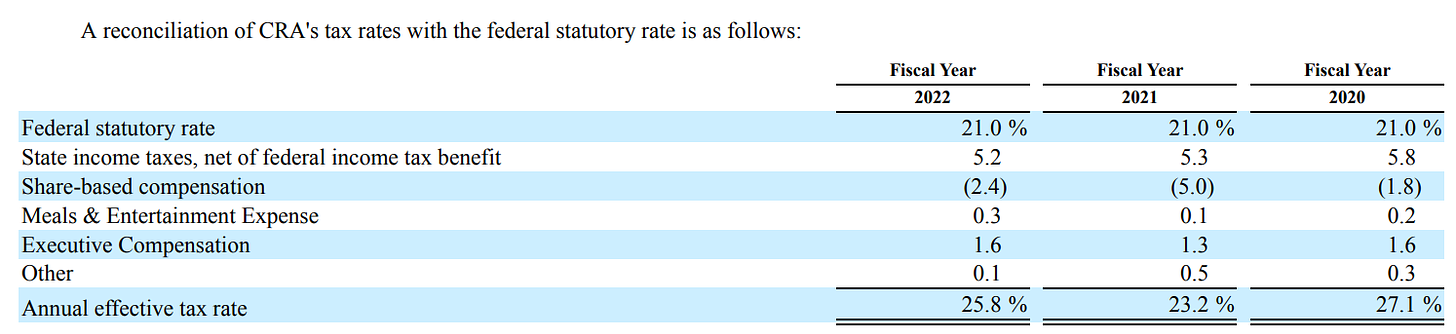

First, the most obvious one is the federal tax cut from 35% to 21% in 2018. A cut of ~40%, which doesn’t quite explain the ~31% improvement in the tax as a % of revenues, but it goes much of the way there, the rest is explained via. state taxes as shown below.

The more intriguing part is the massive improvement in SG&A related costs, which you can attribute to a concerted effort to cutting them in the COVID-19 initial wave in 2020, where the margin fell >4% YoY, which has seemed to of stuck, excellent to see. From Q1 2021 transcsript:

SG&A has been questioned almost every single quarter since this rise, with analysts querying every single time whether we will ever see pre-pandemic SG&A again (18-19% of revenue exc. nonemployee commissions), and management reiterating a steady-state ~15-16% going forward, a structural 3-4% improvement in margins as confirmed below.

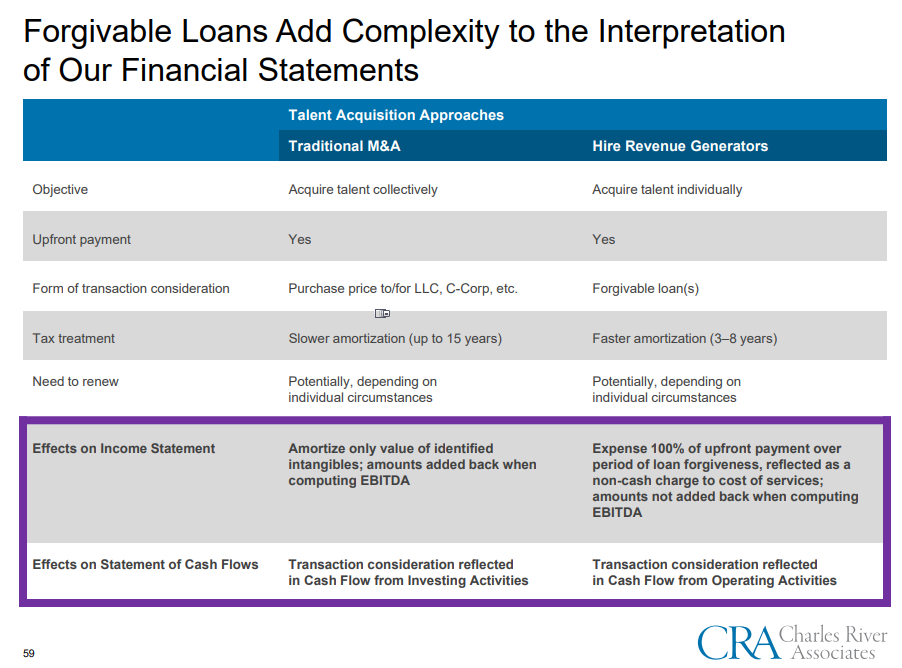

Another point to note is that the company reinvests in so called forgivable loans in order to secure highly credentialed lateral hires. These forgivable loans instead of it being capitalised like a merger, get expensed as effectively a bad debt, despite them being a recruitment cost. These costs have historically hovered around 5-7% of revenue of which management says about 2% is maintaining current employees. Without these EBITDA margins would be closer to 13-19% instead of the 10-12% on a statutory basis.

Wrapping this up CRA is currently trading at a share price of $96.59. With ~10.5 NPAT margins in the absence of growth related forgivable loans the company trades on a PE of ~13x including their net debt. Given ~20% 5y compounded earnings growth, a 7% LTM buyback yield and 1.5% dividend yield, CRA is trading on a 5y PEGY of 0.46x, which is below our stated hurdle of <0.5x. CRA as such looks to be worthy of further research.