CI Financial is a publicly owned asset management holding company. Through its subsidiaries, the firm manages separate client focused equity, fixed income, and alternative investments portfolios. It also manages mutual funds, hedge funds, and fund of funds for its clients through its subsidiaries. The firm was founded in 1965 and is based in Toronto, Canada with additional offices in Vancouver, Canada; Calgary, Canada; and Montreal, Canada.

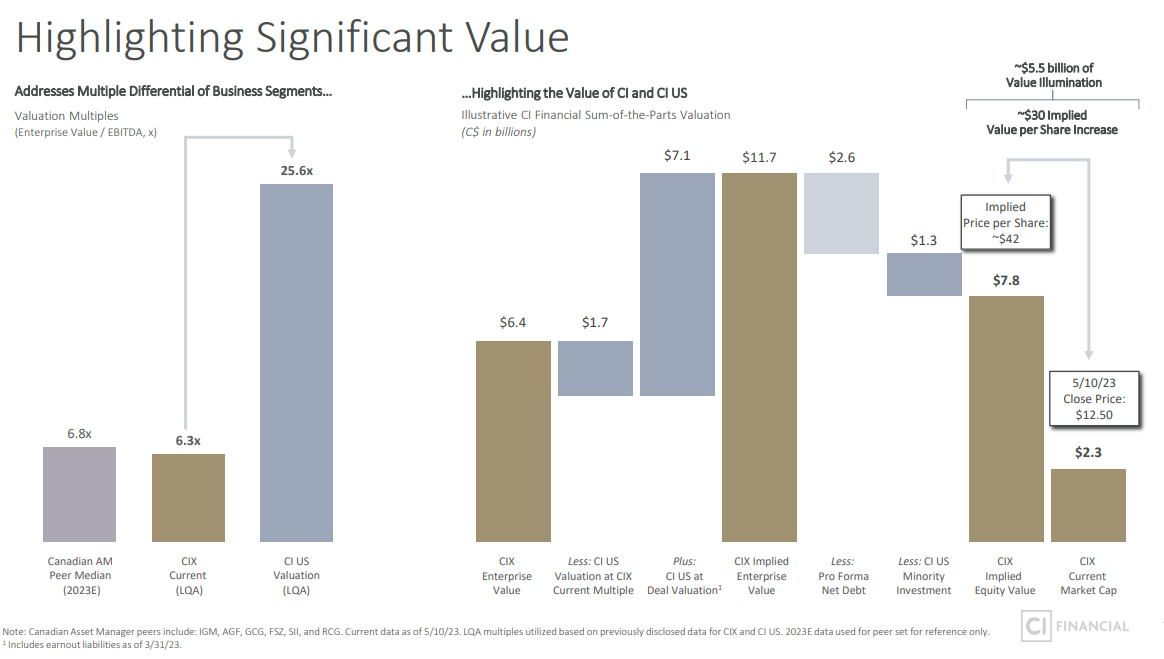

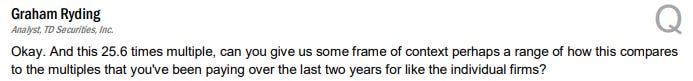

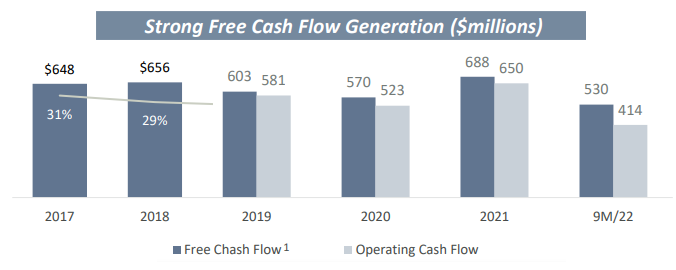

CI Financial announced plans to IPO it’s US based wealth management business by 2030, with a pre-IPO round already completed of CAD $1.34B, or half the market capitalisation of the company. The group highlights that this transaction is highly value-accretive to the company as the US business gets an implied gross valuation of CAD $7.1b and on a sum-of-the parts basis values the equity of the company at $42 per share, compared to the current $14.76 (as at 22 June 2023).

The main assumption here is that they have only raised 20% of the US business thus far and this gap is contingent on the group raising the additional 80% at the same valuation. Given this is really quite a high multiple, there is risk they will not be able to achieve that for the entire ownership stake.

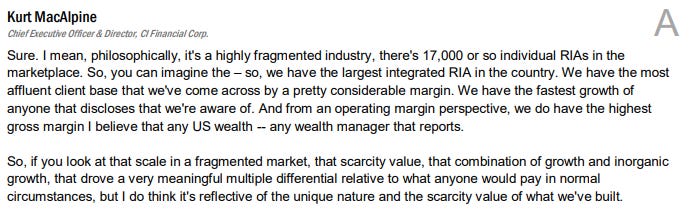

Funds raised are to be used for deleveraging, leaving the group with long term debt with very long-term debt maturity leftover as shown below.

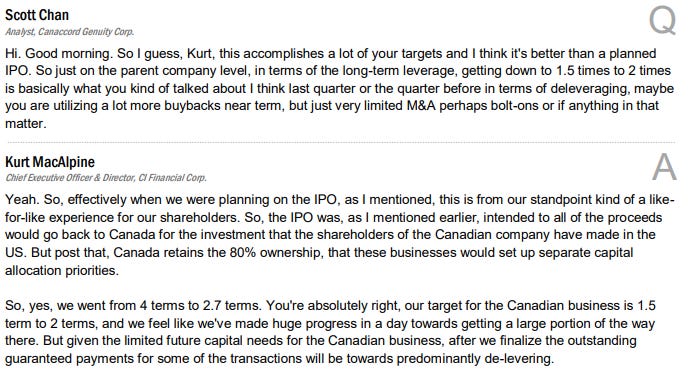

The group’s target for the Canadian business is net leverage (Net debt/EBITDA) of 1.5x - 2.0x, and they are deleveraged down to 2.7x post this Pre-IPO round. So not much left to get there, and there appears to be some smaller divestment transactions lined up in order to further reduce their debt profile.

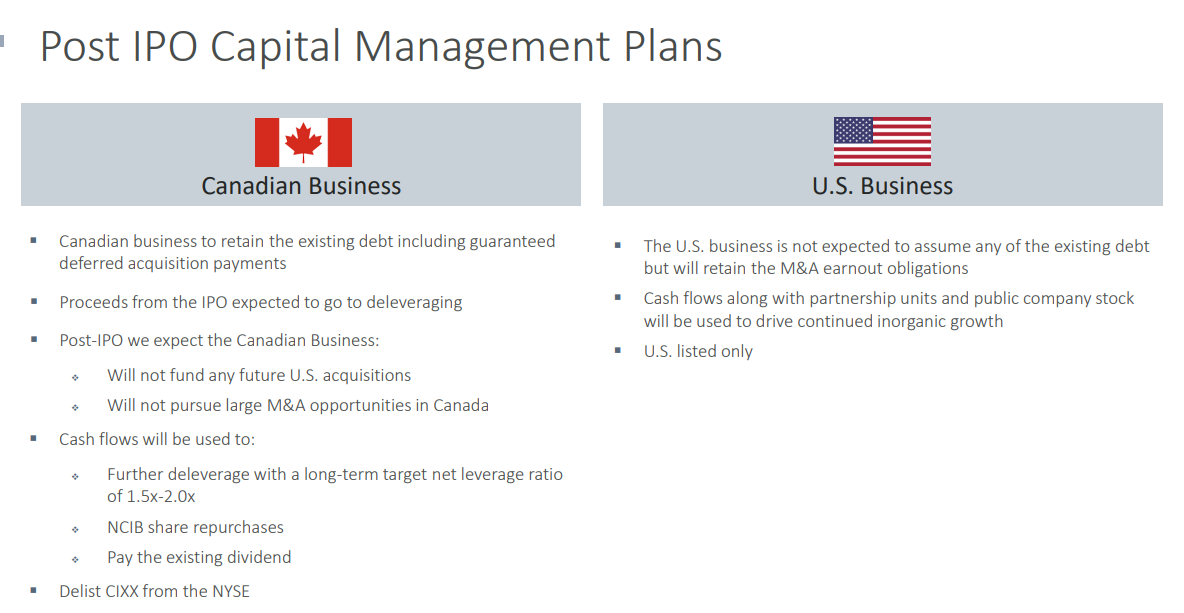

So obviously, there is a catalyst here… the IPO of the US business provides a signficant bump to shareholder value, and given the group’s history of capital allocation, there appears to be a valid investment case for substantial return of capital to shareholders.

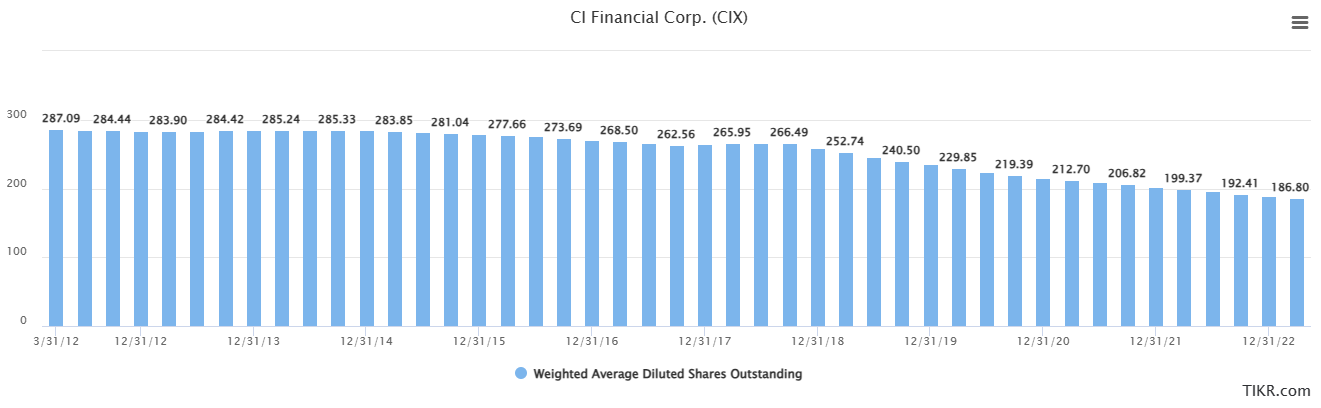

Historically, the group has had a relatively stable to declining amount of free cash flow with growing revenue but declining margins.

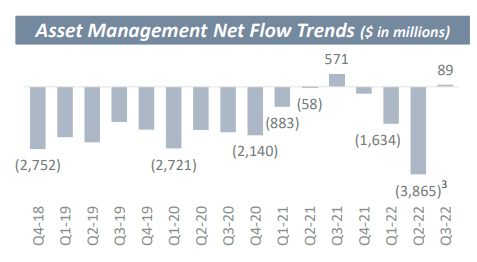

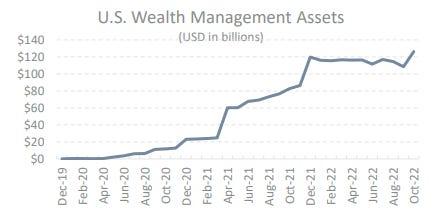

However, notably the only reason the group has maintained it’s current margins is because its US business has been offsetting the consistent net outflows being experienced by the CI global AM business. The Canadian Wealth business remains relatively strong lastly.

If you take this into account and that the group is intending to list it’s high growth counterpart, then the leftover business deserves a much lower multiple as a result.

On a granular level, CI Financial without 20% of CI US is generating just shy of CAD $1m EBITDA and ~$600m of after-tax FCF. With a $2.6B market cap and $5.2B enterprise value it is currently priced at ~9x FCF on an EV basis. On an ongoing basis it looks “OK” but the real pudding is in the optionality of their future US spin-off.

Thanks for reading.

This is a reminder that currently, the Hurdle Rate Substack is offering subscribers a 50% discount through to 30 June 2023 on an annual subscription at a rate of AUD $75 per year (USD $50), down from AUD $150 per year (USD $100).