About

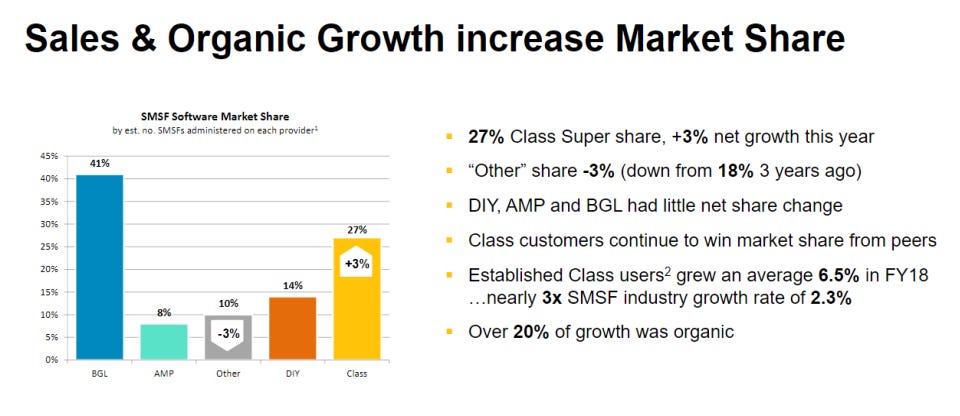

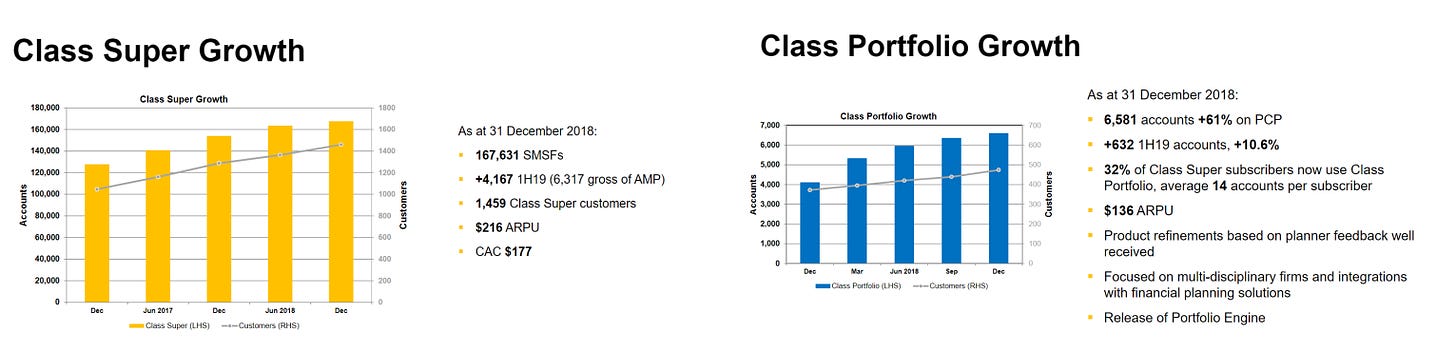

Class Limited CL1 is the provider of cloud-based administration software solutions tailored to the requirements of SMSF administrators in Australia. It also provides software to streamline the administration of investment portfolios held by non-SMSF entities such as companies, trusts and individuals. More than 165,000 accounts are administered using Class software by more than 1,400 accounting and administration practices. Today, Class is the leading provider of cloud-based administration software for SMSFs, with around 28% of all SMSFs administered on Class Super.

Strategic Focus

Over the years, Class has gone through lots of change as we’ve continued to develop a strong and innovative organisation. But at the core, we’re still doing what we set out to do – delivering robust wealth accounting solutions that drive positive change, and deliver significant business results. The business is continuing to invest in product and people to ensure that we are well positioned to take advantage of several trends that will drive our growth over the next few years:

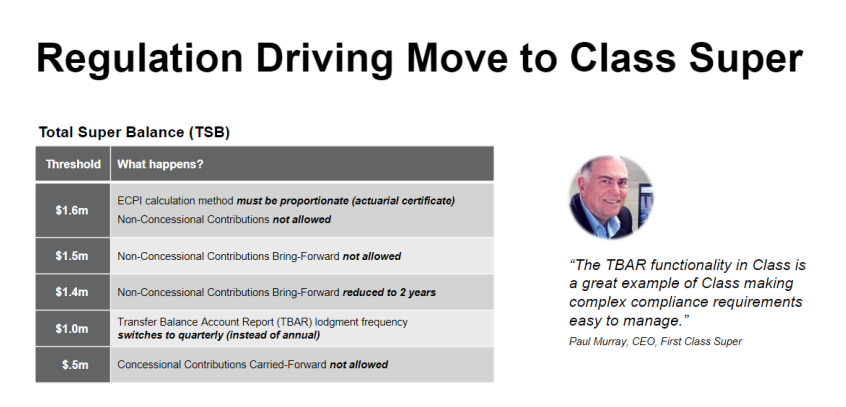

“Other” Excel) users adopting technology due to tighter caps, limits and reporting requirements

Increasing conversions from other cloud solutions as clients look for efficiency gains

Continued strong organic growth from Class customers

SMSF industry consolidation

Future SMSF establishments

Class is set to benefit from these SMSF growth trends, and outside SMSF we will:

Expand on our engagement with partners and financial planners

Grow Portfolio and partner revenue, and

Explore strategic alliances and acquisitions in adjacent markets

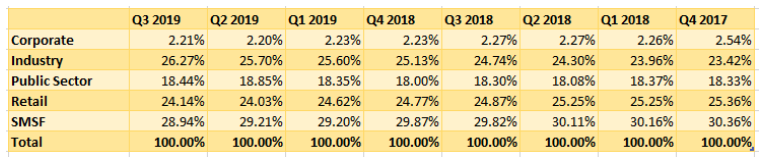

The Superannuation Industry

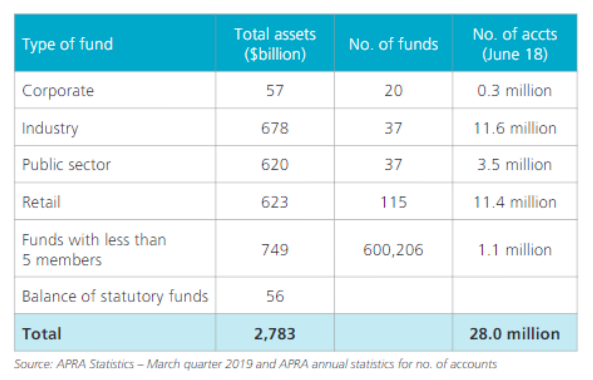

The Superannuation industry can be broken down into several types of funds

Corporate (Arranged by an employer)

Industry (Not-for-profit )

Retail (Run by banks/investment companies)

Public Sector (Government)

Self-Managed (Private management)

Superannuation assets totalled $2.8 trillion at the end of the March 2019 quarter. Of this SMSF's account for $749 Billion or 27% of all Superannuation assets in circulation.

It is obvious that these are mostly the wealthy as in terms of the number of accounts, SMSF's only makes up 4% of the total number of superannuation accounts.

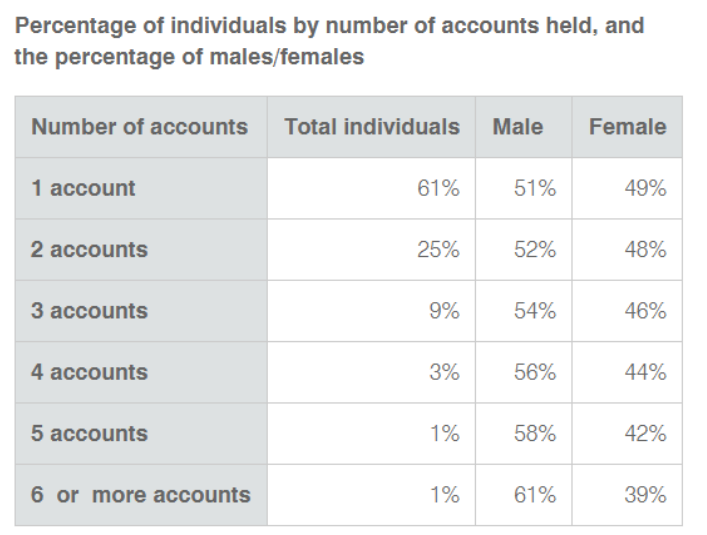

It is important to keep in mind that approximately 39% of Australian's have more than one super account. Taking this into account, the total number of Australian's with super is 15.6M people.

Furthermore, as at 30 June 2018, the ATO has indicated that there was a total of 6.2 Million accounts considered 'lost' or ATO-held with a total value of $17.5 Billion.

With the onset of recent legislation such as MySuper accounts and the 'Protect Your Super' Laws, superannuation assets should grow at a faster rate without unnecessary depletion to to fees or insurance

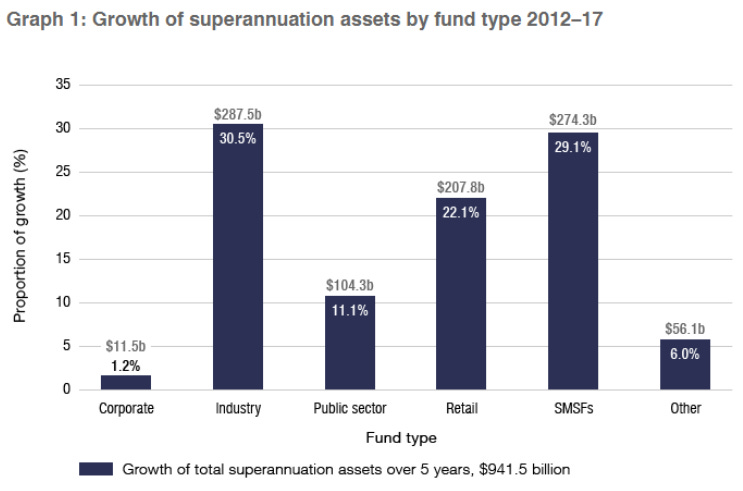

Statistics from the ATO on the growth of Superannuation assets indicate that Industry and Self-managed funds are leading ahead of other fund types.

Industry funds are the main concern, however, the majority of inflows into those funds are from retail and corporate sector funds as a result of a focus on fees in recent years and the banking royal commission.

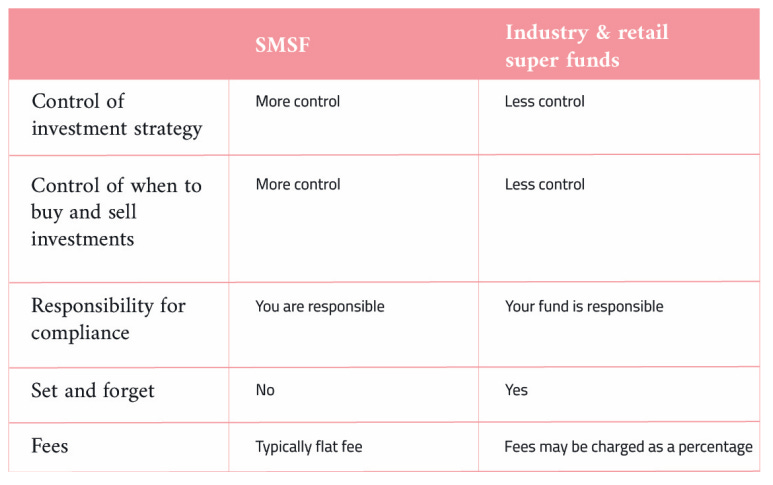

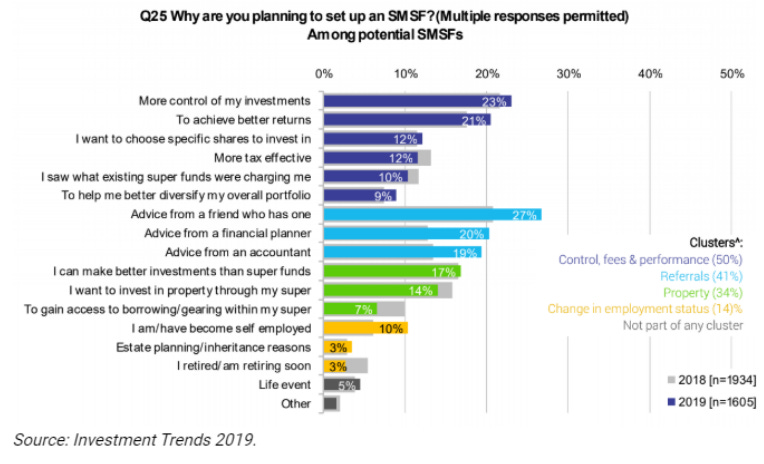

The main benefits of having an SMSF are outlined in the chart below. It's clear that those that want to be proactive in regards to their retirement funds are better off in an SMSF. Hear me out here.

SMSF's allow for comprehensive control and flexibility in regards to taxation, strategy and estate planning. This in of itself is a huge advantage over industry super funds. A few SMSF Specific examples are:

Limited Recourse Borrowing arrangements LRBA. This allows SMSF's to enter into the property market. This allows for business owners to hold their business premises inside an SMSF. You can use the benefits of the concessional contributions tax deduction to accelerate the rate at which the loan can be paid down. It also carries other tax benefits in regards to capital gains tax and general tax at 15% rather than your marginal tax rate.

Transitioning from accumulation to pension phase in an ASFA Regulated fund will incur a buy/sell spread and taxable event. This is non-existent and an SMSF and rollover into pension phase results in no fall in asset value.

The Impact of the Banking Royal Commission

Key recommendations:

People should only have one default super fund.

Financial advisers who are not independent must disclose this to clients in a prescribed format.

Ban hawking (the promoting of superannuation products during unrelated financial product discussions).

Ban grandfathered commissions (attached to some bank and insuranceowned super funds).

Overhaul executive pay so that incentives are more aligned to nonfinancial risk.

Overhaul the culture of the regulators.

The majority of these regulations have impacted Retail super funds mostly, as they suffer significant conflicts of interest being aligned with their shareholders rather than their members. As such a mistrust in Retail funds has materialised in a loss of market share over the last few years, with industry super funds picking up the slack.

Meanwhile, Self-managed super funds seem rather unaffected by these particular proposals, however SMSF's have suffered a decline in recent years as the appeal of industry super funds has become mainstream.

The Future of SMSF’s

A decade ago, over 40,000 SMSFs a year were being established. It’s now closer to 20,000, but that looks more like a maturity than a sector decline. The 2019 Vanguard/Investment Trends SMSF Reports show funds are being established when trustees are at a younger age, and one in five institutional super fund members is considering setting up an SMSF in the near future.

The Reports show responses from 5,000 SMSF trustees and 300 financial planners who advise SMSFs. This sector holds $750 billion compared with $1.8 trillion in all the large funds. There are now 600,000 SMSFs with average assets of $1.2 million, although the more meaningful median measure is $693,000, usually between two members. At $350,000 each to last for decades of retirement, SMSFs are not only used by wealthy people.

On the other hand, between 2013 and 2019, there is a massive increase in the number of trustees who have considered closing their SMSF and moving to a large fund, from only 4% to 20% 17% industry fund, 3% retail fund). The Royal Commission was a major factor, as well as the franking debate. Therefore it would be safe to expect that SMSF's will have some degree of bounce back in adoption rates due to the cleared stigma in the industry.

What dos this mean for Class?

While growth in the set-up of SMSF's has declined over the years, Their is a unique proposition in using a self-managed super fund and i believe that there will be no shortage of people who see the benefits of using one in the future. Rather than that, if retail funds do not pick up their game, industry funds will soak up all of their market share.

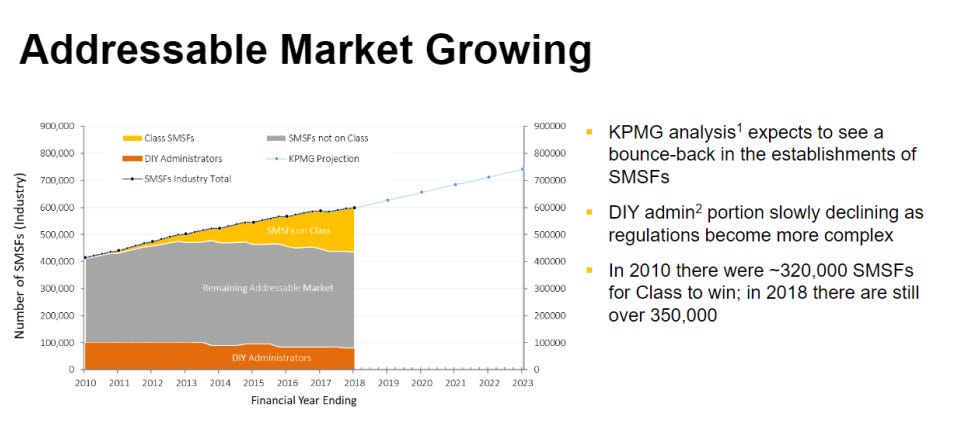

For Class's addressable market, they expect that the DIY fund administrators will begin to decline as regulations become increasingly complex, bringing them an adoption opportunity. Furthermore, their market share is also rapidly growing as excel spreadsheet and BGL legacy products lose out in quality to Class's innovative solution.

Andrew Russell (New CEO) & Management Incentive Structure

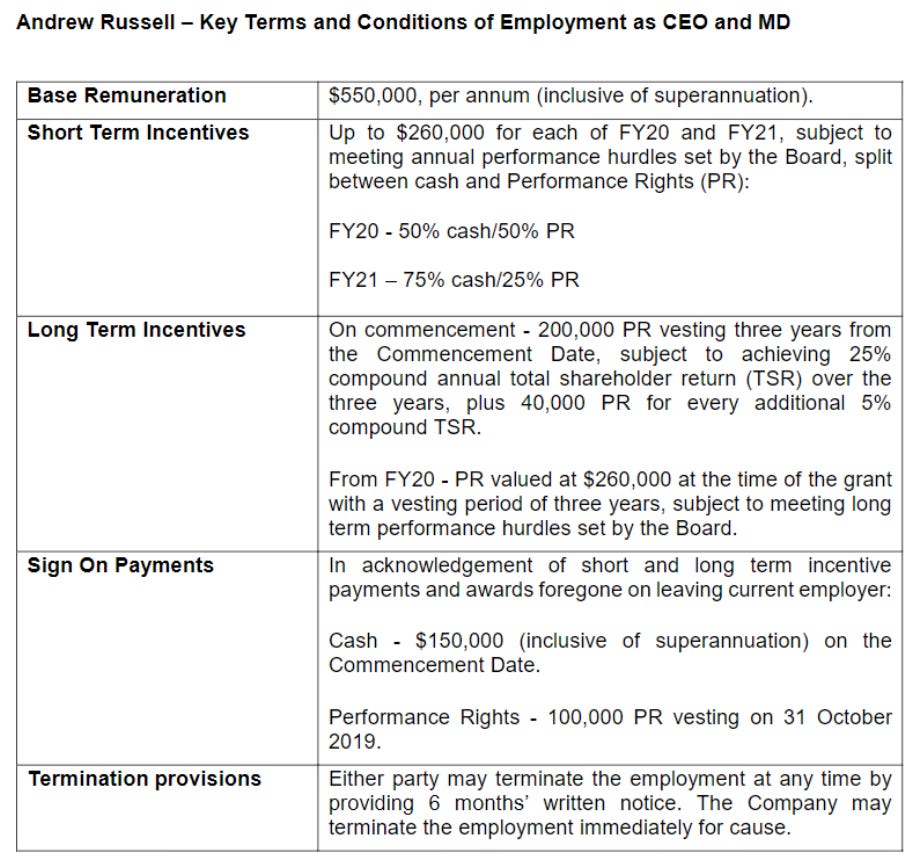

The recent appointment of Andrew Russell left a valuable terms of employment disclosure which i find perfect to analyse.

For comparison:

Steven Vamos, CEO of Xero is on a base gross salary of $1.012 Million

Sam Allert, CEO of Reckon Ltd is on a base salary of $723k

Here we see a base gross salary of $550k. Therefore this is not particularly excessive, which is a good sign.

What is very interesting is the Long term incentive of 200,000 Performance rights for achieving 25% CAGR for shareholders over the next three years with 40,000 for every additional 5%. This is excellent alignment of interest and is very reassuring for shareholders that management is incentivised to reward shareholders.

Financial Performance

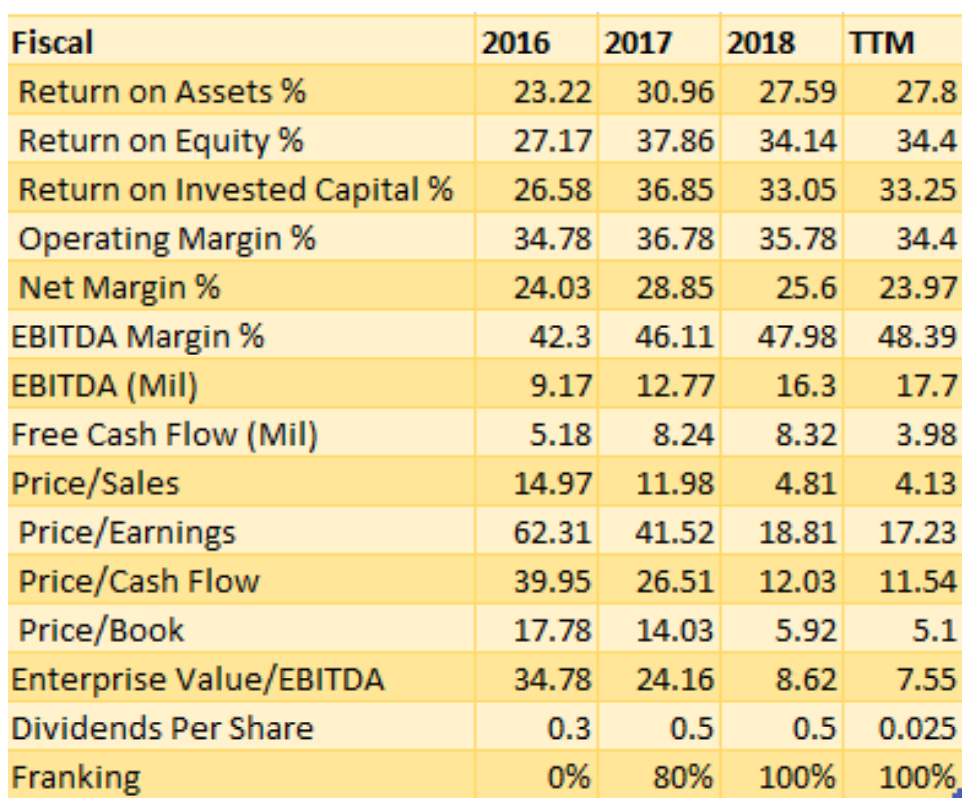

Profitability metrics are extremely attractive, especially the level of return on invested capital. At above 30% this means that paying out 65% of the earnings is sustainable due to the fact that every dollar they put into the business generated a 33% return. Last year the Earnings growth was 9% with a 33% return on invested capital.

Furthermore we can see that these were priced aggressively in the past, yet in recent times has become significantly cheaper by a factor of almost 4. No significant change in profitability has caused a justification for this and it really is an unwarranted change in price.

This presents an opportunity for me to pick it up while it is cheap. It's likely future expectations of the Superannuation industry, particularly SMSF's were hurt by the growth of the industry funds, Royal commissions and Franking credit debate. However, as an accountant in the industry, i have seen nothing but a growing amount of clients in our practice. The numbers reflect my experience despite a small sample size.

Valuation

Using the above growth we can conservatively assume the following:

Class Super subscriber growth rate = 15%

Class Portfolio growth rate = 25%

Expenses are equal to the current NPAT adjusted by adding back Depreciation and amortisation.

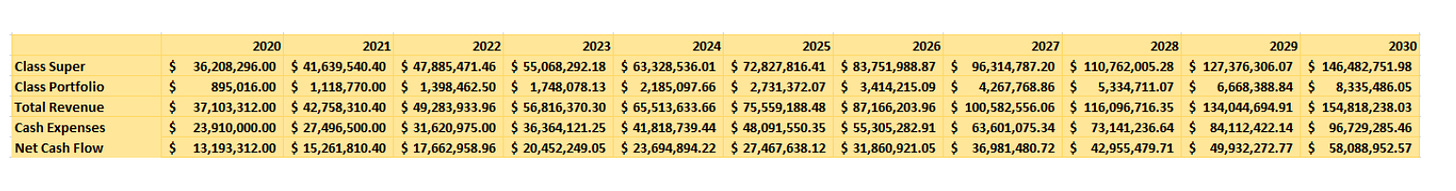

Using these assumptions and the ARPU figures class has given us we can model future cash flows to be the following:

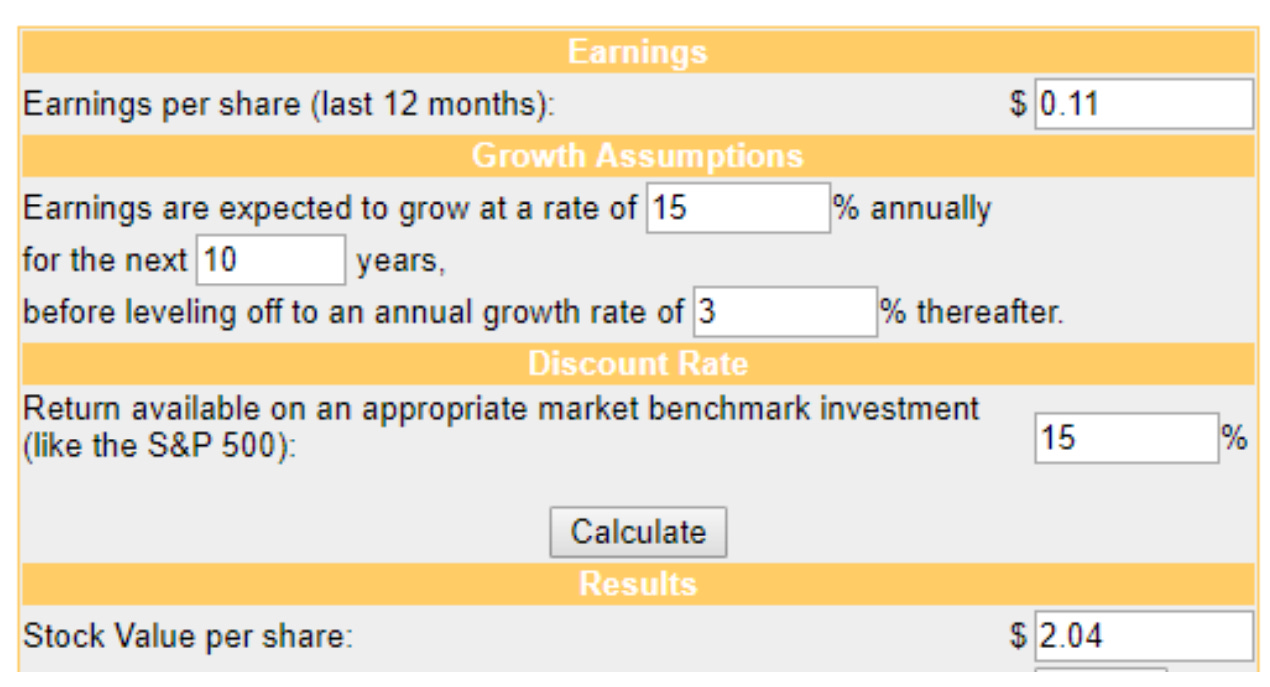

This implies a Growth rate of 15%. Taking this and putting it into a DCF calculator with the following assumptions yields the following:

15% Discount Rate

3% Inflation

$2.04 represents a current Margin of safety of $0.77 per share or 37.7%. Given conservative assumptions on earnings growth Past 3 years actual = 35.7% and revenue growth Past 5 years actual = 43.94% this is a very attractive position.

Conclusion

Class is an attractive player in a niche industry with little in the way of competitors. This has translated to wonderful returns of capital and consequently, value for shareholders. Opportunities exist in the onboarding of DIY administrators and general consolidation of market share to Class and BGL.