Class (ASX:CL1) - #2 - Deep Dive

SMSF Accounting Software - "Capital-Light Duopoly with 99% Retention rates"

Class is the leading provider of Cloud-based administration software tailored to the requirements of SMSF Administrators in Australia. It was founded in 2005, with the intention to address and automate the manual workloads associated with SMSF Adminsitration driving processing efficiency and scalability.

The industry is driven by two specific growth trends; 1) The increasing number of Australians choosing the manage their superannuation through SMSFs; and 2) The shift away from desktop-based systems and manual processing.

Besides their main focus of SMSFs, Class has recently embraced are more holistic approach to their platform, looking to capitalise on opportunities such as the recent theme of investment trusts.

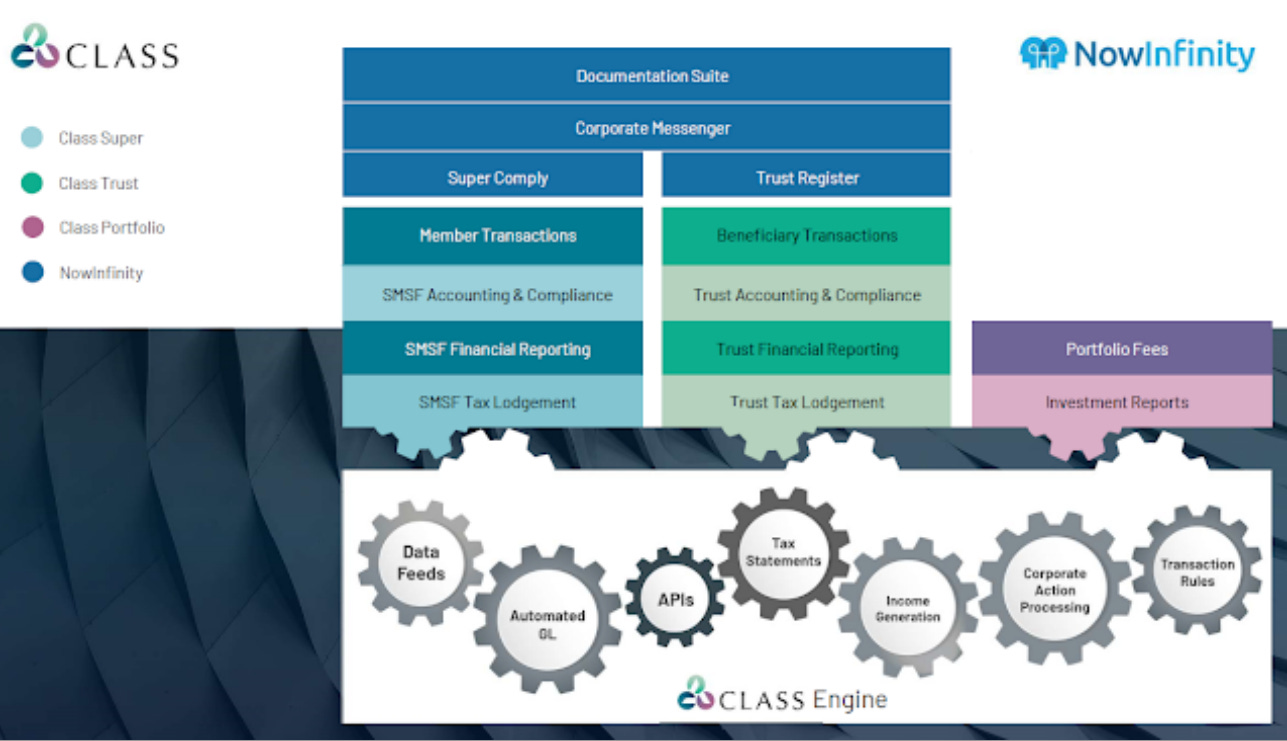

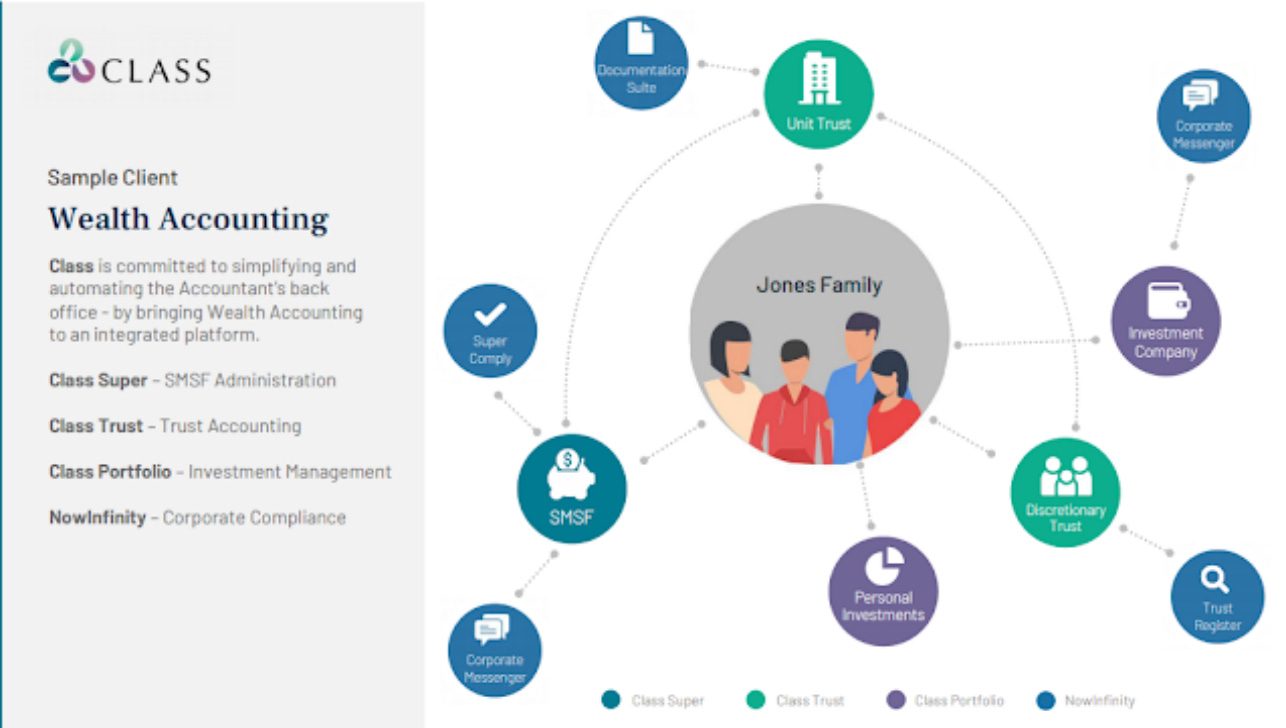

Their products include Super, Portfolio, Trust & Nowinfinity. The features and how they work together are outlined below:

So we know what they are, but how are they offered is just as appropriate a question to ask. Class Super, Portfolio & Trust are all offered to the 'Administrator' (Usually an Accountant) who pays a monthly subscription fee for the Class service on a 'per entity' basis. That is, if an accountant wants to sign up 10 SMSFs on the class platform, Class will collect a monthly subscription fee from 10 different entities despite these being under the umbrella of one 'Administrator'. The same goes for both the Portfolio and Trust platforms.

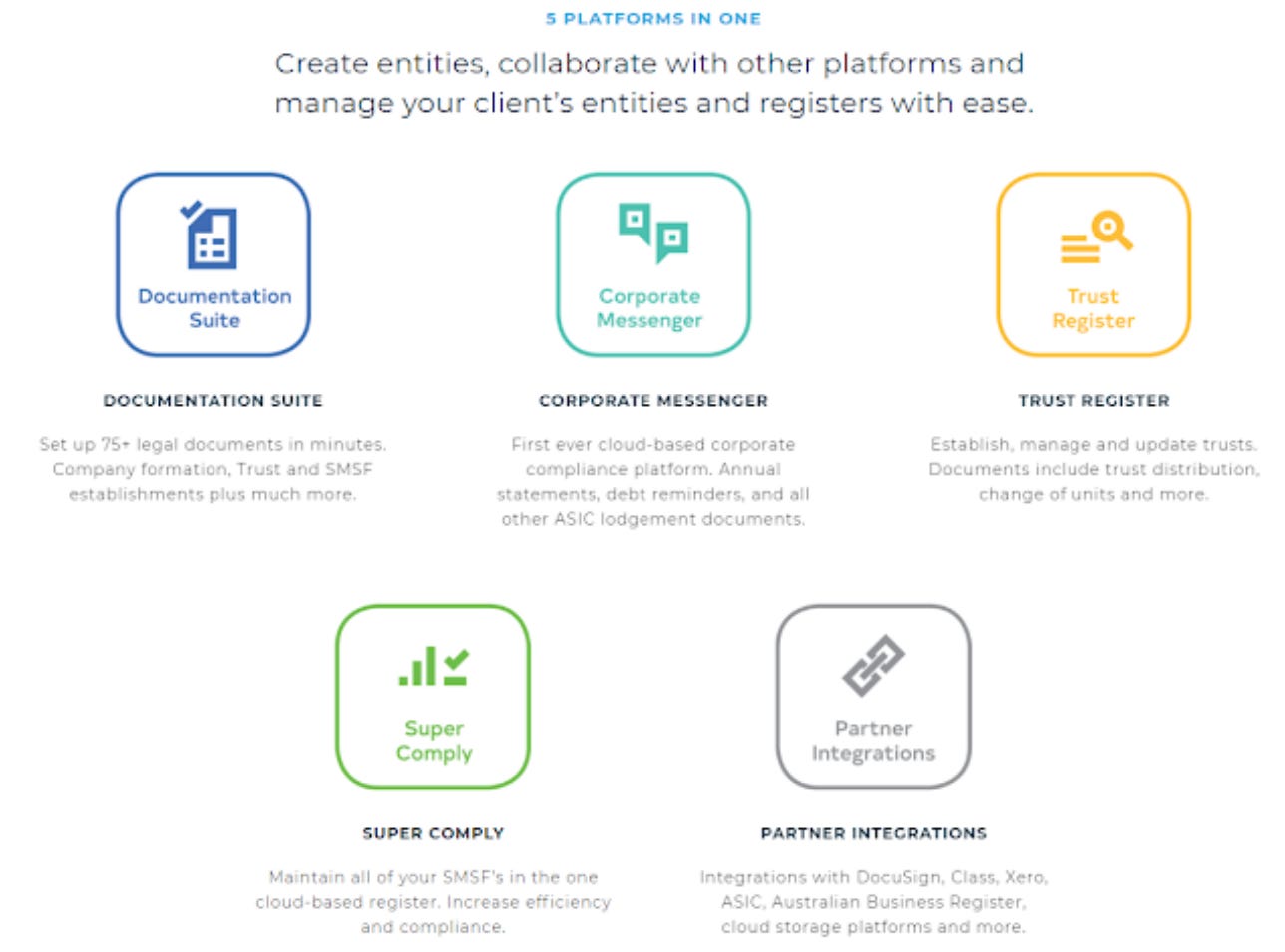

Nowinfinity works differently to the aforementioned products. To give a brief primer, the platform is actually 5 different services.

This demonstrates the value it offers as it bolts straight on to both the Class Super and Trust products as the compliance service, therein directly improving the experience and efficiency of business partners if they can integrate these offerings into the administration services. Furthermore, It also provides corporate messaging services which opens up the opportunity for a company-driven service in the future, namely investment companies i can think of would be a natural progression.

The fee structure for this platform is similar yet again to the Administration services outlined earlier. However the fee for most documents are charged on an annual basis rather than a monthly basis. Here lies an important point for revenue recognition. Currently as Class subscriptions are billed on a monthly basis and revenue is recognised over time, the contract liability is only a month of look-through revenue. This cash flow is received in advance, but only for a month. Now take that concept and apply it to Nowinfinity's model. As a result I expect the cash flow from Nowinfinity to be recognised 12 months in advance. This will result in a drastic increase in contract liabilities and cash flow, leading to a differentiation in cash conversion assuming the number of subscribers to Nowinfinity continues to grow.

With this suite of products they work in tandem with one another and provice cross-selling opportunities to Class when conversing with Administrators. For example. If an Accountant has 500 clients registered on Class with SMSFs, but 100 of those clients have discretionary investment Trusts, that's an opportunity. Repeat this mindset over the entire product and partner ecosystem and you start to see the addressable market open to Class. (Note below that Investment companies are administered in Portfolio hence my previous comment on the opportunity)

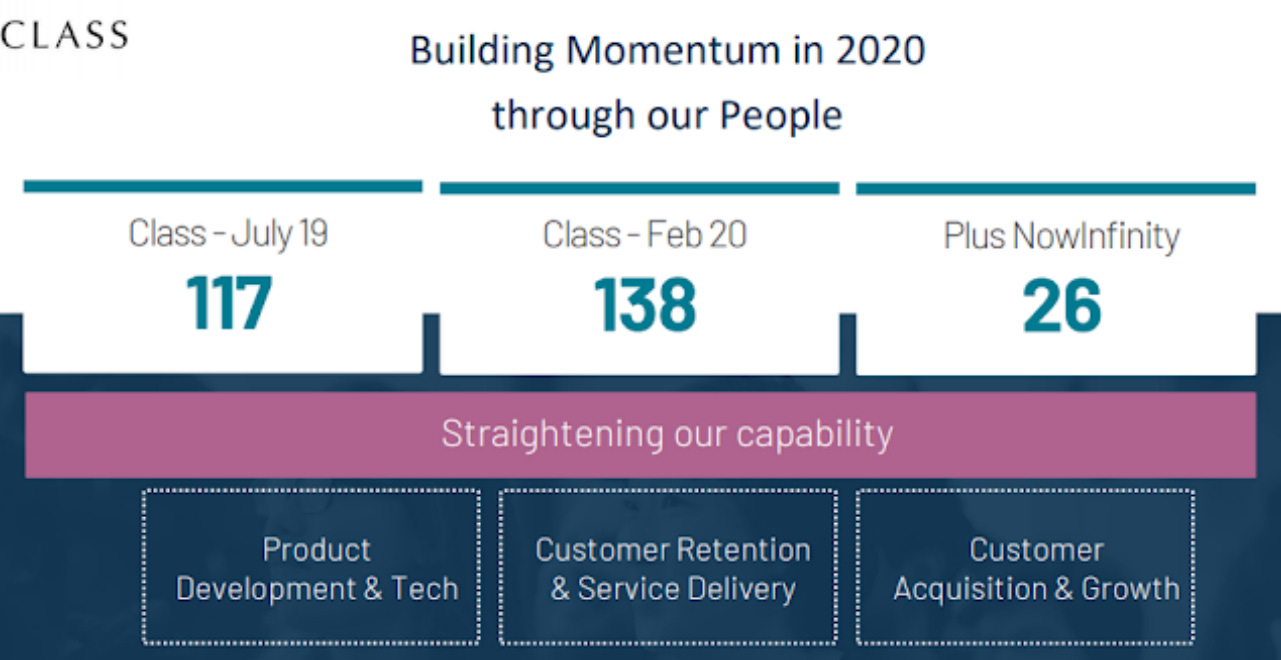

With that, we've covered the top line opportunity for Class, but that provides misleading context without a focus on cost. Fortunately for Class it's relatively lightweight leading to high margin profits. The bulk of the costs (About 2/3) is related to talent acquisition and retention. They mention that this is a core cost of their strategy to grow.

This investment in talent acquisition can be broken down in a focus on:

Customer Acquisition Employees - Sales and Marketing capacity

Product Development & Tech - Broadening feeds, software development and Integrations to lift per-partner revenue

Service Delivery - Efficient service delivery in scalability and automation drives margin improvements.

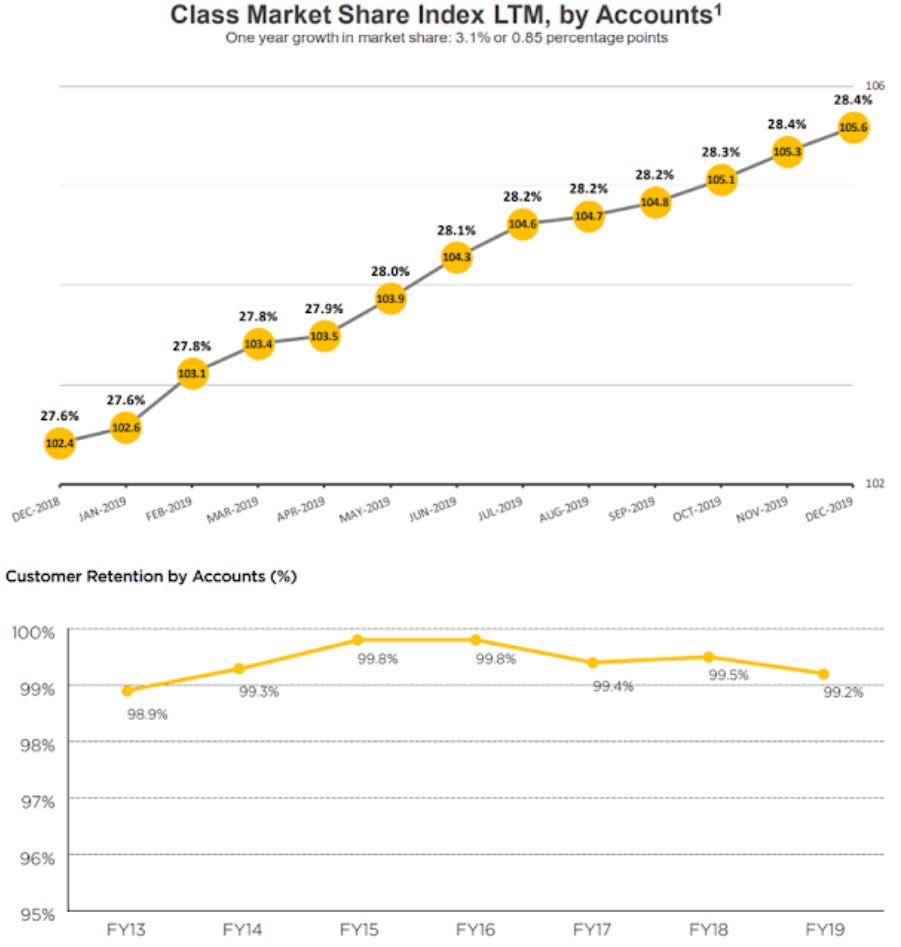

With these in mind, it paints context to the trajectory Class has taken and the results they have achieved. For instance the Customer retention rates are driven by Service delivery, Market share growth is driven by Customer Acquistion and the new products and switching costs are driven by product development and technology. Therefore the value of this staff can not be understated. Besides this the rest is mainly costs relating to data feed hosting and expensed research & development costs.

Lastly, those in charge of the strategic management of the company (Executives) include Andrew Russell and Glenn Day. Andrew was only recently appointed due to the previous CEO Kevin Bungard, who left on good terms and is now the COO of 'MyWorkpapers'. Andrew Russell brings over a decade of experience from REA, Mortgage Choice & Virgin money. Given his lack of Accounting exposure i'm not particularly confident on his prospects although there to make up for that is Glenn Day. Glenn has been with Class for over 10 years and is charge of financial management for the group.

These managers don't own much in the way of shareholder interest which is a big red flag for me given i tend to favour the 'Outsider' CEO traits such as high ownership interest and being a founder. For this reason the remuneration structure is particularly important here to ensure these two are acting for us, the shareholder.

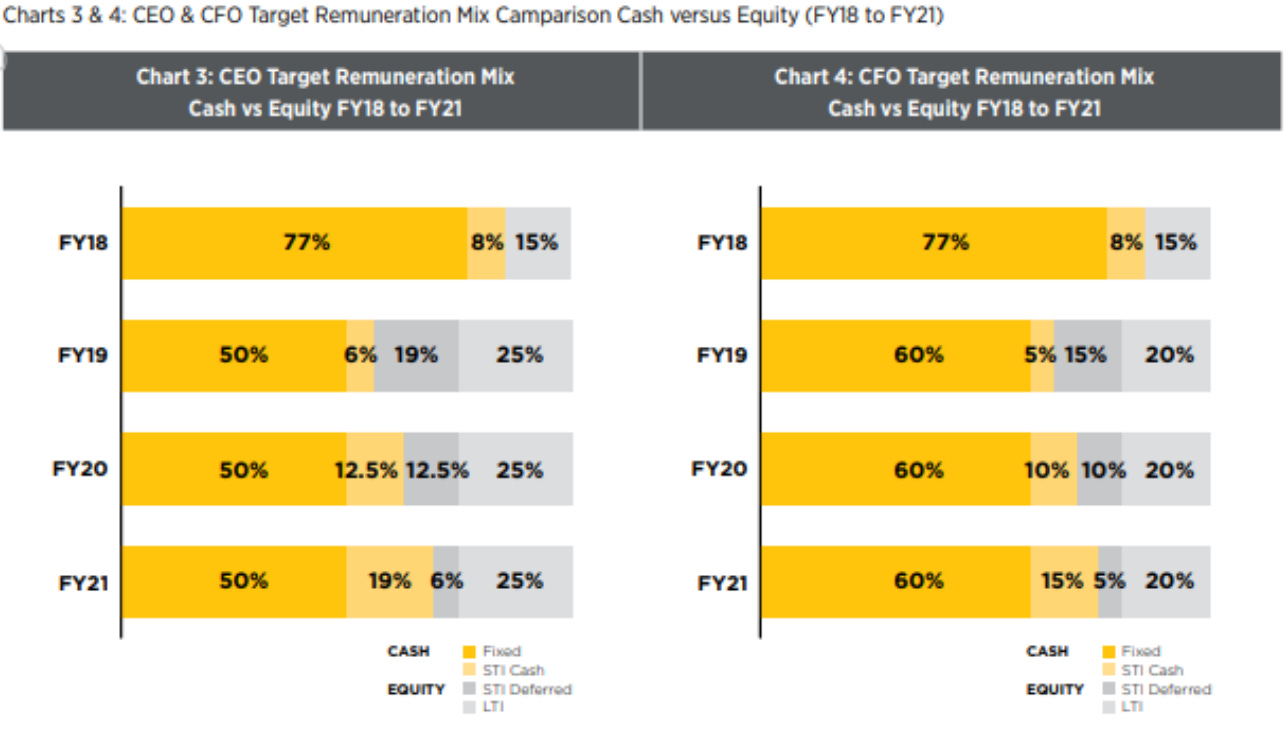

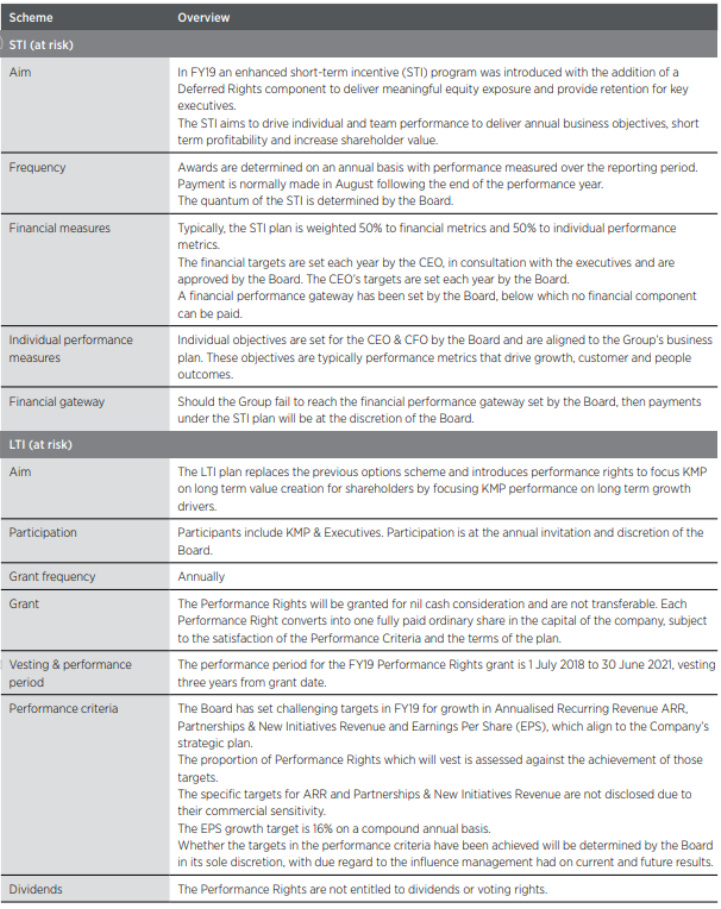

Given the above, you can see that despite a declining trend of fixed remuneration, it remains the largest portion of remuneration here. The fixed portion is about $250-300k for both of them. Reassuring to see is a large portion of Long-term incentive, specifically higher than the short-term incentive. The details of both the LTI and the STI are outlined below:

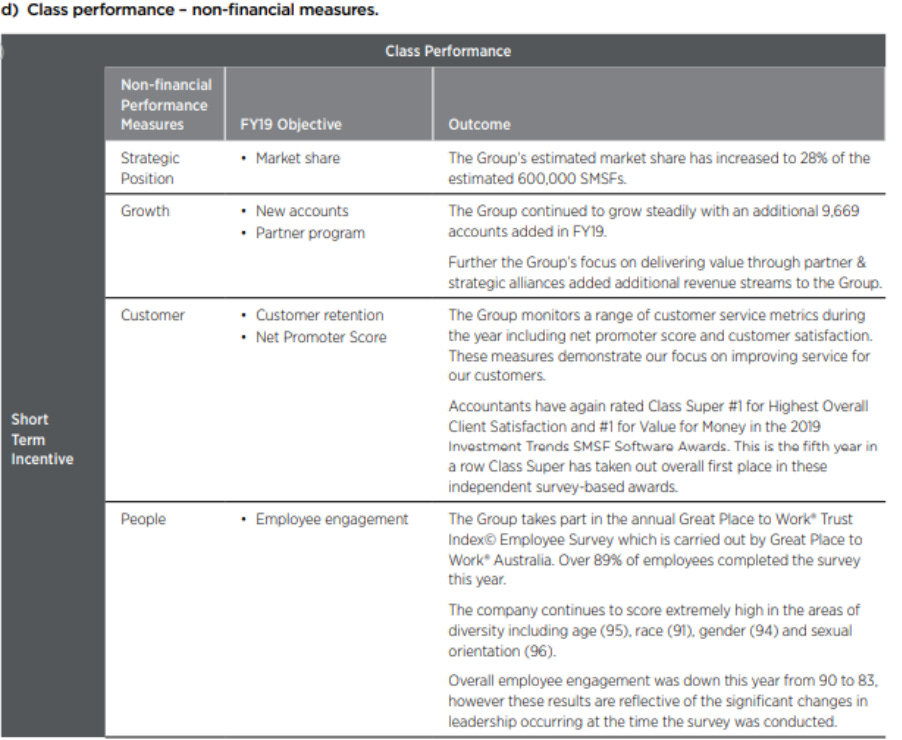

So in short, you can see the LTI consists of targets for recurring revenue and a 16% EPS CAGR target. The short term incentives are equally weighted between financial and non-financial metrics which are detailed below:

These KPIs are exactly what i would expect to see given the outline i gave on the business. If you recall the employees are targeting customer acquisition and services. Notably the Class employees have almost all voted in the 'Great Place to Work' survey, giving Class passing scores with flyng colours. With these strong LTI and STI plans in place along with an increasing skew in executive salary towards achieving these it gives assurance that management is atleast incentivised via this plan.

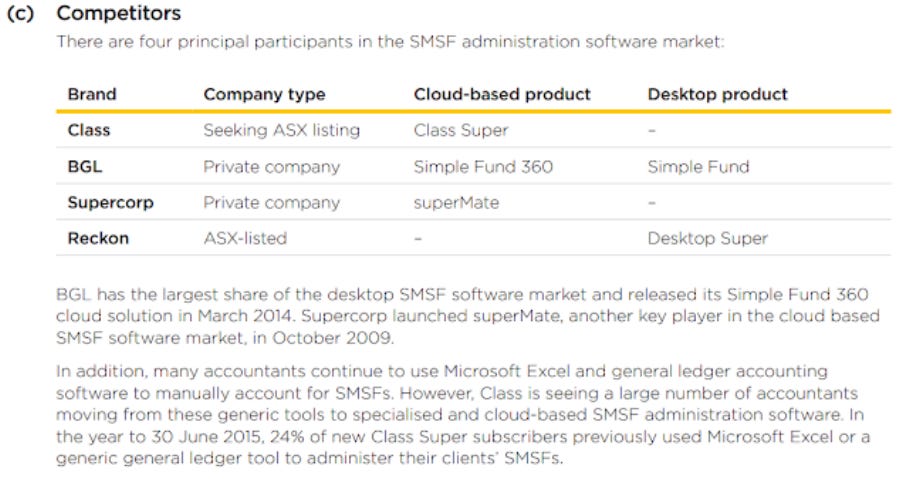

So how about competition? This is where Class shows it's strength and promise as an investment opportunity. The below excerpt from the Class Prospectus outlines the competition for Class SMSF (which accounts for the majority of the Class revenue).

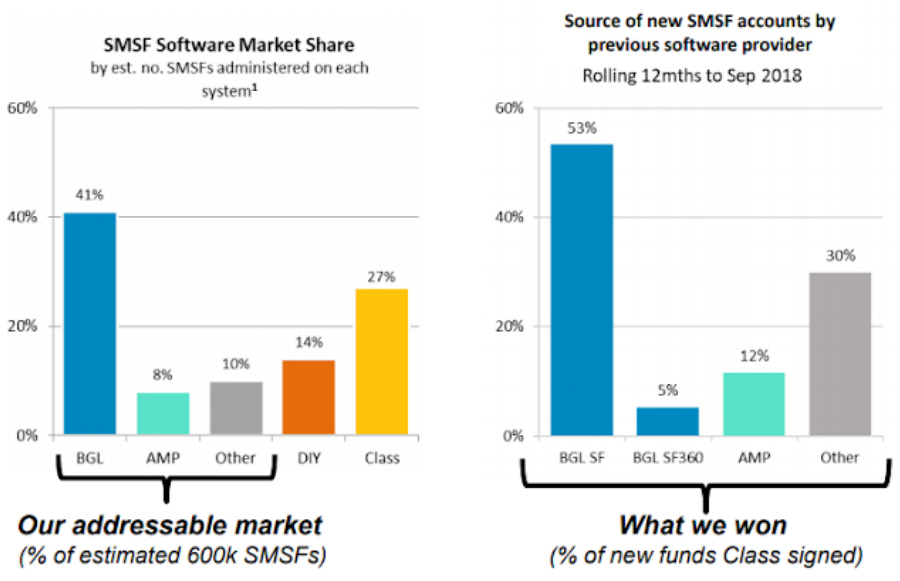

So you can see here it's already a small number of firms that actually offer a Cloud-based SMSF administration product like Class Super. Furthermore The majority of SMSFs are registered on BGL's 'Simple Fund' desktop product, an encumbent where Class provides a huge upgrade to, demonstrated below with large inflows from that platform.

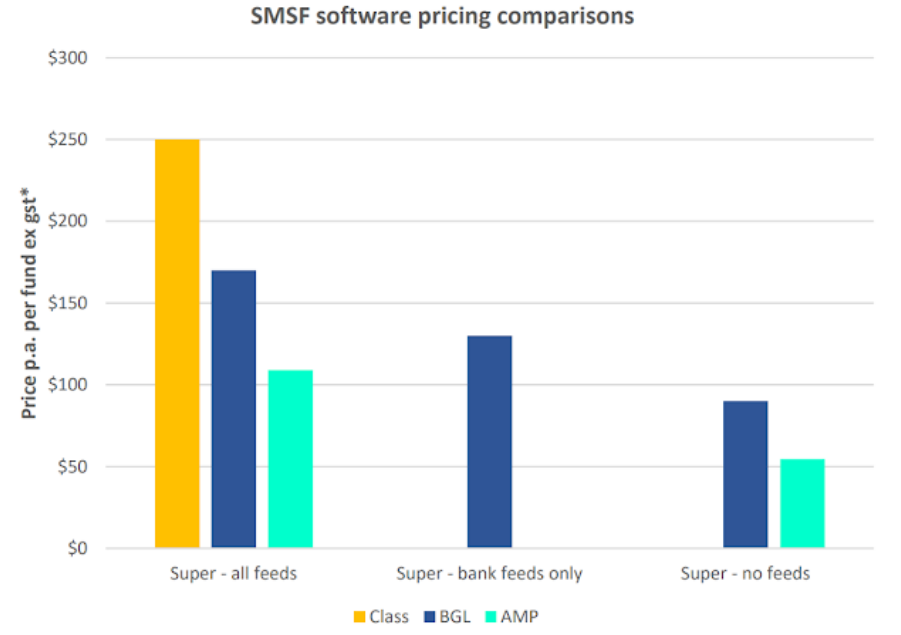

Class is stealing market share from the encumbents and gaining tailwind from DIY upgrades, but to add to this, Class is offered at a substantial premium to other software packages despite winning the Investment Trends 'Value for Money' award 3 years in a row. This screams 'Pricing power' and only gives Class a more sustainable market positioning in the long term.

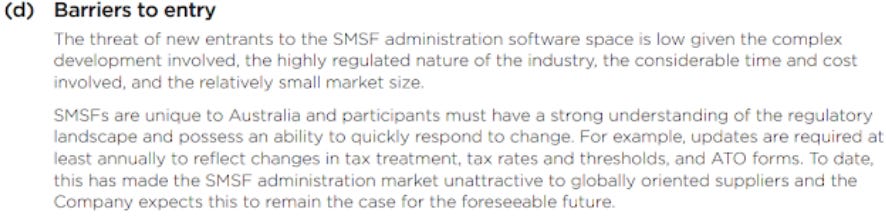

So whilst Class is clearly a force to be reckoned with in comparison to the other product providers in the SMSF administration software industry. What is going to protect its position is an increasingly complex regulatory landscape and relatively small and niche market. They outline this in their prospectus as well.

This competitive force has proven to be a brilliant business with near perfect customer retention and a seemingly unstoppable market share growth.

Of course I have only commented on the SMSF competitive positioning for the time being, however this platform accounts for almost all of the revenue Class generates at this current time. With future R&D and product development, additional sources of revenue may be value accreditive, but for the now Super is the driving force for this company.

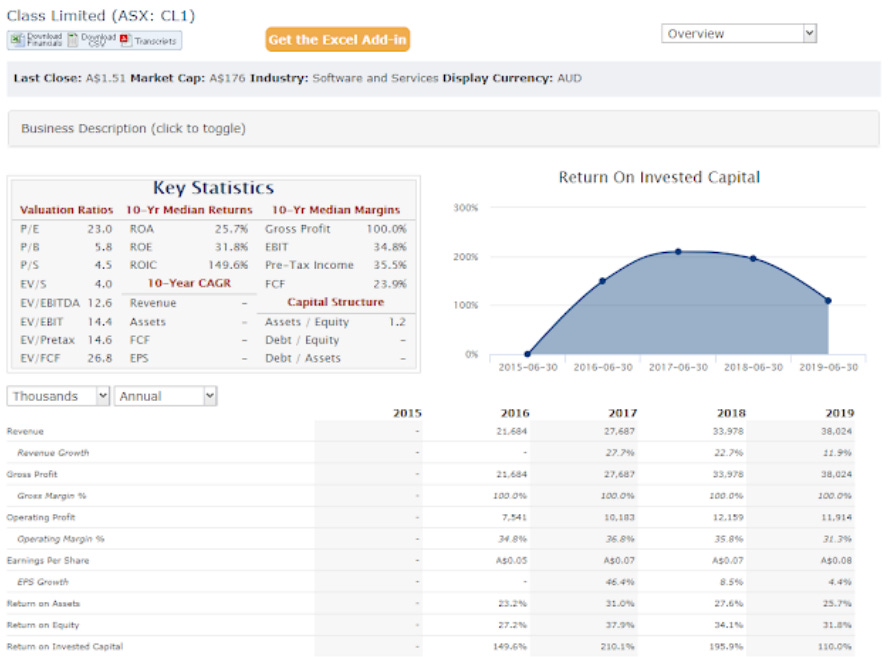

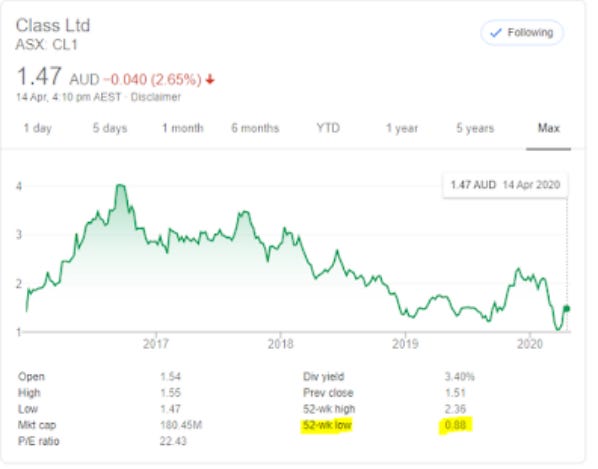

So while i've talked about the business and it's market positioning, one would assume this business is priced accordingly, being such a wonderful business. In a sense it is definitely too much at it's current price (23x earnings) for me to consider this a good investment, but this will always stay on my watchlist with it's high quality traits and cash generative business model.

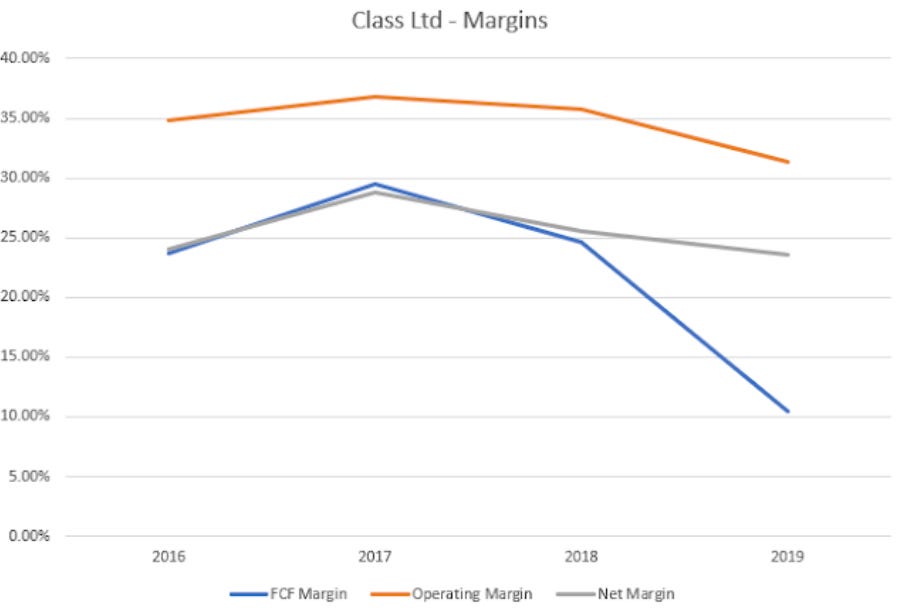

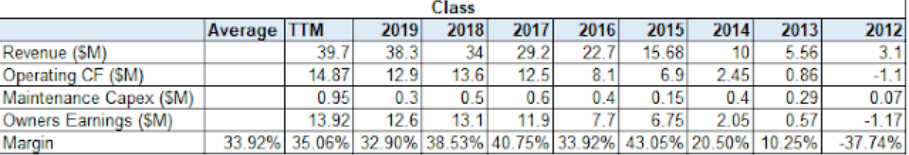

Class has wide operating profit margins where almost everything is retained after employee costs. However you'll notice that the FCF margins/valuation are far disconnected from accounting profits.

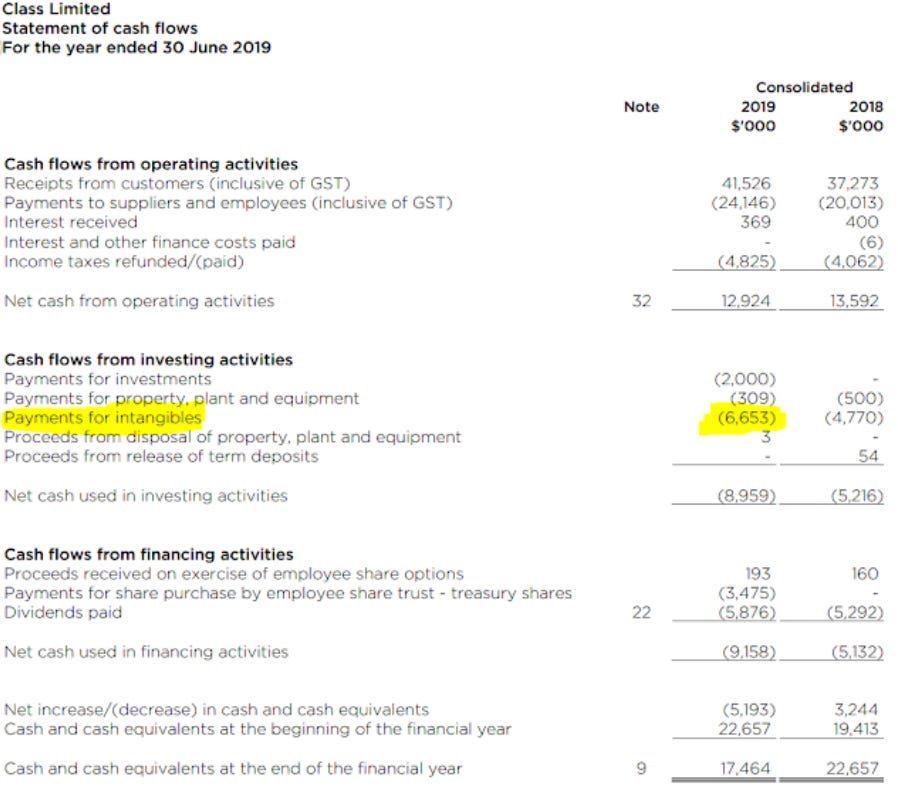

This is due to the capital expenditure, which is predominately made up of software development costs. Capital expenditure costs are required by the business to both grow and maintain. The exact split of this is important in determining the true owner-attributable earnings. So by looking in the cash flow statement we can see the majority of capex is related to intangibles.

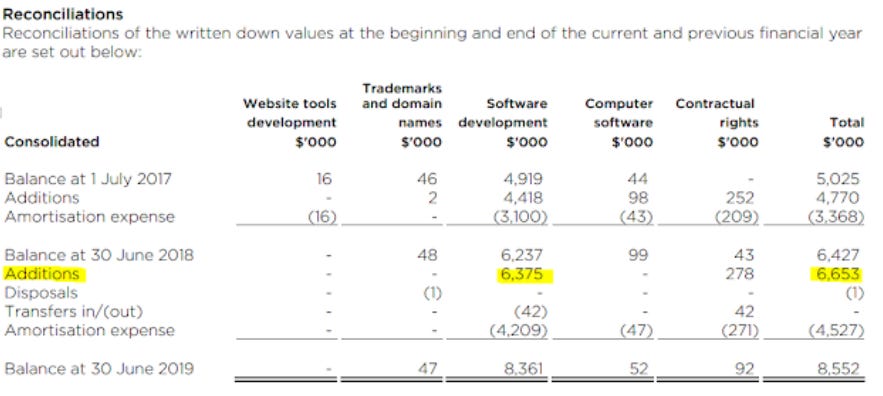

Ok so we know that it's intangibles causing this differentiation between FCF and net income. So what do the intangibles include?

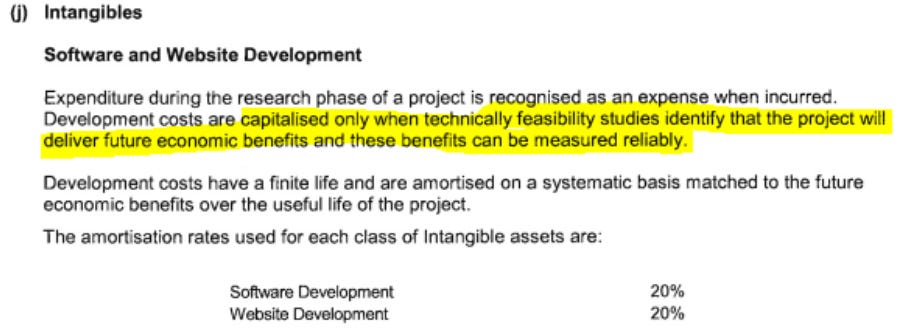

Seeing this, it's basically all "Software Development". The last step on determining growth capex is to source the recognition criteria for intangibles

Intangibles are ONLY capitalised when it's feasible that it will result in future economic benefits. This means software development that isn't expensed is growth capital expenditure and the software development that is expensed is research phase expenditure. In actuality we would be underestimating the growth capex by disregarding the research and development costs taken up in the profit and loss. With this we can assume that an accurate estimate of owners' earnings would result in us adding back this intangibles capex. Using this approach i have calculated the owners earnings and median earnings margin below:

On this assumption a normalised cash earnings margin is ~34%. On the current ~$40m of trailing revenue that gives us a normalised earnings of $13.6m. I should note that the business has a balance sheet full of cash. Albeit some of it has been used for the recent Nowinfinity acquisition. However nonetheless, using the December 31 2019 balance sheet i arrive at an enterprise value of $165m. The normalised EV/Owners earnings is therefore just a little bit above 12x. Not a bad price however with a hurdle rate of 15% and a required margin of safety of 50%. This means I intend to only buy covered stocks if they offer a 26% IRR using the "Davis Double Play method". As Class is a predictable stock due to it's recurring revenue i can use this method to estimate the current IRR making the below assumptions.

10% Revenue Growth P.A.

Fair PE of 20x. Allow 10 years for Multiple Expansion. (Currently basically 15x)

Earnings Yield = Owners Earnings/Market Cap = 13.6/180 = 7.5%

Current IRR = 7.5% + 10% + 0% = 17.5%

Desired IRR = 26% (Therefore Solve for x)

30% = 9.5% (X) + 10% + 6.5% (Y)

Desired Multiple = 1/9.5% = 10.5x

Therefore Target Share Price = (1.47/15)*10.5 = $1.03 Per Share

So using this method and some common algebra to solve for the share price required to receive my target return i have arrived at ~$1 per share. Of course this precision is not really necessary. Anything within the +- 10c range would work just fine

I do note that Class has a 52w Low of 88c which is below my target price. I doubt I will get to own Class shares any time soon, however as an investor I believe in waiting for Mr Market to give me a quote I like rather than allowing him to control my decisions.