COG Financial Services (ASX:COG) - One Page Stock Pitch

Asset Finance Broker Aggregation and Lending

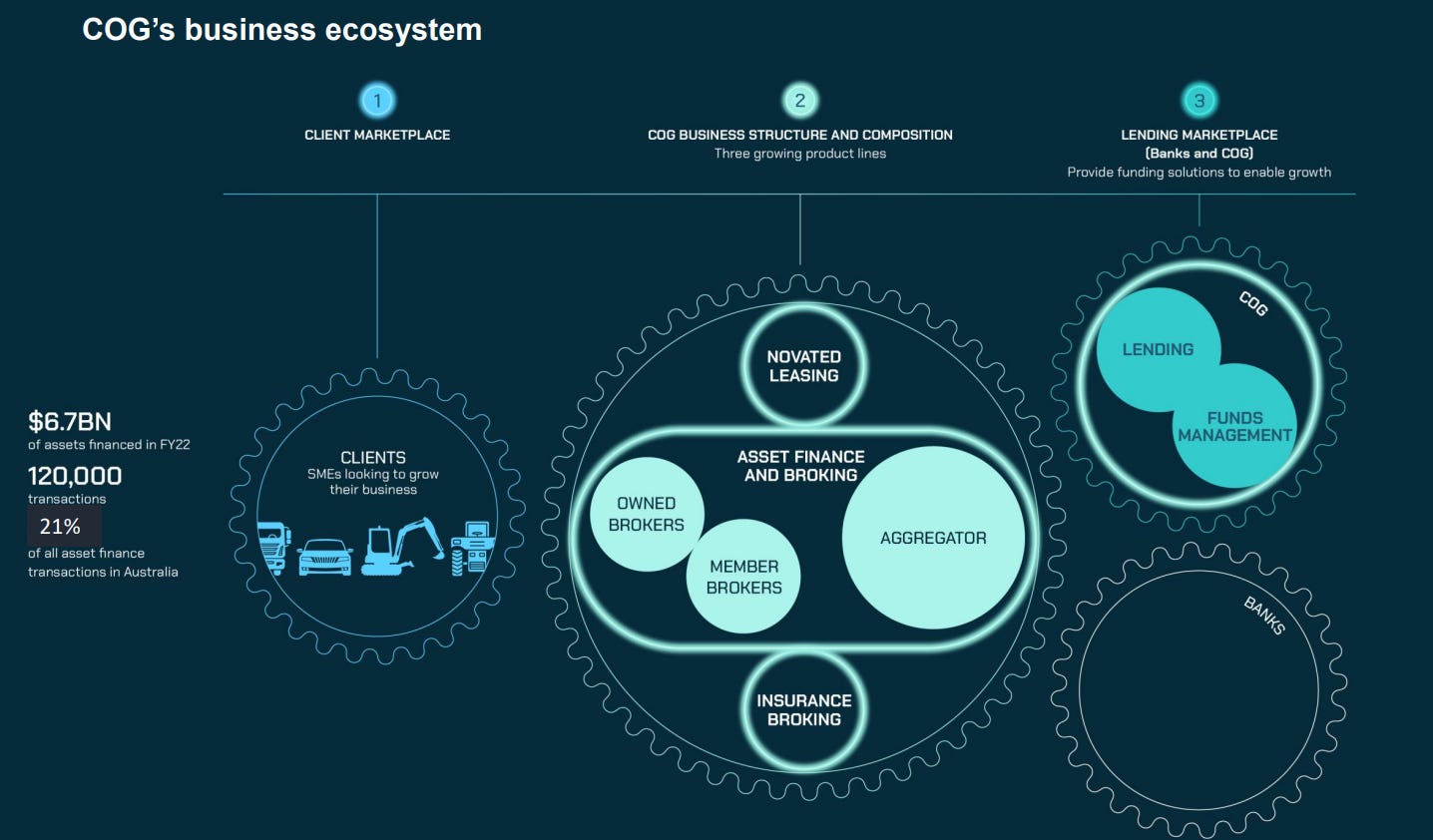

COG Financial Services (COG) is an ASX Listed Asset finance business historically, which accounts for 21% of all asset finance transactions in Australia. These primarily relate to SME’s looking to grow their business through the purchase of vehicles and specialised equipment such as those used for construction and farming among others.

The actions of COG’s executive director Cameron McCullagh is highly unusual having accrued almost $27m on shares since being appointed in 2015, of which nearly $5m has been spent on the open market and another $7.3m in dividends reinvested, which has led to a current ownership interest of 21.3% in the company.

Furthermore, there is a number of highly vested institutional owners, all of which are renowned Australian investors including TIGA trading with 7.2%, Thorney Opportunities with 7.2%, Sandon Capital with 9.6% and Naos Asset Management with 30.2%. This means that these shareholders and Cameron control over 75% of the company. I think this represents a highly appealing shareholder base and is the cornerstone of my interest.

Where I would like to mention however, is that asset financing (particularly by SME’s) has been benefited with upfront depreciation for over half a decade with instant asset write-offs and more recently the temporary full expensing by the ATO. This has effectively allowed the company to purchase assets in a cash positive manner (net of tax) for the first year.

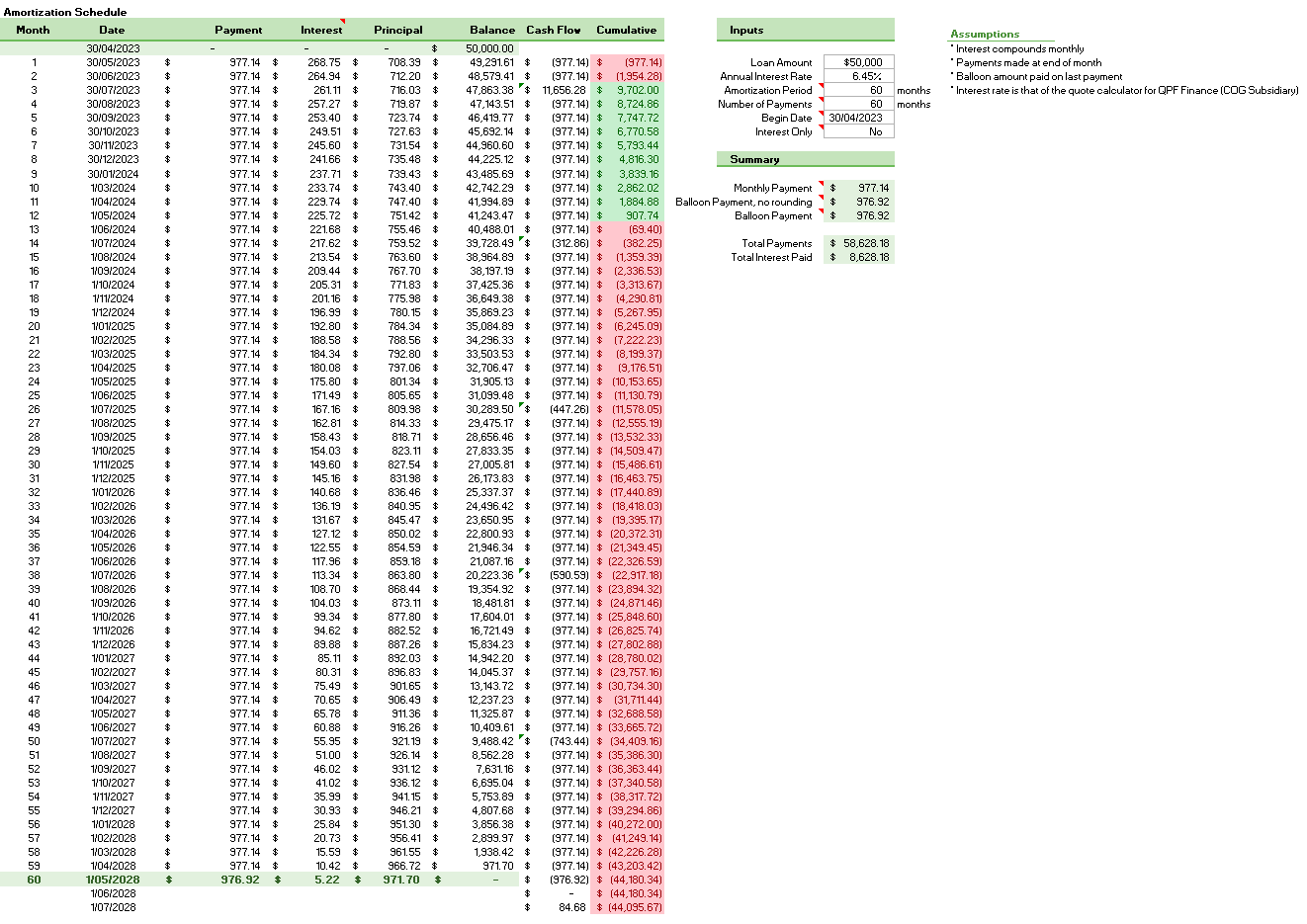

Take for example (Shown with a rule of 78 amortisation schedule above, which is used by accountants to step out interest for tax and accounting purposes), if one were to purchase a $50k piece of equipment today at the current base rate entity tax rate of 25%, they would receive $12.5k back in the form of a tax deduction. At financing rates of the 6.45% (per QPF Finance Calculator) I have observed they would take some 13 months for the purchase to become cash negative (from today’s date) which is a huge incentive to purchase assets. Most people purchase assets in the last few months of the tax year in order to get the cash refund sooner rather than later. Without this tax incentive, chattel mortgage’ are cash flow negative from day 1, so I think this will impact it greatly starting from FY2024 onwards (2 months away).

There is also a funds management business, focused primarily on these chattel mortgages, so again, the risk is concentrated into the volume of PP&E and vehicle loans. I suspect these to have much lower originations over the next few years but offset to a degree with higher interest rates. Borrowers perhaps are more likely to take a longer lease term or higher balloon payment as well with a worsening cash flow profile to align with depreciation rates.

Furthermore, with the recent acquisition of Paywise for an upfront 6x EBITDA multiple, it is growing it’s presence in novated leasing and salary packaging which is timely because of the government incentives around FBT-exempt EV’s. This is garnering high levels of interest from my clients as an accountant for SME’s so i fully expect this division to have high organic growth on top. Naos expects the novated leasing division to contribute >20% of the group’s earnings in the coming year (per pages 5-6 their Q3 update)

Financially the group was left with $38.8m in unrestricted cash on hand less $9.1m drawn in acquisition funding. This leaves some 12% of the market cap in net cash. When including the trailing NPATA of $25.6m this equates to a trailing PE excluding net cash of ~10x, notwithstanding the run-rate of any acquired businesses. On a PEGY basis with a 3y growth rate in EPS of 33% p.a. and a current dividend yield 8.5% including franking of this puts it on a multiple of 0.24x which I think is highly attractive when you consider the shareholder base and potential tailwinds for novated leasing, even accounting for the reduced incentives to finance assets from the ATO.