DSW Capital (LON:DSW) - Deep Dive

UK Mid-Tier Accounting Firm - ‘Una Validores’ (We are stronger together)

Executive Summary

A profitable, fast growing, mid-market, challenger professional services license network with a cash generative business model and scalable platform for growth.

Benefits from favourable industry trends interrupting the long held Big-4 oligopoly (EY, PwC, KPMG, Deloitte) that are experiencing pressures to restructure due to countless audit failures in years past.

Highly illiquid, tightly held shareholder register (by founders, family, and internal partners) with just 22% of shares publicly traded.

Unique & flexible license fee acquisitions in recent years with high returns provide upside potential in the event of capital deployment.

DSW Capital is currently trading at 14x 2023F PE, and 11x when excluding excess cash despite 3-year Revenue & NPAT CAGR of 28% & 35% with >75% of it coming from organic means.

Professional Services – A primer

Before we get to the topic at hand, I think it’s worthwhile providing some context as to how to view professional services firms. Professional services firms exist in many different industries. They include lawyers, advertising professionals, architects, accountants, financial advisers, engineers, and consultants, among others. Basically, they can be any organisation or profession that offers customised, knowledge-based services to clients rather than tangible, physical products

Most professional services firms use a leveraging system to maximise profitability. Their profitability comes from "face time," or billing hours, with clients – all of whom have different needs and demands. If team members don't meet with clients or work on specific projects, they don't earn money for the firm. Therefore, it is essential to keep employees highly motivated and to reward your strongest performers.

Source: David Maister’s “Managing the Professional Services Firm”

To flesh out what I mean by a ‘leveraging system’ the above formula can be used to conceptualise the unit economics of a typical professional services firm. Profitability of professional service companies is driven by these four plus two additional drivers: financial leverage, and capital intensity, which is capital employed per senior professional. So, the result is to have the highest possible profit/partner whilst employing the least amount of capital per partner. Now the four factors above can be any composite of the above, and it depends on the service offering, for example a commoditised offering typically has a low margin but utilises a higher degree of staff leverage and utilisation, an example being bookkeepers where leveraging technology goes a long way to lowering their costs and time expended, making the business viable. On the flip side high margin and highly specialised services such as the highly technical consultants servicing top global law firms and listed companies.

What you will come to realise during the following write up is that DSW Capital is not a traditional professional services model so whilst some of this is applicable, do note that it is likely to be in an indirect manner and not core to their platform style business model.

Company Brief

Source: DSW Capital FY2022 Investor Presentation Page 23

DSW Capital (LON:DSW - £24.5 million), is a profitable, fast growing, mid-market professional services platform business based in the UK, that helps entrepreneurial professionals start and develop their own business.

DSW was established in 2002 by three ex-KPMG partners, James Dow, John Schofield & Mark Watts who under their existing capacity own 37% of the company. If you extend that to include their broader relatives & partners some 67% of the shares outstanding are held by the concert party. In fact, only some 22.2% of shares are tradable in public hands, a free float of just £5.4 million and an estimated daily turnover of just £3,500 firmly placing this into the camp of illiquidity.

With 88 Fee Earners & over 30,000 in mid-tier firms (~23,000 in Big 4) working in non-audit services, the industry is very large, albeit highly concentrated. With the ability to pass on wage inflation to clientele and a time-based business that requires little to no capital to grow (just incremental Lockup), the industry alone generates excellent returns with 25% net margins or more being normal in a big 4 environment, inclusive of partner salaries.

On a valuation basis the business trades at an estimated 14x 2023F PE ratio, and when considering excess cash, it is 11x earnings. Given the closest comparable peer Keystone Law currently trades at close to double this... on a relative basis DSW Capital is appealing. However, I believe that this business offers much more than a poised re-rate and that’s what I want to attempt to convey below. The company outlines their investment case into 5 key points of which I will use as topic points to discuss.

Large market ripe for disruption

Source: The Big 4 Accounting Firms

The accounting industry has long been dominated by an oligopolistic structure where the ‘Big 4’ (EY, KPMG, PwC, Deloitte) control the lions share of the revenue base. In the UK these 4 firms have >85% of the market, generating over $10b in revenue from non-audit services and employing over 2,300 partners and 20,000 staff.

It is no secret that these firms undergo their own fair share of scrutiny, specifically in the UK the FRC is putting a high degree of pressure on firms to address the rampant misconduct that comes about in large part due to the intertwining of audit and consulting services under the single brand. This breaches the simple audit independence test that external auditors need to adhere to and as such regulators do not take them lightly.

This creates a tailwind for the likes of DSW Capital & other mid-tiers where the big-4 are in the mindset of restructuring. As such there has been prior examples where teams were divested from the big 4 such as the KPMG UK restructuring practice being sold to Interpath Advisory where KPMG stated that “an increasing number of conflicts of interest had become too complex and was ‘likely limiting’ the growth of the firm’s restructuring business”. This is not in isolated case with Deloitte selling its pension advisory firm back in 2019 for example. With separation comes increased competition and potential service lines for sale. For some, dramatic change could force staff to search for new options, including start-ups becoming more viable in the wake of increased competition.

Lastly, perhaps it is worthwhile to mention the partner to fee earner ratio of some 9:1 as a limiting factor on staff to spend valuable time with their senior partners, inhibiting career growth and creating pent up stress and frustration with the static and bureaucratic hierarchy of the Big 4.

The point remains that the top end of the market is increasingly under pressure and DSW Capital with its dry powder gained from the listing and increasingly compelling partner offering is in an excellent position to capitalise on these trends detailed above.

Scalable and innovative platform model

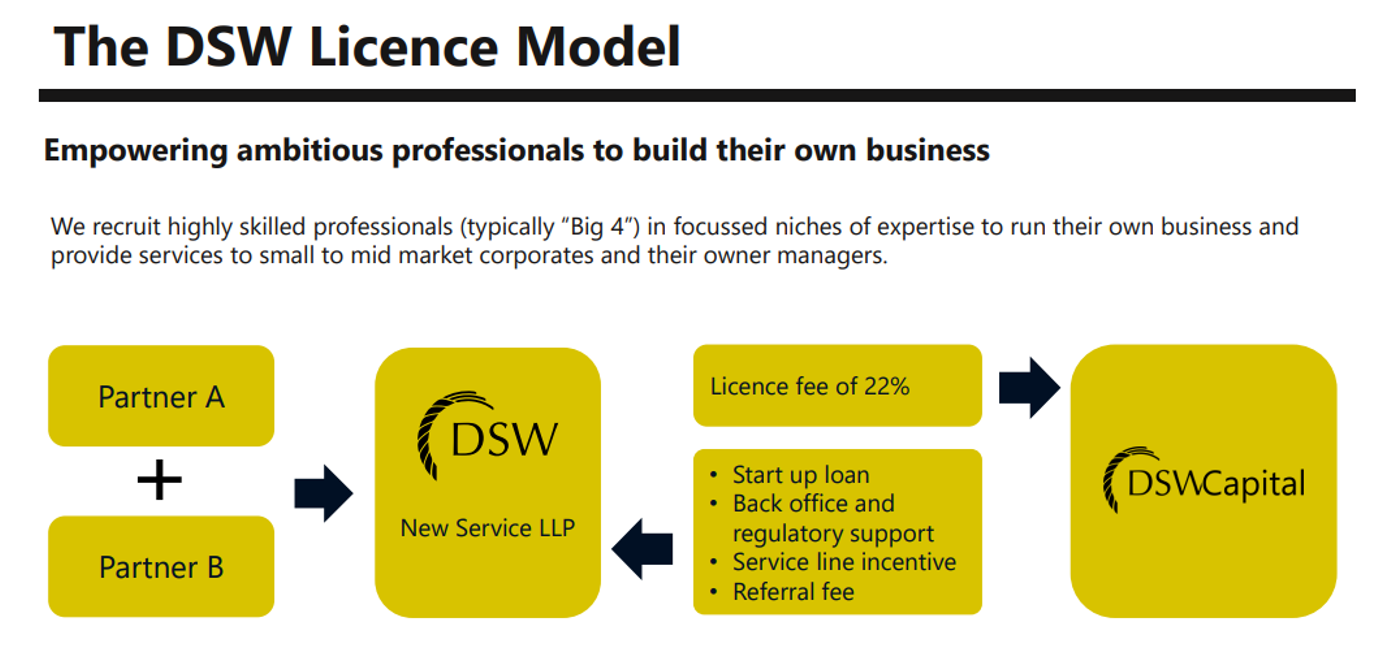

Source: DSW Capital FY2022 Investor Presentation

Financially, the business operates through a license fee model where the partners own 100% of their business and in return for a fixed % of their revenue DSW provides fully funded partner drawings for an agreed upon period, back-office support, and access to a broader network of partners along with full autonomy to run their business in the way they see fit. If you are interested in what these services might include, there is an excellent breakdown here that lists things including the use of the DSW brand, compliance, finance, technology, recruitment, culture and premises.

As you can imagine after reading this, it really is everything except the core functions around firm unit economics as shown at the beginning. Given this is taken care of, partners are given more time into ensuring highly motivated staff, higher levels of utilisation and leverage and ultimately improving margins and opportunities for growth for partners.

Speaking of opportunities for growth, whilst DSW offers all those services to partners, perhaps of equal value is the network and the leverage that provides. This does overlap in part with the growth drivers I will talk about later, but DSW has schemes to incentivise cross-selling across the network which are an attractive mechanism to accelerate organic growth by encouraging collaboration. These include:

Referral fee commission - licensees usually receive 10 per cent. of the total fees earned on work referred to other DSW licensees. This commission is paid by the recipient licensee directly to the referring licensee i.e., at no cost to DSW

Service line incentive scheme – going forward (From IPO onwards) for start-up licences, DSW will typically distribute 5% out of the 22% licence fees charged to other DSW licence holders. This will apply to all new licence agreements, meaning the net licence fee received by DSW will be 17 per cent. This incentive has been introduced to encourage service line collaboration

Lastly, worth a mention is the Pandea Global M&A network consisting of global firms focused on the origination and execution of middle market M&A. This network covers over 23 countries and 200 professionals. What it provides is essentially an improved network to overseas acquisition targets for its UK-based clients.

Recurring Revenue, Cash generative & Capital light

This section will cover 2 points that I will combine in revenue and cash generation given it addresses the financials. First, as covered it runs a licensee model and in terms of what that means for investors. It does NOT participate in the operations of the underlying firms it deals with, instead it is a parent company that merely provides support.

First, starting at the core of any business, the revenue received by the group. License fees are levied on a % of revenue and partners aren’t paid until DSW is paid, therein the collections pace of the business relies on the cash collections of the partner firms (an indirect reliance of firm capital efficiency). This aligns the interest of the partners with the parent company in this regard.

“It’s recurring, not in the sense that our clients repeatedly want the same piece of work, but that our professionals are required to repeat their activities on a recurring basis in order to get paid”

~ James Dow – MelloMonday 26th September 2022

Furthermore, despite not participating in the cost base of partner firms, the company demands higher margins out of their partners to pay license fees, as a result keeping them uninterested in lower margin work. This tends to be a function of the work they are doing rather than a demand though given their autonomy (higher margin, lower partner leverage).

Regarding DSW’s capital intensity, there is little/no working capital at the parent level when compared to the underlying revenue generation of the group. As per the 2022 accounts, the average credit period for the past 2 years was 74 days, and these license fees are billed quarterly, therefore the point at the end of each quarter is where working capital is at it’s maximum. It penalises the cash conversion and tangible returns on capital as the period end working capital would be much higher than the average ‘year-round’ working capital. So even though I see returns on their tangible capital more than 50%, the real returns are much higher.

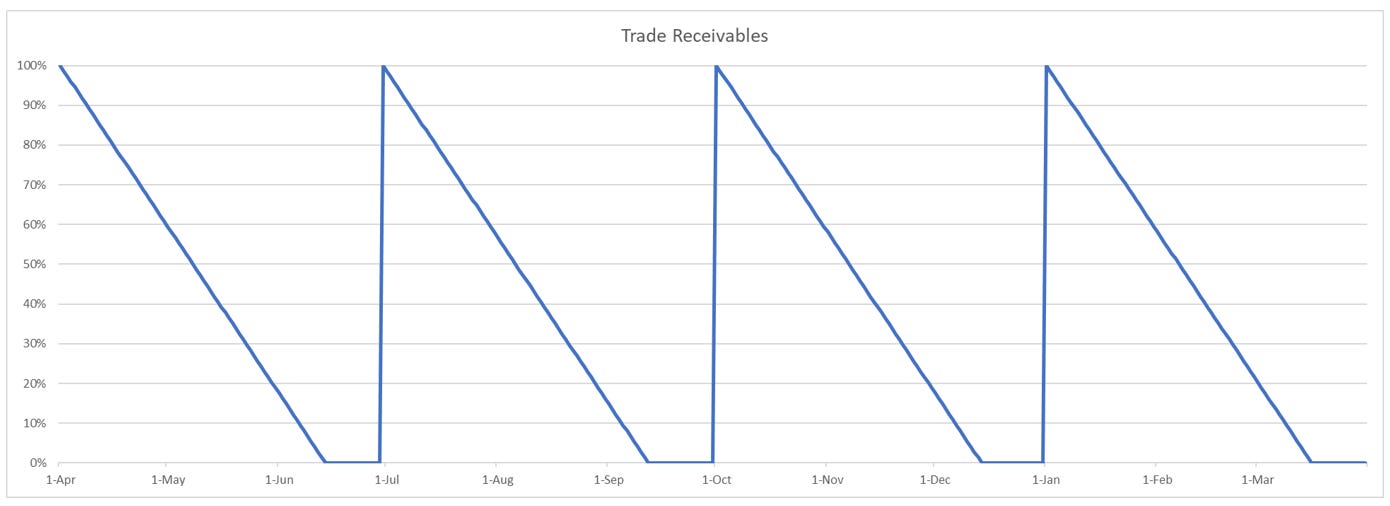

Source: Author’s estimates

To illustrate this, you will note above a crude but useful chart of what a typical year-round license fees receivable account may look like assuming a linear collections rate (which often isn’t the case). Taking a year-round average, the debtors account should average around 40% of the quarter end balance, amplifying returns on their capital significantly. This would give them a year-round lockup of 20 days, which has been adjusted downwards from the 30 days reported by the company to reflect the cyclical swings above.

I do want to stress that the swing ONLY happens to the trade debtors, and not the other receivables which is predominately loans advanced to licensees, these are investments in nature which we will cover in the next section. The amount of cash conversion is also highly impacted by the comparison of bills for each quarter. For example, Q4 2021 was an exceptional quarter relative to Q4 2022, so there is a working capital downward swing when looking at the year-end accounts, causing the 2022 result to have >100% cash conversion. The group says in normal years they expect it to be between 80-100%, and obviously that will depend on the last quarter billings relative to the prior year mainly, which growth YoY resulting in lower conversion, and contraction resulting in higher conversion.

When viewing DSW, it’s important to realise it’s a unique model is not directly comparable to most peers. First, optically the firm trades at 7x EV/Revenue which for any other professional services firm would look incredibly expensive, but it’s important to realise that the licensee model means the parent does not share the operating expenses of its underlying partners, it is equivalent to just having a head office support team. When comparing to other firms you should be viewing it as a multiple of ‘Network revenue’ as that is the underlying revenue generated by the operating partners - on this basis it is 1.1x EV/Revenue.

In 2022, DSW took 15% of the network revenue in as license fees & 2% as a profit share. On the expense side, it spent ~5% on its operations, which excludes the normalised level of SBC going forward, which based on plans disclosed, should amount to ~250-300k going forward. Therefore, from a listed perspective it’s equivalent to an 8% profit margin on network revenue, which isn’t particularly low or high for a professional services firm however, this has scope for change depending on the levers discussed in the next section.

Continued strong growth

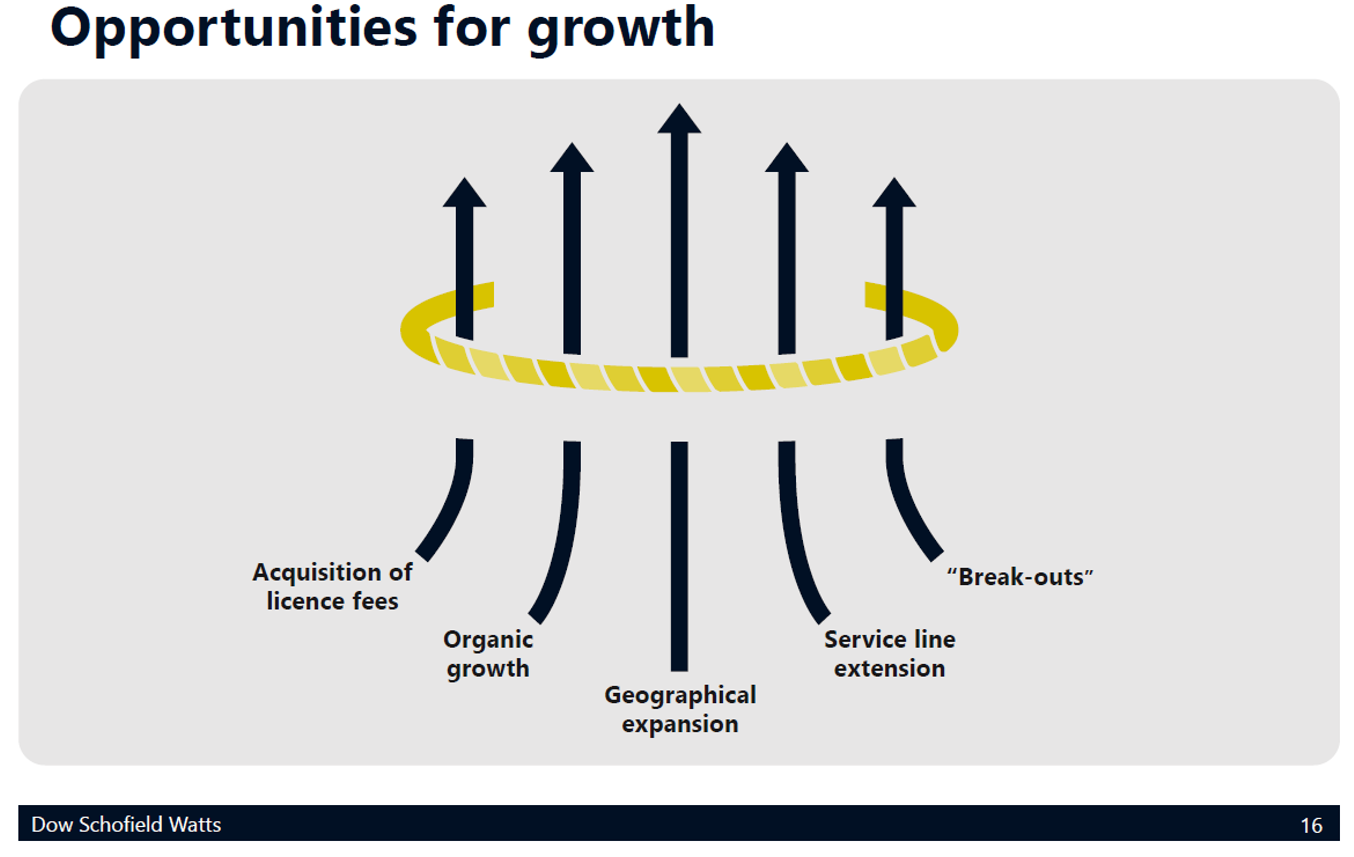

Source: DSW Capital FY2022 Investor Presentation

The company identifies several levers for future growth which are shown above and discussed below.

Organic Growth

DSW Capital benefits from a multi-layered revenue model, so there is more ways to grow than the typical professional services firm. The traditional growth including staff recruitment can be split into volume-based growth (recruiting new partners and fee earners) and pricing (productivity and charge out rates). Recruiting activity has been strong over their history, with a 9-year Fee earner CAGR of 13%, which as mentioned is solely volume based. Typically, it would not be unfair to say that average charge out rates of mid-tier and big 4 accounting firms are a lagging indicator to wage inflation, growing 2-3% p.a. on average. Therein it would not be difficult to assume organic growth in fee earners of 5-15% in any normal period depending on the pace of hiring, which is inherently hard to predict.

DSW also benefits from the ability to alter their license fees, which are quite low as they stand. New partners are being recruited at 22% of revenue where license fees currently equate to just under 14% of network revenue. However, this is also difficult to forecast as the license fee depends on the risk associated with new partners and teams being acquired which is described below.

What they do have going for them though is a rapidly growing presence, best showcased by their rapid increase of rankings in the Accountancy Age which they broke into back in 2018 at a ranking of #73 with fee income of 8.69m. As of 2021, they rank #49 with a fee income of 15.34m. Using 2022 numbers would put them at a ranking of #44. Lastly, using the 1H 2023 numbers would put them at a ranking of #40. Therein it’s clear DSW is rapidly gaining market share rather than pacing alongside the industry.

Referral fees incentivise collaboration and recruitment. On the one hand there is a 10% fee that passes hands from the referee to the referrer when suggesting a client engage another partner within the group, which effectively incentivises cross-referral within the group. On the other hand, there is a unique service line incentive fee where a portion of the license fee from new partners is paid back to new partners, which is quite interesting and incentivises partner referral from existing partners in the group, this has the effect of partially de-risking start-up licenses, improving existing retention and growing the group at the cost of shorter-term profits.

Acquisition of License Fees

Perhaps the most unpredictable of the lot, the group is NOT a serial acquirer of any sense of the word. During its 20-year history they have completed just 3 acquisitions in this space (1 each in the years 2018-2020) so we should not necessarily expect them to be consistent in this area. These have also been quite small with one consisting of 4 staff doing slightly over 300k in revenue at the time of acquisition and the largest doing 1.5m at the time of acquisition.

I say “acquisition”, but these are most definitely not structured like a traditional acquisition where there is a merger of a business into another entity and the purchasing entity absorbs the working capital and customer lists as a result. Instead, the firm agrees to provide support services in exchange for license fees, there is no actual consolidation of businesses, the vendor retains 100% ownership in their business.

‘Break-outs’ refers to much the same as license fee acquisitions but a group of people rather than a single partner. These typically have less risk associated to them as opposed to start-up single partner firms, so DSW is prepared to be flexible in their license fee terms on depending on perceived risk.

Taking reference to the most recent acquisition. Thanks to Shore Capital we have some research behind this which demonstrates how flexible and attractive the license model is for attracting new talent via. Acquisition. Camlee group was acquired in February 2020 outlined with the below structure diagram.

Source: Shore Capital Markets February 2022 initiation

DSW put out an initial cash outlay of 1.625m (0.5m IP + 1.125m loan to New Co), and the New Co was established to emulate an acquisition, and they used deferred consideration to be paid out of Camlee profits to lock Camlee in for the long run. Note that DSW has nothing to do with the transaction between New Co & Camlee besides the loan provided to New Co to provide the vendors with a capital receipt.

Knowing the loan was repaid in full on the IPO, the investment returns of the transaction (for DSW) 5 years and assuming NO growth in license fees are an IRR of 14%. Were you to go out 10 years with the same no growth assumption, the IRR would further increase to 19%. If you were to go out into perpetuity, the IRR would gradually approach 30%. With growth these returns are at little to extra capital due to the working capital demands shown before so the IRR’s would escalate quite rapidly.

Risks

This would be incomplete without touching on a few of the key risks of the group, and in my view the most prevalent are below.

Exposure to M&A activity (Revenue Cyclicality)

In 2022, the group generated 70% of its revenue from M&A related service lines, a buoyant market of late. Revenue per employee from these activities is ~15% higher than the rest of the group, which isn’t a perfect comparison as service line make-up differs (refer to leverage system at the start). What alleviates this risk to a degree is other service lines that are more stable in nature such as those related to tax, and countercyclical service lines including corporate insolvency that would see a boost in a downturn.

Sustained Recruitment shortage

In recent months there has been an incredibly tight labour market in professional services in particular and a sustained shortage of quality candidates could dampen growth and elevate FE churn. DSW has seen just recently FE’s grow by 5.7% in the 1H of 2023 indicating resilience in their attractiveness as an employer of choice.

High Insider Interest

In some ways this is very much a trust-based investment, with the concert party holding most of the shares outstanding. This means you’re heavily reliant on the actions of those at the top, with little to no minority influence whatsoever. Of course, insider interest is generally seen as positive for incentives, it can also prove as detrimental in some situations so do not be surprised to see management control be frustrating at times.

Reputation and brand risk

Allowing partners to operate largely autonomously is an exercise of trust, which may well lead to some cases where partners impact material damage on the group’s intellectual property and DSW therein has to use resources to defend itself whilst seeing dilutive effects of its marketing activities.

Valuation

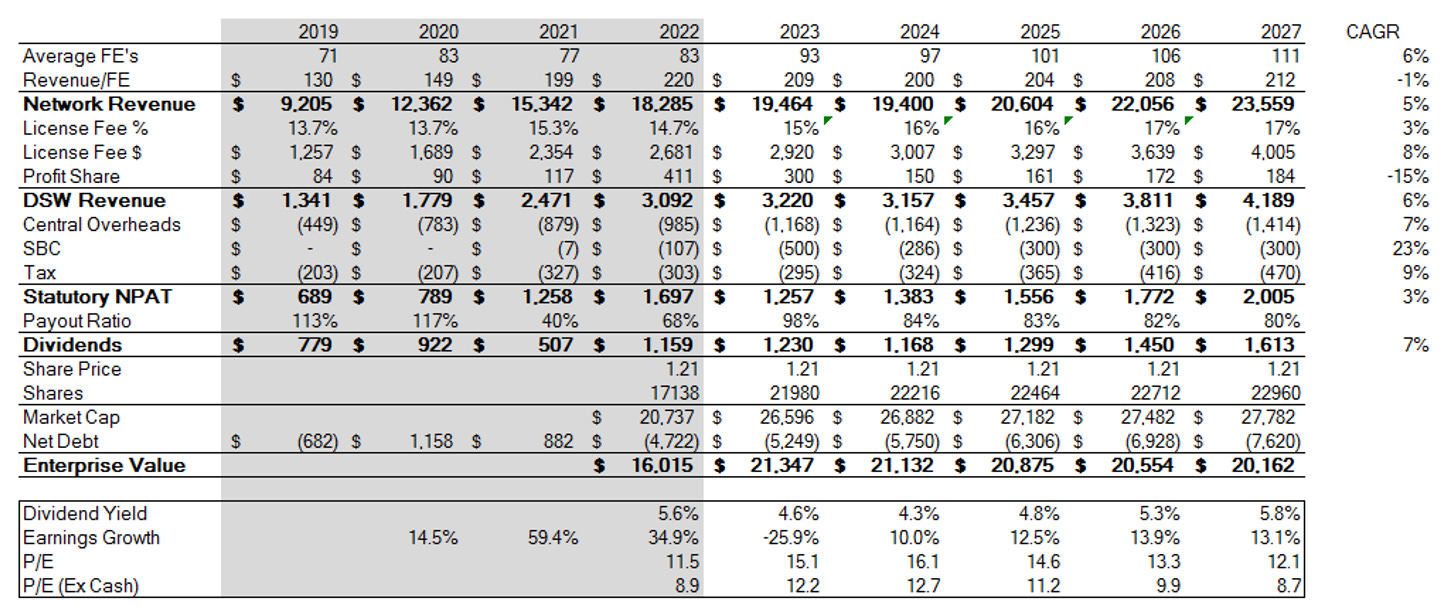

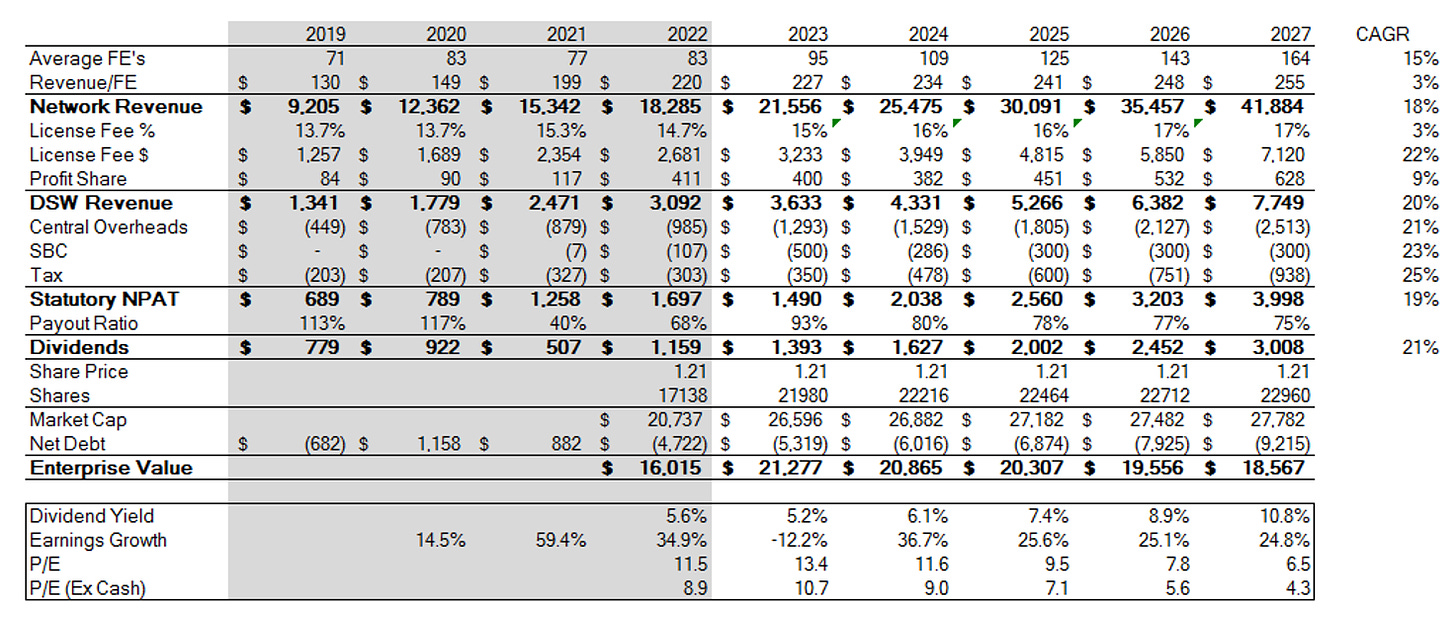

As highlighted at the beginning of this piece, the company is trading at 13x 2023E PE and 11x without, but it does not help to provide that number without context of future earnings power which in my belief, DSW has in spades. However, due to the potential levers and the differing unit economics of each, it is unpredictable to forecast what the future may look like, but nevertheless for the sake of getting an idea, I have drafted up 3 potential scenarios below. Going out 5 years and assuming a constant multiple I have the following 3 cases (No Inorganic growth).

Base Case

First off, the expected middle ground is that the group sustains their current run-rate hiring rate through for the next 5 years and revenue from other service lines starts to catch up and make up for the buoyancy in the corporate advisory service lines, this has the effect of a consistent revenue per fee earner and a gradually increasing license fee due to increasing share of newer licensees. Costs are kept at a certain % of revenue and SBC is levelled out at 300k per year consistent with Shore Capital’s estimates. As you can see, the earnings compounds at 9% p.a. and we see a substantial increase in the cash position of the business as well, leading to very modest valuations going forward.

Bear Case

The bear case realises a faster contraction in the corporate advisory service line and a slowed pace of recruitment along with a faster growing license fee as corporate advisory service lines are mainly the one’s on legacy license fees. Profit share reduces significantly as the equity share is predominately in the corporate advisory service lines. Costs are kept consistent as a % of revenue and SBC is unchanged. Earnings compounds at 3% p.a. and the resulting valuation ratios are fair to mildly cheap over time.

Bull Case

In the bull case I see hiring and revenue per fee earner continuing to increase along with an increasing license fee due to rapid hiring on higher % fees. Costs, like the other scenarios are kept consistent as % of revenue and the resulting valuation ratios become extremely cheap a few years out.

It is worthwhile mentioning that my own cost base is quite a bit below the current price, so these scenarios looked a bit different when I was researching it back in July but nevertheless, DSW offers an appealing investment case for anyone interested in professional services businesses with plenty of embedded incentives to drive the group forward and attractive tailwinds to support hiring. There is optionality depending on future deployment of capital in addition to the above organic scenarios.

I hope you enjoyed my write-up; you can find me on twitter at @tristanwaine. Feel free to reach out there or via. Email at tristan.waine@outlook.com if you would like to chat.