Today (20th January 2023) DSW Capital announced an update in their expectations for the 2nd half of 2023. They were not pretty, with subdued corporate activity impacting their optimism leading to an expectation of flat revenue on the year along with lower EBITDA (Increased Corporate cost base). In addition to this James Dow states they are feeling extreme frustration and point towards a broad range of possible outcomes for FY23.

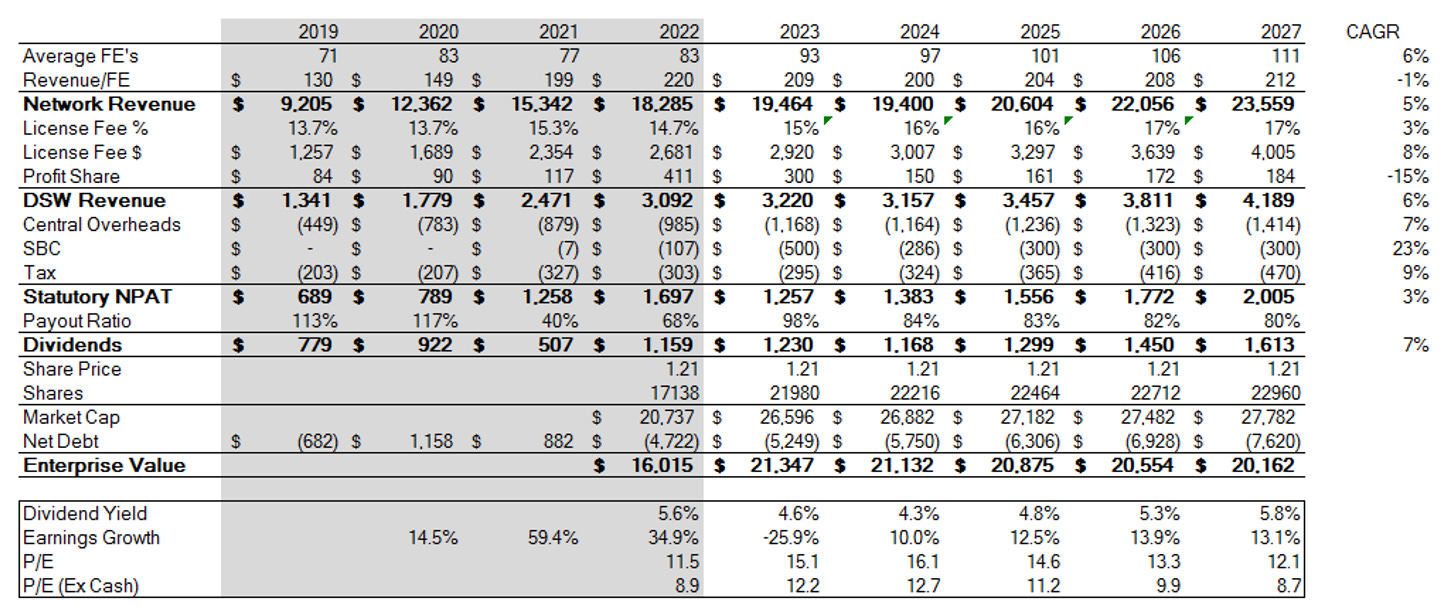

Whilst this sounds bad, it was not completely unexpected, as I clearly highlighted dampening M&A activity as a key risk in my initial write up back in November. However, whilst I crudely suggested a ~15% decline in Revenue/FE was within the realm of possibility, and i still think that is a reasonable assumption, however what I was likely too optimistic on was a resistant profit share. I think that it is fairly likely they get much less in the way of profit share than I originally expected in my bear case, given that this is exposed in full to the cost base of these underlying firms, which have a fixed wage base, including partner base pay and some ~60 fee earners that have likely had a combined decrease in billings and rapid increase in wages to retain. However important to note that this isn’t the DSW cost base, it just impacts their profit share, which is a relatively small part of their revenue. Below is my original Bear case for reference.

The good thing (somewhat) however, is that a declining revenue in the 2H leads to a stronger cash conversion since they have a extremely positive WC swing coming from an exceptional 2H22 to a weak 2H23.

In an effort to mitigate this flagged risk, in December I invested into Begbies Traynor (LON:BEG), the UK’s leading Insolvency practitioners. A clearly counter-cyclical exposure that is intended to run largely the opposite way as DSW Capital to try and mitigate the impact that an event like the current has on my overall portfolio. Not to say I don’t have a solid thesis, which I am currently in the process of writing. But just know that some ~85% of their revenue comes from insolvency work, where they are the leading player by a mile.

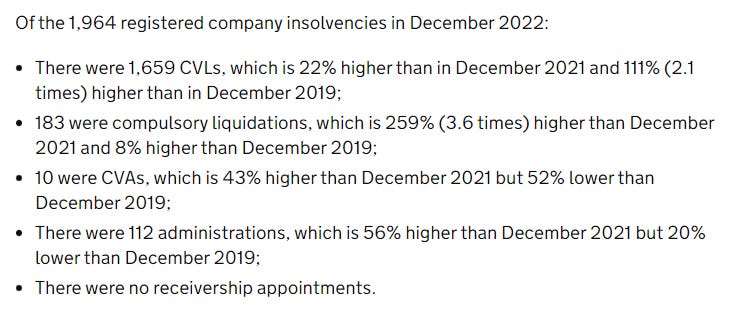

Statistics provided by the insolvency service are encouraging for strong performance in the coming years with the below statistics reported for the December month.

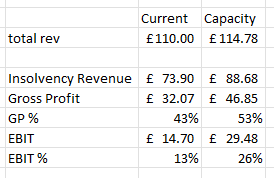

With FE capacity upwards of 20% in the existing staff base, there is scope for both increased billings and productivity, to a potential margin of close to double the current, given that gross margins are the variable component and are ~43%. The way I am looking it this is like follows:

This is a best case scenario, and it doesn’t even take into account any growth in Fee earners or acquisitions done during the medium term future. This would further increase the potential upside. Nevertheless, It is a hedge I expected to make perfect sense given that the drivers of an acquisition are excess capital and the drivers of a going concern are the opposite. I will release a full write up in due course. Until then…

Thanks for reading