This week I’ll be covering the Athens listed company Entersoft. I did start researching Epsilon Net SA (ATH:EPSIL) in anticipation of doing a pitch on that but found the business to be worthy of a future deep dive so I will defer it for a potential deep dive down the line.

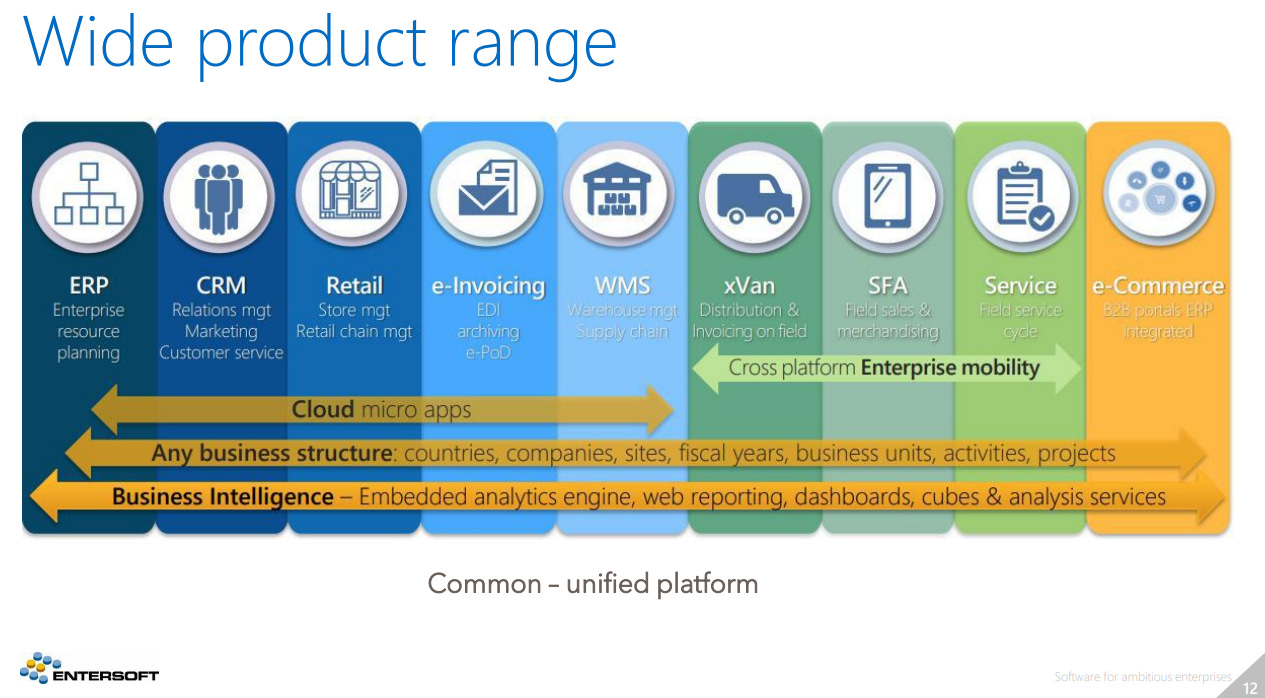

One of its peers is the topic of today, Entersoft. Entersoft is quite a bit higher end and diversified than Epsilon Net, with a fully integrated ERP system with the following spread.

It targets businesses of various sizes and across multiple industries with over 4,000 customers, 400 employees and across 40 countries (although it may as well just be Greece and Romania). Similar to many ERP and accounting software, it partners with ‘consultants’ and ‘partners’ which are effectively it’s main source of distribution. Lastly, the system is hosted on Microsoft Azure.

The attraction of online software has a strong tailwind in areas of less digitalisation as regulators push the need for more ‘real-time’ data to prevent shortfalls in tax revenue. One such example of this is the growth in e-invoicing across the globe. Greece in particular, is incentivising this with significant tax and administrative incentives including:

Reducing VAT Credit refund cycles from 90 down to 45 days

Instant depreciation for capital equipment

Cost of producing/submitting electronic invoices may be written off.

Length of the statute period to issue a VAT assessment is reduced from five years to two years.

This tailwind is quite frankly, extremely beneficial for all companies involved in the industry, and would not be surprised to see increased competition as a result of this. However, existing business models effectively have a first mover advantage and ability to outcompete and invest with scale.

Epsilon has a more pure-play solution for this with the ‘Epsilon Smart’ software, but in terms of Entersoft they target predominately mid-larger businesses with their full-suite ERP platform. These are the type of businesses that are already likely to have been utilising E-Invoicing given the difficulty of administering a larger business without it, so I don’t see the same tailwinds here as opposed to Entersoft. In saying that, ERP software is also stickier and outdated, meaning longer sales cycles have led to more outdated software and incumbents becoming complaced in the face of technological innovation. Entersoft therefore has some degree of market share gain in the form of those switching to a more innovative platform which may for example, offer e-invoicing as opposed to dated peers.

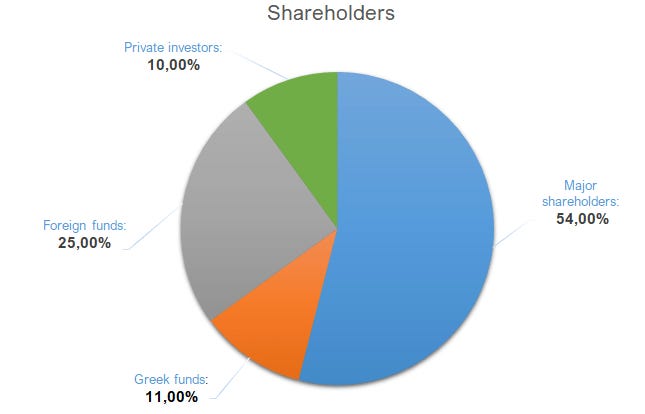

Shares are tightly held, with major shareholders on the BoD owning in excess of 42% of the company, and the remaining being split as shown below:

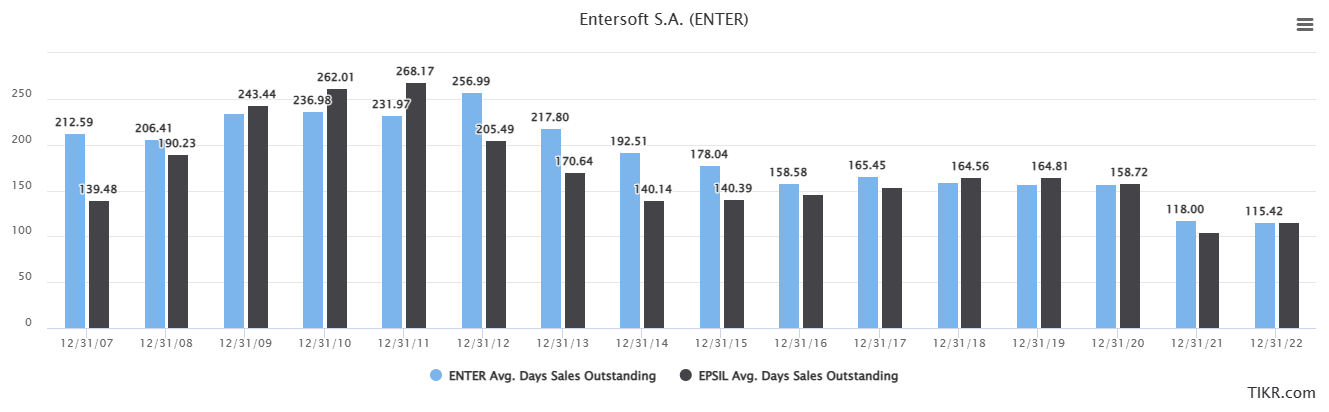

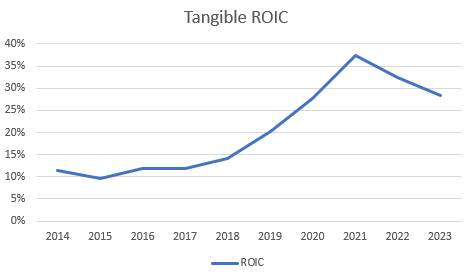

Financially, the group shows a long sales cycle, which has seen a significant contraction (as shown below), likely due to the introduction of the SaaS model as opposed to an implementation model across both businesses. Its profit margin is also exceptional with a NPAT margin in excess of 18% which on an improving working capital cycle has led to increasingly high returns on their tangible capital.

Nevertheless, without getting to much into the weeds, given this is a one-pager, Entersoft currently trades for an NTM PE (exc. cash) of 22x, with a dividend yield of ~2% and a 5 year Rev/Share and EPS growth rate of 17% and 39% p.a. respectively. On an earnings basis it’s slightly above a 0.5x PEGY, but on a Revenue basis it’s slightly below 1.0x PEGY. Given the variance here, it’s hard to say which way it will go, but Entersoft remains a valuable business, nevertheless.

As mentioned at the start, I have saved Epsilon Net for a future post, and hopefully you will look forward to it.

Thank you for reading.

Tristan

Well-managed company. Thanks for the brief write-up. Looking forward to Epsilon.