Historically, the primary activity of Euro-Tax is to claim overpaid cross-border income taxes on behalf of their clientele (Euro-tax & cuf-podatki). Recently they have begun to expand geographically and by product into Cross-Border HR (Euro-Lohn) & PIT preparation for Germany (Taxando).

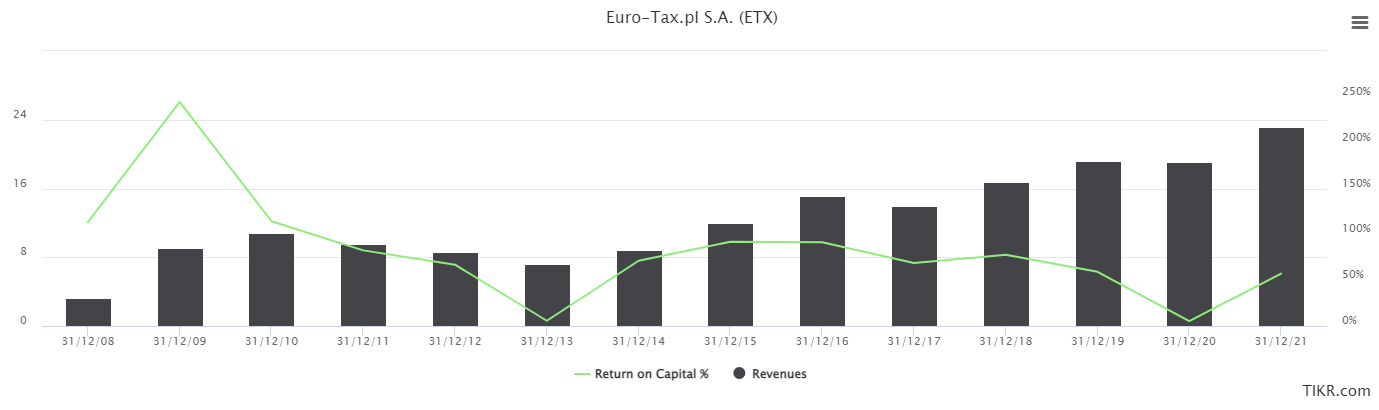

Latter services don’t move the needle, The core really is the reclaim of cross-border taxes which historically has shown to be a high quality business generating consistently high returns on capital.

Perhaps of interest, is that the company provides their IAS36 calculations for Goodwill in their reports, which can give us an idea of how they see these business performing in the following years. and they are telling to say the least. For the 3 acquisitions that make up goodwill, their estimated net present value is 7.9m PLN, which eclipses the book value of goodwill recorded at 800k PLN. It also exceeds the enterprise value of the company.

Potential catalysts for the future include an outright purchase of the remaining share of Taxando along with a turn in Taxando profitability. In addition, the growth of their refund services established outside of poland including their Romanian & Bulgarian subsidiaries (Foreign tax refund service)

Some of the key risks inherent are a obvious reliance on the resiliency of the demand for foreign tax refunds, volatility of exchange rates (Taxes paid from PLN but lodged in other currencies, this is hedged in part), very low free float (<$500k USD) due to members of the management team and ex-members own ~88% of the company.

The share price offers a trailing dividend yield of ~11% and over the past 5 years revenue has grown at a rate of 9% CAGR. With a PE ratio of just 9x that means ETX has a 5Y PEGY ratio of 0.45x. It also has some ~12% of it’s market cap in net cash (net of customer refunds held in trust). which if you were to take that off of the market cap it would give ETX a PEGY ratio of just 0.35x.

Interesting one! Do you know why the operating margins have decreased from over 25% in 2016 to only 6.7% in the LTM?

Hello! How did you find the annual reports of Euro-tax? Their website is not updated and I can´t find them. Thank you!