Fiducian is an Australian financial services business operating since 1996. Like other similar investments made by the trust, it has a diversified set of services predominately centered around the provision of financial advice. It is a founder-led business, of which founder Inderjit (Indy) Singh owns some 28% of the listed company and has done an excellent job since with the group compounding at ~18% p.a. in the past 20 years, and 24% p.a. in the past 10 years.

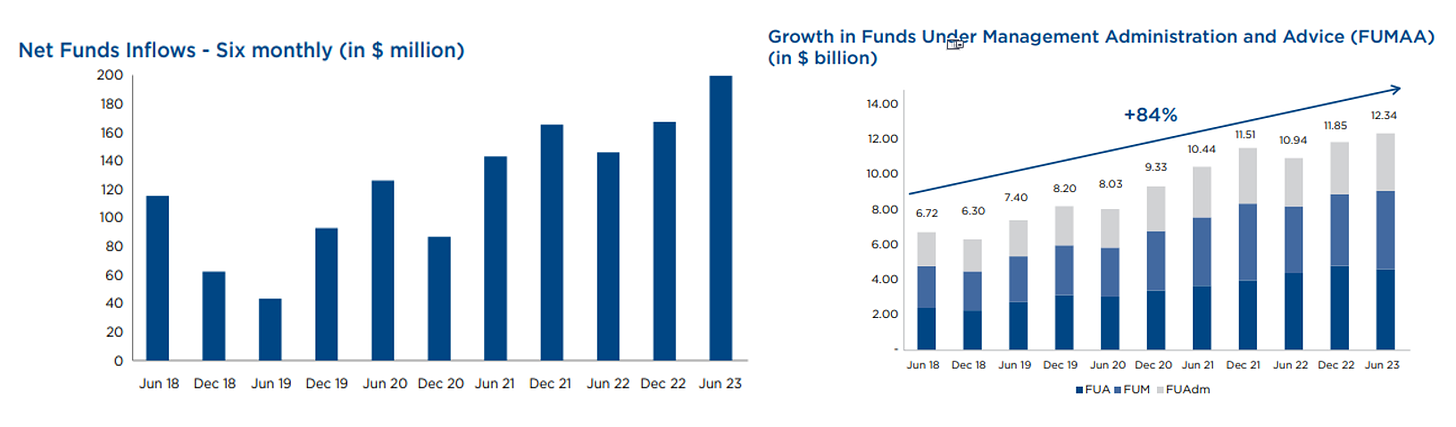

Since its peak in October 2021, it has suffered a 30% drawdown, despite growing its revenue 19% in the same period. Its earnings have grown 7% in the same period. Importantly, the group is highly correlated with the market, thus it is quite highly dependent on the performance of its funds under management and administration over time. As many may know, an asset management business is an exceptional one on the upside but is catastrophic on the downside, in my view this is the primary risk (and opportunity) with the business. Fiducian does a good job of controlling the controllable with gradual expansion of its distribution network over time allowing for consistently impressive net fund inflows to its asset base. I estimate that over the past 5 years net inflows have accounted for 21% of the increase in funds under management, administration, and advice (FUMAA), thus accounting for some 3% p.a. of the total 13% p.a. compounded increase over the period.

Further, there is some things to be aware of which may impact flows, particularly in their administration business. These include the impending $3m total super balance cap, which will tax those with more than $3m on their super an additional 15% tax, which in and of itself isn’t terrible, but the kicker is that this is also calculated on unrealised capital gains, therefore leaving members having to raise cash, through what is likely to lead to more activity between members. Furthermore, other changes include the progressive increase in the employer SGC contribution rate from the current 11% to 12% over the next 2 years and the implementation of the pay-day super reforms although these are unlikely to move the needle. In anticipation of any weakness in super flows, Fiducian has partnered with Generation life (ASX:GDG) to get their funds onto their investment bonds service (next best alternative to super for HNW investors).

In terms of the revenue, the group generates revenue in 3 ways, management fees from their FUM, administration fees from their platform services and fixed fee income from their financial advice. FUM and platform fees (~87% of total segment profits) are based on a fixed % of FUM, are hence variable, are calculated daily and paid monthly in arrears. The remaining revenue is both variable fees related to FUA and one-off performance which are paid as a normal professional service. Thus, we can conclude that >90% of current profit is tied to markets and what would impact revenue is changes in the overall FUMAA through the year (through market performance and/or net flows), and any changes in average % fee because of business mix and/or competitive pressure.

The cost base is the vast majority payments to the group’s employees (salaried advisers), responsible entities and franchised advisers. To a lesser extent the group expenses a small amount of operational expenses, but this would only account for some ~15% of the total expenses. In the existence of volatile markets, we could conclude that the cost base is fixed. Additional hires and/or changes in payroll would impact the cost base the most.

Capital allocation has appeared to be quite reasonable over time, but most earnings are paid out with a dividend policy of 60-80% of ‘underlying’ net profit after tax. The ‘underlying’ referring to the add back of the client portfolio intangibles which is equivalent to acquired intangibles as it represents the customer attributable value of acquired client books, which is an accounting nuance that in my view, does not properly represent an economic reality, and thus the add back is fair. Over the past 5-year period, ~30% of operating cash flow has gone into investment initiatives (26% to acquisitions), ~62% into dividends and paying down debt and the rest piled up on the balance sheet. Considering they compounded FUMAA at 13%, revenue at 9.8% and EPS at 7.4% I would consider this outcome to be reasonably impressive.

The opportunity in my view is that currently, utilising the FY23 UNPAT the PE is about 12x, and there is a little over 1x earnings in cash, thus 11x PE net of cash holdings. The group pays 60-80% of this out, which when franking credits are included is a gross yield of 8.2%, which on a forward basis I expect this to be closer to 9.5-10%. Fiducian has raised the per annum budgeted net flows target to $6m per adviser which when applied over 80 advisers equates to $560m per annum, have doubled revenue targets for salaried advisers to 20% p.a. and launched a platform offering for external advisers called Auxillium. In the existence of market-like returns of ~10% give or take, this gets us to revenue growth just shy of 15%. Not including any capital allocation initiatives, margin expansion or organic growth in adviser count. This and the dividend yield gets us comfortably above hurdle.

Just wanted to say thanks for this writeup. You are more knowledgeable than me on this company and I owned this since 2012...... I trust the management in this company. It is really hard for an Indian to thrive in this industry as AU is white dominated. Please keep us posted if you have new thoughts.