(For those seeing this the second time, I had issues publishing so am publishing once more)

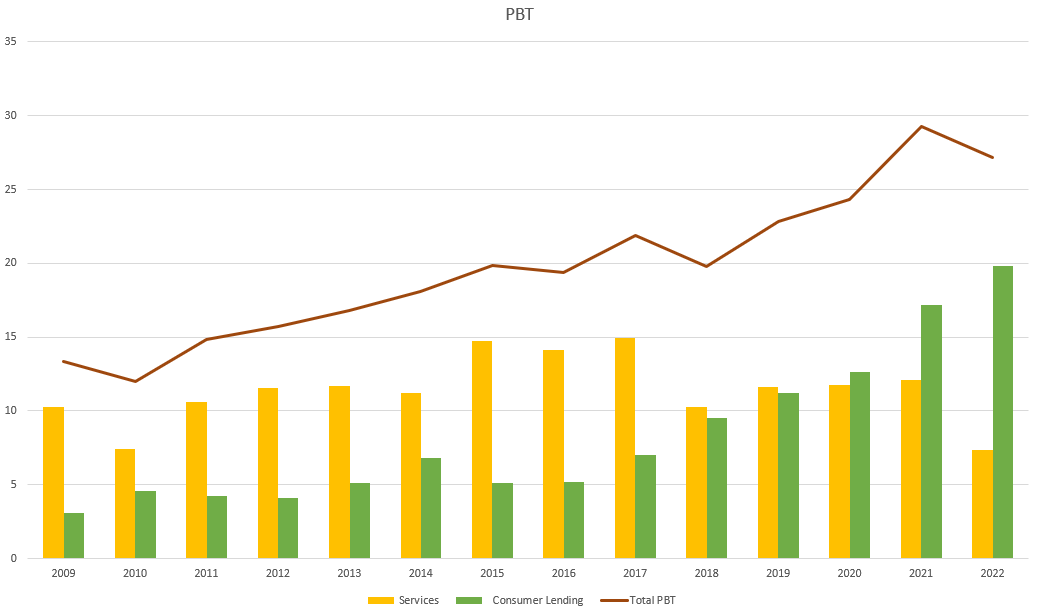

FSA Group is a 23 year old business with 2 main service lines in the form Lending (inclusive of Home loans, personal loans and asset finance) & debt recovery (Informal Arragngements/Debt Agreements and personal insolvency/bankruptcy). All of these services are direct to consumer however, with the acquisition of Azora Finance in 2021 FSA now extends into B2B with the provision of asset finance services for SME’s. In my view, this business model is amply diversified with a counter-cyclical division & a cyclical one, evidenced by the relatively stable consolidated PBT over time.

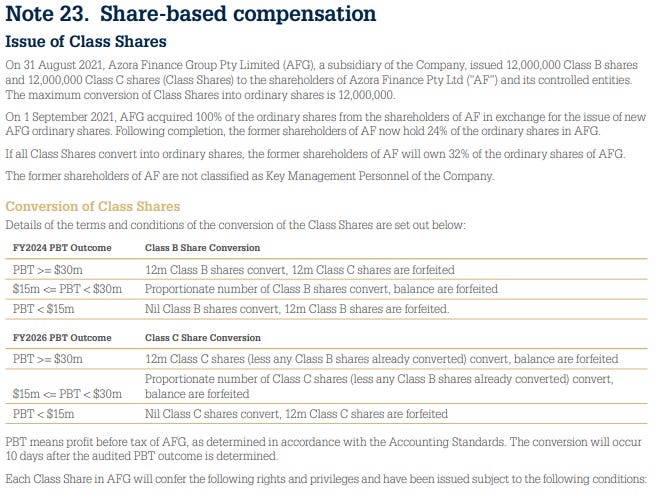

Speaking of that acquisition, there is some very interesting outcomes attached to the consideration here. On the deal, the vendors received a 24% ownership of AFG (the home loans and asset finance subsidiary). And they also received class shares which if converted in full will afford them an ownership of AFG up to a maximum of 32%. The full details are shown below:

That leaves FSA with a ownership of 68% if PBT exceeds 30m in FY2024 and FY2026. Given that AF currently generates a PBT of $12.5m, meaning they require a 2.4x in 2 years for the best case scenario. Should they achieve this, FSA Group would be taking home slightly over 2/3 of the PBT being ~$21m, which after tax amounts to ~$14m. Given that the group generated c. $17m ex. AFG in PBT in 2022, this would near double the groups PBT in 2 years which seems highly unlikely but i digress, a positive development is a near 50% increase in their warehouse facility for the asset finance business shortly after year end.

On the other side, their services segment has shown considerable weakness since the start of the pandemic with appallingly low response by consumers given government debt subsidies and lack of creditor action. This culminated in a near 40% decline in PBT in FY2022 as can be seen through the data below.

Lastly to touch on, the business is owned in large part by it’s long-standing executives which own a cumulative ~46% of the outstanding shares.

The shares trade on a trailing fully-franked dividend yield of ~10%, and the EPS has compounded at ~3% p.a. over the past 5 years, which includes considerable weakness in their debt solutions business due to government subsidies and lack of debt chasing by creditors. Nevertheless, their lending arm has shown it’s cyclical prowess as credit access has soared due to lower rates. In closing, with a PE ratio of 7x, this puts FSA group on a PEGY of about 0.55x.