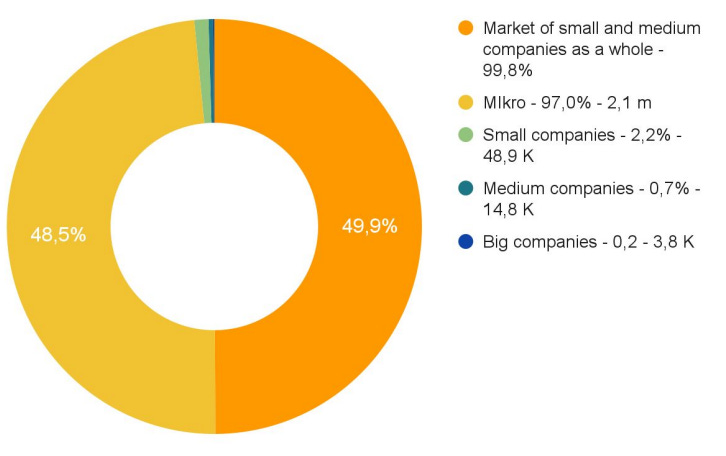

Ifirma is a polish accounting software business for predominately gig workers/freelancers. The company offers three main levels of service ranging from full-service accounting to the invoice only module. Micro sized businesses account for 97% of all companies in Poland as shown below.

It’s services range three levels including:

Modern accounting office – the highest level of service, their employed accountants look after the accounts on behalf of clients.

Independent accounting – historically the first level of service, client sets up an account in the system and conducts accounting independently.

Invoicing – the lowest, paid (formerly free) service for issuing any type of invoices with the use of the Faktura+ system.

The founder, Wojciech Narczyński owns slightly over 1/4 of the company, there is historically a high level of dividends in relation to earnings (~55% of all profits over the past decade have been paid to shareholders) and the retained earnings have not been reinvested but simply held in cash. Furthermore, the business has had a negative working capital cycle for the same period converting more than a 15% mark up to profits in free cash flow. This is because at a minimum Ifirma is booking cash revenue at minimum 1 month in advance, and there is the option to purchase 6-12 months in advance for a ~10% discount notwithstanding promotional periods.

Interestingly, the company in early 2021 enacted a range of significant price increases that ranged from 22-30% and did not see a corresponding loss in customers which resulted in a significant jump in both revenue and margins, which led to a jump from 0.29 polish zloty in 2020 to 1.17 in 2022. Given the companies lack of inorganic motives, this led to a jump in dividends per share from 0.17 in 2020 to 1.15 in 2022. This equates to a dividend yield of 5.5% on the current stock price, although using the last dividend as a run-rate the yield is 7.5%.

Another intriguing fact about this company is that they are developing a new product called firmbee, and until recently were piloting it for free for consumers. Currently it is spending 3-4% of revenue on the development of this product. Firmbee is effectively a type of small-scale ERP software for micro-businesses and is very attractively priced at just 9 euros per month or 99 per year. Currently it’s impact is negligible but the 3-4% spend is something that they could go without should this product not take off.

Financially, Ifirma as a business has done exceptionally well in recent years with compounded EPS growth of 27% in the past decade despite no reinvestment at all, no debt use and no dilution. Rather, than poor and aggressive capital allocation, this group just has no capital allocation for the most part historically. It pays a quarterly dividend but until recently, the payout ratio was smaller leading to a pile up of excess cash. Today the group has over 100% of it’s equity in net cash, which amounts to 10% of the market cap. EPS growth was hit strongly by a change in pricing so we will use revenue growth as a reasonable trailing growth rate. In the past 5 years, the group has compounded it’s revenue at a rate of 20% p.a. which when combined with a dividend yield of 7.5% and a PE (Exc. Cash) of 11.9x we get a PEGY of 0.43x. There is much more to dig into with Ifirma, but you can be assured that it is an interesting lead to dig into.

Note that Ifirma has a market capitalisation of PLN 135m, or AUD 47m. It has average daily volume of around 4k shares, or a dollar value of PLN 84k / AUD 30k.

I hope you enjoyed this pitch, till the next one.

Tristan

I was taking a look a couple of months ago at this company, and even when the past is bright, didn't find enough reasons to think the future may follow the same trend. BTW I've probably missed something.

At the end of Q222, as of Q322, IFI increased ifirma pricing by 12.66-15% (depending on subscription type). Q222-Q322 revenue grew at 1% and in Q322-Q422 at 8%. If my understanding of their subscription model is correct, it basically means they have to lose some customers. Not a huge number, but not negligible. Also, when researching the opinions on the internet about ifirma it seems that in the last few months there is a higher number of customers dissatisfied with the quality of service (high number of customers per accountant). AFAIK management don't provide details on number of clients. Don't you find this issue worrying?

Thanks for sharing!

Just listened to you on Buyback Capital pod. I invested in a couple of waste management business in Poland but they haven't done much. I think maybe the high inflation handclapped them a little. Firmbee doesn't look interesting as it could have global reach.