Kelly+Partners Group Holdings is a network of Australian accounting firms predominantly focused on providing tax and business services to businesses in the SME segment of the economy. Currently, the business covers mostly just the state of NSW, but has an office in Melbourne as well, with some parent company support staff also based in Hong Kong.

The group was founded in 2006 by none other than Brett Kelly and he has since bootstrapped the business having invested his own capital initially and some equity to grow the size of the business 40-fold from $1.2m in revenues in 2007 to $48.9m in 2021 (A CAGR of 30%). This has been done whilst remaining profitable along the way and expanding margins over time as the operations of the business continue to benefit from efficiency gains including software and accumulated business know-how.

I didn’t really know what to talk about here because there is such comprehensive material put out by Kelly+Partners so I will cover a few core things to the thesis in my mind, that in my view you will likely not get anywhere else.

A few years ago I attended a breakfast hosted by CPA Australia, one of the several leading educational bodies for Accountants here in Australia. On that morning, they had a 95 year old with over 60 years industry experience speak on what he said was the most important thing for Accountant’s and he said 2 things.

Know your Client

Workpapers

Now you probably can guess what “Know your client” means, but I will just emphasise anyway that Accounting is a ‘people’ business, and the treatment of your people including not only clients but also employees and other stakeholders is crucial to success. Workpapers is another discussion in itself, but essentially it refers to every little source document behind each number on that financial statement you see at the end of the process. There needs to be documented proof of the numbers you construct, the more comprehensive the better as it provides a) risk minimisation and more importantly b) a base for further optimisation of client workflow leading to significant gains in productivity.

These gains in productivity feed into the CORE formula for per partner profitability, arguably the most important thing for the partner value proposition is to have the best mix of employee leverage (Employees per partner), productivity (% of hours that are billable) and margins (GP Margin %). This deserves a full discussion itself as well, which I may well do in a future post but know this, barring firm overheads the profitability of the firm is dependent on how a partner and their team operates, and I say ‘best mix’ because this can vary to get similar results. For example, you can hire more seniors to do higher value work because that’s all you do, so your leverage will be lower for a similar level of fees or you can maximise leverage and do more low value work. Similarly, you could maximise both leverage and productivity and then undercut client price (charge out rate) to drive volume into the firm, there are many ways to win. For more on this topic I highly recommend reading David Maister’s material, namely his books “Managing the Professional Services firm” & “True Professionalism” among others.

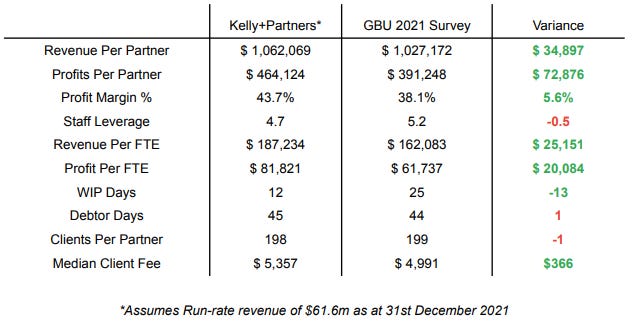

In a report by Business Fitness called “Good bad ugly”, they surveyed several hundred accounting firms to aggregate these metrics, which provides a nice benchmark to compare Kelly+Partners. I have compared Kelly+Partners to the aggregate below. Note that the Profit margin is the firm EBITDA margin + 9% services fee. I would also like to point out that, these firms that participate, likely use the Business Fitness software, so are likely to as a group be above average, but nonetheless, the report is useful for benchmarking purposes. If anything, Brett’s claim on offering partners a superior offering holds up, and this excludes the additional investment office offering to partners and significant support from centralised services.

This memo would be incomplete without a mention on the acquisitive strategy of the business. To put in context here, there are close to ~20,000 firms in Australia and only 100 have practice fees above $4m, the opportunity for ‘programmatic’ acquisitions is immense as succession is driving firm sales. Furthermore, these older vendor firms tend to fail to leverage technology effectively, leaving plenty of room for operational improvement, making an already attractive industry average multiple of ~1x sales/fees very attractive for Kelly+Partners, who is capable of consolidated NPATA margins in excess of 20% and can carry much less lockup than the typical firm (which can further accelerate payback of principal) to allow returns on their M&A to be significant at >25% after tax.

There is a clear focus on increasing the volume of deals rather than the size, and a clear focus not on increasing per client fees, but on maintaining cost leadership, client satisfaction & the partner value proposition whilst executing on a heavily accretive M&A strategy over time. Now, ⅔ of this memo has been a focus on per firm unit economics, which I believe is rightly undercovered, so I hope this memo in conjunction with other resources can help assist you in gaining a holistic understanding of the business. I could write multiple times the length of this quite easily and have not covered a lot about the business, such as the POD model, Brett’s background and influence, employee resources, complimentary business, accounting specifics and so on.

Lastly, a comment on valuation. I initially purchased this business in October of 2019 at under $1 per share, and significantly increased that position in July 2020, which has seen my initial investment go on to 5.5x from there. So it is clearly apparent that the multiple re-rating I have seen to date is unlikely to repeat; however, I believe that even at the current price, there is minimal risk of excessive multiple contraction whilst there is significant business growth on offer over a very long period of time. Personally I expected a 15%+ growth rate over the period 2020 - 2030 was realistically achievable, and to date have executed on that whilst paying dividends that exceed my assumptions. I want to hold this for as long as the business executes, ideally decades.