Legal & General is an extremely old business (1836) that is one of the UK’s largest financial services groups. The lions share of it’s operating profit comes from retirement related solutions including a institutional pension risk transfer business and a insurance provider. They also have an asset origination and management business. Whilst this business I would consider on the fringe of my circle of competency but I still considered it as I believe the risk transfer business (That is, the addressing of retirement stream related risks) aligns nicely with my educational background in financial advice.

Within the Retirement transfer annuity portfolio (LGRI), the business sees a very high quality portfolio with two-thirds A-rated or better and minimal exposure to cyclical debt. Most is backed by counterparties including utilities and government. Because of this, 99%+ of Legal & General’s bond portfolio is investment grade and they haven’t seen any default losses since 2008, with only £25m in 2007.

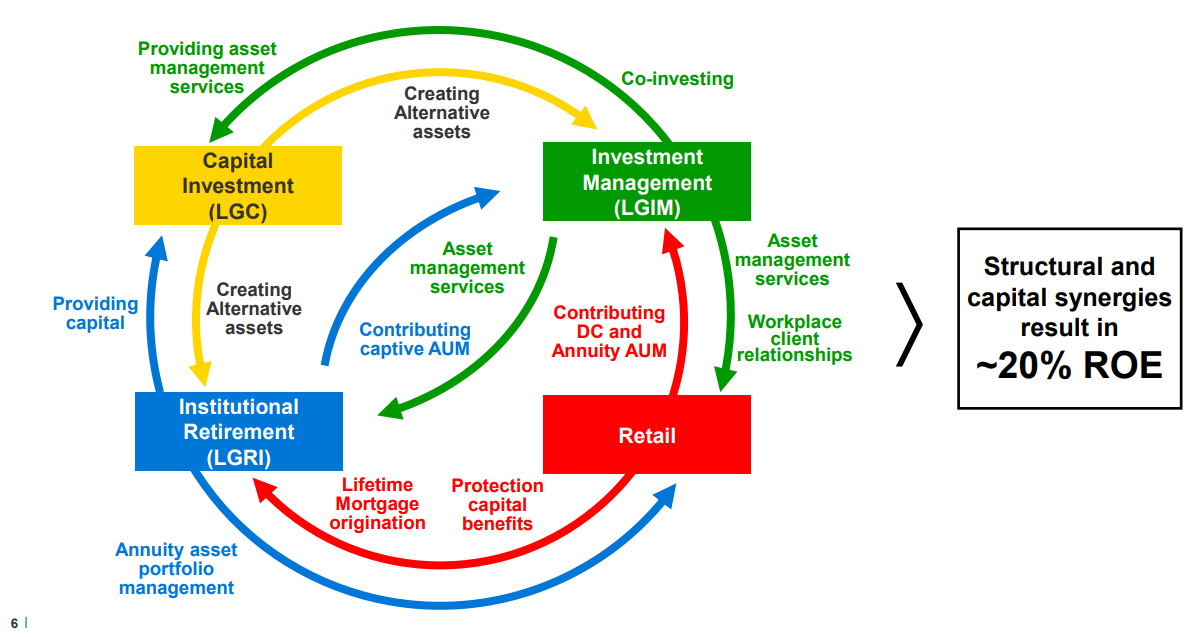

The capital investment (LGC) business is a relatively large mix of alternative investments in a search for idiosyncratic investments such as investments in housing, clean energy, SME finance and specialist commercial real estate etc. with a goal to generate 10-12% returns through 2025. This is their highest growth part of the business with bold ambitions.

Investment management (LGIM) offers a variety of different services and is much the same as a Blackrock or Vanguard in it’s function, offering a variety of ETF’s, indexing or active. It is seeking to grow throughout Europe and Asia.

Lastly, their retail division provides a variety of personal solutions including retirement, financial advice, insurance, mortgages and start-up funding to name a few. These can be largely lumped into insurance and retirement services as how the company reports it.

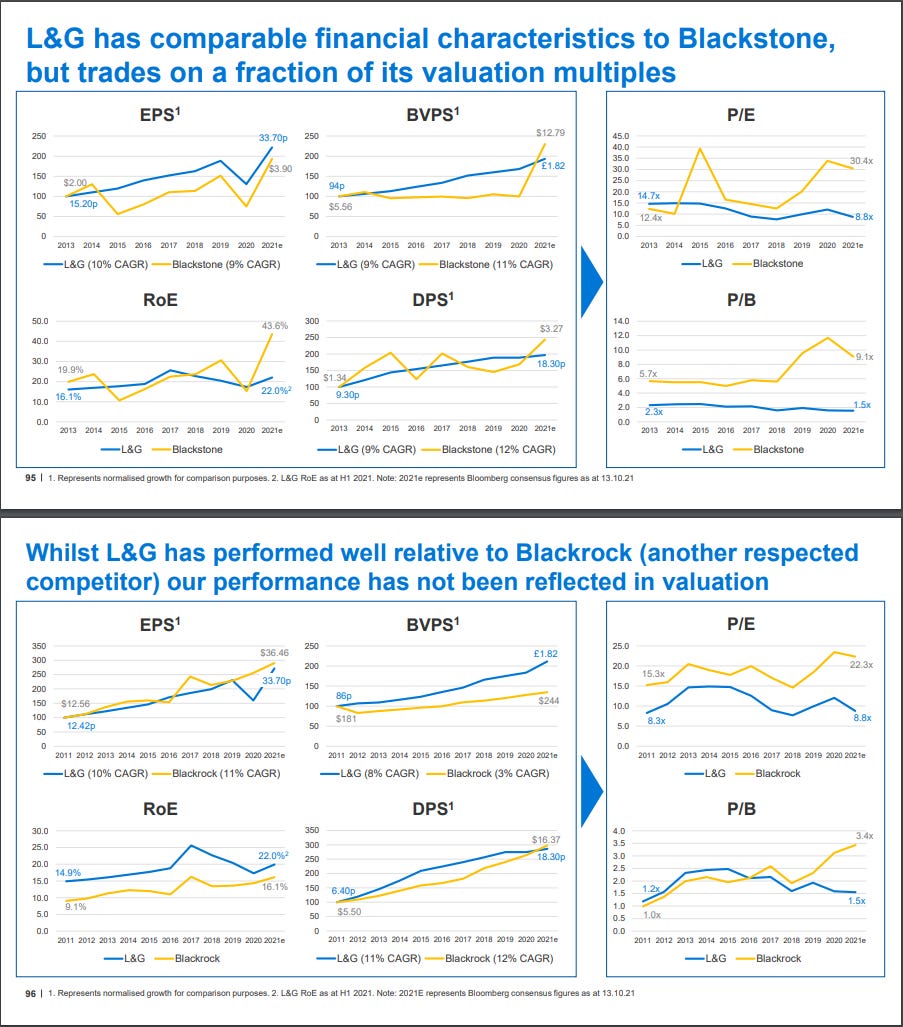

Financially, Legal & General is an absolute powerhouse, with consistently above 20% ROE and a very strong history of dividend growth at a ~8% CAGR since 1998. This is significant as the group is at an 7% dividend yield and 7.5x PE, putting this on a ~0.5x PEGY ratio, scraping just barely into a consideration for a stock pitch. Furthermore, the group has intent to grow their dividend at 5% p.a. for the next 2 years at the least, with EPS growth to exceed it into the high single digits.

The company has highlighted it’s perceived undervaluation in the 2020 Capital markets day relating to 2 main competitors Blackstone and Blackrock. As you can see across the board the stock is cheap relative to peers.

If you like the look of this business and other ones’. Please consider subscribing below.

Thank you for reading