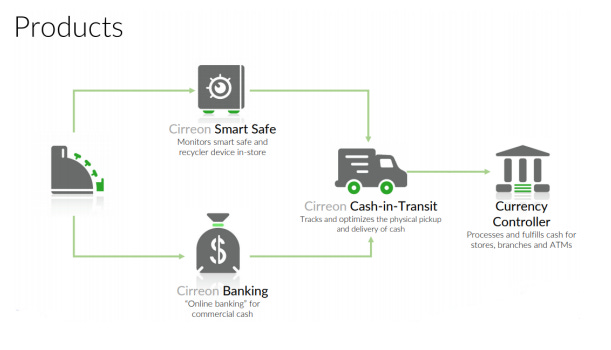

NamSys Inc, formerly Cencotech Inc, is a Canada-based company engaged in the development and production of currency inventory management and control systems. The Company offers inventory management and control systems for financial institutions, retailers, currency carriers, casino and mass transit operators, and various government agencies. The Company's Currency Controller product consists of multiple functions that are separable into various software offerings. Currency Controller is a cash vault management and logistics system designed to manage various aspects of cash processing for banks and cash-in-transit providers. Its software as a service SaaS products are branded as Cirreon. Its Cirreon platform features include bank integration, reconciliation, multi-vendor support, remote management and transactions. It provides cash processors with solutions to challenges, including kiosk processing, cash inventory optimization and store-to-vault customer integration.

Namsys SaaS products address inefficiencies in each section of the value chain (fully-integrated). It's an interesting proposal that can assist the longevity of cash as a payment method.

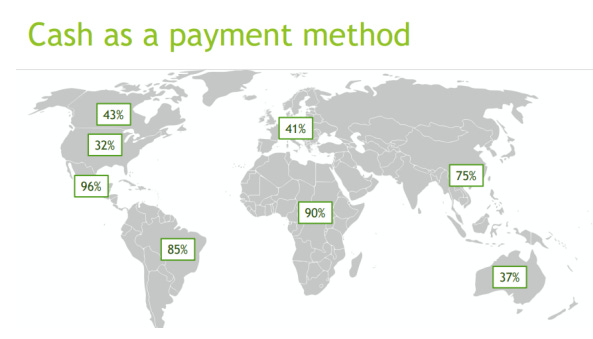

Speaking of cash as a payment method, it's still used broadly throughout the world with clearly large addressable markets in South America, Africa and Asia. Namsys says this is partly due to the number of unbanked customers far exceeds other areas. Europe, Australia etc. are lower due to efforts by the government to reduce physical cash in circulation. For instance, just recently in Australia there has been discussion of Black economy restrictions to target anonymous usage for criminal means

Interestingly the CEO does bring up a good point where their solution can actually benefit from a decline in fiat circulation:

"The other aspect that we'd like to mention is that any decline in cash doesn't necessarily correlate with a decline in our market. And that is because if cash does decline, the cost of handling cash is fairly high, and there will be a need to reduce or manage the costs of handling that cash because of the percentage of the overall payments coming into a retailer, for example, that the percentage would be lower, and it would factor in as a higher cost."

This cost of handling can be reduced by using Namsys products to improve cost efficiencies. This puts Namsys in good stead to gain benefit from a declining market as a result.

As for diversification, the company gathers the vast majority of it's revenue from the US, with active projects in various other countries.

Notably, you can see how Namsys is capitalising on the unbanked markets mentioned earlier and so I expect those will take precedence going forward in terms of target markets.

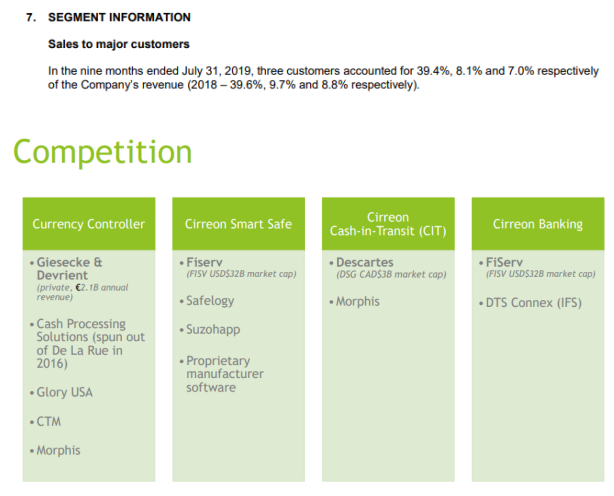

Much of the US revenues are due to a major customer; Brinks that accounts for roughly 40% of group revenue. There are some other large customers which is to be expected given the size of the company.

Turning to the competitive landscape, the currency controller application is the most mature market out of all of them, with the largest threat being a private German Company G&D at the top with a annual revenue of $2b euros.

Smart safe competes against Fiserv, listed on the Nasdaq with a $32b market cap. Namsys has quoted the following in regards to this company:

"We compete against Fiserv which has a $32,000,000,000 market cap on the Nasdaq and Descartes, which is a large mapping technology provider out of Toronto. And in each one of these cases we go head to head, but oftentimes we win as far as we have delivered better technology, we have a better reputation for delivery and quality. So we're confident that we have a track record of successfully competing against even these big companies."

CIT and Cirreon banking is sort of niche in the sense that what is currently competing isn't catered specifically like Namsys product, they state:

"Cirreon and Cash-in-Transit, and our Cirreon bank product, these are our newest, sort of newest entries as far as product categories. And so there's not as much competition yet. And the players for example, in the Cash-inTransit space like Descartes are not making an application that's specific to our Macquarie operations which are a bit unique. Like any industry, there's idiosyncrasies that need to be accommodated and various processes that need to be implemented. And one unique aspect of moving cash is that it is cash. It is a high security, a valuable commodity. And it is not like a courier, which oftentimes, we see courier type products try to be implemented in the Cash-in-Transit industry, and they subsequently don't meet expectations."

"And then lastly, Cirreon banking we are competing with a company called DTS Connect, which has an established presence in the US. And so we're seeking to serve as an alternative to them. They still just operate in a small segment of the market. Also, they do not operate internationally."

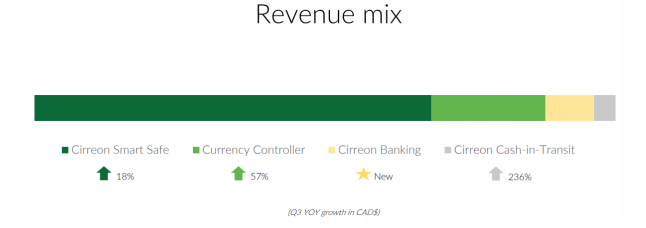

So you can see here that Namsys has a decent amount of competition and by no means a complete monopoly or anything. If you take a look at the revenue mix, you can see growth in the areas that you would expect after reading this. CIT and Cirreon Banking both would be expected to grow the fastest such is evident with CIT growth, however interestingly the most competitive product currency controller has an enviable growth rate as well. This hints towards favourable unit economics which we can turn to financial results to see if this is the case.

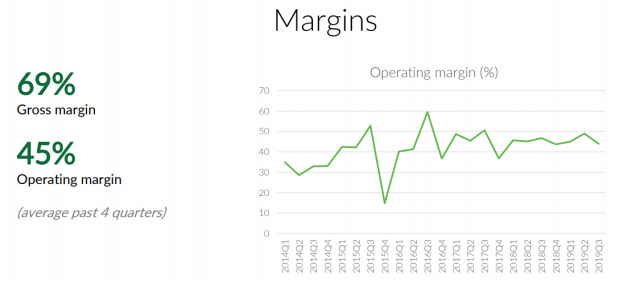

In regards to margins, Namsys has said in the past general meeting:

"So, to review, in 2018, we continued to perform well. We had 70 percent gross margins, 45 percent net margins. In Q1, we experienced 22 percent year-over-year revenue growth and that was largely due to new products coming online. The recurrent revenue is still at approximately 95 percent; we are committed to software as a service business model, so we have virtually eliminated all license sales at this time, and that 5 percent is really just enhancing revenue--one-time enhancement revenue."

This, largely doesn't tell us much besides that the margins are good and assuming costs don't blow out, the recurring nature of revenue can largely maintain the margins. So for more depth we can turn to the interim report to see just where they derive from.

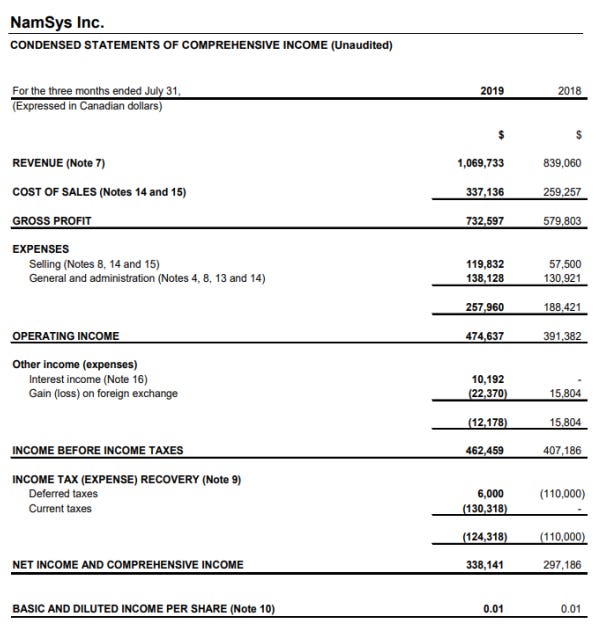

For context the Income statement is very light to begin with as shown below

With this information (and handy notes) we can work our way down the profit and loss, defining each line.

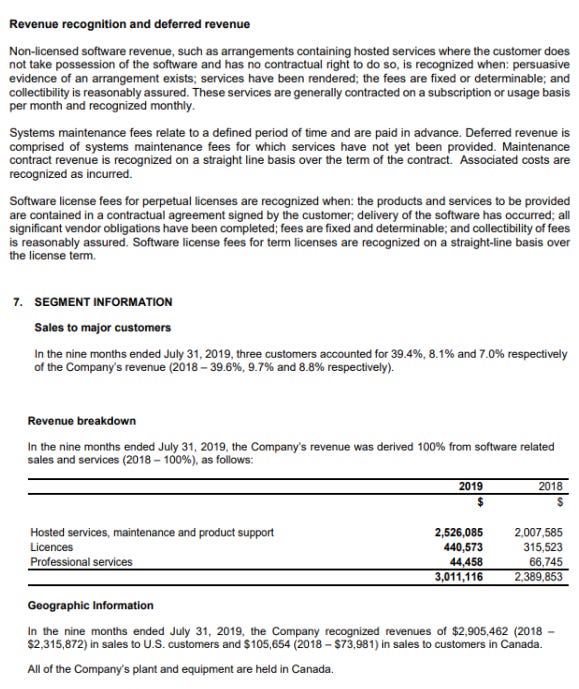

What is very interesting to note here is that maintenance fees are received in advance and recognised over the time of the contract on a straight line basis. This gives the company float to reinvest should they see fit. It is also mentioned in the 2019 investor presentation transcript that these are paid annually on a recurring basis. So essentially, the company receives the whole year of maintenance fees at the start of the year and deferred revenues are recognised on a straight line basis over the period.

Jason Siemens COO describes licensing fees as:

"The recurring revenue for the other products for our other subscription-based products like our Cirreon applications or currency controller are based on active usage. Unless the customer cancels the contract or their usage goes down to zero, of course we expect that revenue to continue on. I mean, it is dynamic. It is variable in nature. It is subject to change. All contracts are between one and three years. That locks in pricing, but it does not normally lock them into a minimum number of units. It is a pure software as a service subscription in that respect"

To reiterate what he has said, these revenues are largely recurring in nature with an upfront maintenance fee that is paid at the beginning of the contract. The remainder of revenue is described by Jason:

"While all of our solutions use a SAS model, there is always a small amount of revenue that comes from custom development enhancements required by customers. These are non-recurring in nature. That accounts for about 5% of revenue."

Moving onto the cost of sales, this is exclusively employee related expenses:

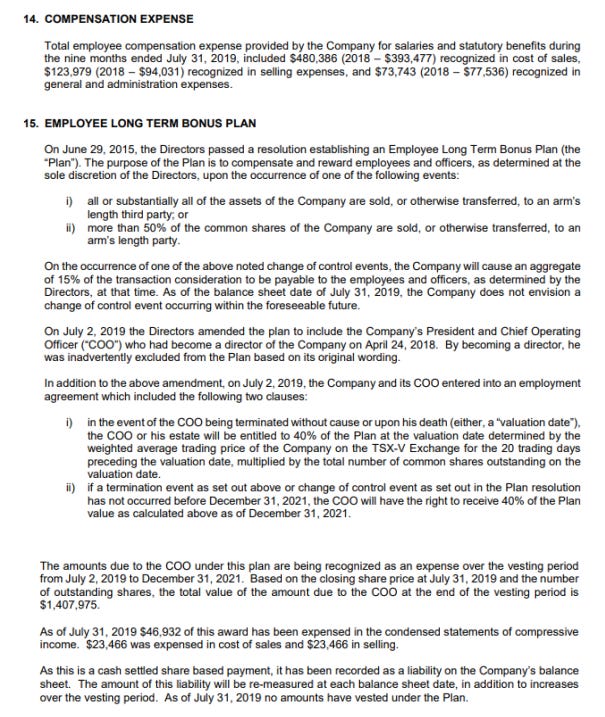

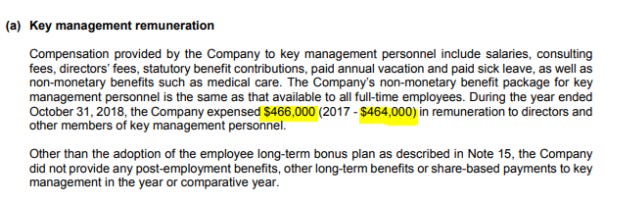

Again this is a very interesting method of accounting for the Long term bonus plan. What is occurring here is they expense the plan before it is paid out over time. That way they are using it as a form of amortisation rather than a one off to reduce taxable profits.

The conditions of this plan as well are rather conservative being 15% consideration on the top options as well as 40% consideration on the COO agreement.

As for the employee compensation expense it is rather straightforward, however to validate this I decided to pinpoint their premises and look at the cars located outside. To my expectations i did find the premises with an expected amount of cars outside. Keep in mind that this Google street view is 'September 2014' and hence would have had less employees as a result. But it's reassuring to see that it exists.

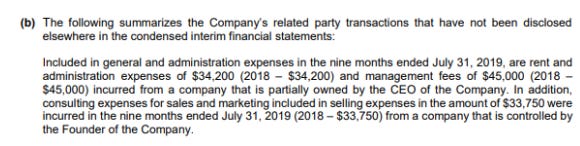

A large portion of the General and administration fees includes rent and management fees paid to a company partially owned by the CEO of the company. A standard affair for smaller businesses and is disclosed with adequate transparency.

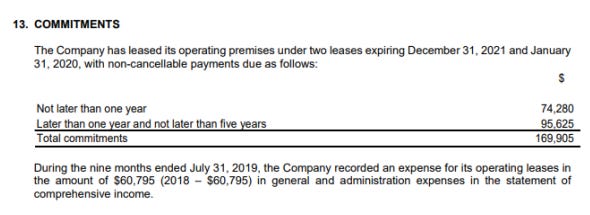

The remainder of the related party rent would be the non-controlled interest portion of that business shown here in the commitments note.

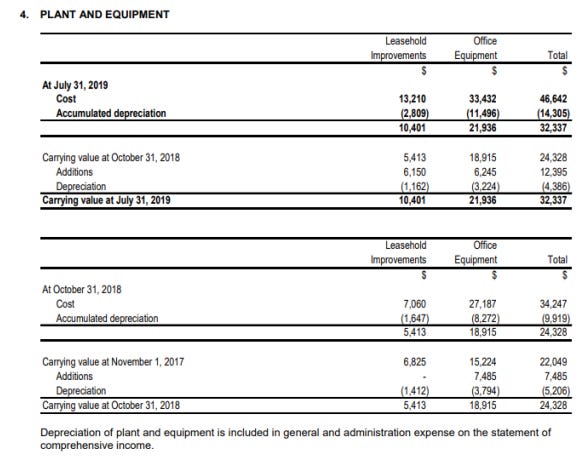

And lastly, depreciation of leasehold assets and office equipment is included:

Interest income relates to cash on hand and deposits

As the company operates predominately in the US market with domicile in Canada, there is much exchange between the pair.

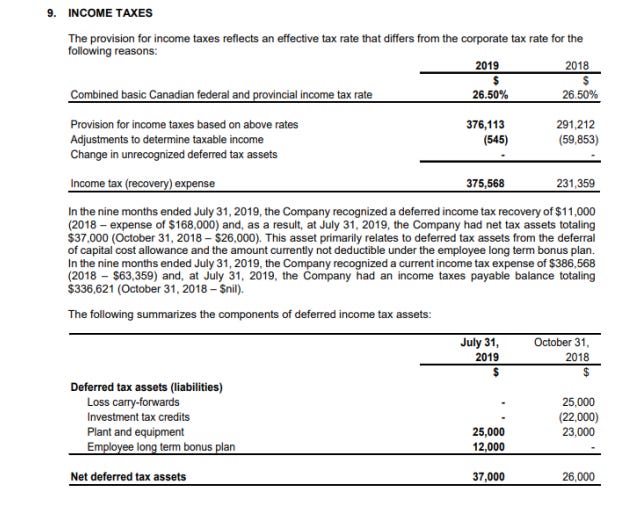

The provision for income tax is the cumulative sum of tax payable for the first 3 quarters of the 2019 Financial year. The DTA's relate to specifically the bonus plan capital cost allowance not yet incurred. Also some degree of depreciation not yet incurred.

After exploring this you can see just how simplistic the operation of this business is. The vast majority of expenses are employee related with also some rent paid to another associated company that Barry CEO partly owns. Speaking of management, it is important to be aware of their aptitude in considering Namsys as a potential investment. I have my own framework of importance when considering a good management team which can be summarised into capital allocation, incentives and integrity.

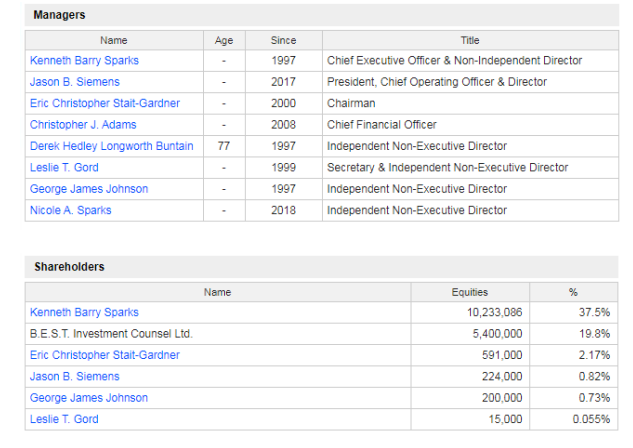

Barry Sparks has been the CEO for over 20 years and owns a substantial stake of the company, this proves to be strong incentive and alignment for shareholders. It also means that we can be reasonable assured that he knows what he is doing. Furthermore there is some other long-standing board members in the company.

Remuneration of the management team is set out below and suprisingly is very conservative. It is clear that the business doesn't have a remuneration issue. Given their is a total of 3 executive team members we could reasonable assume they're being paid between $100-200k each in remuneration.

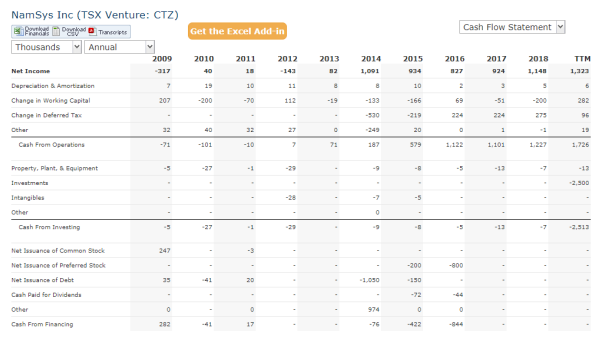

As I mentioned earlier, the business has very high margins and as a result generates substantial free cash flow. The question is, what does the company do with this free cash flow, does it need to reinvest to maintain growth, does it payout dividends, does it purchase company stock?

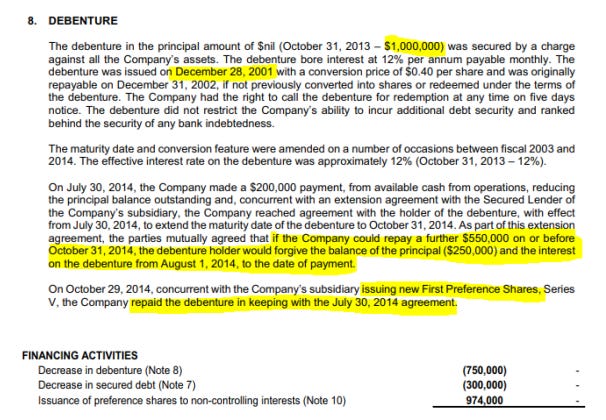

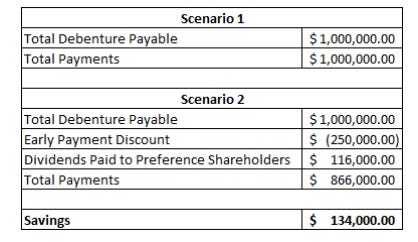

Dividends have not shown to be a common occurence, however their is some debt/preferred stock that we can see above. This occurence in 2014 was in relation to the payment of a long-standing debenture issued in 2001. The debenture holder had a discount of $250,000 attached if Namsys could pay by 31 October 2014, so as a result Namsys reviewed that the best course of action was to issue preference shares to the members of the board. As can be seen above those preference shares were bought back in the following years. The dividend payment of 8% per annum is in relation to those preference shares.

So in summary the savings born out of this transaction are a good decision by management which led to a large saving in a short period of time. Not to mention that Namsys was paying 12% interest per annum on the convertible debenture so it freed up ongoing cash flow of $120,000 per year.

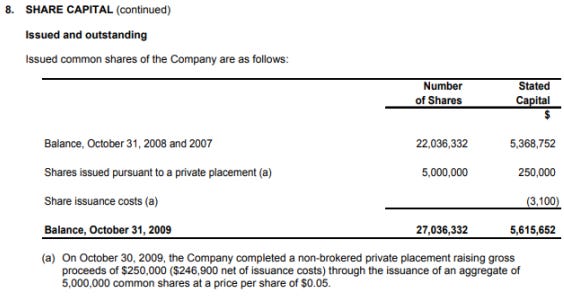

In addition, although it was a long time ago, issuance of common shares in 2009 occured. It's not clear as to what this placement was for besides raising funds, however the private issuer already had a sizable stake in the company.

Besides the repurchase of preference shares, buybacks have not happened either.

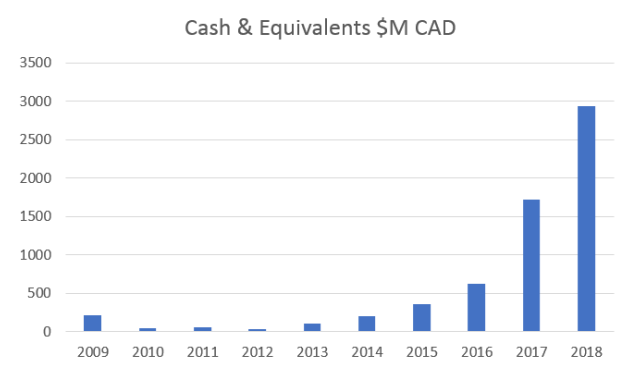

Besides this we can see there is essentially no capital expenditure in the cash flow statement above. To their credit, the company has still remained able to achieve a 10y CAGR in revenue of 8% per annum. With much more significant growth occuring in the past 6 years with a CAGR of 24% in revenues.

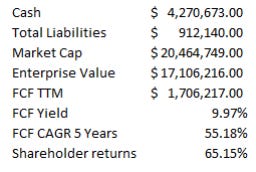

This ability to grow without capital expenditure is a valuable asset to the company. With no capital expenditure or dividends that have happened in the past, the companies cash balance has dramatically increased, currently sitting at a current ratio of close to 9x.

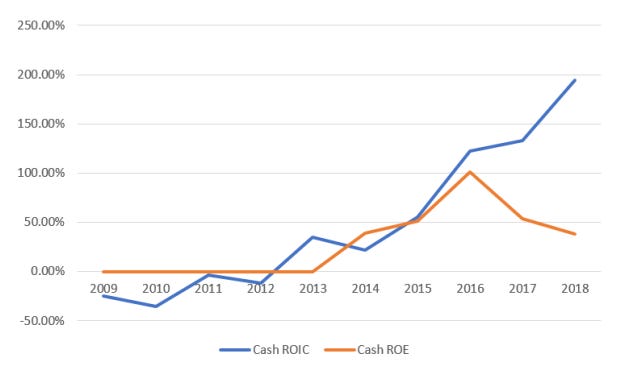

Given their strong returns on invested capital, it's reassuring to know that the company can continue to grow and build it's cash pile while waiting for a good opportunity to deploy the cash.*

*Negative Equity gives inaccurate outputs for ROE from 2009-2013

*A growing cash balance leads to a lower invested capital in later years along with a higher equity, which explains the spread between CROIC and CROE.

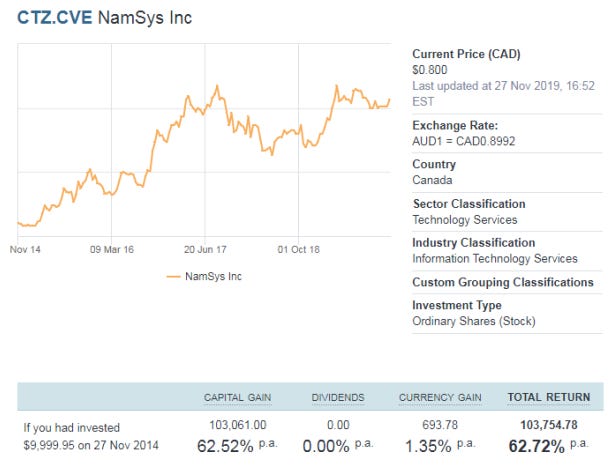

Namsys has a highly incentivised CEO with a strong recent history in performance of it's share price as shown below:

This has not deterred me from considering this as a cheap investment for what you get. With such lean margins and strong returns on capital as a result. With no capital expenditure the current FCF can also be used as the owners earnings.

So with this as a result we can roughly estimate a stocks return as FCF yield + Growth in FCF. Given that the company can experience organic growth without investing capital the calculation is fairly straightforward.

Assuming you paid an entry multiple of EV/FCF similar to today, the results are shockingly accurate when compared to the previous 5 year returns shown below 10-bagger in 5 years!.

So in summary you can see that the business economics of Namsys far outweigh the general consensus and uncertainty of cash as a business prospect. What can be seen as a legacy currency still has quite a number of use cases, especially in South America. Africa and Asia. With operations domiciled almost entirely in the US currently, Namsys has ample cash and cash flow to launch large ventures into these largely untapped markets which should allow for good returns going foward.