Openjobmetis is an Italian employment agency with over 150 branches throughout Italy. It operates across a number of key subsidiaries with the following services:

Employment agency

As an employment agency, Openjobmetis provides to the client companies personnel directly employed on a temporary or permanent (through stabilization or staff leasing) basis and provides integrated management of the employment relationship ranging from the bureaucratic-administrative aspects to training. Furthermore through the subsidiary Family Care Srl - Agenzia per il Lavoro, the Group provides to the client families family care services for elderly and non-sufficient people.

Personnel Recruitment and Selection

With this service, the Group Openjobmetis, through the subsidiary Seltis Hub Srl, singles out the professionals best suited for the needs of its customers.

Training

The Group Openjobmetis, through the subsidiaries HC Srl and Lyve Srl, supplies innovative training solutions for the direct personnel of its client companies. Furthermore, through the Forma. Temp, contributes to the temporary workers training.

Outplacement

Outplacement is a process that supports professional redeployment for those leaving a company. It is a tool for retraining and for training in preparation of a new placement. Through its subsidiary HC Srl, the Group Openjobmetis offers a consulting service to support the worker's re-placement through an orientation and a training program focused on managing the change.

The group trades at a market cap of €120m, and some 44% of the company is available to public shareholders via. free float. Marco Vittorelli, President of the company owns 18.4% of the company via. his controlled entity Omniafin S.pA. There is also a number of key investment funds that own large stakes making up the remaining shares not traded on the market. Liquidity is very low as is typically the case with my ideas with just 12% of shares changing hands in the past year (~€15m).

The groups track record has been reasonably impressive over time as you can see below.

Temporary agency work was introduced in Italy by Law 196 of 1997. Therefore, given the inception date of Openjobmetis, it’s clear that the founder was one of the first staffing agencies to operate in Italy. In 1998 the first year after the statute was passed, there was 33 firms operating. 10 years later there was 81 in operation. These days there is 120 in operation (per IBISworld data) generating annual revenue of €12.5b, meaning that with current revenue of ~€0.8b, Openjobmetis has a market share of 6.4%. Lastly, the industry is projected to grow at low single digit rates going forward through to 2028.

Financially, the group generates it’s revenue through a single performance obligation, for which the customer simultaneously receives and consumes the benefits of the services provided by the group. These services are provided on a monthly basis, with no advance payments made or variable consideration that applies. This makes the revenue highly correlated to the volume of business activity on a month-to-month basis as a result.

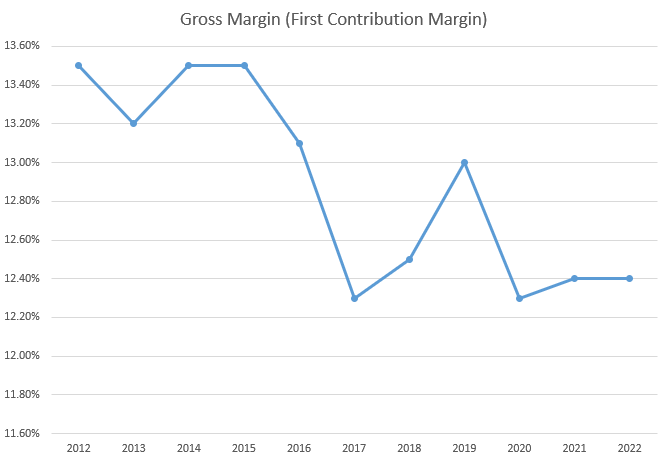

Furthermore, with the provision of temporary work, the group is paid by the vendor, meaning that they also cover the entirety of the payroll of those provided employees. For this reason, the gross margin of the group is extremely small (The company calls this the ‘First contribution margin’). It appears that the variability of this margin is low, but there has been a noticeable downtrend in how much employment agencies keep as a % of gross revenue generated by the temporary workers.

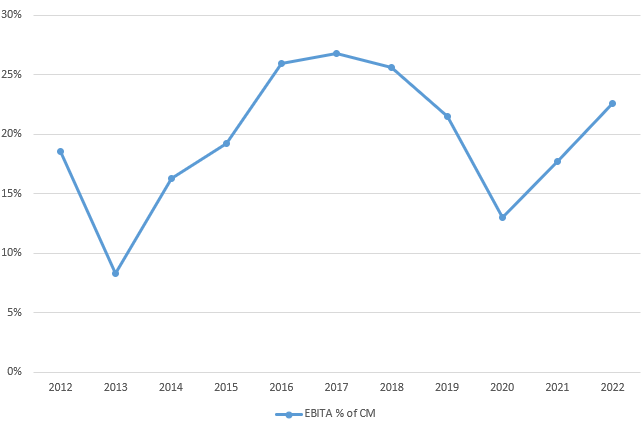

Despite this trend, it doesn’t appear to have impacted the group’s EBITA as a % of net revenue (Given employee costs are a pass through, it is fair to view the company contribution margin as it’s core revenue). In any case, you can see here that there is certainly quite a bit of cyclicality in the margin.

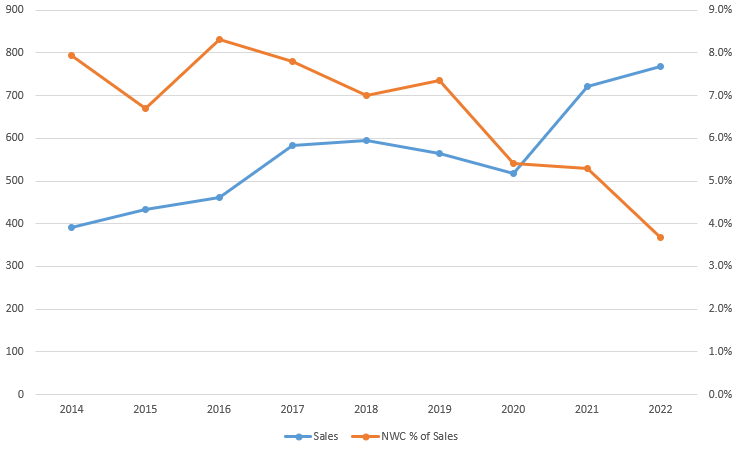

Pleasingly, the group has a strong focus on it’s cash flow with them reporting net working capital every year and days sales outstanding (DSOs). The development of NWC has steadily declined.

Regarding valuation, you can run any assumption on growth you want, the group is highly acquisitive and as such there is a strong element of customer related amortisation in their results. Hence I think it is worthwhile to simply use EBITA and adjust for taxes to approximate a NOPAT result.

Importantly for tax purposes there is 2 tax bases to be aware of, the IRES rate and the IRAP rate. IRES is 24% and IREP is 3.9% in 2023. Furthermore, there is a substitutive tax available for an increase in accounting value due to the impact of acquisitions, making the acquired intangibles in some respect tax deductible as well. For simplicities sake we can simply use a rate of 28% to approximate a tax effect.

For the 2022 year I reach a figure of €15.8m for NOPAT. The group currently trades at an enterprise value of €136m giving us a entry multiple of just below 9x. The group has compounded its earnings at a rate of ~10% since IPO in 2016 and has a dividend policy of 25-50% of their earnings. If you assume a 40% payout ratio, this gives us a ~5% dividend yield. Hence potential hold returns are ~15% dividend + earnings growth on a 9x PE including net debt. A PEGY of 0.60x. Notably, analysts are estimating forward 3 year EPS growth of ~5% which would instead give us a PEGY closer to 0.9x. Whatever the case ends up being, the industry is highly cyclical, but the highly variable nature of the business model is unlikely to result in unprofitability. The risk is capital misallocation due to acquisitions primarily.

I hope you enjoyed reading

This is a reminder that currently, the Hurdle Rate Substack is offering subscribers a 50% discount through to 30 June 2023 on an annual subscription at a rate of AUD $75 per year (USD $50), down from AUD $150 per year (USD $100).

You're so productive