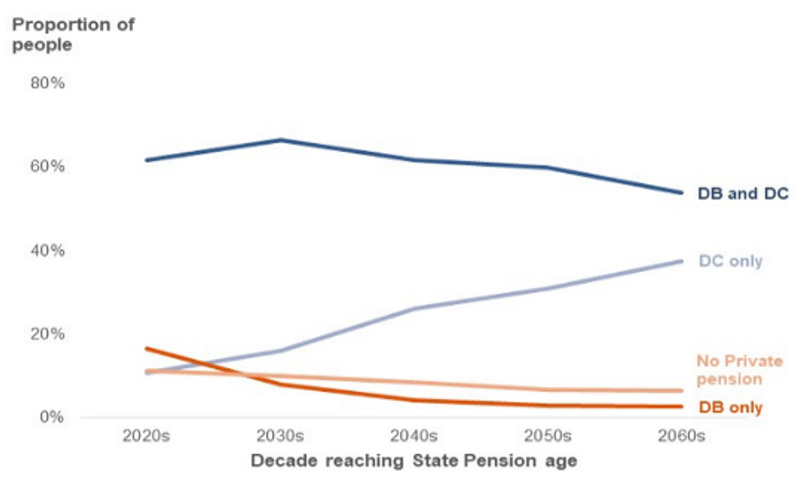

Pensionbee (LSE:PBEE) is a UK pension provider of defined contribution schemes. Historically the UK has has provided individuals with a generous safety net in the form of the state pension but in the past decade in particular have privatised this to provide relief on government finances. You can think of the UK pension system as looking to emulate what Australia has currently by way of it’s Superannuation system. There has been a trend away from defined benefits towards private sector pension providers of both the workplace pension and private pensions. Furthermore, the government is supporting consolidation of tiny pension pots into few providers with the multiple default consolidator model.

Pensionbee was founded in 2014 by the current CEO Romi Savova following a difficult pension transfer experience of her own. She has a background in investment banking at firms such as Goldman Sachs, Morgan Stanley along with being granted an MBA from Harvard as a baker scholar and awarded the highest honors from Emory University. Today Romi owns 35.7% of the shares.

Pensionbees unit economics are highly appealing as is the case with platform administrators (think of companies such as AJ Bell, Netwealth or Hub24). The company benefits from not only strong customer acquisition on it’s marketing spend, but also an increasing average pension pot size through consolidation, regulatory tailwinds from contributions (£1 tax top up per £4 contributed to a DC pension), and asset markets growth over time. Pensionbee charges a flat rate of anywhere between 50 and 95 basis points depending on the plan chosen, with an incremental 50% discount to pension pots above £100k. It does this on what is largely a fixed cost base, besides money manager agreements that are structured as an insurance contract whereby fees (a split of plan costs) are set out and paid on a quarterly basis in arrears.

What drew me towards Pensionbee was not only their Q4 EBITDA profitability (note: intangibles are fully expensed) their announcement of a proposed US expansion whereby their US partner would contribute significant marketing spend and know-how. This appeals significantly to me as co-funding allows Pensionbee to expand rapidly at low cost. They go so far as to say that they would envision that the US business would become as large as the UK business within the next decade. Couple this with the highly sensitive fixed cost base and there is a real opportunity to see a business which is larger by an order of magnitude or 2 within the next 10 years, via. purely organic means.

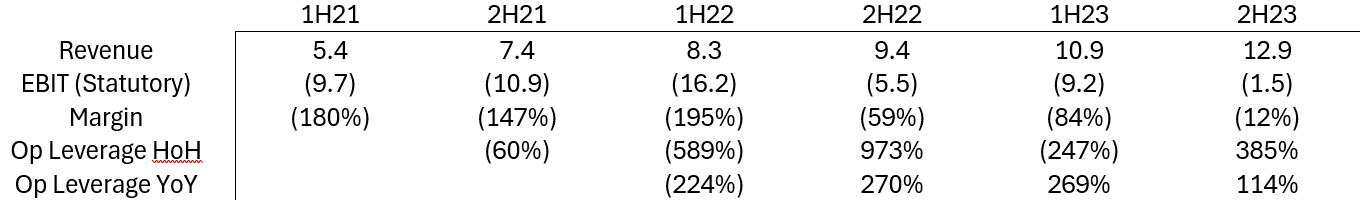

Pensionbee went through multiple pre-IPO funding rounds before listing on the London stock exchange in 2021 at an enterprise value of £307m (EV/Revenue of 34.1x!). Today the valuation is an enterprise value of £205m (EV/Revenue of 7.3x). This may seem quite the price and I wouldn’t blame you for thinking that it may be the case. I would point you towards the cost base where operational leverage is 270%, 269% and 114% over the past 3 YoY periods despite revenue growth of 27%, 31% and 37%. There is clearly a significantly improved level of employee productivity and marketing spend over the past few periods, but, it is important to note that SBP expenses have also fallen dramatically due to the cratering of the valuation on market.

With the exception of any planned increases in marketing as a result of the US-expansion or even just poised UK conditions margins should continue to rise at a rapid pace. Furthermore, there are £81.4m in UK tax losses to carry forward which will grant them a deferred tax asset of £20.3m, likely utilised over the next half-decade or so. The company has long-term ambitions for an adjusted EBITDA margin of >50% whereby the ‘adjusted’ part includes an add back for SBP which is currently about £10-11k per employee and ~10% of revenue, I would expect this to come down as employees are the primary source of operational leverage. With this in mind I would expect longer-term that SBP equates to ~5% of revenue and immaterial depreciation. You could envision PBT margins of ~45% as feasible for this business, which compares to AJ Bell at ~40% and Netwealth at ~49%. However, unlike those businesses Pensionbee has a significantly lower valuation than Netwealth and a stronger growth profile than AJ Bell. This is somewhat of a departure from what I am used to as I believe this business truly has strong long-term potential and is incredibly valuable so I have paid up optically.