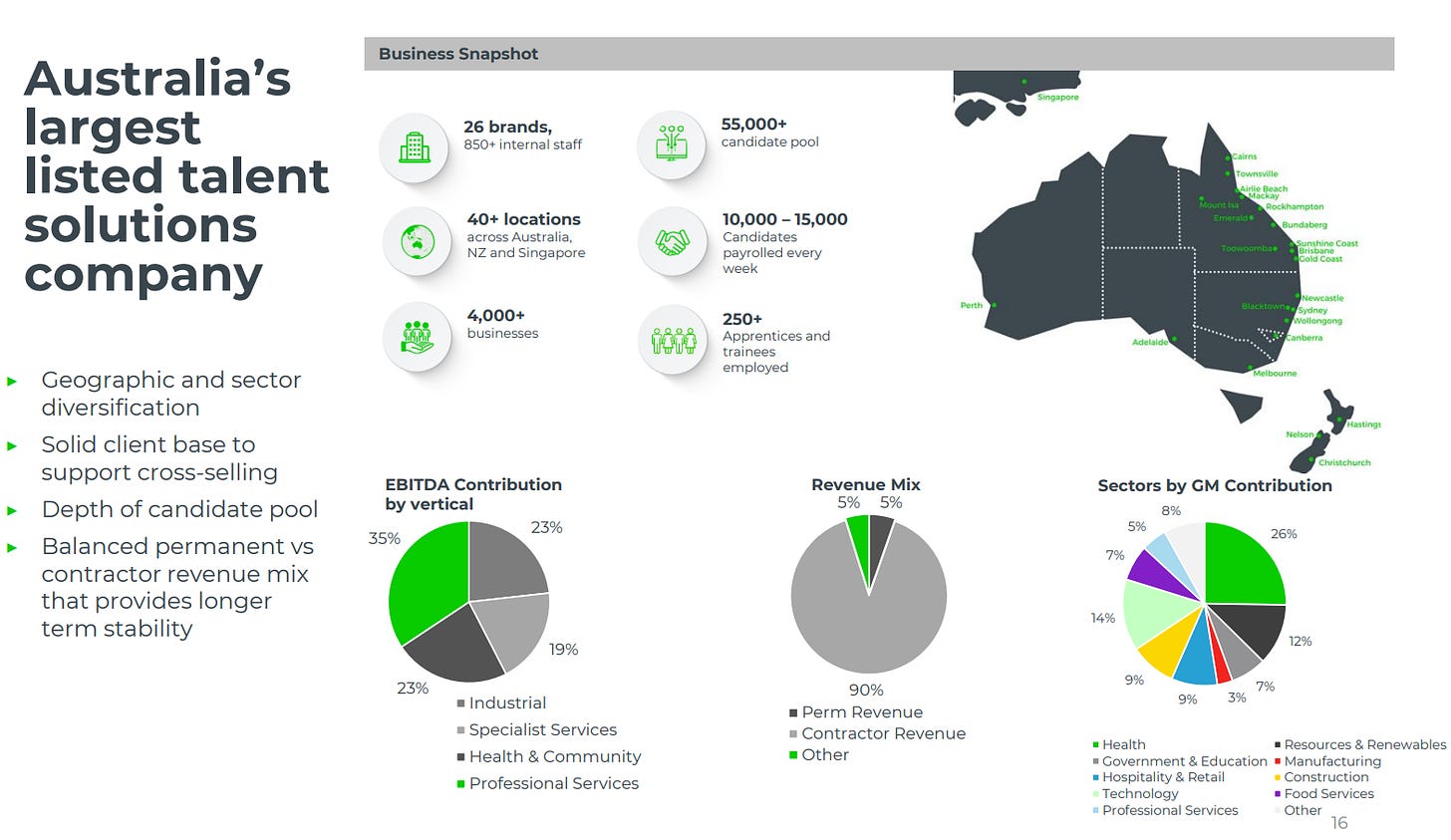

PeopleIN (Formerly People Infrastructure) is in the business of sourcing staff for it’s clientele, primarily temp staffing through the use of contractors. These include appointing supplementary nurses, labour hire, IT contractors and some niche areas including a focus on the PALM scheme and indigenous placement programs.

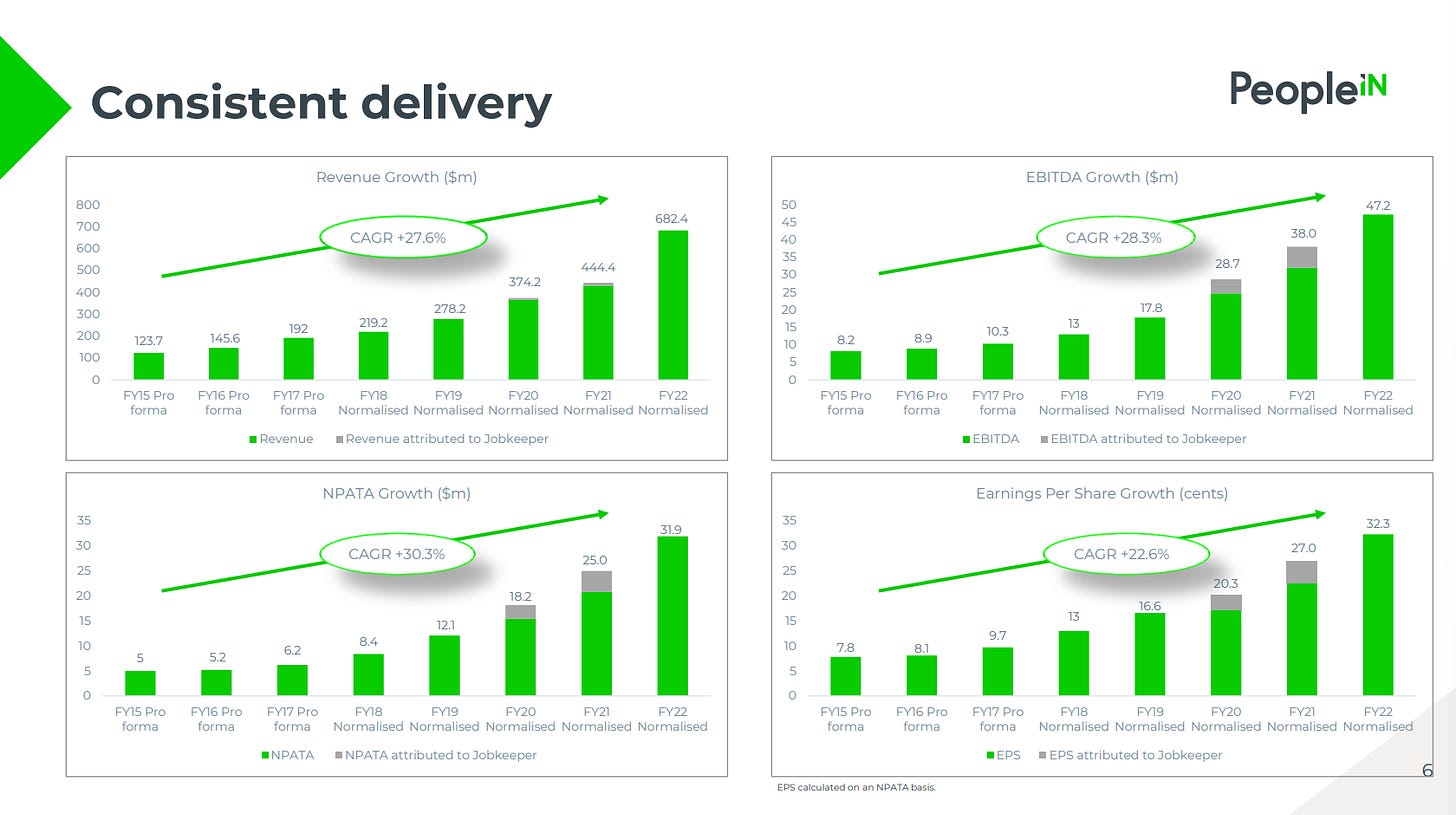

The company listed on the ASX in 2017 with an issue price of $1.00 from which it has generated shareholders a 4x multiple of their initial investment or a CAGR of ~31% p.a. A stellar return, and the company has actually it’s valuation go from 6.1x EV/EBITDA on listing to 6.4x today, meaning it did this entirely with no multiple expansion, an exemplary feat.

Whilst the company is not currently repurchasing shares, it is currently conducting a strategic review with the following rationale:

“The PeopleIN Board considers that the recent share price performance does not reflect the record financial results for FY22 or the fundamental strength of the business and has therefore decided to undertake a strategic review to evaluate options available to maximise shareholder value.”

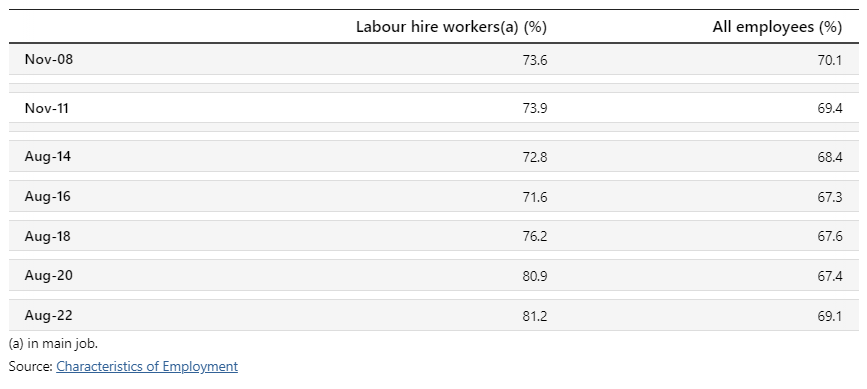

This is sounding extremely positive, so this wouldn’t be complete with a bit of sobering discussion about the risks. Firstly, the business revenue primarily comes from contracted staffing, and is a function of the hours worked and the charge out rate of those staff. Therefore the drivers of growth are a growing supply/demand of labour hire workers, which given their temporary nature, can be construed as being the most cyclical of staff, meaning as a result in a tough environment, PeopleIN should therein also reflect the cyclicality of a temporary workforce. As can be seen below the past 6 years have been a trough-peak scenario for labour hire workers, indicating that PeopleIN are perhaps overearning provided this isn’t a permanent trend, which could very likely be the case.

To offset this volumetric risk in part is that PeopleIN typically charges on a margin of the casual’s wage, meaning that in an environment of wage growth, so too does a company see growth in pricing. Therefore in a way, the charge out rate is a laggard beneficiary to inflation which should see correlation with australian wages.

Lastly, the business enjoys long-lasting client relationships, some of which are material in size in relation to the group, therefore customer churn is a material risk as a result.

The company is currently trading on an PE ratio of 12x including it’s debt used to acquire businesses in the past year, which unfairly hinders this ratio since we are missing the acquired earnings. On my own estimates I consider a no-growth run-rate to be c. 9.4x PE including debt, which given it’s 5y EPS growth of 27% and current 5.6% fully franked dividend yield, gives this a PEGY ratio of ~0.29x, a very cheap ratio which affords the business a large margin of safety should temp staffing suffer any sort of downturn in demand.

Very interesting, thank you. I assume their high growth rates in 2017-2022 were mainly driven by acquisitions?