Commentary

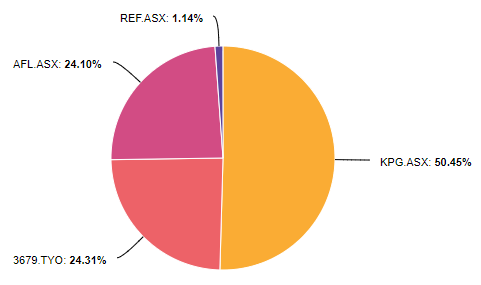

For the Year ended 31 December 2020 the portfolio returned +33.1%

Pre-Trust

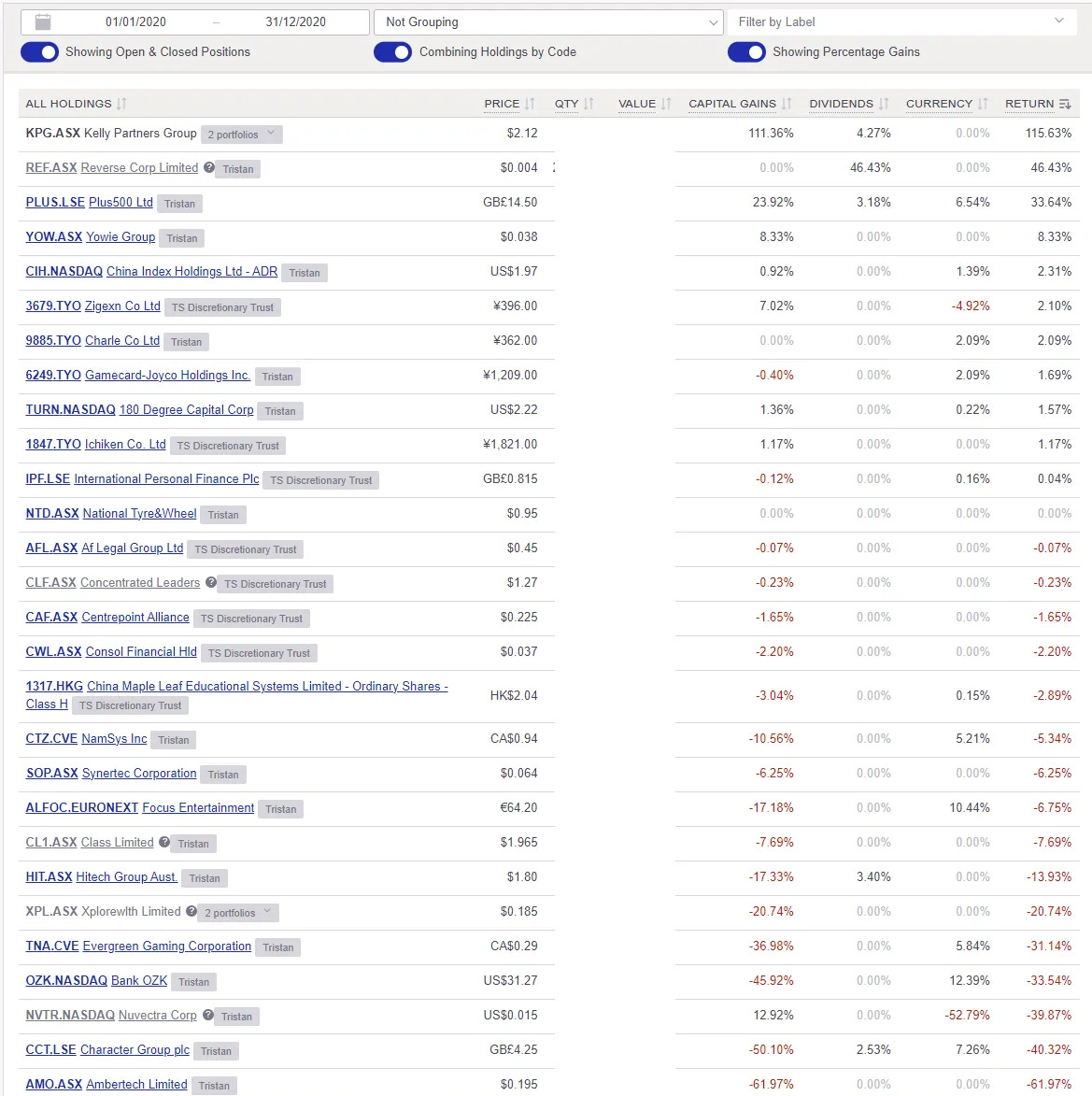

This year is a tale of 2 parts, and that can be broken down into the 1Q as a personal investor where i performed - 11.5% and 2-4Q as a corporate trustee where i saw a +50.4% rise for a combined total of +33.1%. This is because in March (no i didn’t dodge the crash) I liquidated all my investment holdings in my personal account and reconstructed it in a discretionary trust with a comprehensive written investment strategy to come with it. It was in short intended to be a new start where I would take things seriously.

Before we get into that though, here is the FULL update I wrote to myself after Q1 2020:

Major detractors to the performance included the impact of the worst stock market drawdown of ~40% since the GFC. Also some silly decisions made due to me hopping around trying different strategies.

Possibly the worst decision this quarter was to take a concentrated position in a lower-quality net-net (Ambertech ASX:AMO). I jumped into this one with a near 10% position while the business had slow moving working capital and leases I overlooked, only to have them impact my thesis later on. The main point is that whilst I bought this at a significant discount to book, the business hadn't capitalised the impact of their lease commitments. As per AASB 16 changes I found out that the business was actually trading at about book value after factoring in these lease commitments. This left me with a poor business at a probably too expensive price. I decided to basically immediately cut this loss.

Besides this there was a strategy shift right at the beginning of the quarter where I had decided that it was good for me to split my portfolio in terms of strategy. This materialised in a 40/60 split of Asymmetric situations without heed for downside as long as there was significant upside, i.e. $10 gain for $1 risk and 60% to the typical high-quality low chance of loss businesses. While this seemed good in theory, it ended up in my having a diversified asymmetry portfolio, leading to heavy amounts of low quality stock research. Specifically I was adding asymmetric situations after just reading a few things on them. Not only did this just destroy my conviction to hold these positions, but I didn't feel particularly excited in the positions I was holding.

In the latter half of the quarter I decided the time was right to initiate the transition to a Trust structure, unbeknownst to me that the largest drawdown since the GFC would occur in the weeks following this. Nonetheless after the ~20% loss for Q1 I sold the entire portfolio to move to this trust. I have only just finished this process and started investing as of the end of April.

So that quarter will be a new performance and strategy, the efforts until now have been exceptional for my learning process, however with a peak of +45% in mid-January to a -5% total loss at the end of the portfolio, it has become clear to me that all results during this time period were purely due to short term speculation. As such, In the Trust I have adopted a more concentrated high quality approach with a strict valuation hurdle that I expect will lead to me holding very good companies at a very good price, only trading infrequently due to the high standards that have to be met.

In closing I find my initial excitement waning and am coming to realise the amount of time I am wasting on investing (A lot), which could otherwise be spent with friends and family or taking up other hobbies or ventures. I am maturing quickly in the way I invest and really have reflected that my average holding period of ~3 months really should be more like ~3 years. As such I have significantly reduced my exposure to social investing outlets and have closed any previously made blogs in an effort to just invest periodically. More time needs to be spent with my own thoughts rather than others thoughts.

New Beginnings

Going into this, I had the goal to compound trust capital at ~13% p.a. after taxes, I wanted to basically do an inflation adjusted 10% p.a. over time and used the upper end of the RBA’s 2-3% inflation target on top. Sounds too good to be true right? Well that’s certainly a sound conclusion to make, after all there is the belief that active investing and beating the market are much easier said than done and one should just buy a broad market-based index fund and be done with it. This addresses each point in it’s own way through market matching returns, diversification and minimal management fees.

However, I don’t believe that this is the optimal approach long-term for an informed investor to take. Of course I didn't come around to the idea right away and any passive investor might scoff at the level of activity and returns from 2017 to date. Eventually through lots of reading and listening to podcasts I came around to the strategy outlined last year which is basically investing into high quality yet underappreciated business models with an adept manager with a substantial margin of safety.

This underlying investment strategy is combined with a portfolio allocation approach (Or lack thereof) called the ‘Coffee Can Portfolio”. The Coffee Can portfolio concept harkens back to the Old West, when people put their valuable possessions in a coffee can and kept it under their mattress. Buying ownership stakes into high conviction businesses with a long-term view and putting them away without further action is how the coffee can work at its core. This is the result of previous actions. There are a number of investments I could have retained and be in a substantial profit position. Activity is a detractor to conviction and the costs associated are a detractor to compound interest.

“My advice to buy right and hold on is intended to counter unproductive activity”

~ Thomas Phelps

This shift into the Coffee Can Portfolio aligns with my shift into a Discretionary Trust with the former acting as beneficial to both taxes and costs with the latter benefiting taxes. A fresh slate for the start of long-term wealth creation that can flourish given time and discipline. With this said, I believe it is important to plan ahead and set specific goals over time, for the Trust that goal is a long-term annual return of 13% or more after taxes on a nominal basis. Given that the stock market as a whole has a long term return of ~10% this outperformance of 3% is the premium I demand for the added time and effort an active portfolio takes.

Regarding the investments I have made, you can refer to the write ups I did at the time below:

In closing, I would like to emphasise several key takeaways that I deem to be significantly important for building long term wealth. These are to minimise the frictional impact of costs and taxes before investing through foresight and planning and the second is to invest into high quality companies that can generate high returns on capital in a repetitive fashion. These are key themes of this letter and for good reason.

That is all for 2020. Thank you for reading.