Commentary

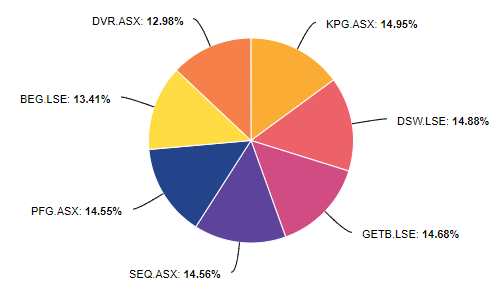

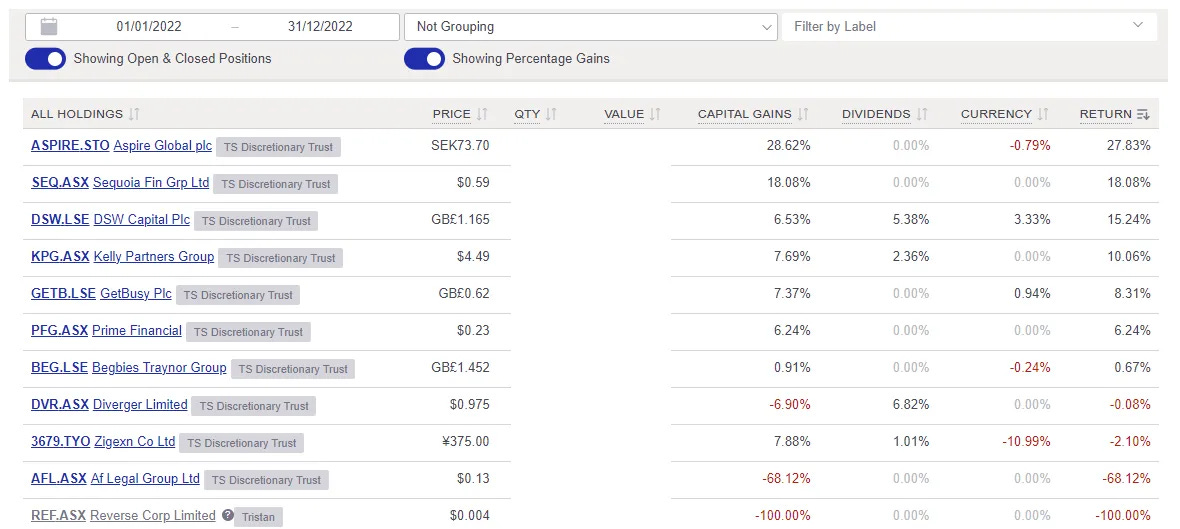

For the Year ended 31 December 2022 the portfolio returned +5.8%

This year you can obviously see a few big changes, and a single big mistake which of course I’m going to address below. Firstly, the bad:

AF Legal (ASX:AFL) Performance

As you can see AF Legal is down 68% for the year, an abysmal performance. So why is this so?

Well the first 2/3 of the year the stock was trading withing a +- 10% range from where it started, but going into the FY2022 results we saw it begin to collapse. The business reported +68% revenue and a 16% improved Loss, on face value it looks impressive however, markets are a consensus machine and the companies habits caused them significant duress.

Perhaps the worst habit of all is merely multiplying a periodic result and calling it pro-forma for the year, this gave the illusion at the half year that the business may report up to 22m in revenue and 2.8m in Underlying NPATA. Instead, the business reported a full year revenue 3.5m less and Underlying NPATA 1.8m less than pro-forma indications. This is effectively like missing wallstreet consensus by 16% & 74% respectively. To which the market responded with a single day drop of ~20%.

To make matters worse, Grant went on to sell 40% of his holdings at a depressed price shortly after results claiming ‘tax reasons’ despite being paid an arm and a leg in remuneration by the company, which mind you has withholding tax attached.

Almost 2 months after the results, the company was trading at 25c per share when they announced a buy-back program, which was accompanied with the following quote:

“Based on the strong results we released in August 2022 and the forward growth pipeline of the business the Board has determined that the current share price levels do not reflect the underlying performance of the Company. With this in mind, we believe it is an attractive investment opportunity for the Company to conduct a buyback of its shares. This also reflects the confidence we have in AFL’s future performance and we believe a buyback is in the best interests of the Company and its shareholders.”

~ Grant Dearlove

But this turned out to be rubbish as the company went on to announce a proposed transformational merger which would dilute shareholders by near 100% at prices half of where they were trading at year start. To make matters worse this would also come with a debt package they most definitely couldn’t service knowing their operational discipline. This deal was heavily criticised by shareholders, and internal dispute ensued where several parties were in cuttthroat dispute with eachother including GTC Legal leaking internal emails to the AFR, Information being announced about the CFO being paid over >$100,000 more than what was reported in the annual report, and the deal terminated eventually.

Admist this fiasco, generous equity plans were proposed in the AGM which went on to be refused and along with it, directors were spilled and what we see now is a largely empty board with a new Executive Director & Interim CFO in Peter Johns (Westferry Fund Manager - Substantial shareholder of AFL) & Chris McFadden (Ex. Ashley Services CFO).

The positive news however is that Key management wages are significantly reduced and hopefully, a decent show of ethics with the new management team. They have their work cut out for them no doubt but the positive thing is that the partnerships owned by the group continued to work efficiently through this period and the group has not lost it’s revenue base. Thankfully the company is extremely capital light being a fast turn legal firm, so should not sustain cash outflows (historically only did because their fat corporate cost base).

What are the lessons learned here and how can I potentially avoid similar situations in the future:

It goes without saying but pay careful attention to the incentives of those at the top.

KMP wages should not increase proportionally with the partnership profits, or worse, faster.

Compare the corporate costs as a % of total group revenue to peers, if it shows a much larger cost base, it is a cause for concern.

Listed nano cap peers typically are charging ~10% of their revenue for their corporate entity but AFL was expensing near double this amount.

Increase my skepticism when the growth story changes a lot or contradicts itself. I.e. originally a digital marketing acquisition story w/ lateral hires but latter end of the investment barely any lateral hires but lots of M&A.

I paid in hindsight a very high multiple of revenue and earnings for the business, even when normalised. This was because it was somewhat of an experiment in hypergrowth investments (AFL was consistently growing >50% p.a.).

Dividends have moved up in my preference, as they also serve to act as a validator for financial profitability, If I can find high SD, low DD yielders with consistent growth, it is a good position for a significant re-rate.

Improve my mid-position monitoring and get better at killing a thesis, don’t try to justify as much (very hard given some changes for the better, but will try my best).

Portfolio Changes & Circle of Competency

Throughout the year I made a few changes in the portfolio, notable of which are that both AF Legal (ASX:AFL) and ZIGExN (TYO:3679) are absent from my portfolio and that Kelly+Partners (ASX:KPG) has been trimmed quite aggressively.

First off, in late January it was announced by Aspire Global (OM:ASPIRE) that they were to be taken over by Neogames (NASDAQ:NGMS), a lottery gaming provider in the US. I ended up selling shortly after it was announced because I considered the closure of the deal a sure thing given that management teams were shared across both businesses with significant control over Aspire. It was not a particularly attractive price given my perceived perspective of undervaluation although I still made a tax-free (utilisation of capital losses) +37% in a 3 month period. With the proceeds I added slightly to ZIGExN (TYO:3679) and AF Legal (ASX:AFL) along with a full new position in Diverger (ASX:DVR).

Following the Kelly+Partners results, while I was satisfied with the results but disliked their intention to shift their focus to international markets including the UK/US. Having worked in the business up until December 2022, I don’t think they have the central services capability to handle it personally, and despite what they say, I also don’t think it is all that much better than a normal accounting firm. The higher margins are merely a function of high performing employees, or inversely quite underpaid employees, In this case it is a bit of both. I won’t get into the details however, this is the driver of margins. Gross margins of 60%+ (and coincedently EBITDA margins north of 30%). I was increasingly aware of this so wanted to move on to somewhere that shared their profits a bit more with the people producing the work. In the end, what they are doing is excellent for shareholders though.

Anyway, this discontent along with a lack of portfolio deposits (having increased lifestyle costs after moving in with my fiance’, wedding planning, house savings etc.) led me to wanting to treat my portfolio with a bit more of a traditional lens. The days of me saving up, deploying and repeating are over. From here on out the portfolio will be managed sensibly. So in saying that, I also wanted to focus heavily into my circle of competence, which I ended up defining as professional & financial services broadly. This includes firms, but also any services to those firms such as training, software providers etc.

I ended up trimming my KPG position 75%, replacing with 3 stocks. In addition I sold ZIGExN in preference for something within my circle of competence. Furthermore, I replaced AFL, which was mainly driven by it being a source of capital losses to offset my significant KPG gains, but also in part a recognition of error… a poor one at that. Under Peter’s stewardship it likely improves significantly, although I opted for something a bit more certain.

Lastly, the investments I made with these trims and replacements are as shown below:

Getbusy (LON:GETB)

Prime Financial Group (ASX:PFG)

Sequioa Financial (ASX:SEQ)

Begbies Traynor (LON:BEG)

As of the time of writing, the only company I have written up here is DSW Capital (LON:DSW), although I have notes on most of these companies in the way of management calls which you can find in the blog archive. My intention is to have a write up for each and every one of these in 2023, and coincedently one of them is well progressed with a likely release sometime in Q1 2023.

That is all for 2022. Thank you for reading.

Hi! Will you write about your Hungarian gem? Many thanks and Warm regards from Madrid :)