Firstly, the pretense for this article will be having read my Investment Strategy in Writing piece, where I go into detail about how I intended to invest at the inception of my Discretionary Trust, which I bring up because as of today, I have made my first few initial investments in my Self Managed Superannuation Fund (SMSF), a retirement vehicle for our family capital which is restricted from withdrawal until our 60s (should the access rules remain the same).

In the near 3 years since establishing a discretionary trust for our family capital, I have managed a compound return +27.1%. In the linked post, I stated a goal of 10% returns, with a margin of safety stretch target of 20%, both of which I have achieved. In another post with more notes on investment strategy shortly after I outlined a list of specific rules for myself, most of which I didn’t adopt, but nevertheless It was interesting to look back at. In that post I was targeting stocks with IRR of >30%, to which i unjustly criticise myself of falling short of, but the number I have tended to focus on was >25%. Lastly, I wrote some notes in March 2020 to which i stressed the importance of sticking to a written investment strategy which will be the topic of this post.

In the past 3 years my trading activity has been as follows:

Whilst my 2020 turnover might seem erratic, for the first 3 months of the trust, I was not yet set in my strategy. Were I to go from July 1 2020, the 2020 turnover would be 18%, and my since inception figure would drop to 27%, indicating an average holding period of 3.7 years. Given that the average holding period (per Reuters research) is just 5.5 months, I am happy to know my holding period is much longer than the average. And generally I think slightly under 4 years is a very realistic holding period for a value investor, and it’s generally a time frame I see as comfortably forecastable. Should I hold a business longer than this, It is most likely because the 3-5 year rolling outlook continued to look positive. Comparing this to what was covered in the posts above, I had a varied view on time frame for investments as an implicit assumption I had to hold things for atleast 10 years If multiple expansion was a major component of returns, and down to extremely short periods if the payback time was short and/or was trading under liquidation value.

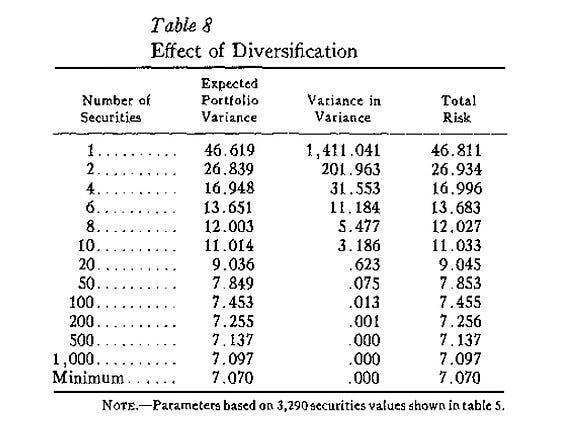

Furthermore, the strategy stated an ideal 8-12 positions (equally weighted) intially, and a maximum of 8 after the fact. I have taken my time building up these positions given the significant impact of external cash flows early on and only recently (in the last 6 months) have I actually hit this range. Currently I am holding 9 positions, 2 of which are what I consider to be ‘tail-end’ positions that are just 1/5 the size of the other positions at cost. I would like the entire ‘tail-end’ to be considered as just a single position as it is reserved for things where the investment potential for outzied returns exists but there is some reason I can’t make it full-sized. But I still remain convinced this is the right number of positions for me (8-12) that allows a good mix of conviction and diversification without putting my track record as risk on any single position. Preservation of capital is increasingly important as external cash flows grow smaller in relative size to my accounts.

The stock selection steps remain largely the same, with a focus on circle of competency, making initial snap judgements, evaluating the business, management and risks and using simple heuristic valuation methods with high minimum hurdle rates. Selling stocks also remains the same which I quote below:

“We’ve spoken about how to buy but not how to sell. The way i look at this is dead simple, it’s merely when either the stock is heavily overvalued relative to my expected returns or more likely, when an attractive alternative would result in it being worthwhile to switch from one to the other. Note that tax consequences are rarely a reason to or not to sell, only really in the case where you are close to receiving the CGT discount would you defer the sale of a capital gain. Basically where it’s obvious to do so you can factor in tax.”

There was a time when I wanted to move towards a coffee-can portfolio approach, and It most certainly did assist me in holding Kelly Partners through peak euthoria, but I do think as I’ve expressed several times, that the ideal is somewhere between selling tomorrow and never selling, expressed simply, there is a reason I would sell… and a ingrained decision not to sell is the same as throwing risk management out the window. Maybe you’ll get an outsized winner and retire in 5 years, but given the concentration required to do so, and relative lack of repetitions (trades) the sample size is so incredibly small that it’s actually quite likely you will not do well at all with such a strategy. My current view is that flipping rocks is and will remain the best method to maximise returns over time, and if that comes with portfolio turnover, then it’s certainly not a bad thing.

Harkoning back to my SMSF, I started this to consolidate both our super accounts into the single fund, which would save us significant fees over time (being able to self-administer) and give me the opportunity to try and materially outperform the APRA funds we were apart of. Strictly speaking, the investment strategy here is intended to be much the same as the Trust, but given the different tax rates and reduced CGT concession, it is likely that turnover will be higher inside the SMSF, and I will be more open to special situations and the like. It also benefits heavily from the franking credit scheme, so a skew in that direction is also likely to be apparent. Nevertheless, I am excited to see how I do within this new structure.

In Summary:

My strategy remains unchanged largely

8-12 stocks, with a ‘tail-end’ making up 1 slot

My aspirational hurdle rate is >25% annual compounded returns, and this will also apply to the SMSF

Holding periods of 3-5 years are considered realistic.

Consideration to all types of value scenarios (davis double play, quick payback, liquidations, special situations etc.)

Likely to consider higher turnover in the SMSF due to attractive overall tax rates and lesser (33.3%) CGT discount

I hope this has been a helpful and enjoyable read.

Kind Regards

Tristan