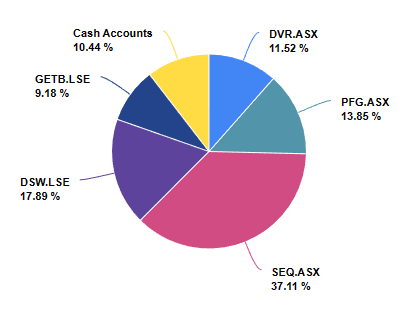

Portfolio (As at 30 April 2023)

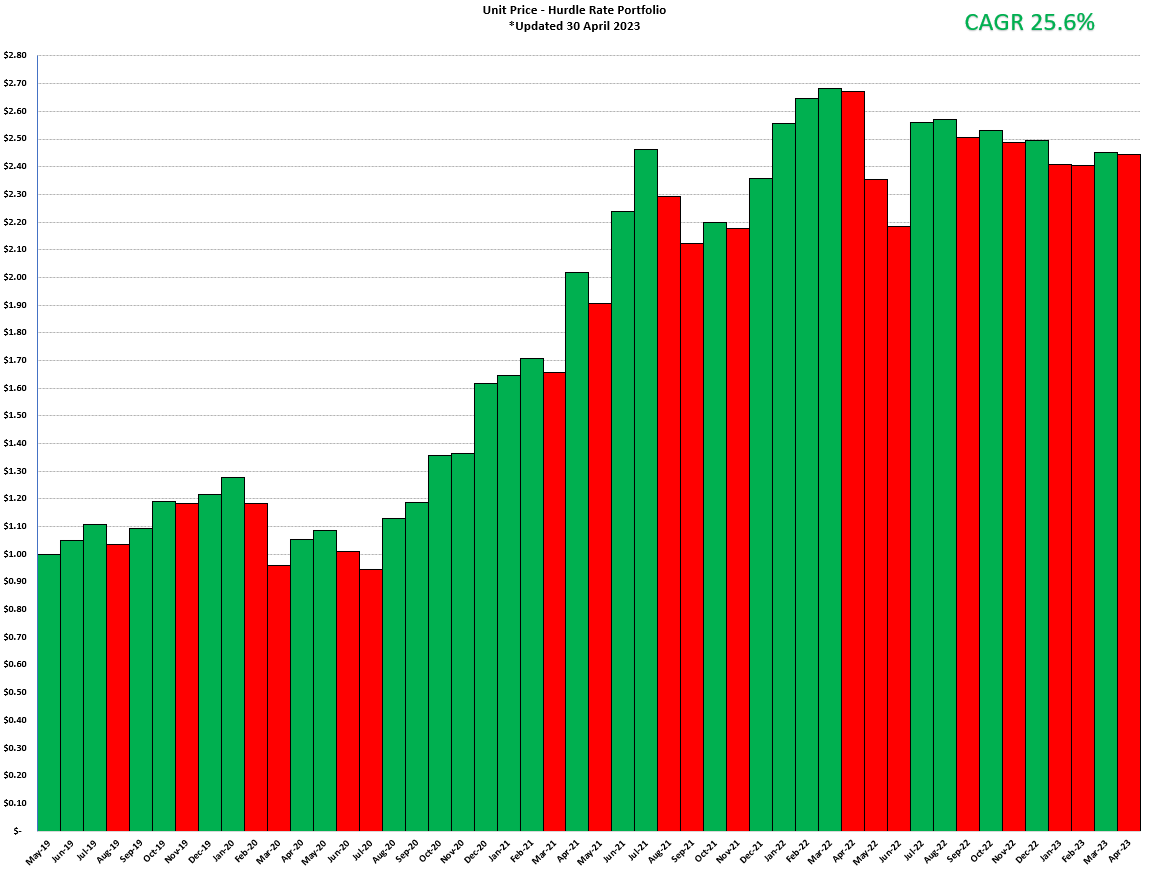

Performance Since Inception

Commentary

For the Month of April 2023 the portfolio returned -0.3%.

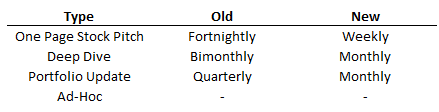

First, I have made an amendment to the schedule for the Substack as shown below:

I felt that the old schedule was too easy to keep up with, so to entice readers I have increased the pace. A reminder that everything except for the One Page Stock Pitches are exclusive to paid subscribers.

In April I also recorded a podcast with

in where I talk about my background, circle of competency, Kelly Partners, AF Legal & Sequoia Financial. You can listen to the episode below:Sequioa Financial Group (ASX:SEQ) - 37.1% Weighting

Sequoia hasn’t announced anything (Besides a few share register updates on buybacks and issued shares) so I will be continuing on with third-party data for this month, with an in-focus on the financial adviser register. What I didn’t know is that you can download a full list of all advisers on the Financial Advisers Register (FAR) which is updated every single week. Allowing for granular detail and trends to be made.

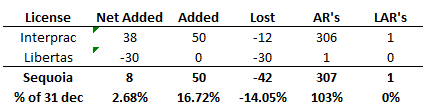

In the year to date, Sequoia has seen very impressive adviser growth with net 8 added in the past 4 months, noting that Sequoia has virtually no limited advisers and that it is shifting it’s Libertas advisers into Interprac to cut costs.

These are fairly positive numbers given that the overall market has seen a net change of 59 advisers, or in % terms +0.37%.

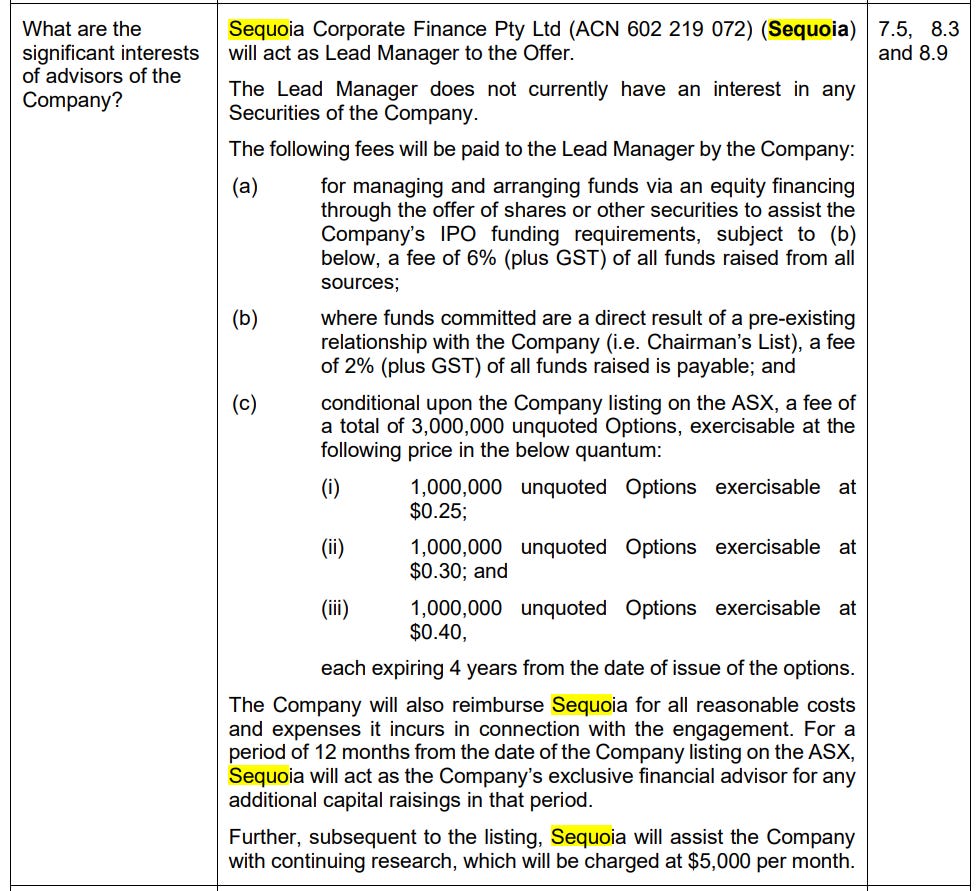

Besides this, during the month Sequoia Corporate Finance announced it is leading the IPO for Chilwa Minerals. This is a classic unattractive mining company so all we really care about is how much is Sequoia getting paid. An excerpt from the prospectus shows us that Sequoia gets 6% of the raised capital of $8m, or $480k in lead manager fees, and 3m options expiring in 4 years, which are valued at $303k as at the listing price using the Black Scholes valuation method. Lastly, some minor fees for continued research of $5k/month. Therefore, this is relatively impactful on EBITDA (Being some 6% of the FY2022 EBITDA).

It is worth noting that it also helped list Soco (ASX:SOC) earlier in the year where it got paid $333k in cash and 3.125m options (with exercise price of $0.30) with the same research fee of $5k.

In May I will be releasing a deep dive on Sequoia, so look forward to that as it is really quite detailed and should be interesting to paid subscribers.

DSW Capital (LON:DSW) - 17.9% Weighting

During the month, there was no announcements, and there was no notable contribution to performance either. Perhaps the only things to note were that Ros Jones was promoted to partner in the north-west transaction services office.

In terms of corporate finance deals, there was a deal done for Beech Tree where they provided due diligence services. Camlee also closed a sale of Lynn Star with Sam Oldfield acting as lead advisor for the Lynn Star Shareholders.

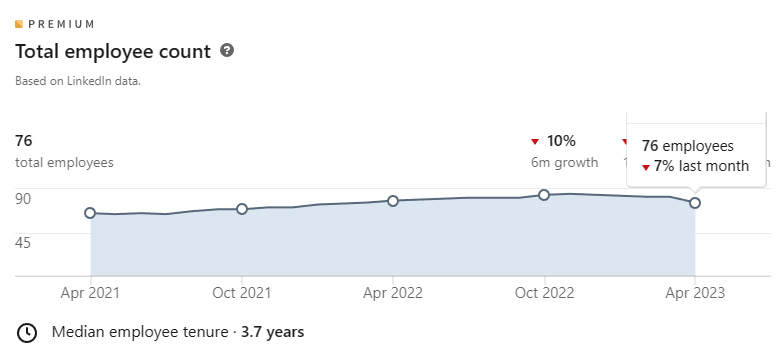

However, there was a bit of an alarming loss of employees in April with the group losing 7% of it’s employees, this may be company initiated or the result of a lost partners. In any case, I have actually lined up a discussion with James Dow in early May, which I will most definitely be asking about hiring and churn. I will hopefully be uploading a recording so that is something to look forward to.

Prime Financial Group (ASX:PFG) - 13.9% Weighting

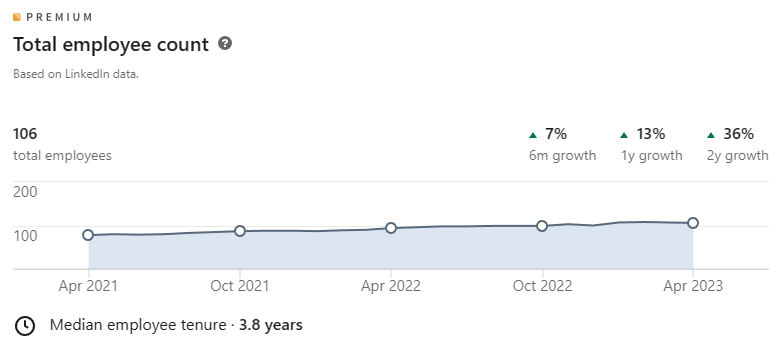

Similarly, there were no announcements for Prime either in April, besides some minor buyback activity. I am very happy with Prime to date, and through the use of LinkedIn am observing a very healthy trend of hiring, which informs me that they lost one employee during the month but have had very strong growth over the past few years.

Diverger (ASX:DVR) - 11.5% Weighting

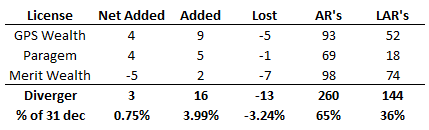

Since the turn of the calendar year 2023, Diverger for example has seen the following across it’s 3 licensees.

Diverger’s small growth is still 2x system, and when removing limited advisers from the mix, Diverger saw +3% adviser growth YTD, which is important as limited advisers bring in revenue just ~5% that of a full adviser for the group, so they are negligible. So, both of this and Sequoia saw growth multiple times that of the market in the CYTD, which is characteristic of a consolidation of advisers to fewer licensees.

At the close of the month. Diverger was trading at $0.85 despite a full year EPS of $0.12 (adjusted for amortisation) and run-rate of acquired entities. it is therefore just 7x or more it’s full year earnings, with a fully franked payout ratio of 40-60% which would result in a ~10% fully franked dividend yield.

Getbusy (LON:GETB) - 9.2% Weighting

At the end of April, Getbusy held it’s AGM and provided a trading update to shareholders. ARR was up 17% YoY and 6% for Q1, with a notable comment that Workiro is starting to pick up traction through its NetSuite sales channel. Cash on hand was down £0.3m to £2.7m at 31 March 2023.

Furthermore, Smartvault released a new version of it’s website and went into full release with Quoters and Docdown, which until recently were only available for Smartvault beta testers (which only launched in August 2022 itself). This along should bring a nice uptick in ARPU as an optional add-on to existing subscriptions. I tried it through a demo and was pleased to see that these are being suggested on the home screen of the platform.

Regarding their sales channels, they also allude to broadening sales channels with new capabilities with other leading tax applications, which remains to be seen but could lead to sustained growth in their userbase.

At the end of the quarter, Getbusy is trading at 65p, indicating a non-diluted market capitalisation of £33m and enterprise value of £30.3m. This represents an EV/ARR multiple of ~1.4x, which when suggested mature margins of the company are 30%+ EBITDA margins with negative cash conversion, is an appealing valuation.

Their nominated broker, Finncap, had the following to say about it (on the 28th of April 2023):

At this point, we conservatively reiterate our FY23 and FY24 forecasts, and note that GetBusy has delivered consecutive upgrades over the past 3 years, including upgrading revenue by +3-5% at the FY results in March. At 65p, shares are trading on only 1.4x 12-month forward EV/Sales with +9% Sales growth, vs fC T40 and N50 peers on 3x EV/Sales with +8% growth, productivity software peers on 6x EV/Sales with +9% growth, and an active M&A market where transactions have taken place at 3-15x EV/Sales in the past 4 years. We look forward to the strong operating and financial momentum continuing at H1 23 results, the announcement of material new channel partners, and attractively valued M&A opportunities.

Closed Positions

Vita Group (ASX:VTG)

The only new position made during the quarter was in Vita Group. Vita Group historically was known to be the owner of the retail side of Telstra which notably ran the physical stores. It lost the license and is now left with Artisan Aesthetic Clinics, a portfolio of skincare clinics across Australia.

Before you say though, the skincare clinics is not the reason I invested in Vita Group. Rather it is as a special situation with a pending takeover offer. The initial offer document you can read here. I actually discovered the idea via

. There is a number of key facts here that are important.

The scheme comes from Practice Management Pty Ltd, a private company from which we are unable to ascertain their funding capability. Information about Practice Management Pty Ltd is scant in Vita Group's press release, but documents from the Australian Securities and Investments Commission (ASIC) reveal the bidder shares the same office address as Sonic Healthcare (ASX:SHL). Going further, I discovered via. ABN Lookup that they have the trading name of IPN Medical Centres, which are an acquisitive arm of Sonic that have welcomed more than 50 practices into their network in recent years.

Vita’s existing board has ownership of 19.26%, which unanimously support the deal, meaning we only need 30.74% additional support to get this through. Furthermore, 10.27% of the shares outstanding have been purchased by Harvest Lane Asset Management post the deal being announced, which I am virtually certain will vote in favour given their history of takeover arbitrages. Another 5.46% is held by Spheria Asset Management who have been selling down fairly consistently, but it is worth noting that Spheria invested in Vita in the hopes of Artisan reaching profitability rather than as a special situation. So in the existence of this, I think the deal has a strong likelihood of closing.

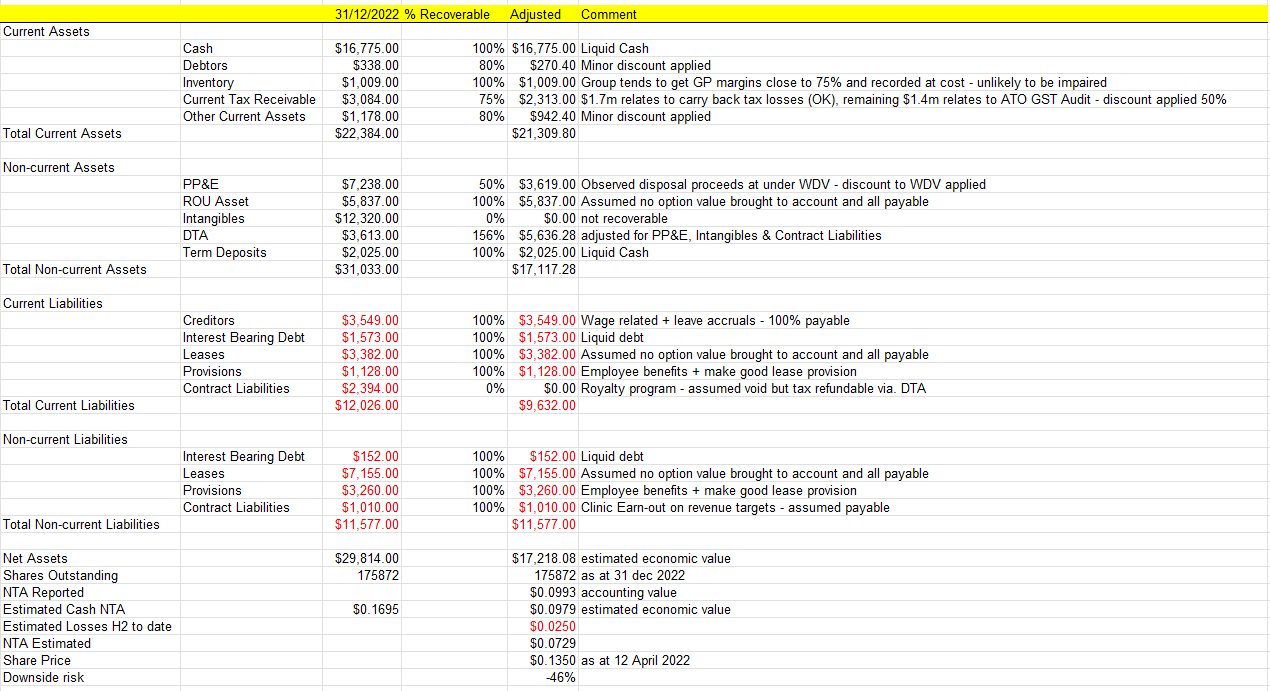

Fundamentally, the group has $0.086 in net cash on it’s balance sheet and $0.099 in NTA per share. After applying various adjustments based on my background accounting knowledge, I reach a conservatively estimated $0.098 per share in economic value per share, applying discounts across the board as shown below. Keep in mind I have been fairly conservative on the current tax refund, specifically the GST audit as it is ATO initiated. But further to that, I made a fairly conservative assumption that they would lose a further 2.5c prior to the end of the year, given the group lost 5c in both 2021 and 2022 on a larger sized business (normalised for tax benefits) it seems prudent to assume.

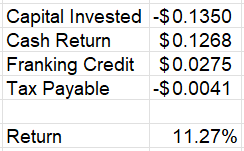

In light of this information, I invested into Vita group at a princely sum of $0.135 per share, and the takeover offer is a total of $0.1268 per share. So what gives right? isn’t that negative value?

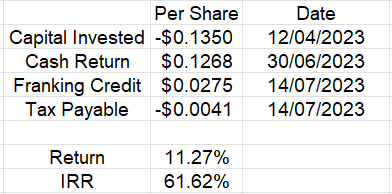

The key detail I left out is the impact of franking credits, If the permitted dividend is declared and paid, the permitted dividend would have up to approximately $0.02754 per VTG share in franking credits attached. Suffice to say I invested via. my SMSF which carries a flat tax rate of 15%, whereas franking credits are a refunded 30% corporate tax. The calculation of potential return is as below.

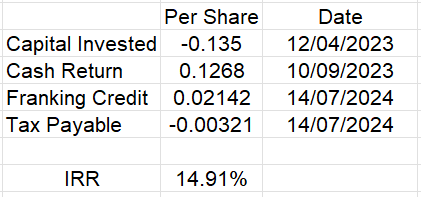

Then you’d probably go on to say, isn’t that below my hurdle rate? Well if you put a time frame on this the IRR is much more appealing. When first announced the deal had an end date of the 10th of September 2023, or 5 months from my purchase date however, what will be absolutely crucial to the IRR will be what tax year the dividend falls into. This is because the group is to be considered a base rate entity from FY2024 onwards, meaning it is taxed at a reduced corporate tax rate of 25%, which in of itself means less in the way of franking credits. If it is to all fall on the end date than the worst case scenario would be an IRR as shown below.

However, if say I were to luck out and receive it prior the the end of FY2023, then the IRR increases dramatically, as the group retains it’s 30% corporate tax rate and the time frame shortens.

Given the reduced corporate tax rate, I find it highly likely for the group the hustle to pay this prior to the end of the tax year as a result, given that that it is a shared interest between the substantial shareholders and myself as a minority shareholder.

Noting that above I have assumed that all capital losses accrued by the deal will be applicable to short term gains as they arise, which is easier said than done, as to do so for example I will need to generate a 50%+ return on my existing Sequoia holding by year end, so it is likely I see my losses carried forward into FY2024 or even FY2025. Either way, my post tax hurdle rate of 20% is likely to be exceeded, and I deemed it a high likelihood of closure despite the nuance shown above.

I also want to note that I turned this position given it was a highly likely outcome with a fixed expected value. So what I did was I purchased shares where I was happy with the IRR and then immediately set a Limit order to automatically sell at a price where I was no longer smitten with the return potential, and intend on then repeating that process as many times as I can before the merger. This is something that I feel is overlooked by many, as remember that both for your portfolio and individual business what matters is the return you get on a dollar, and the number of times you make that sale.

Smartgroup (ASX:SIQ), FSA Group (ASX:FSA), Auswide Bank (ASX:ABA)

All 3 of these companies were used to fund the Vita Group special situation. Net of dividends, I saw a combined return +2.4% on these positions, albeit accrued a capital loss meaning I need a larger capital gain to utilise any losses accrued on Vita.

Conclusion

Thank you for reading, these long form portfolio reviews are part of both my diligence to stay on top of my positions and the value for my paying subscribers, so I hope you get as much out of this as I do, thanks very much for reading.