Prime Financial Group (ASX:PFG) - Deep Dive

A multi-disciplinary professional services business

Executive Summary

Prime is a provider of accounting and wealth services to Australians across NSW, VIC and QLD. It currently operates 4 primary service lines being Accounting & Business Advisory, Wealth Management & Protection, Self-Managed Super Funds, and Corporate Advisory.

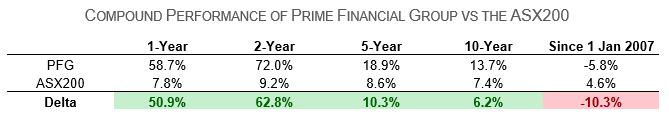

Prime was acquired by AVFM Ltd in 2007 as a reverse merger and suffered poor results in the advent of the GFC due to market linked revenue with extreme levels of operating leverage.

Throughout the mid 2010s Prime made a series of Key talent acquisitions that have transformed the business to what it is today, including Matt Murphy, Olivia Long and Tim Benett among others.

Staff own 48% of the business across all levels of seniority with staff eligible for equity once they hit 12 months in the business.

Prime’s stellar half-decade growth came at the cost of deteriorating capital turns with 1/3 of NPAT going back into the net working capital of the business, which I suspect will flatline or decline going forward given the business mix and growth intentions.

The group intends to achieve a $50m Revenue target in 2025 with >30% EBITDA margins. This would equate to 15-20% NPAT margins. At a current EV of $54m this prices Prime at a FY25E EV/EBITDA of <4x. They also maintain a 40-60% dividend payout ratio with 100% franked dividends.

Prime Financial Group (“Prime”) is a vertically integrated financial services business here in my home country of Australia. They provide critical advice and compliance services for HNWI through to larger SME’s across 4 key service lines. These service lines include Accounting, Wealth, SMSF & Capital, all of which we will cover in more detail further on.

The uniqueness of Prime Financial Group is the relative scale of both accounting and wealth, implying true synergies between the two, whereas other firms these services are merely complementary at best or alternatively outsourced to a partner. Here Prime has a genuinely impressive share of wallet and is pulling off what would be considered very difficult to do.

The business has a chequered history of execution and only in the past half decade has the company shown any promise, despite holding the same management team throughout. We will dive into why this is so and suggest any reasoning as to why I am confirming recent results as a robust trend in the right direction.

Prime today is generating a little in excess of $30 million dollars in revenue, $5m in profit after tax, market capitalisation of $46m and an enterprise value of $55m. With little investor interest, lack of analyst coverage and minimal trading volume Prime is without a doubt overlooked… but is it for good reason?

Prime was founded in 1998 by co-founders Simon & Peter Madder, a father & son duo who both came from the accounting industry. The original company was the Prime Development Fund (PDF) which went on to form an AFSL holding entity Primestock Securities (Primestock). The motivation behind doing so was to provide accounting firms with wealth management services, a service which was historically absent from most firm’s service lines, despite a belief by the Madders that Accountants were in the best position to be able to provide this service to their clients. It did this through enacting on a series of Joint ventures (JV’s) with accounting firms across Victoria and later across several states.

On the 1st of January 2007, the ASX listed AVFM Ltd enacted on a merger with PDF for a total consideration of $38.2m, at which time PDF as a standalone entity was generating $2.3m in net profit after tax, valuing the business at EV/NPATA of 16.6x. Immediately following the acquisition, PDF accounted for 50% of the bottom line of the combined group, inclusive of AVFM & the newly acquired minority stakes in 3 Lateral financial planning businesses.

At this stage in time, the Prime business was generating 88% of it’s revenue from so-called market linked revenue lines, where they would benefit from an asset-based management fee which was par for the course at the time, but would most certainly not fly past regulators these days following the Hayne Royal Commission in 2018. A particularly telling quote by Prime at the time on this is as shown below:

“One of Prime’s key competitive advantages is ownership in both distribution and product providers The ability to cross sell products & services to clients allows Prime to keep a larger percentage of the margin in-house, providing protection against margin compression”.

CEO Presentation – 2007 Full Year Results

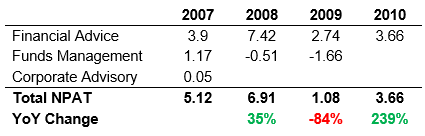

This proved to be problematic in the following few years as the groups variable revenue source broke down showcasing the pitfalls of a model with high operating leverage and in fact, no protection against margin compression. The Financial planning side of the business generated the following over the 4 years 2007-2010.

The key takeaway here is that the business was hit severely by the equity markets in the later stages of the 2000s, with equity markets inhibiting the ability to grow significantly. These days as I will explain, the group no longer shares ownership in product providers and is solely focused on independent client advice. Furthermore, during the 2009 year the group made the decision to divest the funds management business and focus on providing integrated advice. Although part of the financial advice division is the provision of so-called separately managed accounts (SMA’s) which generate revenue on a FUM based fee. More on that later.

With the funds management business (product provider) divested, Prime is starting to take shape into what it is today, with a disclosure in the 2010 AGM that 80%+ of Prime’s FUM is remunerated directly to Prime. They also interestingly state advice fees are less than half their peers.

The management of this business has been fairly important to it’s development especially over the past 7 years since restructuring out of their subpar minority interests and funds management business so we will focus on the heavy hitters.

First is obviously Simon Madder (and by extension his father Peter Madder). If you would like to listen to Simon talk about the business, I recommend this podcast by the Eureka Report where Alan Kohler interviewed him. Simon has been in the MD role since 1998, and has bootstrapped the business with his father to where it is today, with some bumps along the way as outlined above. The obvious downside here is that I am unaware of Simon having any experience outside of his time at Prime, meaning that new perspectives are and have been crucial to the development of Prime as a firm.

Speaking of that, the group has been partners with dozens of accounting firms over the years, and some less than desirable relationships such as the acquisition by AVFM in the late 2000s which did not eventuate in a good result. More recently there have been a suite of very successful partnerships which I want to focus on below. These are the heads of each division.

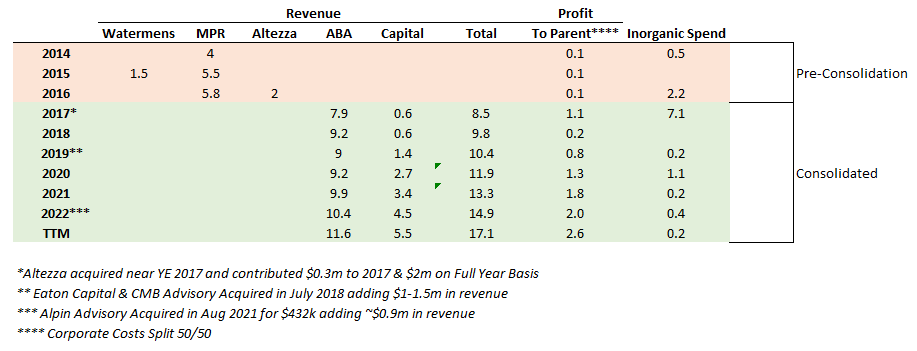

Of these we have Matt Murphy who came into the group as an executive director brought over from MPR group when Prime decided to take a majority stake in MPR. When Prime initially made a minority 10% stake in MPR in 2014, it was pulling in $4m of revenue, In late 2015, Prime increased it’s stake in MPR to 40% at which it was doing $5.5m (grew organically >37% in <2 years) at the same time they made a stake of 40% in Watermans pulling in $1-1.5m. Finally in late 2016, MPR acquired Watermens and Prime makes an offer for the remaining shares (most) in MPR at which time MPR + Watermens was generating $8.2m in revenue. Lastly the firm took a majority stake in Brisbane firm Altezza Partners pulling in another $2m of revenue. Given that Altezza seems to be stable whereas MPR grew it’s revenue from $4m to >$8m in 3 short years ($1-1.5m acquired), Matt Murphy is henceforth an important asset for Prime’s Accounting division, fortunately he owns some 8% of the listed entity through his direct shareholding and performance rights (half have vested). These acquisitions are difficult to follow, so I have summarised the ABA & Capital divisions below by revenue contribution and profit after tax to parent (allowing for a 50% allocation of corporate costs). Over the 8 1/2 year period Prime has spent just shy of $12m on ABA & capital related investments, and gained $10.1m in cumulative NPAT from it. There is no organic component that rolled forward from before this period. Prior minority interests have been found to have largely been neutral in performance so those have been ignored.

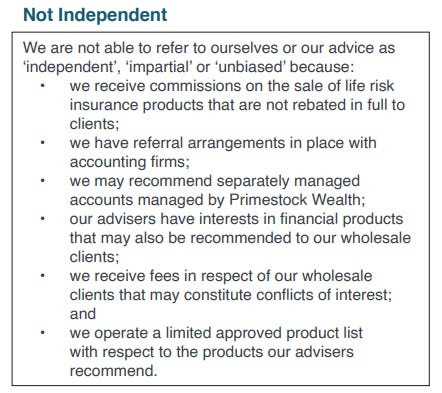

The second largest division, Wealth is fronted by Angelina Rigoli who has been in this role for 19 years. Perhaps what is key about this business is that they are licensed in-house and the group have their own Separately Managed Accounts meaning that the fees and charges from this division may be based on a dollar amount, an hourly rate, a percentage of funds, valuebased pricing or a combination of these. What is key here is that Prime isn’t Independent, which is a big thing in the advice industry. For this reason I am not enamoured about the wealth management division, although their SMA’s perform well enough beyond their goals. See their disclosure from their Financial Services guide below. Speaking of the FSG I do recommend taking a read, specifically on page 3 where they outline how they are remunerated, which is telling as you’ll see a 1.65% asset based fee (with a $5,000 minimum) and out of scope hourly rates. Furthermore, the insurance commissions they can get from placing clients on policies, a clear orange flag. I think that these woes come from the rigidity in the long-tenured employees in this division, who have failed to fully de-risk after the Royal Commission. Most of their advisers are salaried employees, although there is a few consultants where Prime charges a 30% license fee for referring work.

Another person of importance is Olivia Long the managing director of the SMSF division. Olivia joined the group in 2018 after scaling a small SMSF Start-up ‘SuperGuardian’’ into one of Australia’s largest SMSF Administrators. She is also the Eureka Report’s SMSF coach and has frequent Q&A’s over on their podcast. Prior to the acquisition of Intello late last year she solely ran Expert Super (owned by Prime). Importantly this is a service that is identical to Intello in that it is B2c (Trustees) and a white label B2b (Advisers and Accountants). Fees are fixed and recurring retainers billed every 30 days with engagement on an annual basis. The group has a very clear Fee schedule meaning a narrow scope and there is little leakage of WIP and price insensitivity as a result. You can learn more about ExpertSuper below:

Tim Bennett is the head of the Capital Division, Prime’s fasting growing division. Tim was a Partner in Mergers & Acquisitions for 20 years across EY & PwC before heading Prime’s Capital division in 2017 and brings exceptional expertise along with him. In 2018 they acquired $1m of revenue and in 2021 another $0.9m, with today the capital division accounting for $5.5m or ~18% of the group.

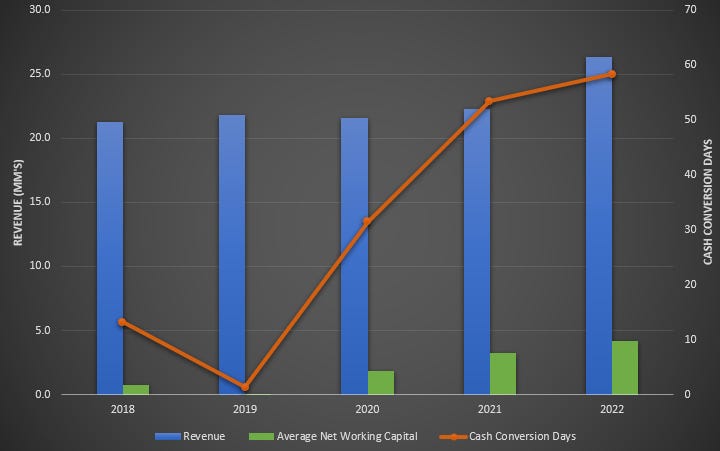

One of the first things I like to look at when looking at any professional services firm is their lockup, or their working capital efficiency. Firms that are growing strongly tend to have poor working capital efficiency and vice versa. Over the past few years Prime has experienced accelerating growth organically rather than through acquisitive means.

The Group’s contract assets are from work in progress earned for the Group and are initially recognised for revenue from services provided to Accounting & Business Advisory as well as Capital clients. Furthermore current trade receivables are generally on 30 days credit terms. However, the Group’s Accounting & Business Advisory service line offers a grant and R&D tax incentive service to customers that are eligible for the Australian Government incentive funding. The payment terms for this service line (due to subsequent Australian Tax Office review) is likely to be greater than the standard credit terms given

This accumulation of lockup in these divisions means that there is minimal equity in the Wealth & SMSF Segment relative to the Accounting & Capital Segment. This has culminated in a high double digits ROTE for ABA & Capital relative to a mid-triple digits ROTE for Wealth & SMSF (excluding corporate costs). These figures are not surprising given the description above.

The overall situation on a consolidated basis has been that net working capital has grown from NIL in 2019 to 16% of sales in 2022, which when you consider that the cumulative NPAT over that period was equivalent to 42% of the current sales, more than 1/3 of it has gone into working capital to sustain the growing size of the business.

The good thing here is that the current level of working capital in the business is well beyond industry norms which if you take ABA & Capital revenue and the total group lockup, you get lockup days of 189, which in of itself is very high for an accounting firm, spelling good things for potential future cash conversion.

Whilst Lockup is crucial, for a firm to get good returns you need good margins as well, and in a firm there is a number of levers you can pull to make this happen. Which is summarised below.

The key drivers are the number of staff along with the revenue those staff are pulling in, and for the sake of ‘owners’ above it typically refers to partners but given we are the owners here the leverage factor is largely null and void. Below is the past 5 years in employees and average annual employees with the revenue per fee employee. Typically firms have a 4:1 to 6:1 ratio of fee earners to admin staff so perhaps we are understating the revenue these employees are pulling in a bit as well. Nevertheless we can see below that they tend to pull in roughly $250k per annum, with the past few years having a bit of a downward trend due to the increased pace of hiring. This is a very standard level of revenue however and not too high or too low so it is not a cause for concern.

With gross margins of ~50%, it’s not unreasonable to expect some future margin expansion either as this level is frankly, fairly low having come from several firms where 60%+ GPM is the standard, even where I currently work which is ‘very’ similar to Prime. So I don’t have any worries on this front either.

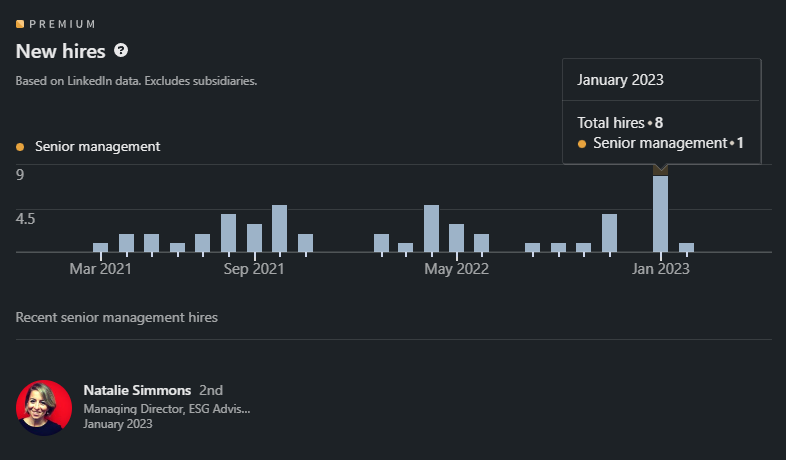

Speaking to their future a bit, the group has the full intention to double their revenue with stable margins from $26m in 2022 to $50m in 2025, a CAGR of 25%, notwithstanding any dilution and debt issuance to get there. However, through discussions with Simon it seems that they intend to get there 2/3 through organic means ($16m) and 1/3 through inorganic ($8m). We have seen c. $3.1m of organic growth already during the first half of the 2023 year and $0.7m of contribution from Intello with a run-rate contribution of $2.3m to go so the pace does not seem farfetched given the rapid organic growth in employees also shown above and the below LinkedIn data I have scraped suggesting continued impressive growth.

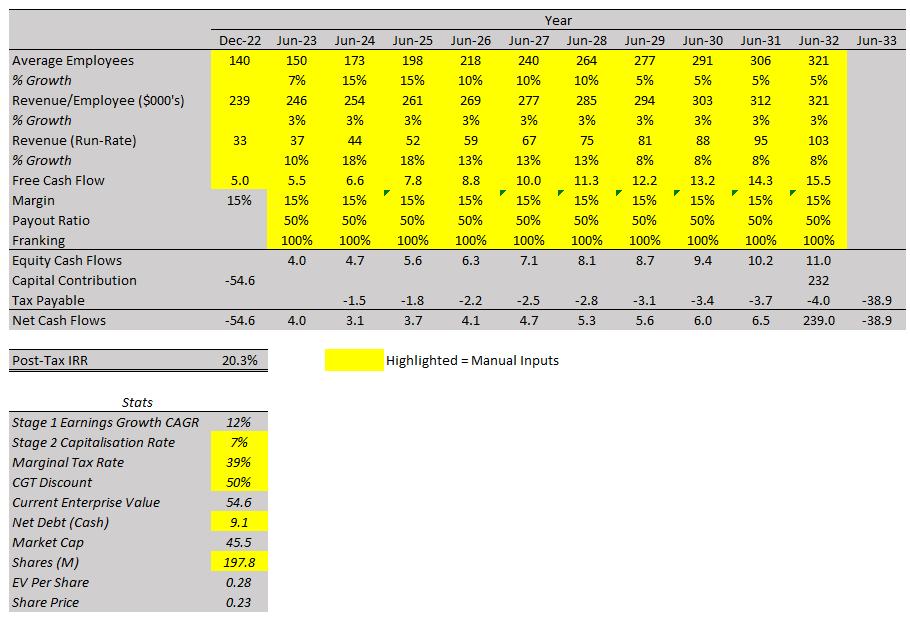

Reaching this goal means that the group is trading at ~1x EV/Revenue and 7x earnings in 2025. I have done a fairly rudimentary DCF on what this may look like below. Keep in mind I’ve applied my own personal tax circumstances so the tax effect will vary between people. Nevertheless, I have made a few key assumptions:

Employee growth is elevated over the next few years as they acquire as well, slowly tapering off over the next few years.

Revenue Per employee is rebased at today’s run-rate and we assume 3% growth per annum in charge out rates (not a stretch)

The group is able to stabilise and slightly reduce it’s working capital needs generating attractive cash conversion going forward allowing for a >15% FCF margin.

Management states a payout ratio target of 40-60% so I’ve taken a mid-point.

Taxed as if we are a 37% bracket taxpayer in Australia (like me…)

We can clearly see that Prime if the assumptions prove at all reasonable offers a compelling investment opportunity, but we have to be aware of their subpar track record prior to 2017, and there is reasonably high reliance on key leaders within the business. Fortunately these leaders and staff all share in very high insider ownership allowing for some solace.

We are coming to the end of the write up now and honestly, I could of written a ton more detail about the operation of the business, such as the nuance of the software stack, detailed breakdown of the employees by seniority level and role, more detail on their historical investments in minority stakes and so on. But I wanted to keep this digestable, perhaps I will talk to these more in the future, so I am leaving them out of the deep dive for now.

Congratulations on the depth of research here, very insightful. But if I may, somewhat technical and just falling short of delivering the killer blows of compelling facts which give the average reader your summations on a plate. Some suggestions: provide an explanation of terms - for example ‘lock up’. Even your use of ‘gross margins’. What about including a summary of the key instrument gauges one needs for this industry - no of staff, rev per staff member, gross & net margins, avg collection time etc etc - and if possible, cross referenced to the industry norm

Finally, as a shareholder, I am vitally interested in the DCF calcs referring to the YoY in terms of eps, divs and your actual DCF figure per share. Otherwise excellent. Be interested to see your thoughts on a few of the competitors like SEQ and DVR.