About

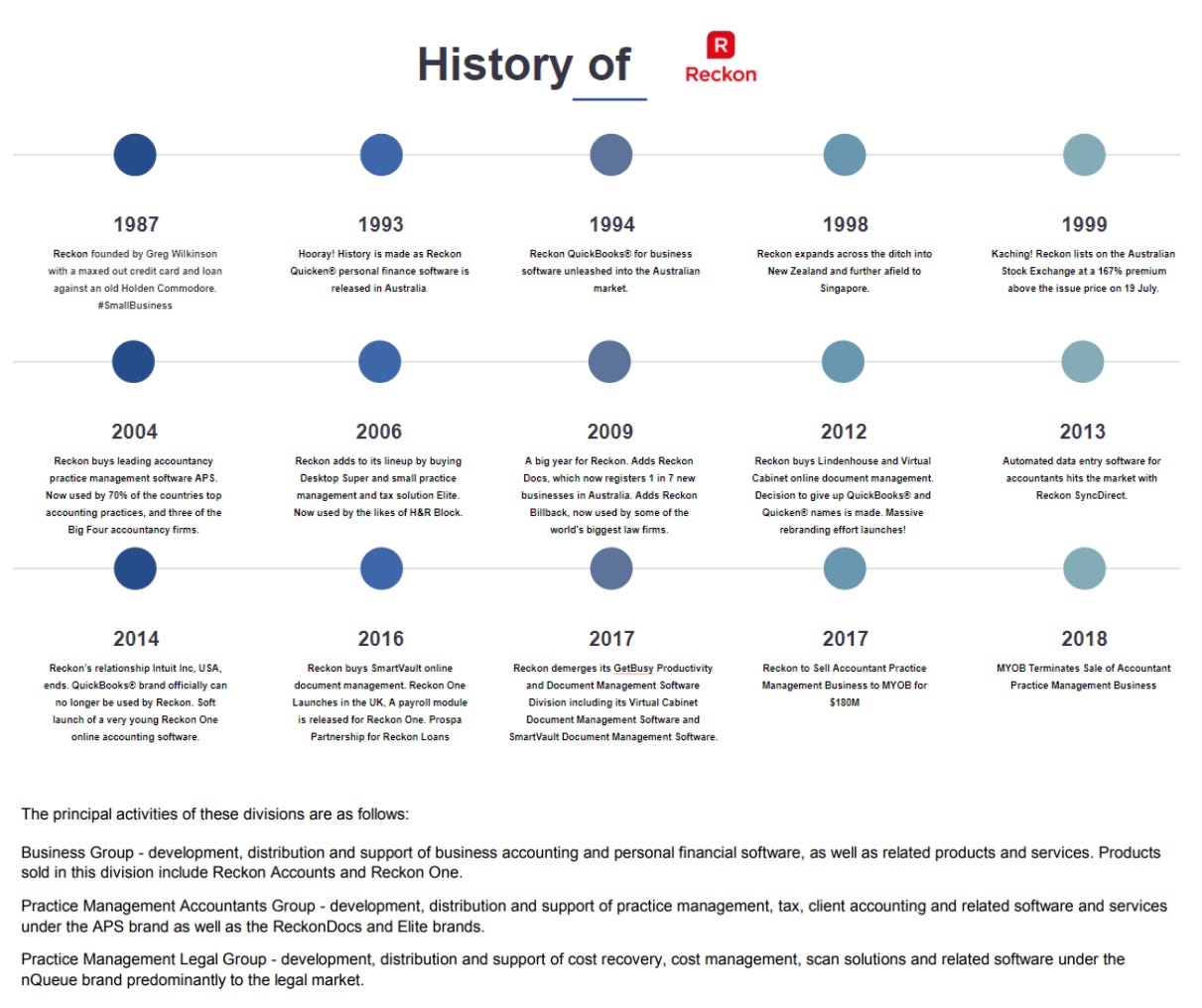

Reckon is an Australian software company that provides desktop and cloudbased accounting software for accountants, bookkeepers, small to medium businesses, and personal users. The company has offices in Australia, New Zealand, the United Kingdom, and the United States.

Reckon One Cloud Accounting

Reckon Reviewers Guide - https://s3-us-west-2.amazonaws.com/secure.notion-static.com/d59677

Reckon One is an accounting solution for small business that works on a modular pricing system, in order to give you the flexibility to choose the features you need. Start with the accounting software basics for $5/month, then select from 5 additional modules to create the perfect package for your business.

It is clear that Reckon is attempting to penetrate the market via a competitive pricing structure that offers superior value for money than alternative accounting software including Xero, Quickbooks and MYOB.

This pricing strategy extends to their recent timely In line with the Single Touch Payroll legislation) free payroll app for small businesses with 4 or less employees. This is a simplistic app however, can draw customers into the 'Reckon' ecosystem, making the switch to Reckon One seemless when needing to upgrade. See the app below:

In an effort to target niche markets. Reckon also has some proprietary integrations with Reckon One, including Better Clinics, Reckon Cloud POS and IPA Books.

Better Clinics is catered to as you may guess, Health and fitness professionals. It's essentially a add-on to Reckon One which turns it into more of an ERP system. With scheduling tools and customer management. See more in the link below:

https://www.betterclinicsapp.com/

Reckon POS is a cloud-based point-of-sales software that integrates with both Reckon One and Accounts. The video outlines it below:

IPA Books is a whitelisted version of Reckon White available to members of the Institute of Public Accountants. IFA members who recommend IPA Books+ to their clients will receive CPD credits to the value of 50% of their annual IFA membership fee when 50 active IPA Books+ subscriptions are associated with their practice. This incentive is valuable to bring on partners and hits a niche without much extra work outside of the regular Reckon One maintenance.

https://ipabooksplus.com/

I have used the Reckon One software and I did enjoy my time with it. While not as feature rich and satisfying to use as Xero, It has several advantages which i think are the most important below:

Significantly Cheaper than all competitors

User Friendly

Modular pricing structure

Proprietary integrations with niche targeting.

The price easily justifies any other advantages the other softwares' have as the bulk of what any accounting system is here and works well.

So, why doesn't this software have a significant market share? The product is relatively new only launching in 2014 for Australia. Compare this to MYOB Essentials in 2014 Desktop long before this), Xero in 2008 First mover advantage) and Quickbooks Online in 2013 Huge International Penetration).

Keeping this in mind, the cost advantage combined with a huge addressable market could allow this product to service many businesses that value cost over all-else. Given that only a small portion of SME's are in the cloud currently, the addressable market is huge and their is plenty of room to compete. Reckon's cost advantage will help them out in gaining market share, however their Average Revenue per unit suffers from this.

Where i think Reckon suffers the most is in their customer acquisition and marketing. In comparison to the largest firms, resources here are much more finite and in turn One is lesser known as a result.

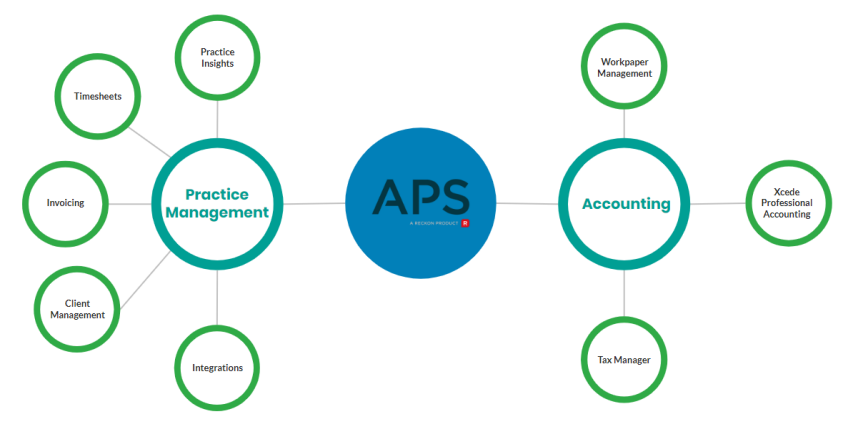

Practice Management - APS

Reckon APS is what i use at my current employer on a daily basis. The main structure of the program is as follows.

I have extensively used this product and have come to the conclusion that while very comprehensive and meets a lot of practice management needs. The product is a dated desktop-based program. Reckon are addressing this with incremental improvements including Syncdirect, Online time-sheets and intent to provide a new cloud solution sometime in the near future.

The value of this segment can not be undercut as 70 out of the top 100 Accounting firms in Australia use this product on a daily basis. That is a huge market share and if they can continue to provide product improvements, this asset will continue to drive strong performance in the business.

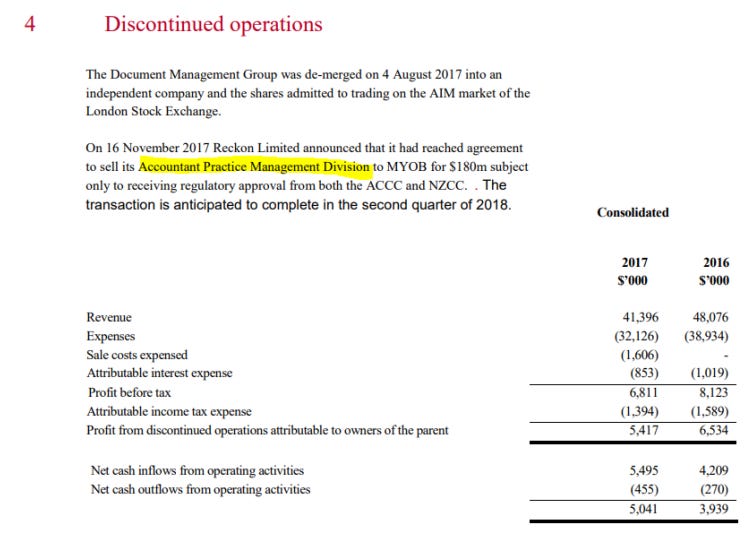

Not to mention. Reckon had intended to sell this asset to MYOB for $180m recently, however the sale was aborted by MYOB. This clearly has value as Reckon as a whole has a current enterprise value of $140m. So in short a deal like this for what contributes to 3040% of Reckons' total revenues seems like an absurdly generous price for Reckon owners, valuing roughly 1/3 of the business at more than the total cost to buyout the business from a financial position view.

Furthermore, the deal was subject to the attention of the ACCC who were concerned that if the deal had taken place then MYOB “would likely be the only supplier of practice software suitable for medium-to-large accounting firms”. This paints context as to the value of the practice management segment of the business. Reckon has a strong place in the market and MYOB wanted complete control. In an interview with the MYOB CEO (link broken) there is a few key takeaways.

Some very important facts mentioned in this interview are:

The Big 4 all use MYOB Practice management

H&R Block switched its 470 offices to Sage Handisoft from Reckon Elite

There was a lack of clarity around Clive Rabie's statement regarding Cloud adoption.

So MYOB thinks that with further revelations that it has a better chance to compete rather than to acquire. This poses quite a risk to APS given MYOB is a large software provider. More recently, MYOB Was acquired by international investment firm KKR which will provide support.

Another large risk APS faces is moving APS to a cloud-based model. Such a deeply integrated Desktop based model will be difficult to shift quickly, giving market participants with more flight of movement the advantage to steal market share. So while in the recent half yearly results Reckon quotes ""substantial progress has been made on the development of a new cloud suite", the question is how quickly can they get this done so as to enjoy their long term competitive edge.

Practice Management - Legal

This division is small however Reckon also states that it is experiencing significant growth. Specifically from their scan and print management solution. Which makes sense given the growth of cloud-based practice software and even the demand for high security document management.

Community Reviews

Reading some Trustpilot reviews on Reckon's products, I found these key takeaways:

Many bad reviews relating to older products that Reckon has had to cease supporting.

Customer service is a mixed bag. There is many reviews saying the service has a long waiting time and consultants don't have good knowledge. However there is some, presumably relating to easier more routine issues that give them a good review. Overall i would say customer service needs improvement.

Pricing is reviewed well, however their has been some issues relating to educating new users. That is, a lack of a tutorial. Albeit i think these people aren't paying enough attention as Reckon has a YouTube channel with a wide range of tutorials relating to every product.

So it seems to me that if Reckon can focus on improving customer relations, unlocking a tailwind for customer retention that will unlock value and help maintain their Moat.

https://au.trustpilot.com/review/reckon.com

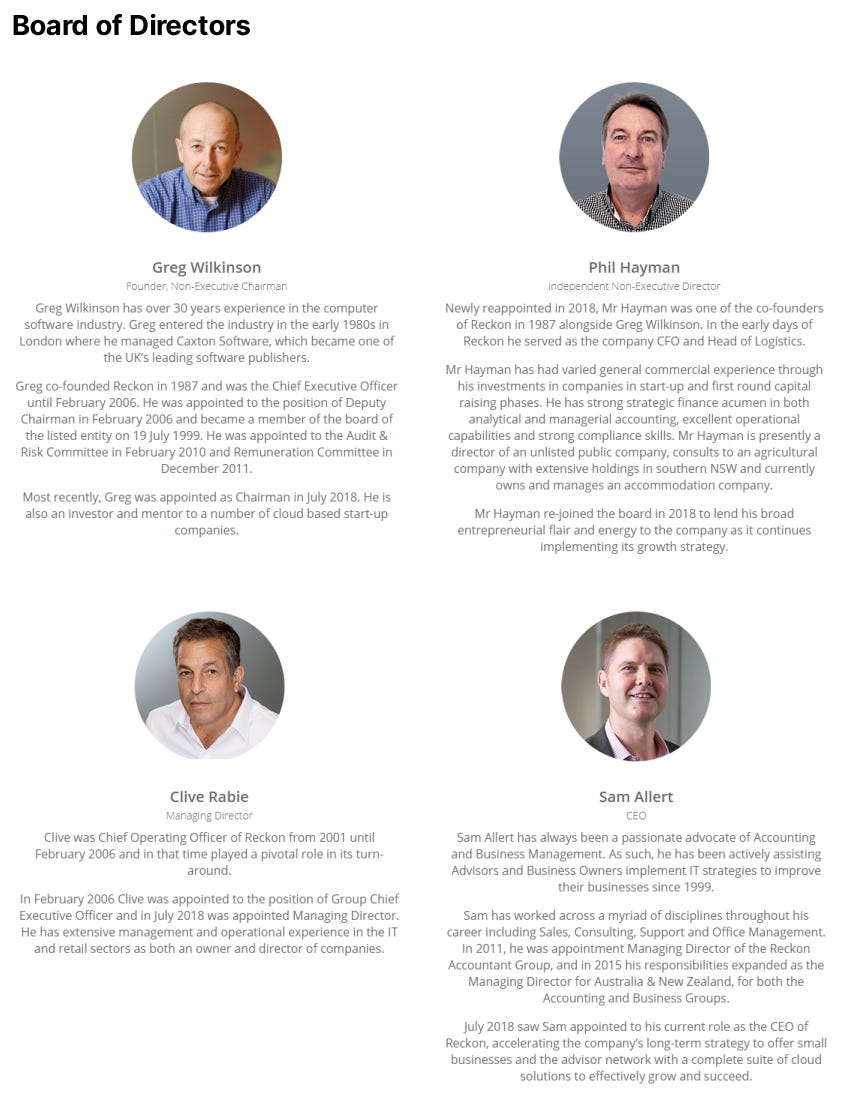

Management

Incentives

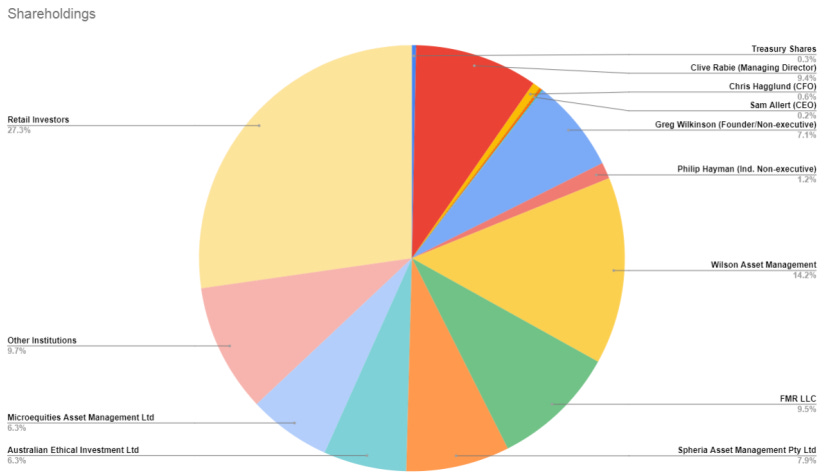

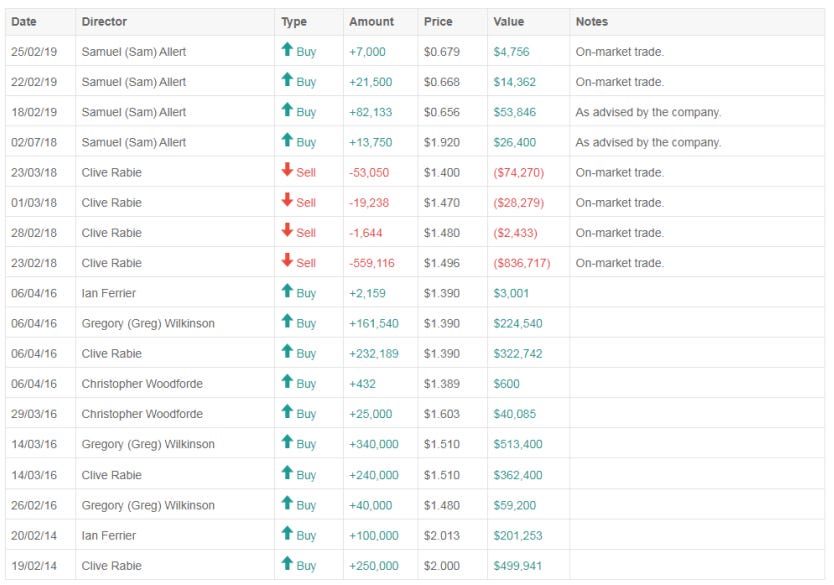

Reckon directors hold a decent chunk of the company. Clive Rabie holds close to 10% of the company and is involved in day-to-day operations. This is reassuring as Sam and Chris both hold minimal shareholdings. At 63 years old, Greg Wilkinson i imagine would prefer to take a backseat on the business and enjoy a carefree retirement. Incentive is decent here, however i would like to see Sam & Chris take on more shareholdings to provide an alignment of interest with shareholders.

Worse off than that, Institutions own the vast majority of shares outstanding, leading Reckon to be subject to the short term orientation that they generally carry with them. Notably, Wilson is the largest of these holders, of which WAM Research has a 0.8% RKN weighting and WAM Capital has a 0.4% Weighting.

To try and guage why they hold it, the WAM Research investment strategy is as follows "WAM Research provides investors with exposure to a diversified portfolio of undervalued growth companies, which are generally small-tomedium sized industrial companies listed on the ASX. WAM Research’s investment objectives are to provide a rising stream of fully franked dividends and achieve a high real rate of return, comprising both income and capital growth, within acceptable risk parameters". So it's clear that they consider Reckon Ltd to be an undervalued growth company to a degree.

Subsequent to FY18 end, there has only been several trades from Sam to increase his shareholding.

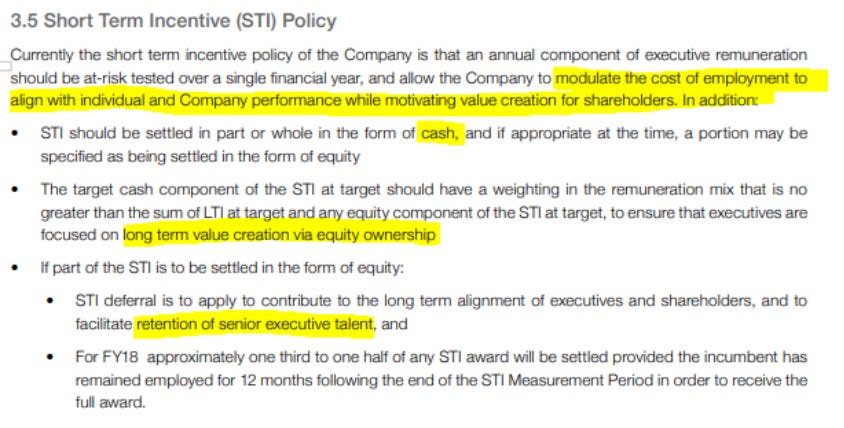

Remuneration of Management is also key when determining the alignment of management with shareholders, of which the plan should incentivise management to create long-term 'Sustainable' value for shareholders. That is, value created without negatively impacting other stakeholders.

Reckon's Short term incentive STI policy hits on some key points which i have highlighted below. In essence to retain superior talent, there needs to be a strong base remuneration. However, to align interest moreso to shareholders, some payment may be made in the form of equity. Preferably not options due to their short term nature.

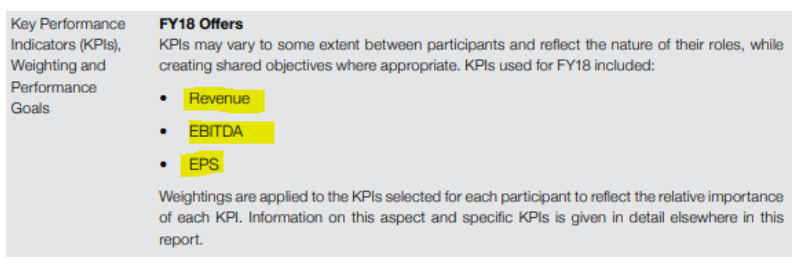

To achieve this alignment, the company has chosen the following Key performance indicators, with weightings of 40% for both Revenue & EBITDA and 20% for EPS. I do like to see a strong weighting to Revenue, however i feel like EBITDA may not be the best metric to incentivise. This is because what is between Revenue and EBITDA is Product Costs, Employee Benefits and Marketing costs. These customer related expenses have been incentivised to be cut, which could hurt the leading indicators such as customer waiting times and satisfaction. Earnings per share is another which i don't necessarily like to see. I would prefer a metric of cash flow instead to shift the focus away from taxable profits and instead to smart long term cash flow generation.

The Long term incentive uses 50% EPS growth and 50% Total Shareholder Return Relative to the ASX300 Index.

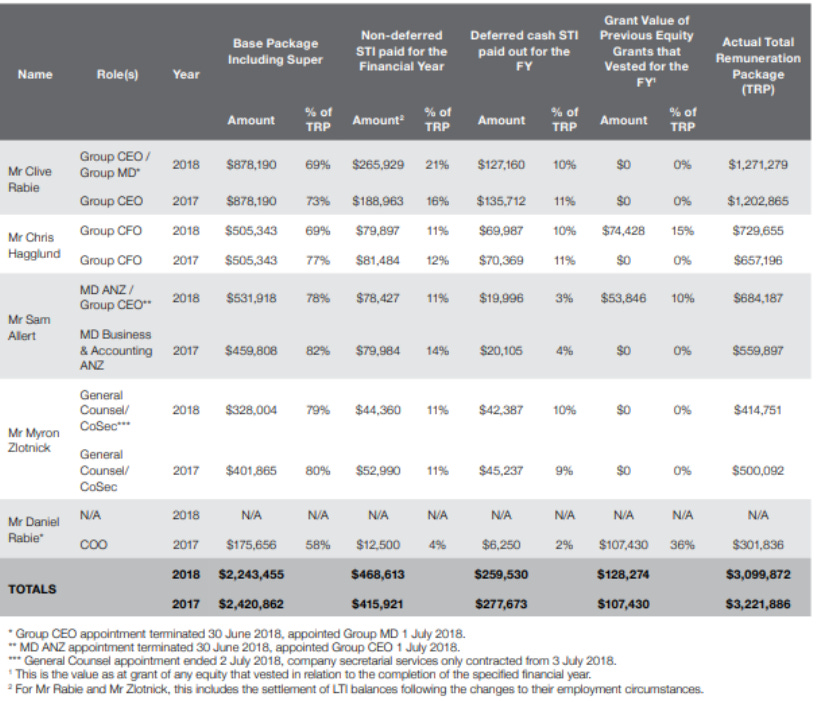

The total remuneration package for Key Management Personel totalled $3.1m in the year ended 31 December 2018. Which seems like quite a lot. The total Employee benefits expense for the company totalled $23m. The breakdown of each payment is as follows:

Integrity

Clive Rabie may be the single most influential person for shareholders. Given his strategic role as MD and large incentive via his shareholdings. For that we should find out how he is as a person and whether he exercises a professional ettiquete in his correspondence.

To get an understanding and feel for Clive as a CEO, below is an interview from CNBC from back in 2016 with Clive's commentary regarding the 2016 Budget. It also demonstrates the way he deals with common investor questions from the sharemarket, with some commentary regarding competitors near the end.

https://www.cnbc.com/video/2016/05/10/how-will-aussie-budget-impact-smes.html

From that video while not the most confident of speakers, the points put across were all fine, albeit general. Regarding competitors Rabie states that it is important to take a long term view and the interviewer also highlights the huge variance in market capital in comparison to Reckon. This huge difference in market capital is where the opportunity lies. Albeit the company is not even close to on par to Xero and MYOB in terms of influence. The practice management business pulls leagues ahead of competitors.

More recently, Clive has sold two properties Sydney and Melbourne).

https://www.realestate.com.au/news/managing-director-of-software-giant-reckon-clive-rabie-to-sell-vaucluse-home/

So how does this speak for Clive's integrity? A long-term mindset is a good sign and it is clear Rabie is an avid investor himself with multiple properties sold in recent years.

So how about the CEO himself? Sam Allert has quite a small interest in the company yet is part of the link between operations and the board. For this we need to determine that he has a strong understanding and vision to lead the company to a prosperous future. To understand, below is an interview with Digital First right after the cancellation of the MYOB deal:

https://digitalfirst.com/what-me-worry-reckon-shrugs-off-rocky-outlook/

The interviewer prods quite a lot in this interview (especially in comparison to his admiration for MYOB CEO, putting Sam in difficult spots. However, that is good for us to understand the level of understanding Sam has. Some key points i have are listed below:

Deeply focused on continuing the business development

Contradictory comments made by Clive Rabie regarding Cloud.

Lack of new Sales and big firms like H&R Block and KPMG leaving, Reducing revenues for APS.

It seems they are developing APS, however are also open to prospective offers at the right price.

Iterative Cloud developments rather than all at once. I have seen this first hand, with features such as the ability to link to the ATO from tax manager etc.)

Sam mentions that during the period of of the MYOB acquistion there was a 'huge influx of clients'. Most of the loss in revenue was likely from H&R Block and KPMG, yet made up for by newer clients as a result.

Sam seems like quite a driven CEO with good response to each question. The risk stays though that MYOB looms as a competitor now with viability given their Big 4 clients. Yet this is likely priced into the market given the large downfall in stock price over the years.

Capital Allocation

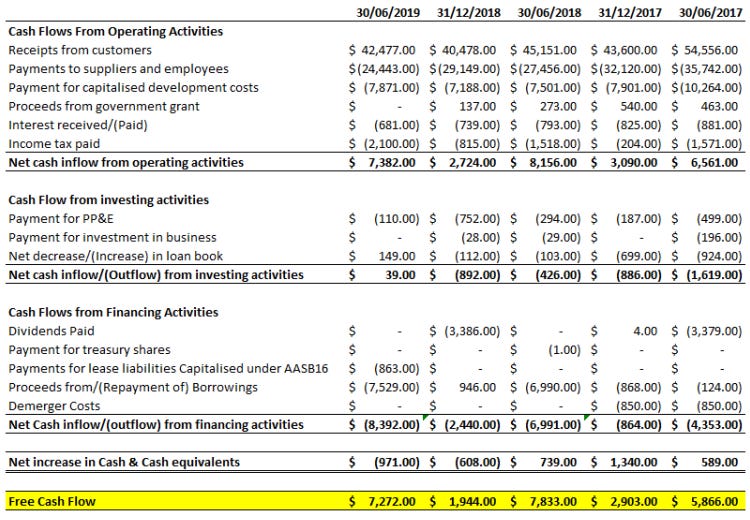

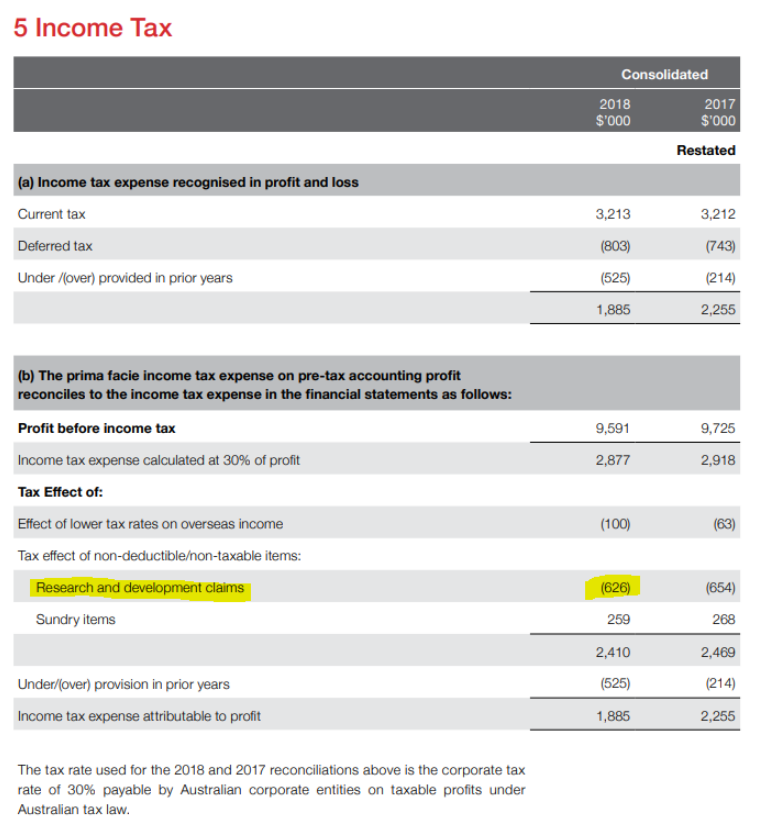

Capital allocation is important as it is what lays the foundation for future growth and returns for shareholders. A healthy capital allocation policy creates long-term sustainable value for shareholders. Below is the cash flow statement for the last 5 Half-Year reports that Reckon has posted.

To note are:

The operating cash flows weight towards the latter half of the financial year.

There is a low amount of investing cash flows. This is largely due to the capitalised development costs. As these costs are associated with Research and hence could be considered the services form of growth expenditure.

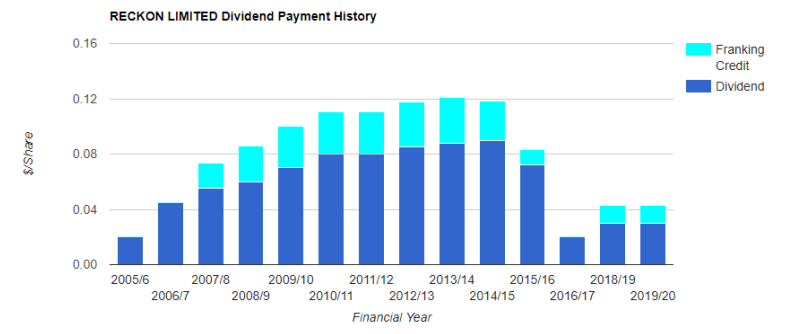

Dividends are sustainable at only roughly 3035% of annual operating cash flows.

The remainder of free cash flow is being used for debt repayments in recent years. Of which it experienced a decline in the dividend payout

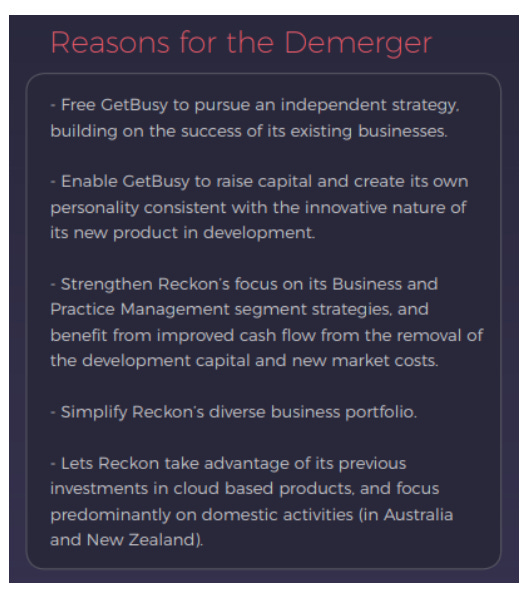

This is likely due to their demerger in the document management business. The rationale behind this is as follows.

Shareholders received consideration from this demerger as an 'in-specie distribution' of Getbusy Shares listed as an IPO on the AIM market of the LSE.

Keep in mind that during this period, the share price of Reckon also fell drastically to accomodate the smaller scale of the business, as a result the dividend yield remained strong, and is very attractive now at an 11% gross dividend yield.

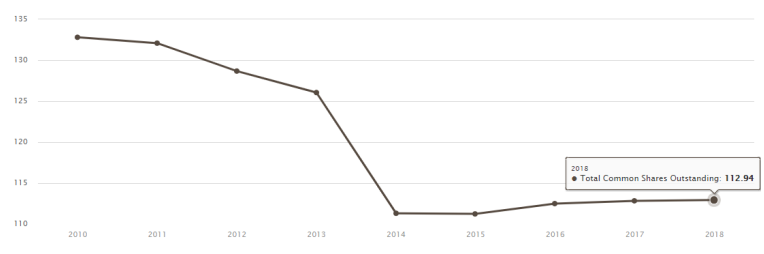

In addition to this, the number of shares outstanding as been stable in recent years, with an on market buyback being authorised in 2013 of up to 10% of the shares outstanding Which was followed through).

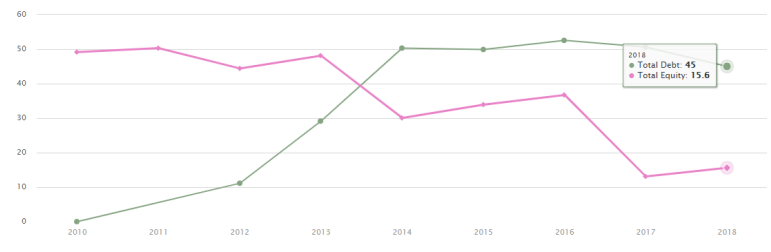

Financing is another area of which Reckon has leveraged in recent years. Despite a buyback in 2013, the company funded further through debt facilities.

They did this back in 2012 to fund the Lindenhouse acquisition which total consideration was roughly $22m. This was later demerged as Getbusy. To assess the success of that investment we can do some simple math to calculate the return.

Purchased for consideration of $22m in 2012.

The business generated $27.2m over 5 years.

Demerger consideration of $26m in the form of retained earnings.

Therefore from this information we can conclude that the document management investment had returned $53.2m from an initial investment of $22m in 2012. Which is a CAGR of 27%, a very respectable return even despite it is gross of tax paid.

So bringing it back to comparison of debt interest rates, this acquisition turned out in their favour, providing value to shareholders well in excess of consideration paid and interest expenses.

As as result, the capital allocation of Reckon is not very bad at all, rather it is quite diligent. Leveraging on profitable opportunities and providing a consistently competitive to shareholders. I expect this trend to continue until the company is at least net tangible assets and hopefully net cash. From there, the capital allocation has capacity to provide outsized returns for shareholders.

Given the price of the stock right now, paying out dividends to shareholders provides much more value to shareholders in the short term. However the prospect of capturing returns similar to that of the Lindenhouse acquisition is preferable, and to do that they need to deleverage. Hence the aggressive pay down of debt in recent times.

Fundamental

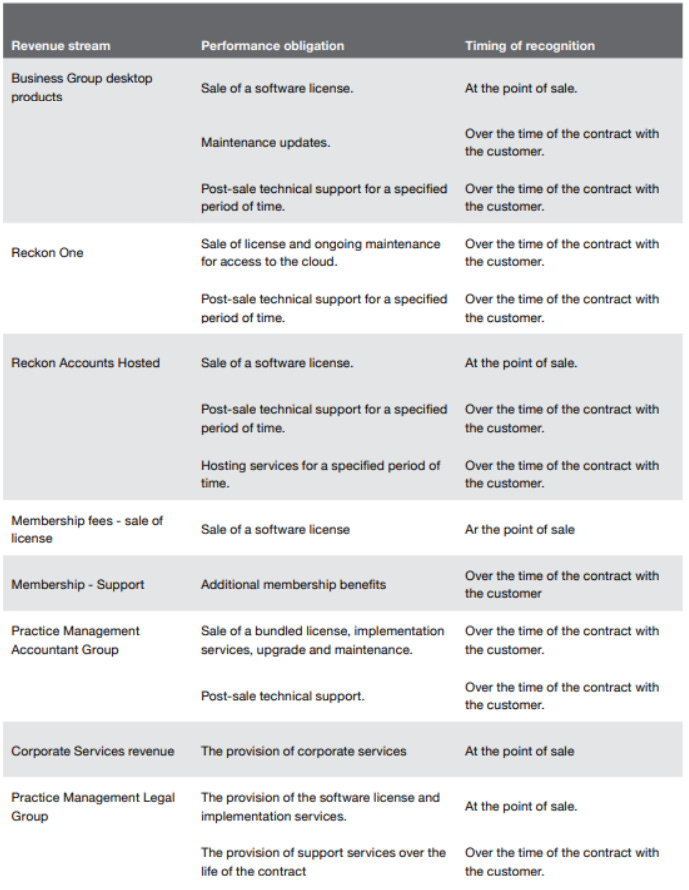

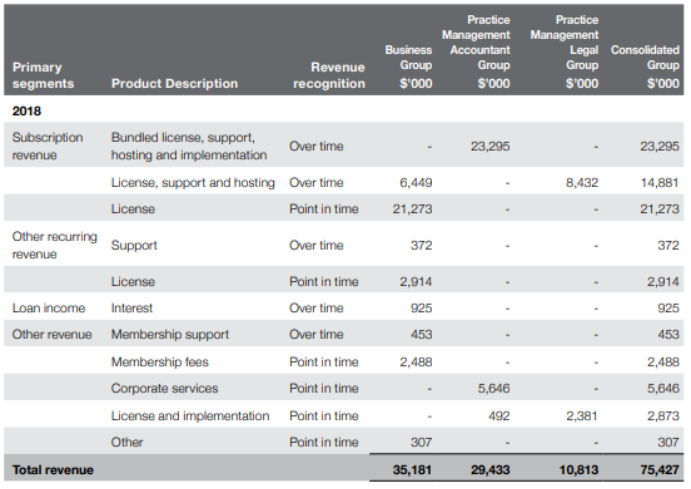

The following table summarises how Reckon revenue recognition occurs:

During recent years, the business has pointed towards the shift to the cloud, and with that comes reccurring revenues. Reckon One is the clear standout in this regard. However, also of note is the Practice Management Group as being a recurring revenue stream as well. Given the large market share, It is reassuring that technical improvements can assist in retaining clients.

Older products such as the Accounts hosted still run on a point of sale structure which is somewhat still prevalent in the context of the total revenue at $21.2M.

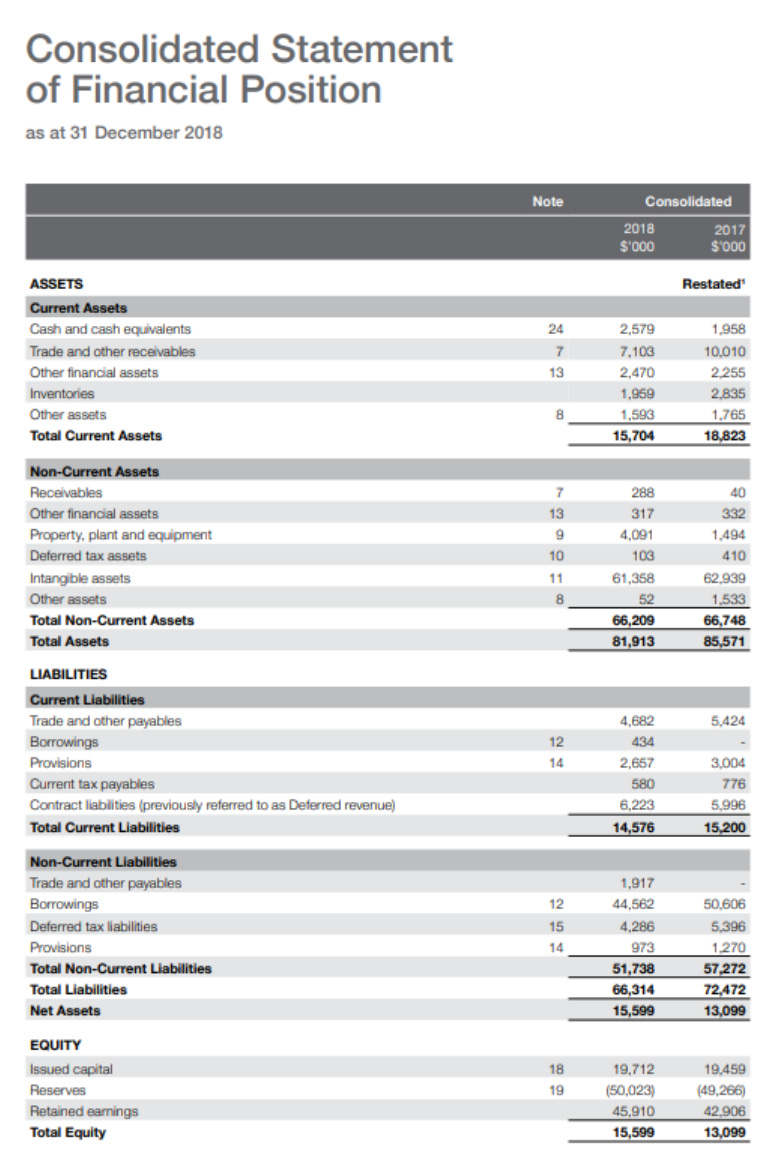

The financial position of the company is relatively lightweight in terms of capital, however, debt exceeds tangible assets of the group, raising the concerns about going concern viability. However given the level of recurring revenues and EBITDA of close to $30m per year, the company has the cash flow to fund and reduce this to zero within 35 years assuming no further growth.

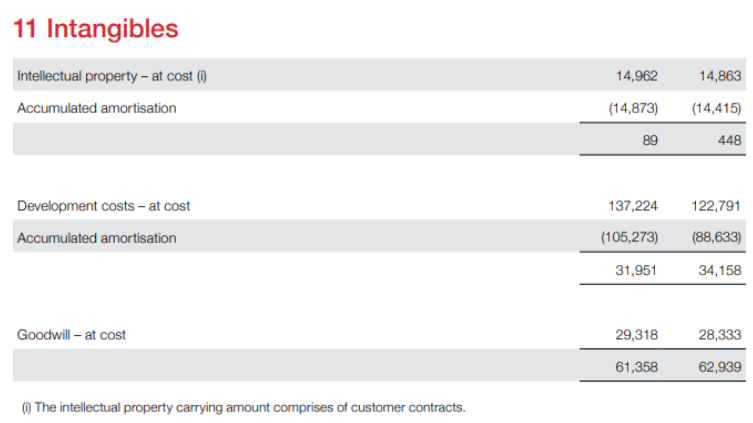

Another key point is the significant level of intangible assets on the Reckon Balance sheet. It is important to be aware of what this consists of and whether their is substantial risk of write-down.

Right off the bat, customer contracts is largely fully amortised, leaving me to believe that their is no more fixed revenues. This means Reckon has to construct a moat by building on factors such as switching costs to boost customer retention and hence improve the reliability of the 'recurring' nature of revenues.

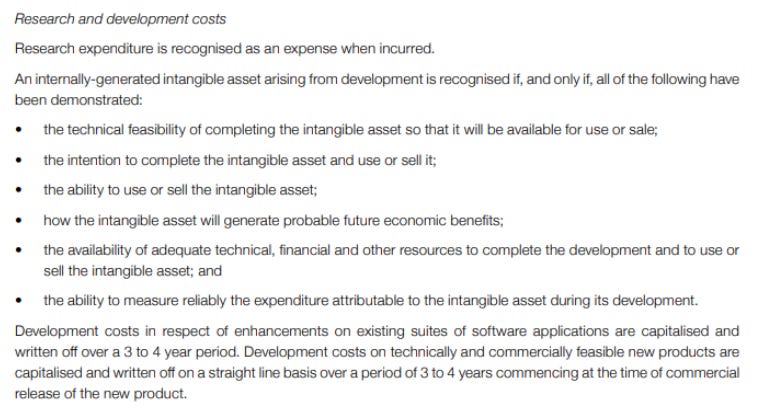

Development costs are in relation to new or existing software solutions. That is, it's essentially capital expenditure for any other normal business.

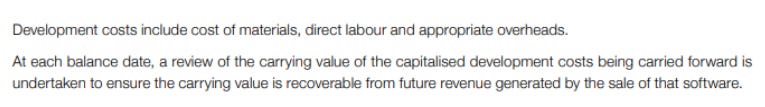

Now with some leverage of taxation knowledge, the growth portion of this can be calculated via the research and development credit in the income tax reconciliation. The rationale behind this is are in the below links:

https://www.ato.gov.au/business/research-and-development-tax-incentive/about-the-program/

https://www.business.govt.nz/news/r-and-d-tax-incentive-2019/

So from this we could discern that the growth portion of R&D was at least $4.35m in the 2018 Calendar year (626/0.385) + (410/0.15)

Taking this one step further, We can then work out owners earnings roughly using this cash flow statement:

The owners earnings would be calculated as $10,880$4,350 = $15,230. Is this good value? Well to put this into context, a yield on what a private buyer might pay is my preferred valuation method Owners' Earnings/Enterprise value).

Enterprise Value can be calculated as $86,000 Market Cap) + $44,562 Debt) - $2,579 Cash). This gives an enterprise value of $127,983. Owners earnings is therefore yielding 11.9%, which is definitely on the cheaper side

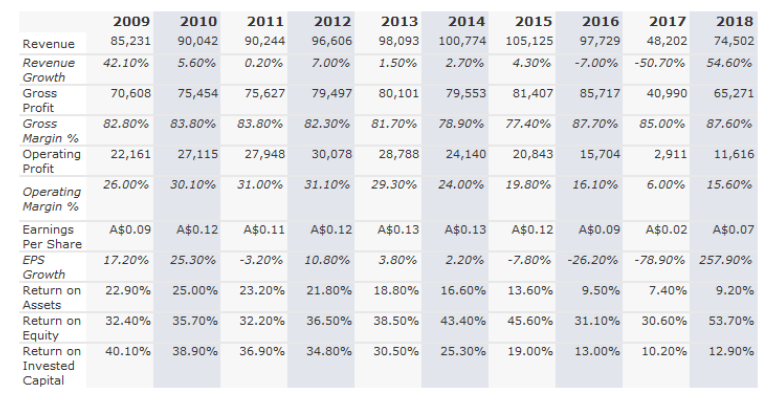

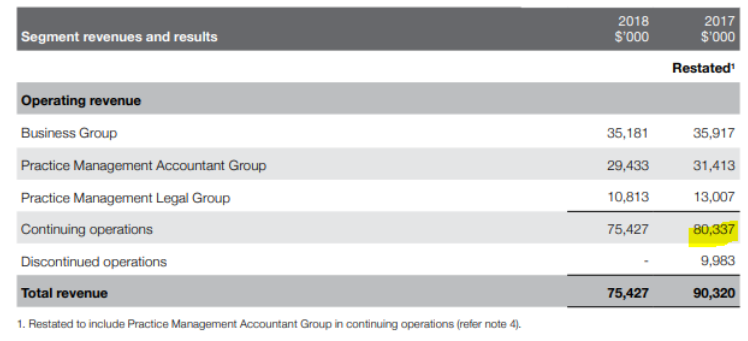

Revenues have been consistent up until 2015 in which is around about the time Intuit ended it's relationship with Reckon. The sharp decline in Revenue in 2017 is partly due to a demerger of the document management business which previously accounting for about 15% of turnover.

So where is the other 35% in declining revenue? The answer is that the revenue for discontinued revenues is not included.

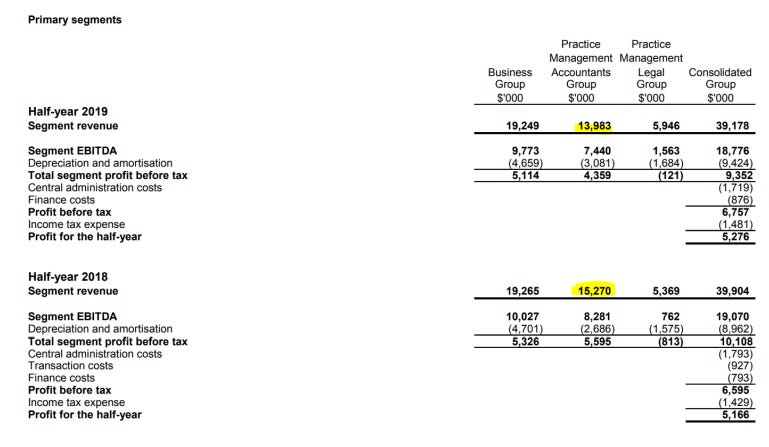

Granted that some of this revenue is legitimately discontinued in the form of document management revenue. We can look to the 2018 Financial report to find comparative Practice management revenue.

Now this doesn't change the fact that these revenues are experiencing a slow decline. Yet we can attribute some of that to the drama that was the MYOB bid, which has caused ongoing trouble with the following half year revenues also declining for the practice management division.

The company has mentioned that they intend to re-establish revenue growth in this division, likely through the development of cloud adoption. Of which i have seen several additions come through the pipeline in our own business. Namely, ATO linking with tax manager and timesheets online.

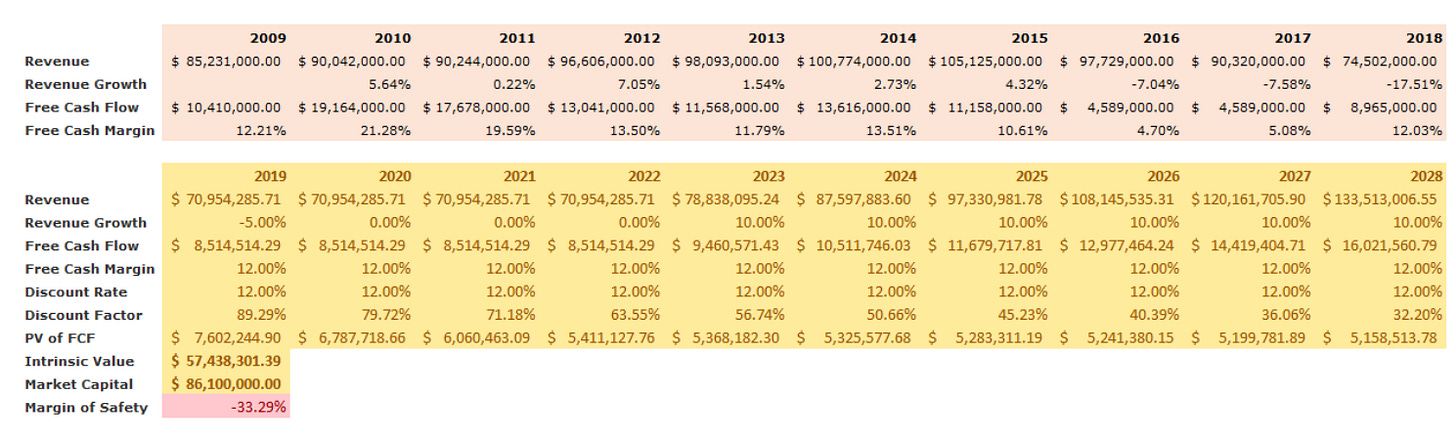

With all of this financial info in mind, what is a fair value for the stock? A discounted cash flow can help to discern a fair value for the business, given that the revenues are relatively easy to look-forward. The assumptions that were made:

Discount Rate = 12% Target ROE

FCF Margin = 12% Fair

Revenue declines 5% in year one given the half yearly report decline.

Due to capital allocation towards debt and dividends, i assume all excess cash flow goes towards payment of debt, and hence no growth projects in particular leading to a lack of tangible revenue growth.

After debt is paid off, growth initiatives lead to an estimated 10% revenue growth.

As can be seen above, from the Forecast, the company is relatively overvalued and may not provide a strong return going forward.

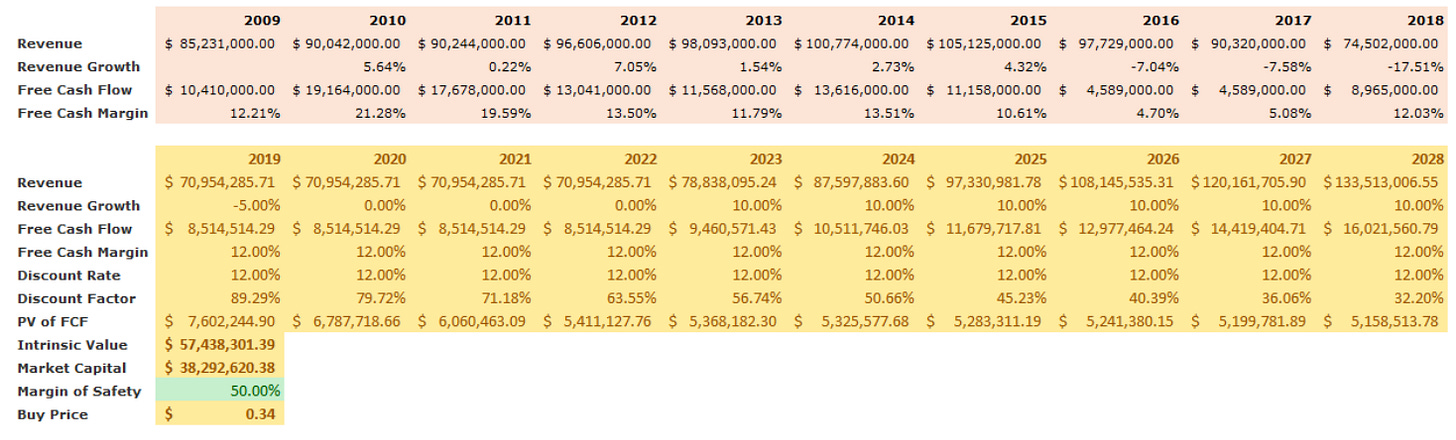

To add to this, the stock becomes a 'No-brainer' to buy at a large margin of safety, which i would consider to be 50%. The price it becomes an obvious buy is modeled below.

Conclusion

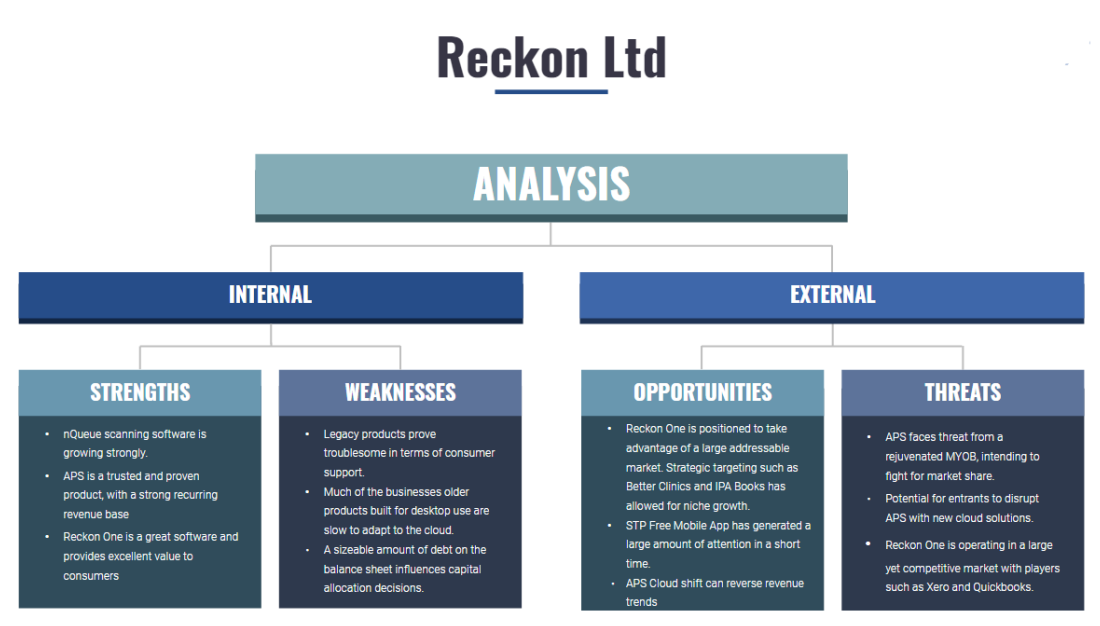

The strong Gross dividend yield of 11% that Reckon Boasts might seem strong at first glance, however after careful analysis of the business. It seems that Reckon faces some key risks that if materialised, could further cause them to lighten it's operating model, much the same as their recent Virtual Cabinet demerger. At the current price, while not a bad buy for most, my target return of 12% can not be satisfied, largely due to declining APS Revenues due to shifting of large firms to MYOB. While not all is lost however, with an attractive document scanning division and a lightweight SME cloud accounting solution to drive the business forward.

Potential catalysts that may warrant a revisit is a debt-free balance sheet Leaving room for growth intiatives), or another proposed sale of the lagging APS business.