Dear Unitholders,

This month the Hurdle Rate Unit Trust generated a Gross return to unitholders of +3.23%. Including performance fees, the Net return to unitholders was +2.45%. The unit price as at month end is $1.0866. The full history of performance data can be found on the first page of this document.

DSW Capital (LSE:DSW)

During the month the group announced that it had conducted its first ‘breakout’ deal, where they are offering teams of 3 or more £50k worth of underwritten drawings for them to start their own business as a new licensee of DSW Capital. The licensee this time is 3 people based in the newly entered Midlands UK, where they acquired license fees from recovery firm Bridgewood just a few weeks ago. Further to this, at the end of the month a new tax advisory partner joined the group.

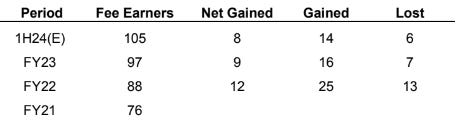

Of note in these announcements is a quoted tally of 105 fee earners after the deal, down from the 107 they quoted in the results announcement back in July. It would imply at least gross churn of 6 since the start of April. Using LinkedIn data, I have approximated what they have experienced in 1H24. It appears that they have hired ~14 people including the breakout and seen churn of 6 people, an attrition rate of 5.6% in a 6-month window (11.2% annualised). For comparison the group saw full year attrition in FY23 & FY22 of 8.1% and 16.5% respectively. This churn is not outside the normal amount they experience.

The issue here is the rate of hiring, whilst it may be in line with previous years, this is inclusive of the Bridgewood acquisition, which was a lead from a partner rather than recruitment staff. The substantial investment into several recruitment initiatives in FY23/24 have yet to show their worth and I expected to see a step change in the rate of hiring which we have not seen yet. Whilst this is not encouraging data, I am also aware that it has only been a short period of time, and given the shift back towards acquired leads, fee earners may come in group’s more often than the past.

ONS statistics indicate a flat quarter relative to the end of last year, which would suggest very weak revenue per fee earner once more. Furthermore, with an increase in DSW Capital parent company corporate costs, and lack of profit share in the 1st half, it appears likely that 1H results will see a significant drop on the record half of last year, perhaps having licensee income fall upwards of 30% YoY and with an increase in corporate costs, a significant decline in earnings is highly likely. £450k of net profit after tax was made in 2H23, inclusive of some £240k in profit share, which I deem unlikely to recur in the 1H. So, I am expecting around £1.25m in licensee income along with an increase in corporate costs again on the half to ~£1m, thus leading to ~£250k in operating profit, or £187k in net profit after tax, down ~60% on the half year PcP. For this reason, I would not be surprised to see a decline in price once results in November are released.

The positive signs are that the rapid rise in funding costs may be on its last legs, as cited by the BoE governor earlier this month. This is important as uncertain cost of funding impedes M&A activity. As I said last month, I think we bought DSW Capital at a single digit multiple of trough earnings, and my opinion on that remains consistent. We have ample room to increase our position should the price retrace on weak half yearly results.

Just as a side note, you can see here there is a reasonable focus on the macroeconomics for DSW Capital, which some of you may deem unnecessary. The reason why I am discussing it, is that it is highly correlated to the businesses organic business volume, it is crucial to the ability of the investment to succeed. Thus, there is a reasonably high risk that it does not due to sustained weakness in corporate activity, but at least in terms of weighing up the odds, I think that the investment can succeed even in relatively hostile environment, giving us substantial upside in the event of a recovery in volumes due to more certainty coming back into the corporate dealings market.

Diverger (ASX:DVR)

This month, Diverger received a takeover bid from Count (ASX:CUP). The possible payout for Diverger shareholders is:

• $0.367 in cash and 1.38 Count shares per Diverger share. (Default option)

• 2.07 Count shares per Diverger share (Subject to a scale back arrangement)

• $1.10 in cash (Subject to a scale back arrangement)

I am of the view that the offer substantially undervalues the Diverger business, however, given that Hub24 owns 1/3 of Diverger it appears reasonably likely that the deal will go through without a hitch, subject to any counteroffer. Unfortunately, the headline price is not nearly as great as my estimate of intrinsic value, and I hope there is an additional offer or increase in price, if not a refusal by shareholders. I am in active discussion with fellow shareholders as to what can be done here to maximise shareholder value.

The merits of the offer go beyond the headline price, with implied synergies embedded in the scrip proportion of the offer. On the day of the offer, I took to liberty of phone calling both Nathan Jacobsen (CEO of Diverger) & Hugh Humphrey (CEO of Count) to discuss the rationale of the deal and as part of that discussion it was noted that Diverger’s CARE business offers substantial synergy potential for Count, the tax training businesses are better suited to Count’s accounting business, and that Count has several equity interests like Diverger’s. Count themselves have identified $3m in cost synergies (primarily corporate costs – including Nathan’s & CFO wage) in addition to this. Which should take the combined EBITA to shareholders from ~$15m to ~$18m in the year or so after the deal. Combined market cap is $94m and Enterprise value of $107m, leading to about a 7.5x EV/EBITA multiple post combination. But our effective price would be closer to 6.5x as we are receiving the $0.37 in cash as well. I have looked extensively in the past at the Count business, and I am not enamoured with it, given their lacklustre discipline on accounting firm KPI’s.

However, with the introduction of the Diverger businesses, and the ownership of Accurium, I find the combined package reasonably appealing, especially if they can materialise cost and revenue synergies.

In any case, as at this stage I expect to either wait until this deal is in effect in February 2024, Diverger receives a counteroffer, or the deal is turned down by shareholders. Most likely, I will consider taking scrip and only reevaluate after we have both hit the required holding period for the CGT discount and are in the 2025 financial year as I view the combined entity as cheap as well. Either way, it has become more apparent that our purchase was indeed substantially undervalued at the time of purchase which I find pleasing. With this catalyst, I took the opportunity to trim some other holdings and average up into Diverger at the end of the month, as I view the possibility of an increased bid as likely, and the closure of the offer as very likely. The default offer is still a 13% premium to the most expensive purchase, which if it closes in late February would equate to a mid-30s CAGR on that purchase.

Getbusy (LSE:GETB)

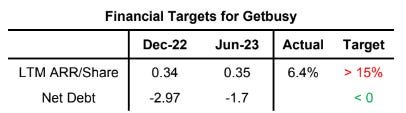

Getbusy reported its 1st half results to the market in early September. The results were reasonable, in the context of their discussion to the market. First, the ARR in constant currency terms was up 7.8% on 31 December (16.2% annualised), but with a 2.6% FX headwind. Furthermore, the group ended the 2022 year with 56.85m diluted shares, which has increased slightly on the year end to 57.63m diluted shares, dilution of 1.4% in the 2023 year to date. Cash was down from just shy of 3m to 1.7m in the half year in addition to this. The group continues its long-term incentive plan share issuance, which I was forgetting when initially setting the targets. As such I changed to ARR/Share compounding at >15% p.a.

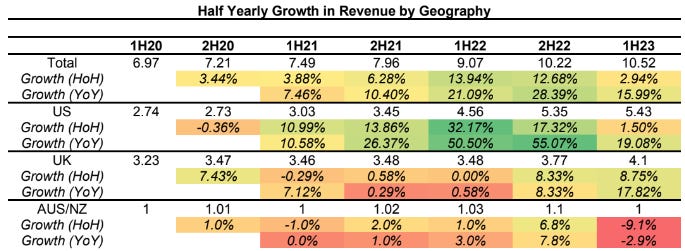

These results certainly don’t look too good when compared to our targets, but perhaps to provide some context, regarding ARR the group took initiatives to change up its sales and marketing methodology in the Smartvault business unit, delaying growth in this division. US revenues grew by just 1.4% in the half year (negatively impacted by a strong performing GBP relative to the USD), despite its significant investment. Ironically the UK was the standout with 8.7% growth in the half year. It is important to understand that particularly in the Smartvault product, the group has adjusted it’s pricing plans, such as introducing minimum account sizes, and increased average sale price, shaking out the lower value customers which bring in both lower sales price and higher churn rates. The board’s view is that the churn is worthwhile to them in the short term to remove engagements which do not have attractive unit economics to them (lower sale price but similar attention demands).

Targets remain feasible given the group is intending to double its sales team in the US and has introduced Right Networks as its 1st US partnership, which is a sales channel they don’t need to pay for, has low correlation in userbase, and 1.2x the userbase of the entire Smartvault userbase currently. All signs point to strong Smartvault growth in Q4 as the group goes into the months leading up to the 2023/24 tax season. Workiro also has 20 partnerships now which should also lead to some positive momentum. Net debt is down on the half, but the group receives most of its annual prepayments in the latter half of the year, which given the prospects for Q4, may result in a very strong half year cash inflow for the 2H period.

Dividends, Franking Credits & Priority in the Source of Returns

This month we received our first round of material dividend income, which has put the trust into a realised gain position for the first time. For transparency, income is taxable at the end of each financial year as normal, but I process distributions monthly. This is to ensure that each unitholder is entitled to their fair share of income, and to prevent new unitholders being taxed for income from previous months or old unitholders from dodging tax which would have been attributable to them prior to their sale. Importantly, this does not shield new unitholders from unrealised capital gains, however.

Speaking of this income, I have included the grossed-up value of these dividends in our performance, this is because franking credits represent equivalent value to $1 of cash, as they are what is called a tax offset, rather than a tax deduction. Franking credits are a tax credit paid alongside dividends for company tax that has already been paid by an Australian company. From the investor’s point of view, they can use that credit to pay tax they would otherwise pay, and any excess is an allowable cash refund from the tax office (For receiving companies it is a credit to their own franking account). To date we have received franking credits of $4,268, or $0.0146 per unit.

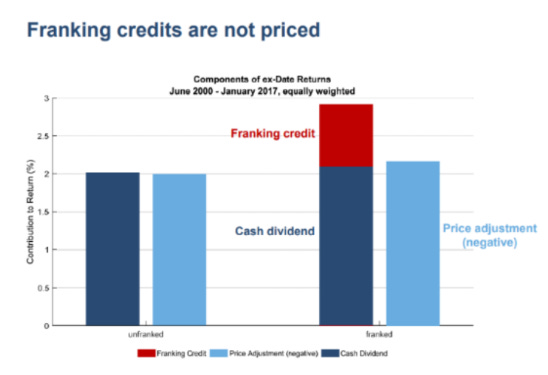

Having established this, an excellent presentation from the Plato Income Maximiser LIC (ASX:PL8) talks about how when a dividend paying company passes it’s ex-dividend date, unfranked dividends are understandably represented in a price decline equivalent to the dividend payout. But interestingly the price adjustment does not have the same 1:1 adjustment for franked dividends. The effect is shown in the charts to the right, only a mild value is ascribed to franking credits, which is largely due to the large foreign shareholding in Australian shares. Furthermore, many funds are not managing their performance on an after-tax basis, meaning that to display strong performance, funds often opt away from high franked dividends, and particularly large special dividends or off-market buybacks.

All of this is strong evidence towards explaining why we might have a non-negligible contribution from this effect over time to our performance. This doesn’t mean I will go out of my way to chase fully franked dividend payout companies, but just that it will be a minor consideration when comparing alternatives.

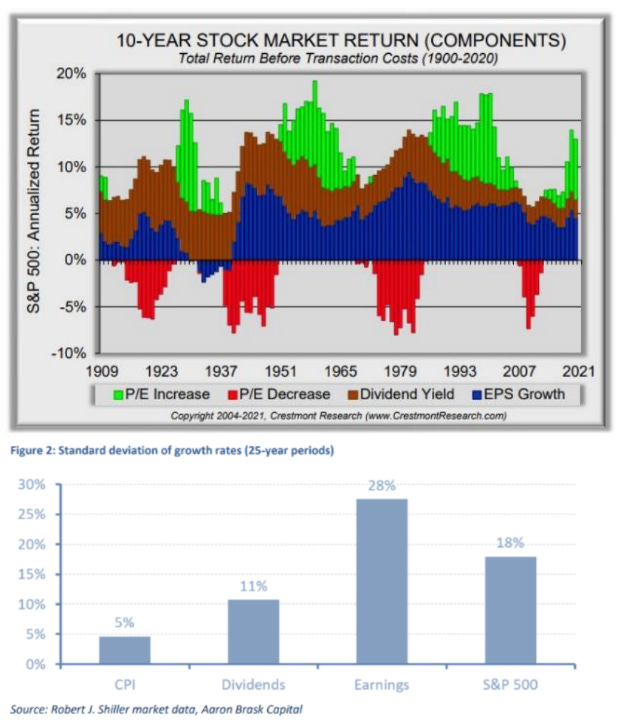

The discussion on franking credits and comparing alternatives has prompted me to think about weighting different sources of return. TSR is driven by intrinsic value growth, dividends, and multiple expansion/contraction, but perhaps it is worth it to think about the drivers of that equation, and what appears to be more favourable. In my view, a capital return is the most predictable and favourable of all returns, but in lieu of franking credits, is typically taxed the most, so there is much investment research speaking about the impact of compounding a deferred tax balance, which of no surprise Buffett also talks about in his 1989 letter. As an Australian trust, with all beneficiaries able to benefit from franking credits, this consideration holds less weight, but ignoring taxes for the time being, investments based on capital returns tend to be significantly more predictable over the long-term (shown with charts to the left), which when combined with the nullification (via franking credits) of the double taxation issue that international investors may have, I tend to view a higher Australian sourced dividend as preferable to other sources of return.

This doesn’t put me in a camp of ‘dividend investing’ or anything like that, it is merely a structural advantage that would weigh in its favour. As evidenced through our holdings of non-dividend paying companies such as Getbusy and AF Legal along with double-taxed dividends from DSW Capital, consideration is to be given to what the total return would look like from multiple competing factors which includes but is not limited to confidence of future organic revenue and earnings growth, the capital efficiency of the underlying business, the capability of management to reinvest profits, potential catalysts, market valuation, and the tax impact on the HRUT unitholders. Ultimately, our aim is to maximise after-tax rate of return as consistently as possible.

Concluding Thoughts

Last month, I touched on special situations and noted that we spent a small amount of trust capital on a subscription to Special Situation Investments. I am happy to report that we have made the first investment because of that subscription and have recovered the subscription and then some. Importantly, this was done using interest free debt instead of trust equity. You can read more about our investment into Direct Digital Warrants later in the document.

Similarly, I have decided to utilise a small portion of the trust ($595 or ~0.2% of NAV) for a Koyfin Plus subscription. This platform I have been using the free version of for some time and find it to be an excellent companion tool to my research process. The Plus subscription will allow for things such as an increase from 2 years to 10 years of financial data, access to filings and transcripts within the platform, earnings calendar, stock and transcript key word/phrase search, and significantly customisable stock screener’s and watchlists which can also be exported to excel. If you are a unitholder and would like to use this, please reach out to me as I am happy to share the login details.

My comments last month about incorporating an opportunistic tail have evolved into simply removing all constraints on position sizing, instead opting to let it ‘evolve’ over time, with an allowance to be more diversified so long as hurdle rates are maintained, as this will smooth our results, whilst still allowing for excellent returns. Similarly, if an outcome appears very confident, I will consider quite high levels of concentration. Portfolio turnover is the price of progress, in periods of abundant opportunity it makes sense to trade much more, although it is a delicate balance.

As noted last month, my discussion with James Goodwin on the Firm Discussions series about Sequoia Financial Group (ASX:SEQ) was uploaded. You can listen to it here. Furthermore, a live discussion on X spaces also discussed has now come and gone, it was an excellent experience. Early in the month, my application to join the revered MicroCapClub was accepted, and I have had a very interesting time browsing the website for ideas

and commentary from many investors much more experienced than I. Membership is voted on by peers, and my short pitch on DSW Capital (LSE:DSW) received 71% approval by those that voted, earning me just enough (>70%) to reach the line and be approved. This sounds low, but historically only 18% of applicants gain approval, and once declined you must wait 90 days to try again. Considering this was my 1st application, I was pleasantly surprised to receive entry without having to re-submit.

As a reminder to all unitholders, please feel free at any time to deposit or withdraw funds. I am also open to negotiating savings plans for a recurring deposit if it suits you better. Additionally, we still have 7 free positions for new unitholders so if anyone is (or you know someone who is) an Australian tax resident and interested in the prospect of investing into the Hurdle Rate Unit Trust, please contact me using my details below.

Yours sincerely,

Tristan Waine