Shine Lawyers (ASX:SHJ) - One Page Stock Pitch

Australian Personal Injury & Compensation lawyers

Some of you may remember this tweet, where I listed 4 potential stocks to cover with the winner being Business Brain Showa-Ota Inc (TSE:9658). Were valuations to persist below the hurdle of 0.5x PEGY I intended to just go through the list in terms of voting priority. So this week is the ASX Law firm, next should be the LSE Consulting firm and lastly the NYSE Recruitment firm.

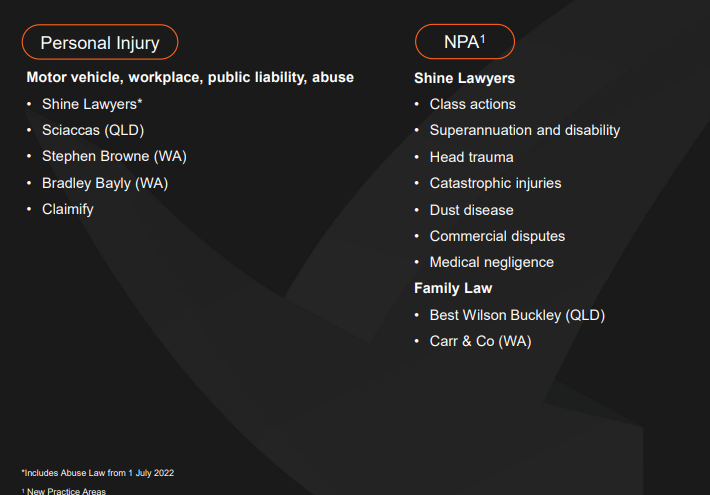

With that said, Shine Lawyers is the topic of todays pitch, an AU/NZ plaintiff legal firm and is the ASX’s 2nd largest listed law firm (as of the time of writing), with intellectual property lawyers IPH Ltd (ASX:IPH) being the largest. It was founded in 1976 and has since acquired and integrated more than 20 legal firms and employs >1100 people as of 1H2023.

Shine predominately operates on a no-win no-fee model where they carry out the Work in progress associated with their class actions through to the completion. More recently they have engaged the use of litigation funding to improve their cash flow (which also hurts margins), which is basically the same as invoice factoring, but I imagine more expensive due to the contingency aspect. There is no mention of whether Shine is utilising WIP funding as well however from my own research, disbursement funding looks to be competitive and there are even providers that charge interest on a simple interest basis rather than a compounding one. Lastly, perhaps the most attractive part is that the lenders also operate on the same no-win no-fee basis for their own B2B lending, that is the law firm doesn’t have to pay if they don’t win the case.

Whilst this funding helps the cash flow, the lions share of costs in most cases is the WIP, which can be outstanding for 3+ years at times, meaning that Shine Lawyers is going to take a long time to convert their profits to cash, even with the aforementioned funding. For this reason I am typically looking at normalised FCF that lags NPAT by 2-3 years as a result and I am more inclined for example to look at 2019-2020 as a reasonable approximation for actual free cash flow as a result, which was about 75% of the current bottom line. The cash conversion has been historically very poor as you can see below. This implies that on average it takes 2.5 years to convert EBITDA to OCF, which is obviously really quite poor. However, the good thing is that the trend is going in the right direction, with cash conversion, barring the exception of 2022 moving from a 3 year average of 17% in 2014 to 60% in 2022.

In September 2022 Shine announced the settlement of the Ethicon Mesh Class Action, a case that was commenced back in 2012. This is a large catalyst to cash flow, and should the settlement be approved Shine will see a large cash inflow in the 2023 year. The details of the settlement are below and the update given by Shine, the approval of which looks to be pending so we may see a settlement roll into the FY24 year if this drags on much longer, but the cash flows are very substantial as you can see. What they do with the cash is a question mark.

Wrapping it up, referencing the growth of EPS from 2017-2022 we can see a CAGR of +9.1%. Overlaying this with a TTM PE of 4.3x and a fully franked dividend yield 10%. The PEGY is 0.22x, clearly worth looking into, especially given that the business trades at 0.5x book and are improving their working capital cycle through litigation funding and the potential imminent Ethicon settlement. The graham number of 2x is cheap on that basis as well.

I hope you enjoyed reading

Regards

Tristan

As a shareholder in SHJ I admit being seduced by the attractive numbers but wary of the markets assessment of its operations and future. The big issue is, and as you have alluded, the lumpiness in profits beng turned into cash. The divergence between NPAT and Cash Ops adjusted for non cash items is appalling. In short, investors like myself are shouting SHOW ME THE MONEY - more accurately, GIVE ME SOME OF THE MONEY!

But, it could be just around the corner with the Ethicon case due to settle - probably 2H2023.

In the meantime, I am wary of the massive growth in WIP and disbursements on behalf of clients and truly trust in the auditors diligent testing on recoverability. Good article, well done.