Upfront, Sky is a short-medium term special situation initiated by the trust in response to the receipt of a non-binding indicative offer (NBIO) to acquire all the shares in Sky without a price disclosed. This was announced to the market on the 13 of October. On my numbers the group traded at a FCF yield of ~20%. According to local reports, an unnamed overseas private equity firm could be the mystery bidder for the business.

Several days later a reference point valuation was shown with Southern Cross Media (ASX:SXL) receiving a similar offer from Anchorage Capital Partners (ASX:A1N), which contained a price. This is where my interest was drawn as the Sky business generated >$50m of NPAT in 2023 and held >$50m in debt-free cash on the balance sheet (all numbers converted to AUD). On a market cap of $370m this is a valuation of 6.4x earnings. The Southern Cross Media business by comparison generated NPAT of $19m, had net debt of $105m and a market cap of $205m, valuing the business at 16x earnings, a differential of some +-150%. Whilst these aren’t identical businesses, the model in my view is quite similar, with them effectively being advertising channels, despite the channels being TV and radio respectively. Importantly, the cost structure would be relatively similar.

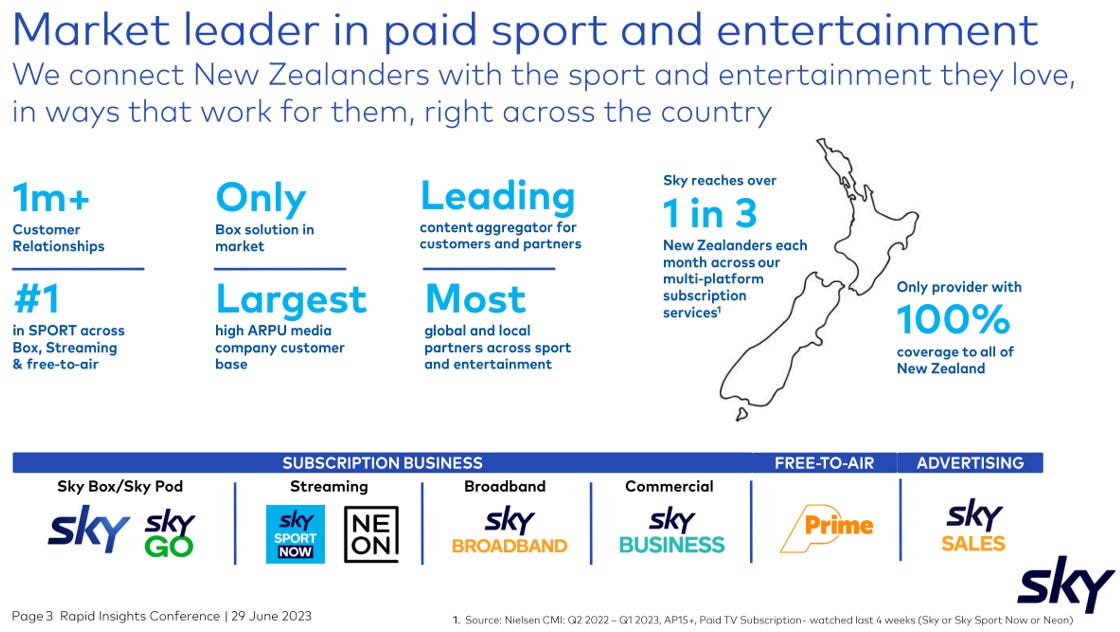

Of course, I should provide some background on the business as well as the special situation thesis. In the case of Sky, they are like the likes of Foxtel here in Australia or Comcast in the US, and it is effectively a ‘paid subscription’, to either a digital TV box or streaming. It also offers broadband, and advertising via. it’s free-to-air television service etc. Some 10% of the New Zealand population have a Sky Box which shows their strength. As the graphic above also shows, their overall paid business reaches 1 in 3 New Zealanders each month. It has undergone a significant transition over the past 3 years, stabilising the businesses income streams, decreasing the reliance on Sky Box as its key division and streamlining costs.

The board are all rather new and, Belinda Rowe, one of the groups’ independent directors, also happens to be a non-executive director of ARN Media (ASX:A1N), the company which put out a bid for Southern Cross Media (ASX:SXL). They have more in their executive team than I would like (8 people!), but with 6 of those people joining the executive team within the past 5 years, it appears that at least most of the current executive team were not responsible for the bulk of the lackluster performance leading and further exacerbated by the pandemic.

To add to the appeal, Sky appears to also be a good value stock for all intents and purposes. It’s FY26 targets outline 3-year target revenue, EBITDA and NPAT of +9-12%, +17-31%, and +35%-86% respectively along with a potential doubling of the FY23 dividend. This would equate to a FY26 FCF yield of 22-30% and dividend yield of ~12%. To add to this, the company initiated a share buyback in March 2023 where the board quoted that “Sky’s shares are significantly underpriced”. If they were unable to secure a transaction in the short term, I am comfortable holding Sky as is, as if the management targets are met, we would benefit from a hold return of >16% p.a. with what I believe to be ‘significant’ strategic value to a potential acquirer. Of course, it isn’t in line with our loose mandate of professional and financial services, but I believe it an easy business to understand and most importantly, is 100% financed by debt, meaning that until this investment is materialised, we will be doing minimal small special situations due to a lack of credit facility to access. On the upside, any contribution to the trust is in effect an unlimited ROI as we are utilising no equity and interest free debt.