Continuing the trend of having a noticeable focus on e-invoicing, I can present the Unifiedpost Group (‘UPG’) business. UPG founded in 2001 by existing CEO, Hans Leybaert (12% shareholder) and has scaled up over the years to what is now a business with over 1,000 employees operating in over 30 countries. Its products are predominately focused on e-invoicing (80% of revenue) with a base subscription revenue in order to access the platform and transactional component on top which allows the group to benefit from volume through a usage-based fee.

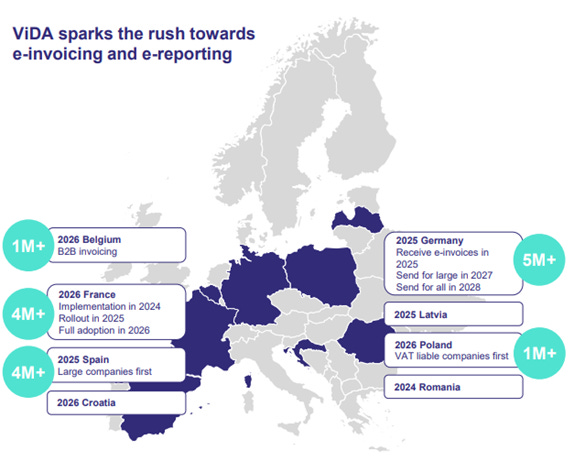

In recent months the business has implemented the first stages of its Strategic plan announced in April 2024 through the divestment of several of its businesses which will result in the company returning to a comfortable liquidity position. Furthermore, much of its digital investments in preparation of the mandate of e-invoicing in key markets has now been completed, paving the way for the company to reap the benefits of high incremental margins both on gross profit level, and especially so at the operating level due to an increase in e-reporting driven largely by B2B transaction volume.

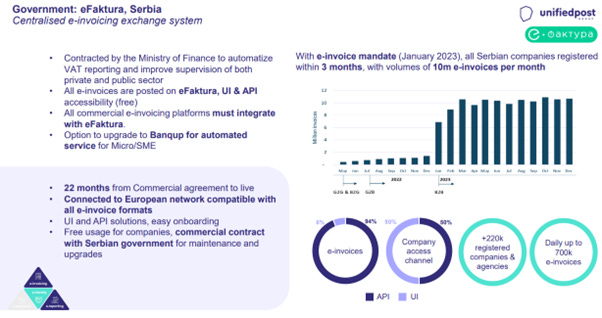

To demonstrate this is the case study provided for Serbia. In May of 2022 the government implemented eFaktura in Serbia. In 2021 digital processing revenue was €9.6m. In 2022 E-invoicing was mandated between the government divisions and for business to government which caused Serbia’s revenue to increase by 27% in that year. In 2023 B2B was implemented which increased Serbia’s contribution by a further 39%, representing a 2-year CAGR of 33% over the 2 years, despite involving just 220k registered companies and agencies.

Now you keep in mind that the group has a very lucrative position in the France market, represented through a joint venture with ECMA (created by the institute for CPAs in France with over 20k accounting firm members with over 4m end users). Jefacture is the software created for this with current clientele of 18% of those accounting firms (over 710k SMEs) as of March 2024. It is worthwhile noting to use this as a customer it retails at €7/mth and €12/mth extra for both when including the ‘Banqup’ payment module, so clearly the revenue opportunity is relatively significant, but more importantly, should flow through a comparatively fixed cost base, increasing margins.

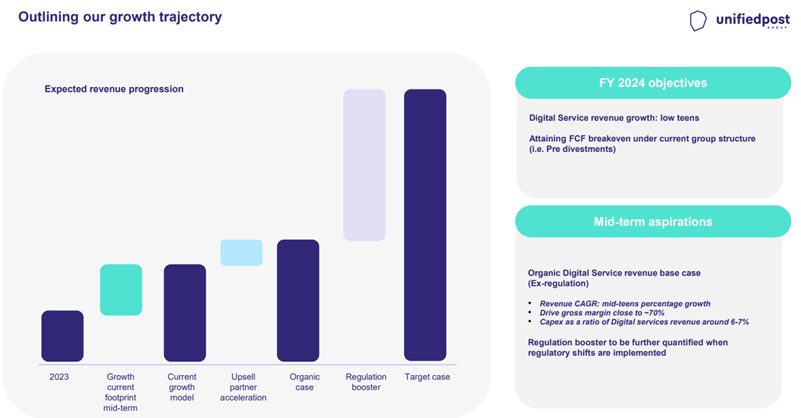

The plan has a focus on achieving and maintaining FCF positivity (exc. working capital benefits), a feat which they have done in some recent quarters but most of the time are well into the negative after accounting for R&D and capex. However, the group has in my belief spread themselves too thin to achieve this in short-order and are set up to achieve this with more reliability once regulatory volume flows through in the coming 3 years via. the mandates mentioned previously. To give you an idea of the growth profile is a slide from their plan below.

With a market capitalisation of €130m and a pre-tax cash balance which is expected to net out post-divestments to c. €40-50m before accounting for contract liabilities. Taking into account that the continuing business generates roughly €90-95m and will be fairly into the red after the divestment of the highly profitable wholesale identity business, it would be relatively prudent to assume that the plan to become FCF positive is likely pushed back a year and they generate somewhere in the realm of 10-20m in free cash outflows in that first year before moving to breakeven or even positive in 2026 following the various mandates going live in that period, and eventually moving towards double digit margins in the medium term (3-5 years). This is the yard-stick I am looking for and would hopefully expect that this proves to be realistic given that their ‘South Europe’ geography has a 24% EBITDA margin and just so happens to be predominately made up of revenues from Serbia, whilst the group also targets a 6-7% Capex target in the medium term.

EDIT 12/10/24:

In the original post I failed to touch on the boardroom struggles the company has gone through with it’s largest shareholder ‘Alycho’, run by Marc Couckes.

Alycho issued a press release in April noting that it would attempt to improve governance by proposing some new directors and trying to remove other directors. These included Jürgen Ingels (shareholder pre-ipo) and Els Degroote (Alycho Principal), whilst trying to remove Stefan Yee (Chair) and Michael Kleindl (director). None of these proposals were accepted but there was a clear divide in the shareholder base which may of lead to the subsequent resignation of Stefan Yee just recently.

The impetus for this was the non-achievement of the group’s IPO business plans with reference to the below:

1. Promises are not kept: the IPO business plan was not realised in any way.

a. In 2023, organic growth of 7.6% was achieved in digital processing, while an annual growth of 25% was promised during the IPO.

b. In 2023, the gross margin of digital processing was 43.2%, while a gross margin of 60% was projected during the IPO

c. In 2023, the UPG generated a negative cash flow of €13.7 million, while it was projected that the cash flow would be positive already in 2022.2. Despite the recent restructuring, costs remain excessive and are not under control. In 2023, total expenses remained at €217.7 million, barely 1% below those of 2022.

3. The financing of the company (often at 11% or more) is very expensive, and makes it harder to reach the break-even point for the Unifiedpost Group. There is moreover a lack of a clear financial plan and the requisite credibility to address the high interest cost (€14.1 million in 2023) in the short term.

CEO Hans Leybaert responded to these assertions in an interview with De Tijd stating the following:

You can hardly blame Alychlo for asking for change? From the outside, you can only conclude that Unifiedpost is indeed not delivering on its promises.

Leybaert: 'I understand the perception. It is true that we are not where we wanted to be at the time of the IPO. We are facing unexpected headwinds, especially due to the suspension of regulation in France, where the legal obligation for digital invoices has been postponed until 2027. If that had not happened, we would have easily fulfilled our promises. But that potential is not gone, is it? That market is coming, also in other countries. A digital tsunami is coming, propelled by regulation, and we are best placed to catch that wave. Over the past four years, we have built a company that will become a leader anyway, if we do not do stupid things now. I can only tell my team that it worked well, I mean it.'

I tend to lean in favour of the CEO throughout these struggles as the company has to me, demonstrated a sliver of what is possible from regulations via. the Serbia result. But, I believe that all of this struggle is going to create a more sustainable way of running the business in the future and look forward to 2026 and beyond.