Today’s post is a highly intriguing business, which is focused believe it or not, on getting those that have come to the end of their careers back into work. An obscure concept made even further bizarre through the use of a franchisee model. This is Veteranpoolen, a Swedish industry leader.

The naming sense is intended to be a replacement for the term ‘employee’ where they state instead

“We call our employees veterans – because they are in the finest sense of the word: people with long life experience and personal maturity.”

~ Veteranpoolen

What incentives are there to work as a pensioner? Well, first, is that there is substantial tax incentives to operate as a one. But first, the Swedish pension system consists of a national public pension, an occupational pension and any savings/assets you may have. The national pension is based on your total income within Sweden you have earned throughout your working life. Therefore, the longer you choose to work, the higher your monthly pension becomes. Furthermore, the system has what is dubbed an automatic adjustment mechanism (AAM), which refer to predefined rules that automatically change pension parameters or pension benefits based on the evolution of a demographic, economic or financial indicator. Sweden has one of the most effective AAM’s in the world, which is also linked to life expectatncy.

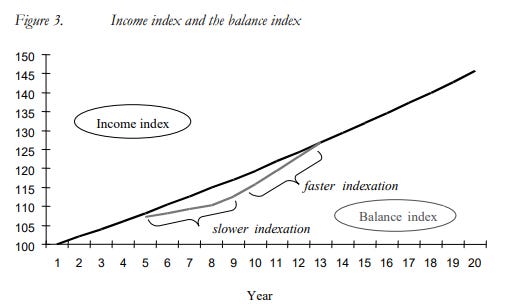

Effectively the AAM utilises a balance ratio of contributions / pension liabilities notwithstanding a so-called buffer fund. It is quite similar to an insurance company in it’s operation. When the balance ratio is >1 the system has surplus and vice versa. If it falls <1 the AAM kicks in they multiply the the income index by the balance ratio, bringing the pension accounts back in line.

That’s enough about the pension system, I was just interested. Coming back around to Veteranpoolen, the target market is these so called pensioners who are on the denominator in the balance ratio. The pension liability so-to-speak. On an individual basis, this may be more or less than they need depending on how much they have worked to date and the concessions they are eligible for. If they deem the pension insufficient, and have no external self-funding available, that is when they can come to consider a franchise such as Veteranpoolen. The concessions for working late in life are immense as shown in the excerpt below:

The Swedish Pensions Agency has published a report on pensions and taxes for 2021 and has also produced calculations on the effect of tax on pensions and salaries for those who continue to work after the age of 65. It found that delaying retirement is beneficial for several reasons, including the obvious that those who work longer will continue to build up more pension rights.

Individuals that continue to work also receive a more favourable tax deduction on their pension if they wait to withdraw it from the January of the year they turn 66 in. From the year a person turns 66, income tax on salary is also lower. The Swedish Pensions Agency said another advantage is that time spent working with a salary usually means having a higher income than if they were to be living on just a pension.

“From the year you turn 66, and on income up to SEK 437,000, you can actually say that the tax is negative. You then pay less in tax on your salary than the pension right you receive on the same income,” Swedish Pensions Agency analyst, Stefan Granbom, said.

In addition, Swedish Pensions Agency analyst, Hannes Nilsson, said that few people know how much more money you get from working later in life.

European Pensions - Sweden reduces taxes for pensioners and employees over 65

Thus, we get to the key driver for Veteranpoolen’s absurd growth with 1.1m billable veteran hours in 2022 up from 0.42m billable hours in 2016, almost 3x greater in a 6-year period, volume growth of 17.4% p.a, which compares to revenue growing from SEK 149m to SEK 482mm, compounded growth of 21.6% meaning we saw low single digit price growth as well. Lastly, this is done in a highly profitable manner with returns on their capital averaging about 86% over the 6-year period. Well then, you’d ask yourself surely the business is expensive right? Not really, with the business being at an LTM PE multiple of about 14-15x which in light of their 22% 5y earnings CAGR and a 6% dividend yield, is just a tad above the hurdle. Veteranpoolen is henceforth intriguing to look further. into.

Now I leave you with an image to think about…

One additional key driver is I believe that a lot of people want to continue working from time to time.

This one is very cool, I've been studying HireQuest for weeks so this was ideal timing. Thanks mate