Wrkr is an Australian regulatory software business founded in 2009 which helps employers with the various compliance moments for their employees such as superstream contributions, Single touch payroll (STP), employee onboarding and so on. It is a business which predominately offers its solutions through the larger corporates and APRA superannuation funds across millions of employees at a very low average ticket size. It is one of just 9 gateway operators on the Superannuation Transaction Network (STN) and one of 9 ESA providers (only 5 including Wrkr can process rollovers and release) in the country. Furthermore, the company has one of few ‘Non-cash payments’ AFSL’s as well.

Initially the business was known as the Payment adviser group and was founded by Robin Beauchamp and acquired Clicksuper in 2013 before listing on the ASX in 2016 as InPayTech. From here it had an awful run as the company as it struggled scaling its revenue up until 2021 when ComplyPath was acquired. Complypath was formerly known as the ‘Bond’ platform and was conceived within PwC Australia to improve employee onboarding and manage single touch payroll for its employee base. ComplyPath was a game changer for the business which was generating on a standalone basis more than double the revenue of InPayTech. An independent expert report at the time of acquisition had gone so far to say that the combined business was capable of EBIT margins north of 40% in the long term, contingent on increased revenue at a fixed cost base at maturity.

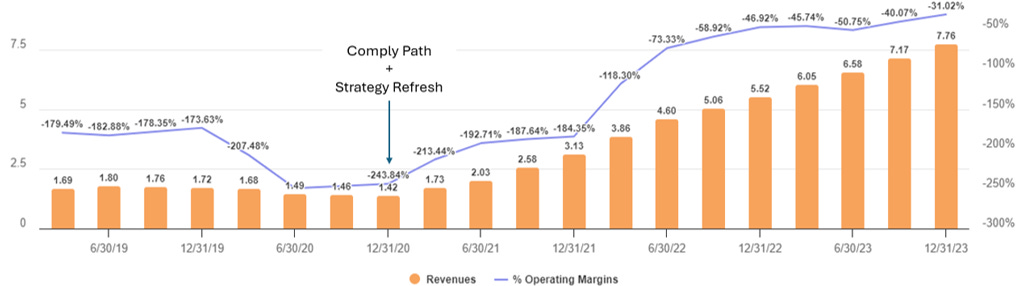

As part of the above deal the InPayTech business gained the current CEO Trent Lund as a non-executive director who was a partner at PwC for 11 years leading the innovation and new ventures part of the firm. It wasn’t long before Trent was appointed interim CEO in April 2021 and launched a strategic refresh in June 2021. This appeared to be a turning point for InPayTech with 4 key pillars being to capitalise on the Comply Path platform and payments IP within InPayTech whilst moving to a single brand (Wrkr), increase depth in the ecosystem, and to move towards higher value compliance moments (Wrkr Ready), and to innovate and partner for future value. Rolling LTM revenue and operating margins is shown below:

From here Wrkr has gone from strength to strength with major contracts announced with Beam from Precision (Reckon uses this clearing house) Consortio, Link Group, and KPMG. But before this I should mention that throughout this time the business has been burning cash and diluting shareholders, most of which related to actions before and including the Comply Path acquisition, but the looming overhang is in the form of a convertible note that the company issued in late 2022 which has a variable component which converts at a 20% discount to a ceiling price of $0.039 and floor price of $0.018 per share. At the floor price the notes are converted to 183m shares (~15% dilution) and 85m shares (~7% dilution) at the ceiling price. It matures on the 4th of October 2024 and the company is exploring avenues as to how to deal with it which I have been told will be conveyed with the FY24 results since it would be a key audit matter. For reference the company is very tightly held with Trent owning 20%, CTO Joe Brasacchio owning 20%, and Ex Chairman Donald Sharp owning 15% with the top 50 shareholders all together owning 85% with very little movement.

Fortunately, Wrkr has been piloting the Wrkr platform with Rest Industry super (with potential for more APRA funds) under the Link Group MSA (3y contract with options to renew for 2 additional years) which has a $3m minimum contract value over 3 years with substantial upside as the platform is rolled out to include compliance events, which could average $7-8 per employee across an estimated 1.4m accumulation phase members just in Rest alone ($11m revenue opportunity), there is substantial additional upside should they implement with other large funds in the Link Group which administers over 6.5m members. To give context, ASFA has data that shows employer contributions totalled $128.4 billion for the year across 22 million members, which if you were to apply $7-8 per member of Superstream cost it equates to a rate of 0.12%-0.14% of all current contributions. If you compare this to something like a merchant fee for credit cards, it is clearly insignificant.

This isn’t even considering the upcoming implementation of ‘Payday Super’ whereby Super will be paid at the time wages are paid (currently 28 days after each fiscal quarter end) which will increase the number of Super events in Australia from 160m p.a. to 500m p.a. where Wrkr gets ~$0.20 in revenue on each event. Furthermore, there was a recent launch of Wrkr Ready through KPMG for employee onboarding. KPMG has approximately 10,000 staff in Australia and Wrkr Ready has a revenue per employee of anywhere from $22 - >$100 per year so it could drive anywhere from $0.2m to $1m in revenue for the group. There is also the prospect of their current work with Link in hong kong expanding further, and the UK as an early DC pension market as well.

I expect this to largely be done in a fashion whereby Wrkr can grow its revenue at a significantly faster rate than its costs. The company is targeting positive EBITDA in FY2025. I see the possibility for the company to have >$30m in revenue and >$6m in NOPAT within 5 years which would reflect post-development super contribution revenues for Rest Super and perhaps an additional fund such as Australian Super or CBUS which are both under the Link Group umbrella. However, I am aware that even with this substantial growth opportunity there is reliance on large contracts, risk of possible future financing requirements, and a relatively expensive ~3.5x FY24E EV/Revenue. It is cautiously sized to start out with further ability to add as the fundamentals become more certain.