Xplore Wealth is one of Australia’s leading independent platform providers and investment administrators. Established in 2004, they deliver platform, administration and technology solutions to some of Australia’s leading stockbrokers, wealth managers, and financial advisory firms

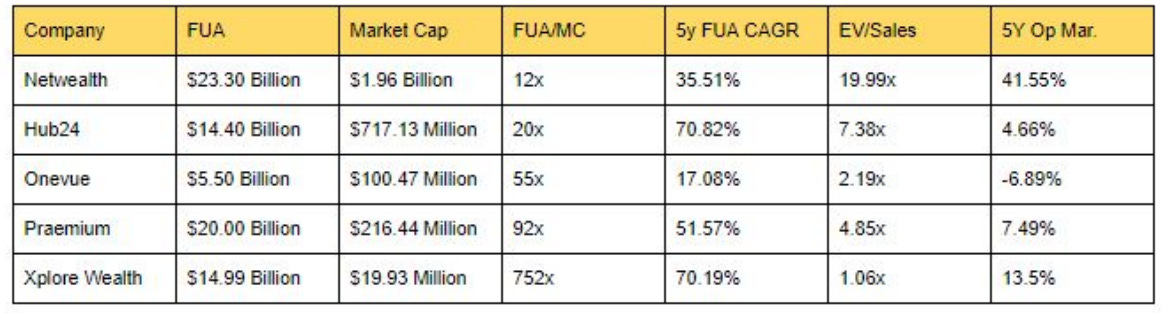

What stood out to me first with Xplore Wealth was the market cap relative to Funds under administration (FUA). Below is a comparison between the main competitors in the market.

This begs the question, why is there such a huge discount on offer for Xplore Wealth despite FUA growth rates at the top of the cohort? This comes down to the operating margins which as you can see, it’s clear that Netwealth is a strong leader here in operating efficiency, but to our surprise, the next best is Xplore Wealth, the cheapest of the pack by far.

Furthermore, a comparison of the pricing structure of Wrap accounts indicates that Xplore wrap is the cheapest of the cohort, which makes sense given the market positioning.

Xplore Wealth has not been wasting this opportunity though, prior issuance of shares has seemed to change it’s trajectory. Last year the company opted for buying back 2% of the float in the company. Not particularly impressive, is reassuring from a capital allocation viewpoint.

In addition to this, the CEO has been steadily purchasing shares, now at over 1 million shares (~$70k). Nonetheless I believe the growth and pricing of this business is highly asymmetric so i have decided to take a small position in the business.