About

Yowie Group Ltd is a global brand licensing company specialising in the development of consumer products designed to promote learning, understanding and engagement with the natural world through the adventures and exploits of six endearing Yowie characters.

Educating children and adults about the environment and ecology is at the heart of the Yowie proposition.

Yowie Group employs its company-owned intellectual property rights in the outsourcing of the manufacturing and distribution of the Yowie chocolate confectionery product and in the development of a Yowie digital platform and Yowie branded licensed consumer products.

Yowie Group Ltd was first listed on the Australian Securities Exchange in December 2012 under code name ‘YOW’. The Company’s registered head office is in Perth, Western Australia.

Strategic Focus

The Company’s vision for the Yowie brand includes distribution of Yowie product in North America, with further expansion planned into Australia, New Zealand and throughout Asia, where the Yowie brand is known and brand equity remains strong, even with the brand not having been active in the market for around eight years. Expansion into Europe and the Middle East are key strategic priorities for a second-stage brand rollout

Financial Performance

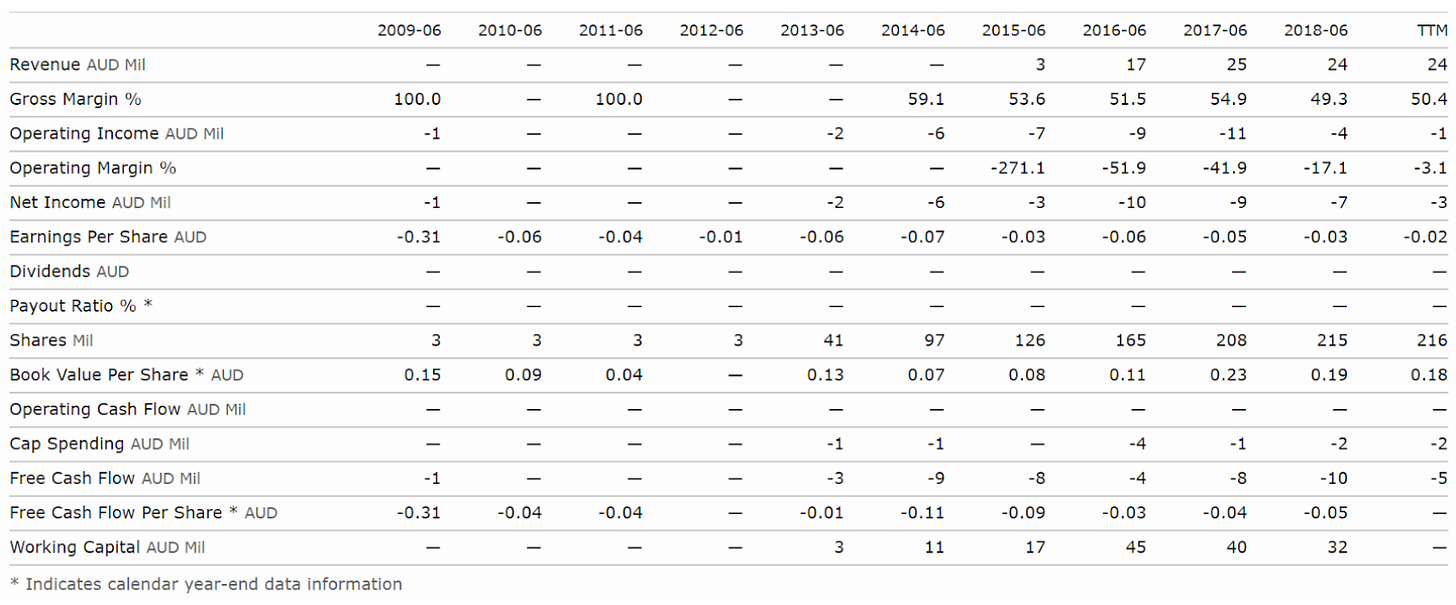

As Yowie listed in 2012, any years prior are not of priority given their private shares. So, looking at it from 2013 onwards, we can see a consistent loss each year, along with this, their is a growing amount of shares on issue. The key figures that initially striked my interest is the book value per share and the operating margin as a potential Deep Value Stock.

Cigar-Butt Investing

To introduce the concept of cigar butt investing Mega investor 'Warren Buffet' quoted the following in his 1989 shareholder letter:

“If you buy a stock at a sufficiently low price, there will usually be some hiccup in the fortunes of the business that gives you a chance to unload at a decent profit, even though the long-term performance of the business may be terrible.

A cigar butt found on the street that has only one puff left in it may not offer much of a smoke, but the ‘bargain purchase’ will make that puff all profit. Unless you are a liquidator, that kind of approach to buying businesses is fooling. First, the original ‘bargain’ price probably will not turn out to be such a steal after all. In a difficult business, not sooner is one problem solved than another surfaces - never is there just one cockroach in the kitchen. Second, any initial advantage you secure will be quickly eroded by the low return that the business earns”.

So in summary, a cigar butt investment constitutes a stock that is a bargain at it's current price, however one must be careful not to buy into a business that is burning through it's assets at an alarming pace

Benjamin Graham Style Valuation

"Bargain at it's current price"

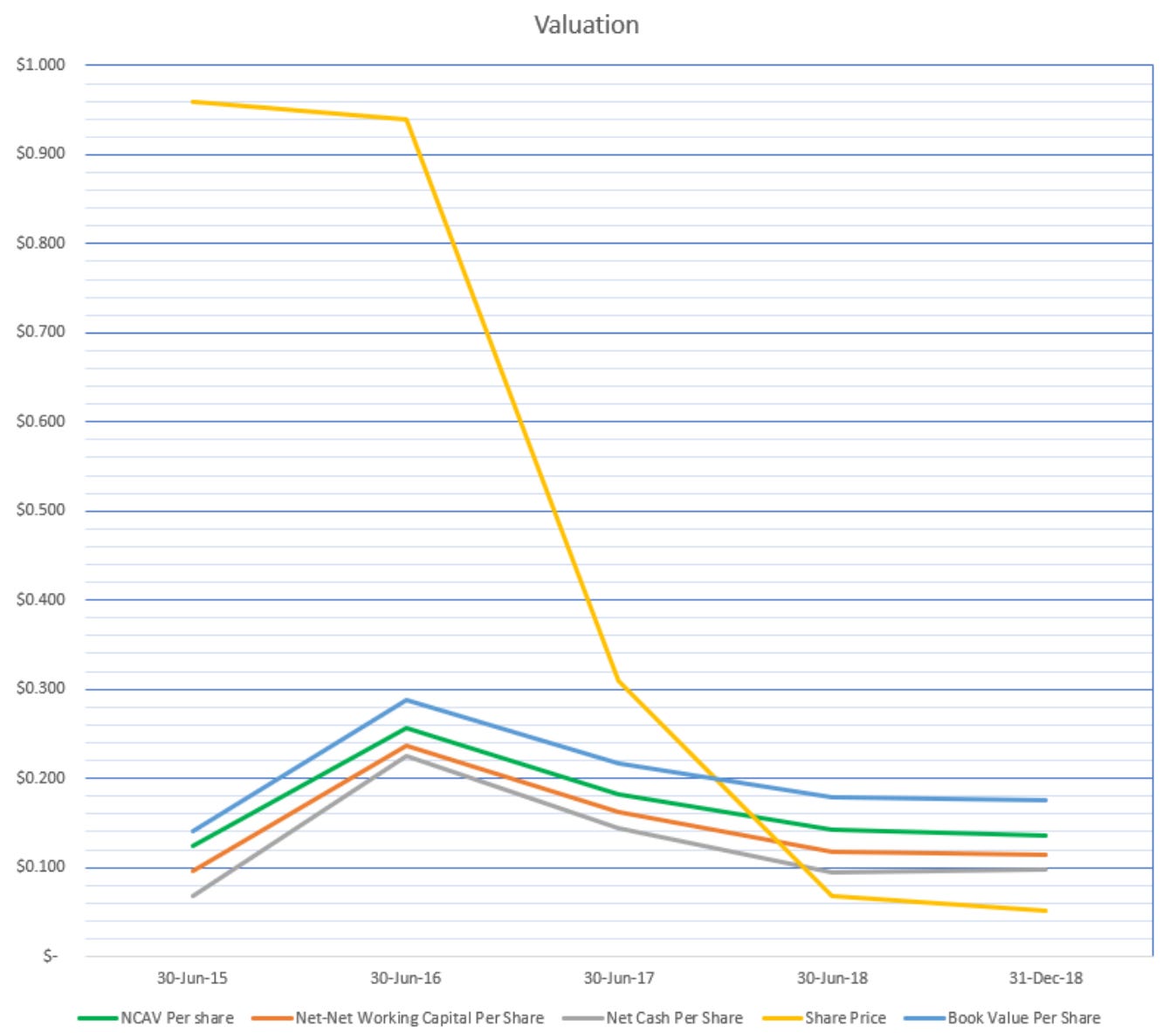

Yowie is currently trading at $0.052 per share as of 1 July 2019. As illustrated in this accompanying chart, that is significantly below all of the conservative valuation methods Benjamin Graham has illustrated in his publications. Links to what they mean will be included in the bibliography.

Potential Catalysts

To further illustrate Yowie's cheap share price, their has been 2 acquisition offers from Keybridge Capital Limited and Aurora Funds Management Limited significantly above the current share price, of which Yowie has declined. This attraction to the stock as a takeover opportunity is attractive as a potential catalyst to unlock the underlying assets of Yowie. Keybridge Capital has as of 2 June 2019, called a General meeting to remove 3 of the current directors. This could be big for shareholders.

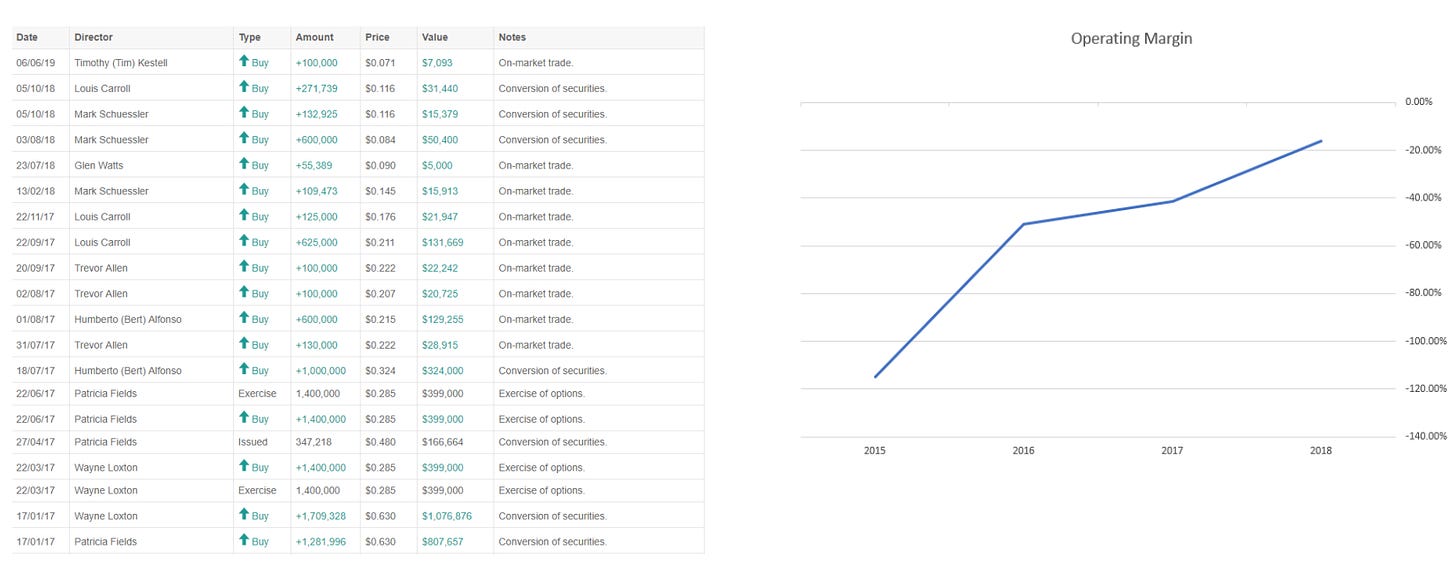

In addition to that, directors remain very confident in the future of the business, only ever buying stock as well as declining both acquisition offers.

It could be the case that given the asset value of $0.1256 per share, the directors are waiting for an offer at least above that price.

Yowie has significantly reduced the degree of non-profitability in the last few years, with a clear strategic vision for the group which involves prioritising positive revenue, cash flow and EBITDA performance along with new products and diversified operations.

If it remains on it's current trajectory, Yowie could return to profitability.

Risks

Yowie has been in negative earnings territory ever since it listed, It could continue to struggle and continue to make losses, declining the value of assets and bringing it closer to the share price.

Management can continue to decline acquisition offers with a large premium on the share price.

Liquidation/Voluntary administration. Given the poor operating performance, there could be a chance that Yowie brings on an administrator to take over operations.

Conclusion

While Yowie does look like an extremely good bargain, as the company is still distressed, i am only comfortable exposing a small portion of my portfolio to this opportunity. Should it pay off Yowie could offer extreme returns on investment, however, it is not without risk. If i have not sold the stock, The review date is 01/07/2020.