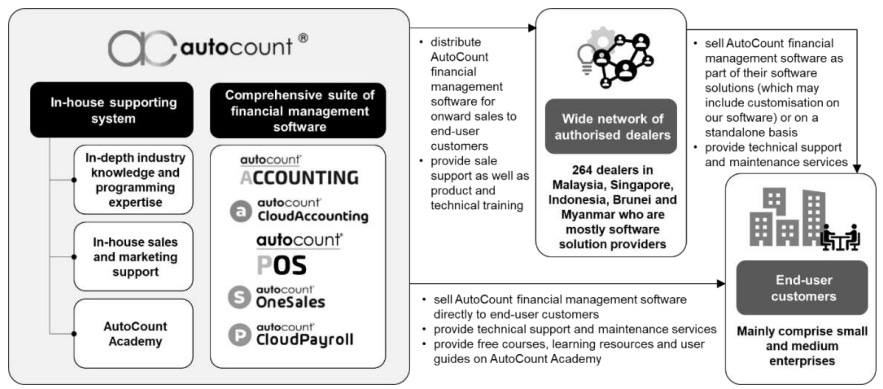

With the introduction of access to the Malaysian Bursa on Interactive Brokers I was pleased to be able to look further into Autocount in preparation. Autocount was founded in 1996 and has the largest and fastest growing accounting software in Malaysia. The founders were existing executive directors Choo Chin Peng (CCP) and Choo Yan Tiee (CYT) along with another who has moved on. For background on these two I recommend reading this article.

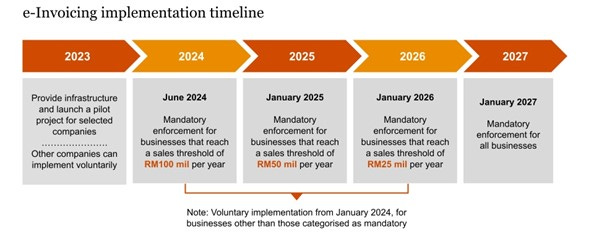

The company has a focus on using their IPO proceeds on expanding their existing presence in Singapore along with other ASEAN countries such as the Phillipines, Indonesia, Thailand, and Vietnam. However, these initiatives have taken a back seat whilst the company prepares for the impending e-invoicing mandate which CYT mentioned in the above article that “it will likely involve more businesses than the GST”. For some context here, Autocount upgraded its software to account for the introduction of GST in Malaysia in 2013 which saw the firm increase it’s sales by 458% in the following 2 years from RM6.8m to RM37.8m, a compound annual growth rate of 136%. Thus, to say that e-invoicing will be larger is a bold claim and is clearly an opportunity for the group.

Shown above is the timeline for implementation, which you will see has already begun. However, Autocount has been offering SIGNIFICANT discounts on its software offerings with discounts of 65% and 75% on a 12mth or 24mth pre-purchase of the Cloud Accounting software and 35% on v2 of their pre-packaged software which is compliant with e-invoicing. The company has an overwhelming % of it’s revenue that comes from pre-packaged software as opposed to cloud accounting software, which is an opportunity for the future but relevant to discuss for another day. The point is, that Autocount is undercutting prices to onboard clients significantly.

Despite the nature of perpetual licenses, Autocount has seen consistently strong revenue growth due to the increasingly digitised Malaysia economy. In the 4 years leading up to the float the company sold 5-6k perpetual licenses per year, but their cloud accounting business sold 91, 1,183, 2,140, and 2,326 respectively, showing a significant business mix shift which should only accelerate. They have managed to do this whilst only investing a very small % of revenue in either marketing or R&D, showcasing the underserved nature of the market and regulatory tailwinds which allow them to grow ‘scot-free’.

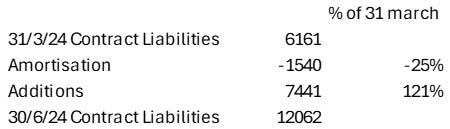

Coming back to e-invoicing, in their Q2 2024 earnings release the company posted YoY revenue and earnings growth of 53% and almost doubling net profit, attributing much of this success to the ‘substantial uptake’ from e-invoicing, registering over 6,000 new companies during the quarter. Despite the significant discounting going on, even after allowing for a straight-line amortisation of last quarter’s Contract Liabilities balance the group has doubled, with contract liabilities of 7.4m, which I would suspect is a multiple or 2 of this if not for the discounting going on, depending on the renewal rate after the promotional period.

Thus, there is significant potential for the company not only from an onboarding perspective, but also from a pricing, margin, and shift to SaaS perspective over the next 3 years, but even longer term as well. I wanted this pitch to be short and sweet, the company trades at MYR 0.96/share, has 0.10/share in cash, and earned 0.03/share over the past 12 months, putting it on a 29x EV/NOPAT multiple, but for the reasons discussed I think that even this multiple will prove to look conservative in the future.

Thanks for the writeup. quick questions if I may:

1. do you know if Xero/Quickbooks etc are in Malaysia or planning to enter into Malaysia?

2. do you know if malaysian uni teachs or uses Autocount software in accounting courses? (this is a great way to plant the seed for future users)

3. who are their competitors? and do you have market share information?

Not familiar with the stock (although I have been in Malaysia many years FYI the Edge here and in Malaysia are fantastic papers for local business news...) - I linked to your writeup in my links collection post for today: https://emergingmarketskeptic.substack.com/p/emerging-markets-week-october-14-2024