Executive Summary

UK Listed Software holding company with an impressive product suite of document management related products.

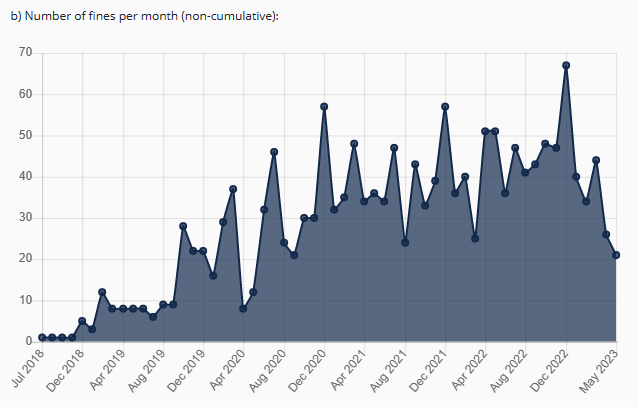

Benefits from favourable data privacy trends with regulatory pressure for increased GDPR style regulation across the globe.

Very illiquid with 30% of shares not in public hands and trading volume of just 13% of all shares in the previous 12 month period, equivalent to a daily trading volume of £17k.

Highly valuable Virtual Cabinet product produces operating margins of ~50%, masked by capital re-allocation into 2 pre-revenue products and an extremely fast growing Smartvault product in the US.

Negative working capital revenue model with 70% of subscription fees received annually in advance and access to the appealing UK R&D Tax credit system.

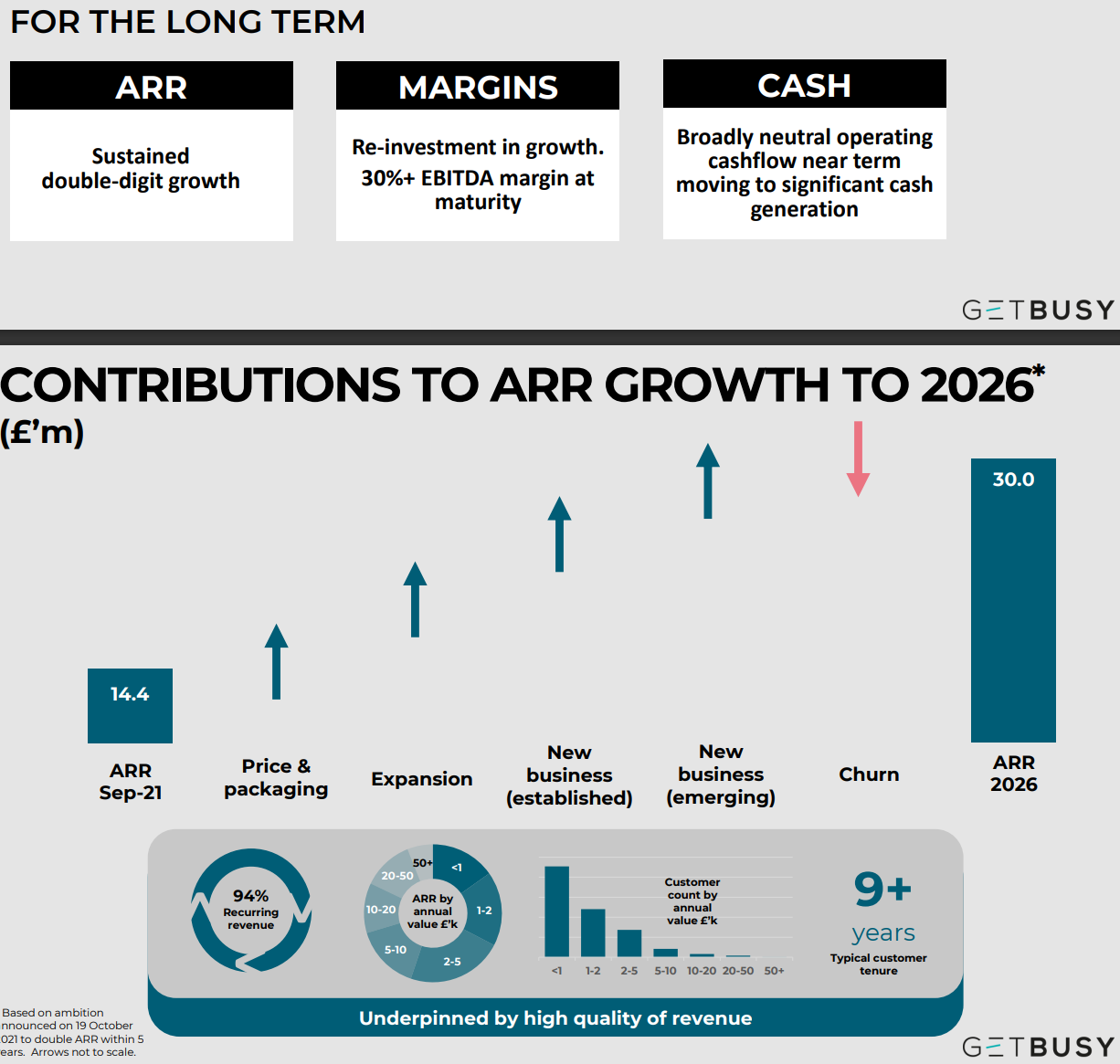

Getbusy is currently trading at ~1.5x EV/ARR, with peers commonly transacting at 4-5x greater prices. Management has highlighted that the group could potentially generate 30% EBITDA margins at a steady-state which would price this at ~5x EV/EBITDA.

Company Brief

Getbusy (LSE:GETB - £32.3m Market Cap) is a holding company for a group of software companies providing productivity software for professional and financial services. The company operates in a several core products, Smartvault, Virtual Cabinet, Workiro and Certified Vault.

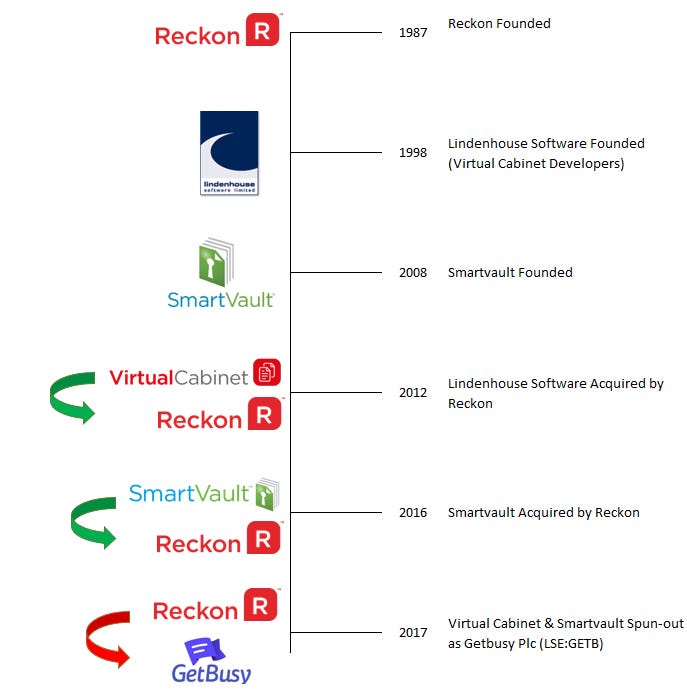

Getbusy as a PLC has only existed for slightly over half a decade, as it was brought to fruition by it’s predecessor company Reckon Ltd (ASX:RKN). The events preceding the formation of Getbusy are shown in a timeline below:

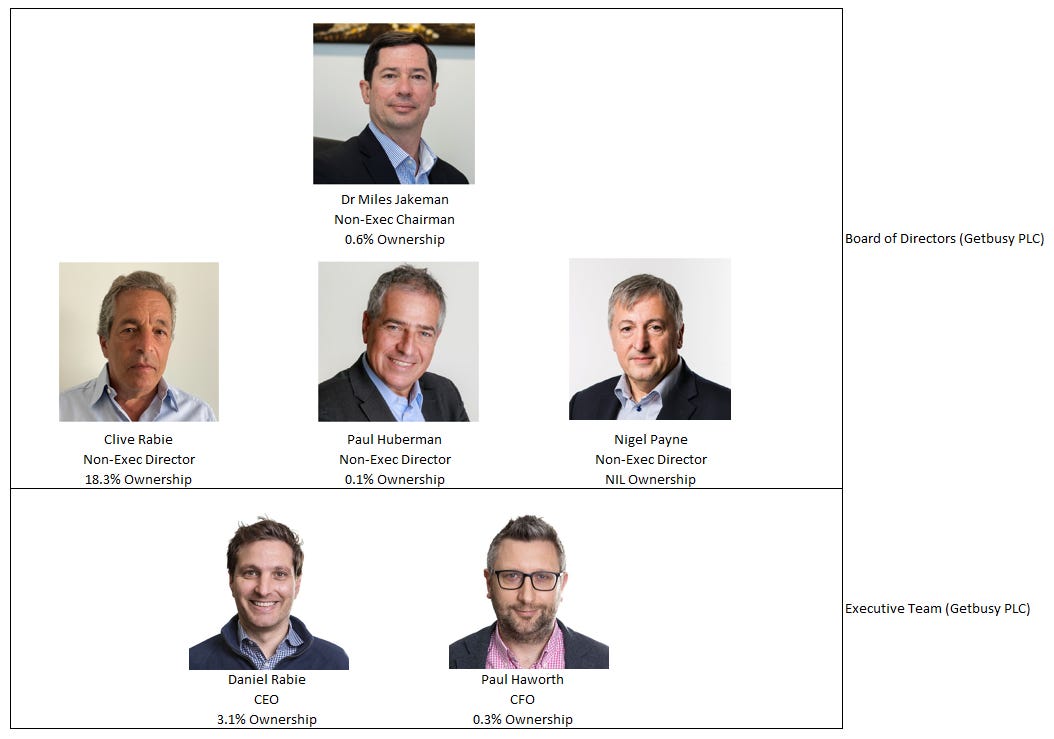

The Rabie Family own the most shares in Getbusy by a landslide, with Daniel and Clive accounting for over 20% of the issued capital of the company. Other members of the board and executive team make up an additional 1% of the company.

It’s worth noting that in addition to those named above, Reckon Founder Greg Wilkinson also retains a 7.4% stake in the company, making him the 4th largest shareholder and 2nd largest individual shareholder. Other notable shareholders include the UK based Business Growth Fund (BGF), Herald and River and Mercantile with 14.0%, 5.8% and 5.5% respectively. Although I would note that the Getbusy holding for the last 3 funds are all minimal in relation to the overall assets they manage.

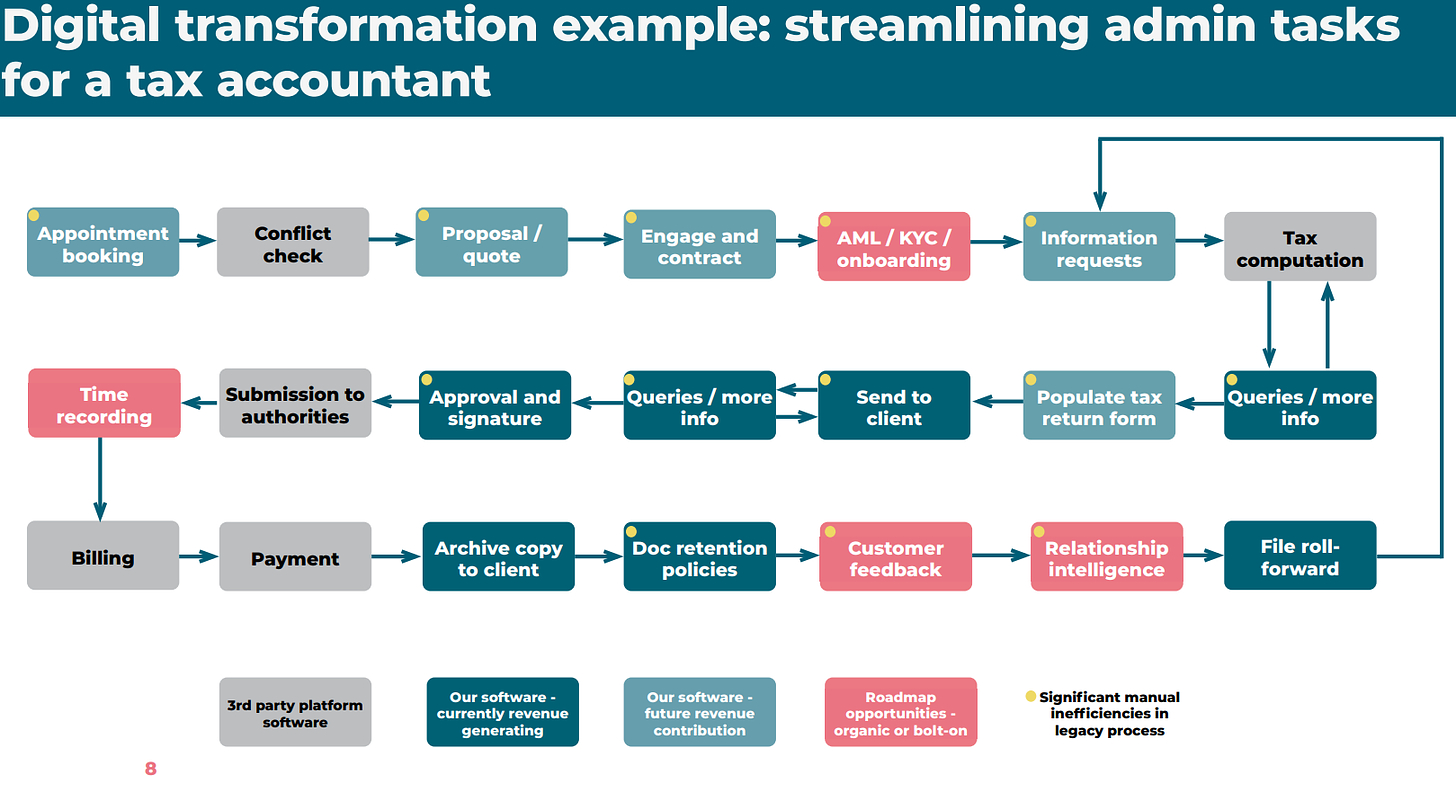

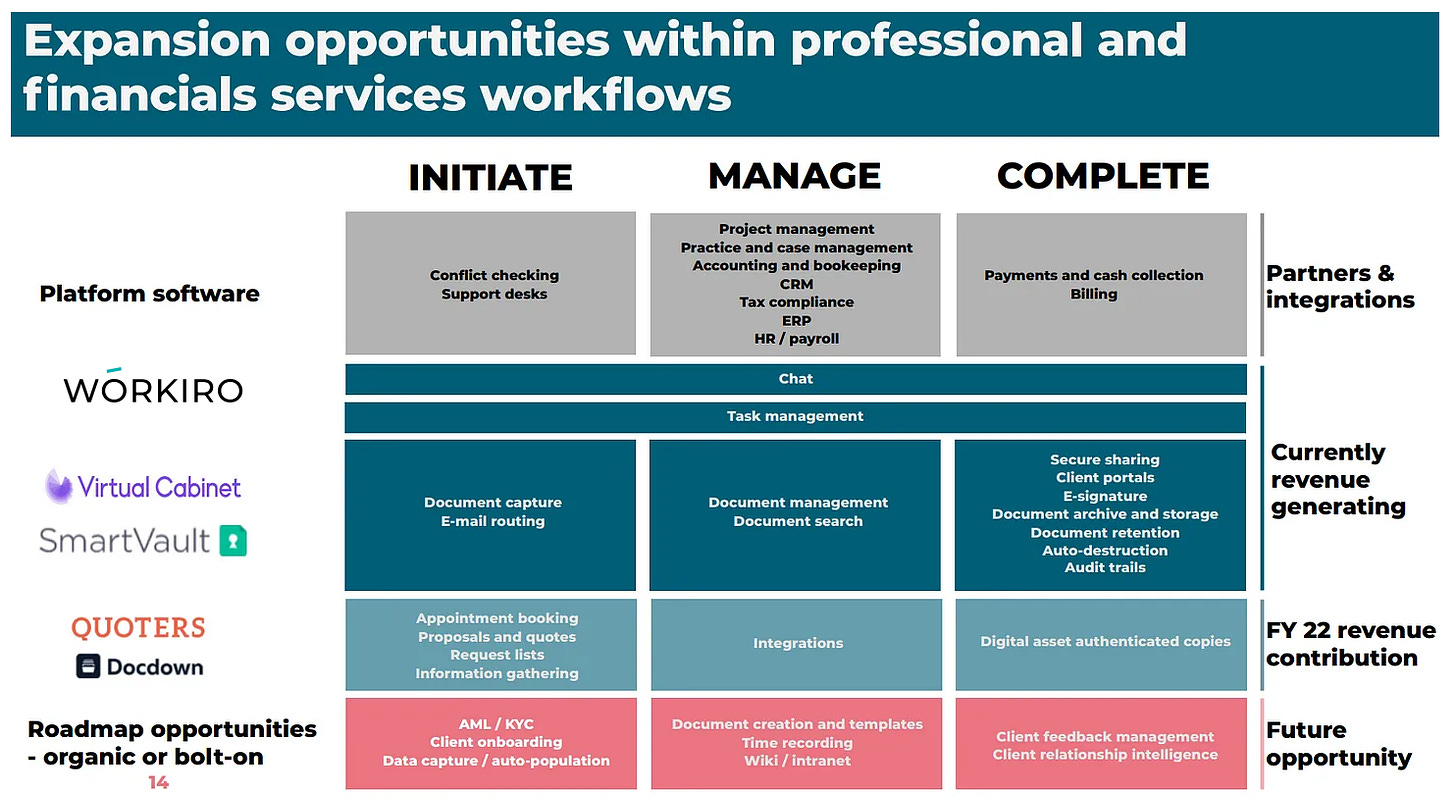

Before diving further on the specific products I wanted to note the core customer of Getbusy is typically a professional accountant. These Accountant’s typically deal with significant amounts of highly personal information and require a structured and secure document filing system in order to operate. Furthermore, these systems need to accommodate to the usual workflow as shown above.

To do this, Getbusy has a suite of products where they are specifically attempting to increase their exposure to each individual touch point of the job matter process. I will touch on each individual product below.

Established Products - Virtual Cabinet Overview

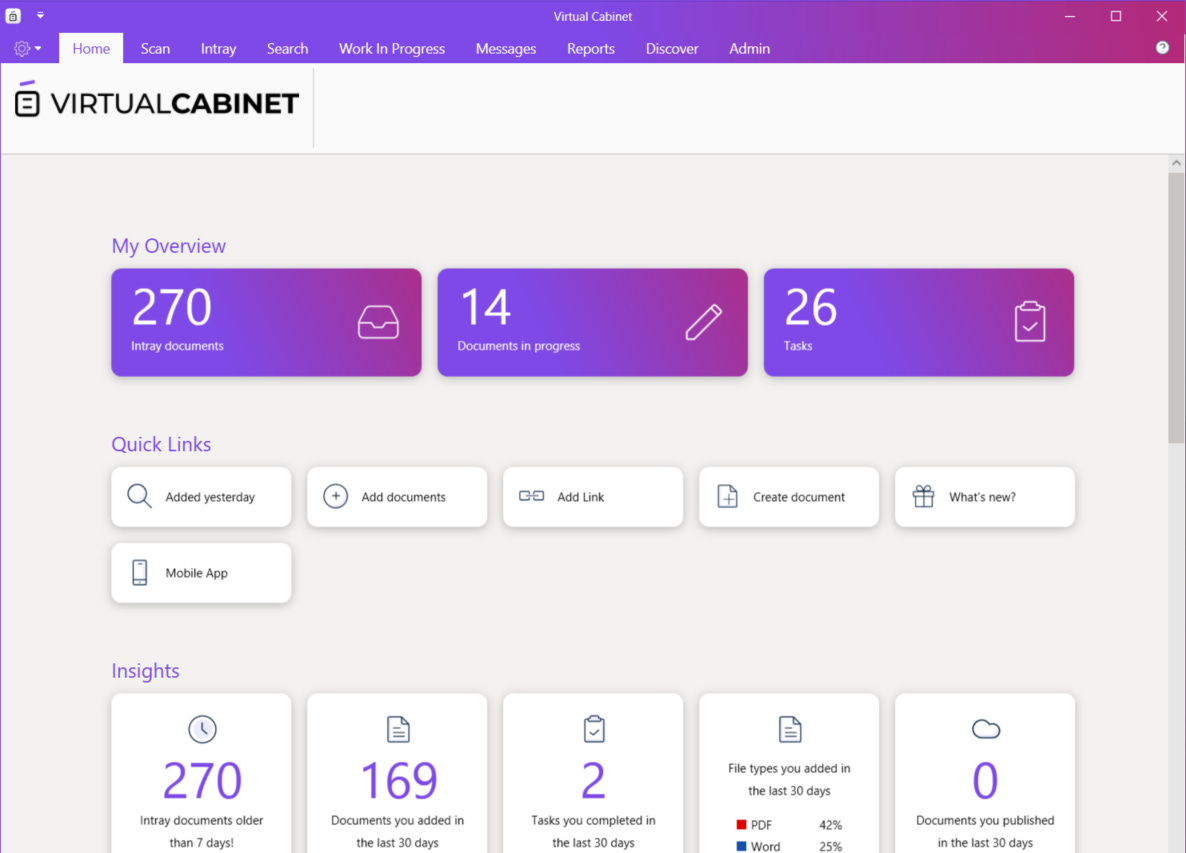

Virtual Cabinet is the oldest product under the Getbusy umbrella. Originally developed by Linden House Software, a business based in Cambridge, UK. The below video outlines the core functionality of the product, despite it being a bit old.

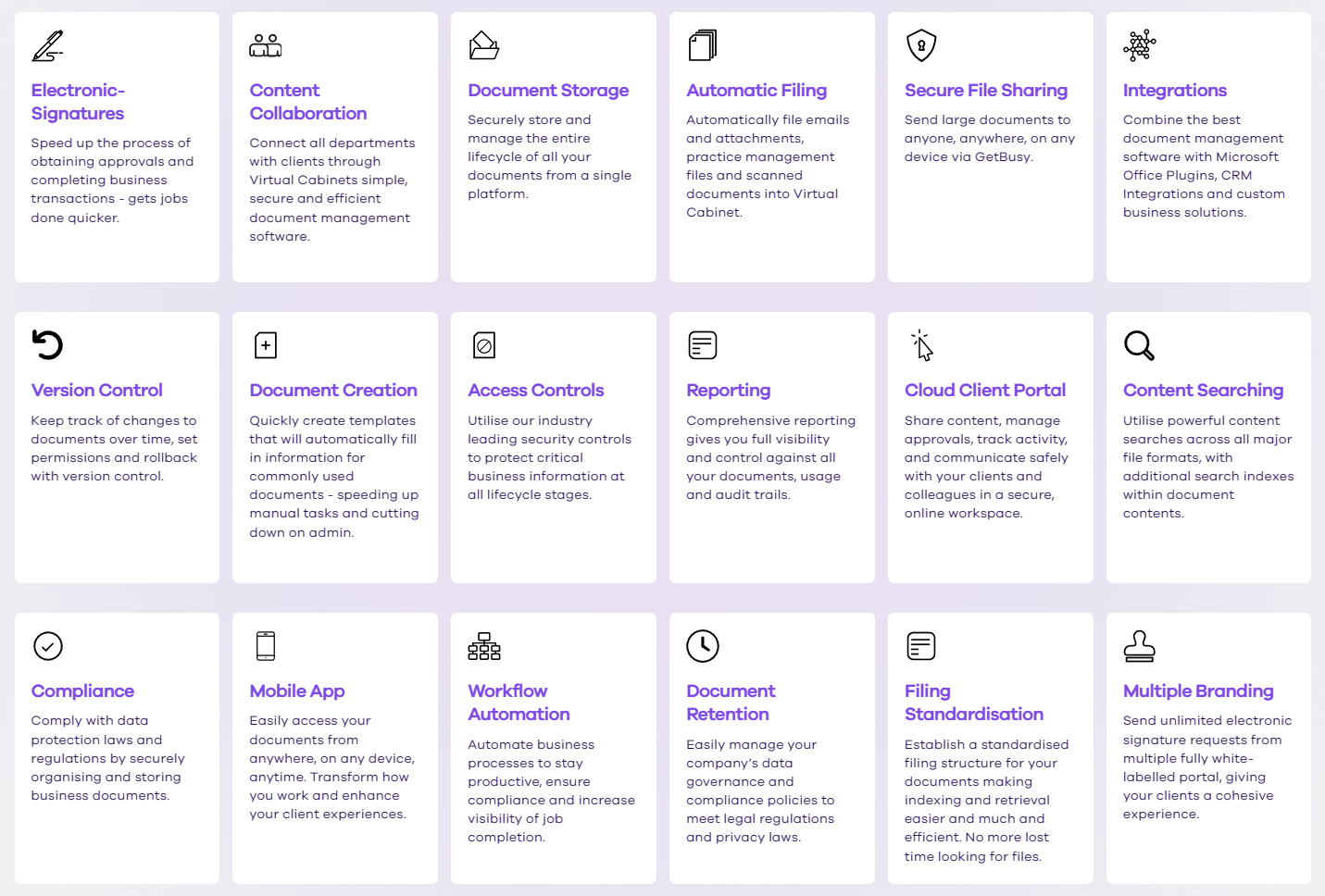

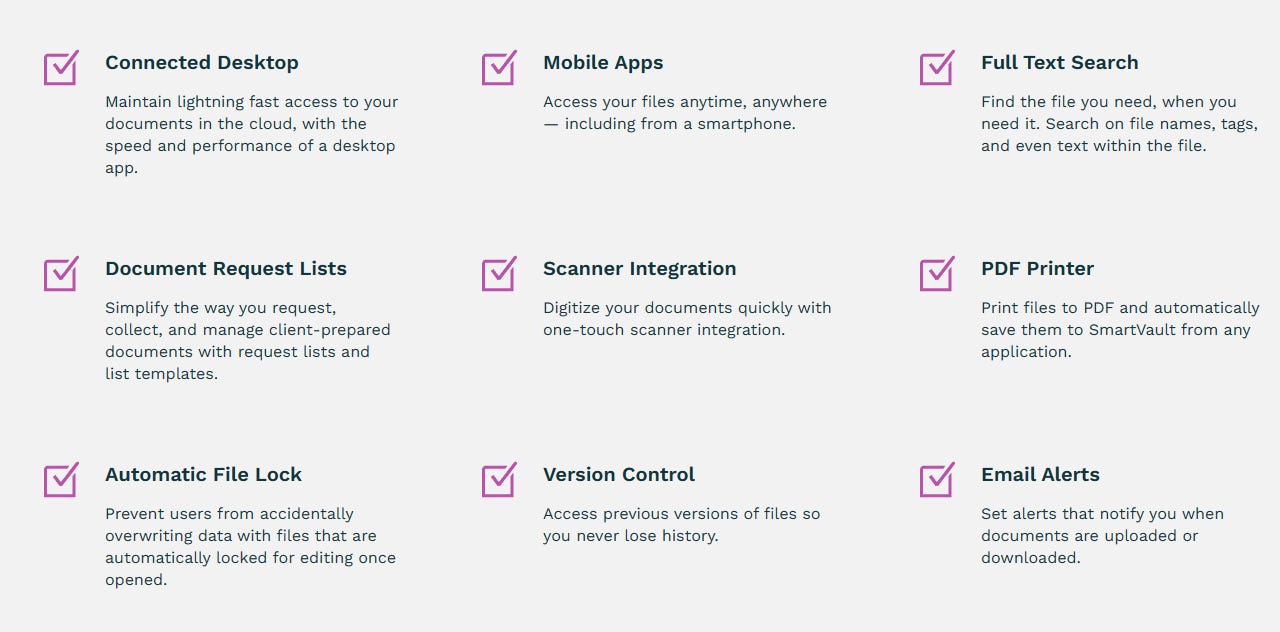

On a more granular level there is a swathe of features, including the ability to collaborate, auto-file, version control and e-signatures among other things.

Another extremely important trait of the Virtual Cabinet offering is the multitude of integrations they offer. This covers anywhere from the obvious Outlook plug-in to various accounting software and more niche things such as ATOmate, CAS360 and Turnkey IPS. All-up there is 60+ integrations as per their website at the time of writing.

Historically, Virtual Cabinet has been an “On-premises” solution, meaning that it was typically installed on a physical server for use across the firm.

Virtual Cabinet has addressed this in recent years with the development and release of VC Cloud. This allows users to do away with the remote desktops of old (Citrix I’m looking at you) in Favour of faster, more efficient methods of accessing secure firm files. Seriously, I mean it… it is significantly faster without having to go through a local server. Furthermore, there is a companion app which allows for quick and easy access on mobile devices.

The last thing I wanted to touch on to greater effect is the ‘signatures’ part of the product. The value of this cannot be understated. Instead of having to add another provider to the software stack, such as Docusign or Annature, Virtual Cabinet allows you to fill out the signatures in the platform and because it is already within the platform, there is no need to re-file a signed copy.

I will let you explore the website for more features, as there is really quite a lot of them, and to go through them all would be beyond the scope of this deep dive.

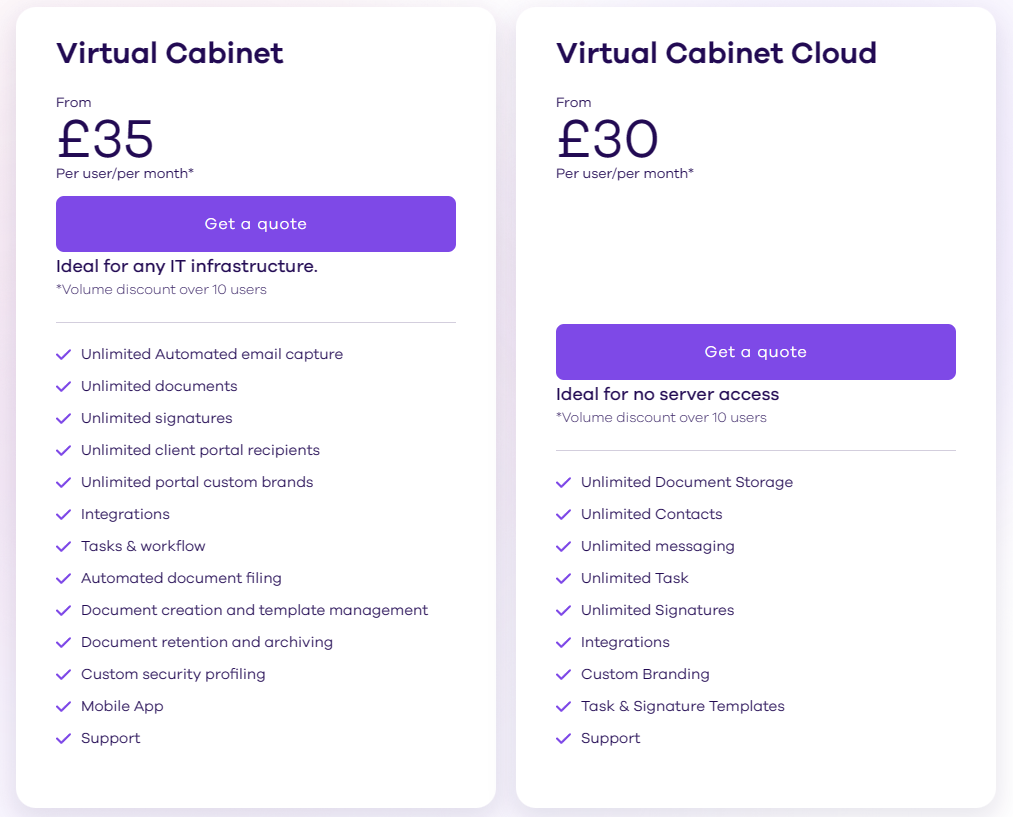

Lastly, regarding pricing Virtual Cabinet starts at £35 per user/per month and £30 for the cloud version. This doesn’t include the potential for volume discounts when the purchaser will have >10 users. If you take into account that the average employee in an accounting firm is billing >200x this amount, it seems like a small impact on firm profitability for what you get in return.

Established Products - Smartvault Overview

Smartvault was founded in 2008 by Eric Pulaski & Dania Buchanan and subsequently acquired by Reckon in 2016 before the Getbusy demerger. Much like Virtual Cabinet, Smartvault has the same core functionality as an online document storage solution with many different integrations.

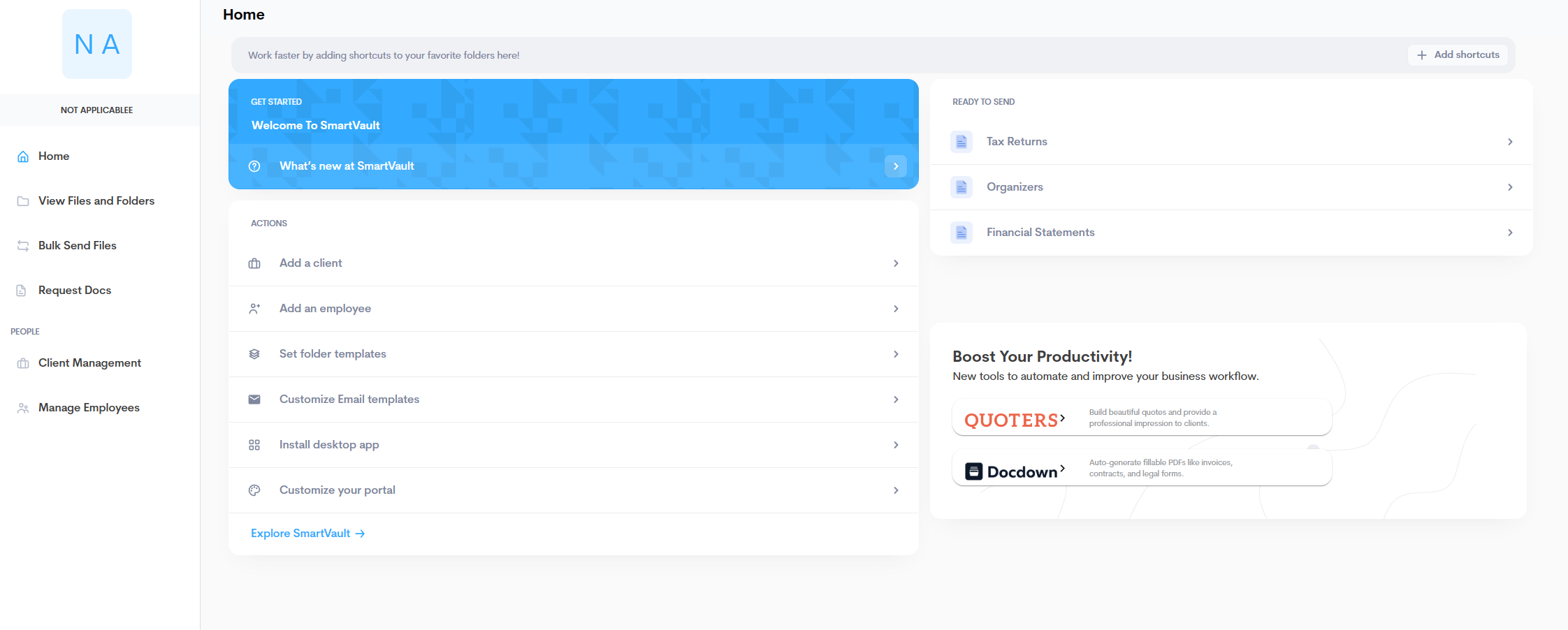

Smartvault offers on its website the opportunity to commit to a free trial, so I took the opportunity to log on and try out the product, as I have used Virtual Cabinet, but not Smartvault. It’s quite different to Virtual Cabinet, which is a testament to the decentralised nature of the business. Getbusy is really a holding company for these businesses, but I see little to no synergies between the 2 businesses. For example, as opposed to Virtual Cabinet, Smartvault has chosen to partner with Docusign to provide e-signatures with the rationale of it making more sense to do instead of developing a native solution.

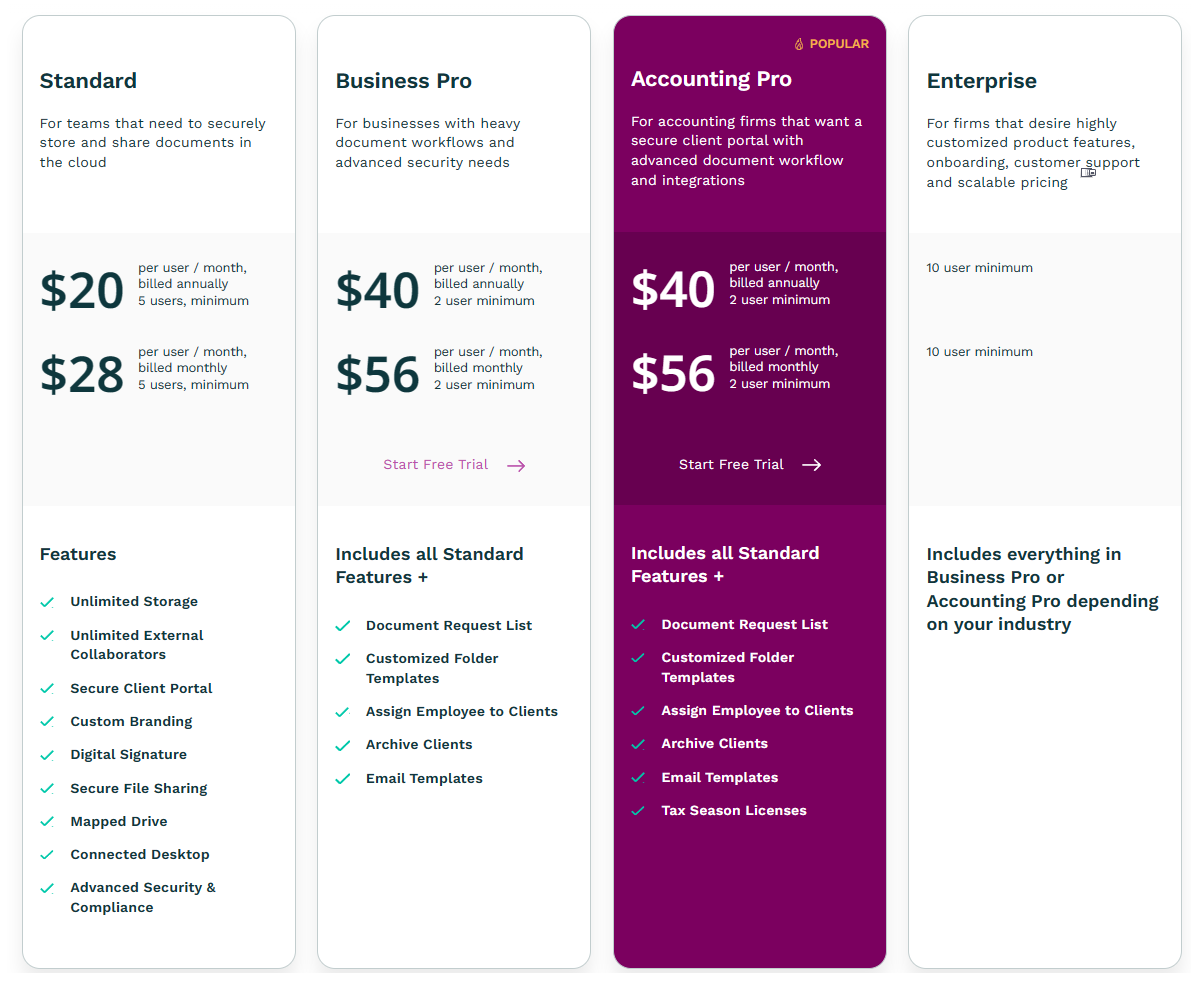

Smartvault however, is targeted towards a smaller firm as opposed to Virtual Cabinet with the average firm having fewer users. This is reflected in the pricing, with minimum user thresholds to ensure no micro-accounts for the business.

Again however, this pricing is but a small fraction of the revenue these users can bring in, the value given by a software such as Smartvault is multitudes of it’s pricing, especially when you consider that for example, an accounting software is priced per entity, a genuine “cost of sales” for the firm. Smartvault is priced per employee, and most employees have a few dozen clients they would look after, which would have a few entities under itself as well, meaning that the leverage of entities/users would again be probably 50-100:1. When taking into account that the most popular Quickbooks Online plan in the USA is also priced at nearly double that of Smartvault, Document management software is a fraction of the cost of an accounting software to an accounting firm, in conclusion.

Emerging Products - Workiro (Previously Getbusy)

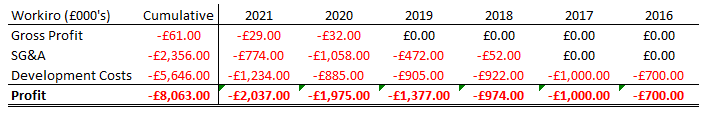

Perhaps, the biggest reason to love or hate Getbusy as an investment, is their historical development of Workiro, which has been in development since the business floated, and yet to really demostrate product market fit, with the cumulative spend being estimated to be in excess of £10m, with actual data through to 2021 being £8.06m of Development and SG&A costs attributed to Workiro/Getbusy, with no gross profit contribution at all.

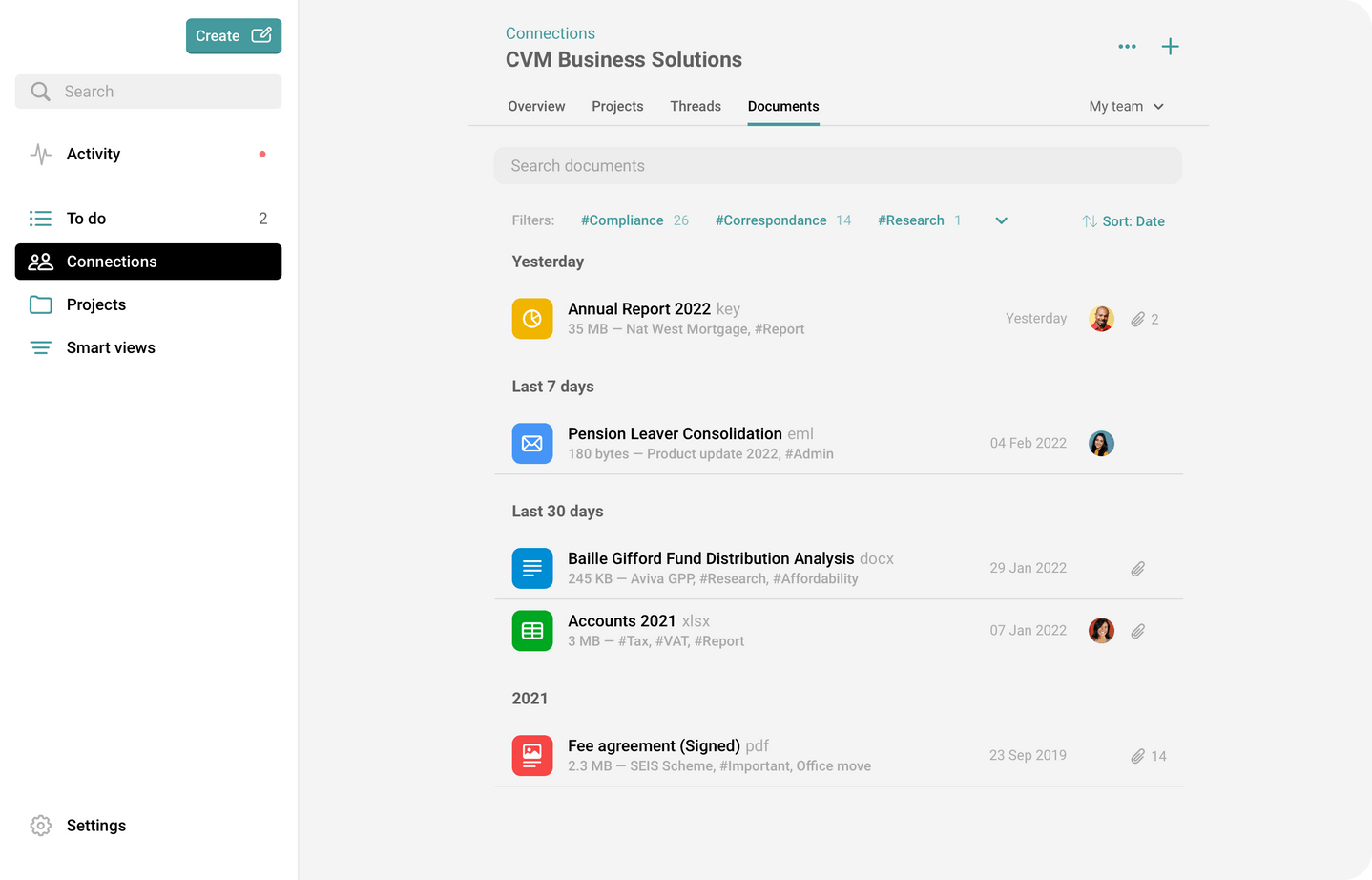

Workiro as a product is a Netsuite document management filing system, with built in collaborative tools to manage tasks as well.

There are signs of this improving, and they have merged all of it’s development functionality into Virtual Cabinet clous now as well and there is scope for it to be integrated into other ERP systems down the line. Furthermore, it won the “SuiteCloud International Partner of the Year” award in 2022, which ideally assists them in growing their Netsuite userbase.

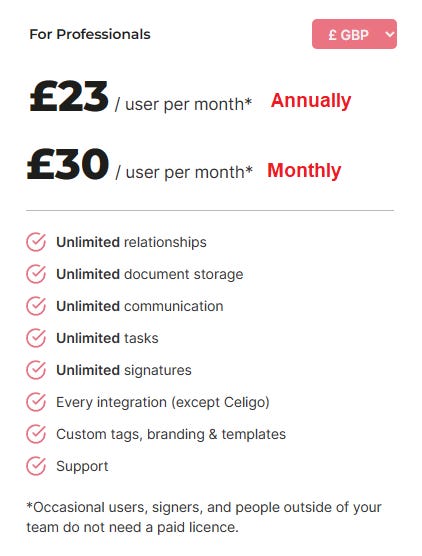

Pricing is cheaper than both SV and VC which is to be expected of an emerging product.

Emerging Products - Certified Vault

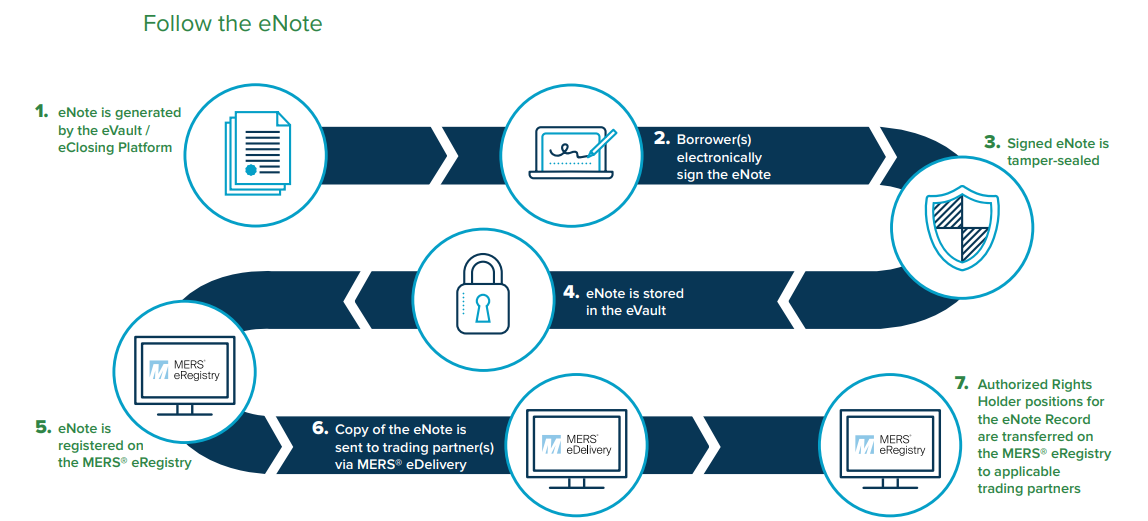

Perhaps the most niche of services that the Getbusy business offers is their Certified Vault product. This is developed within the Smartvault software specifically for e-contracts that require an authoritative copy, otherwise known as eVaulting software. To explain further, here is a video describing how it works.

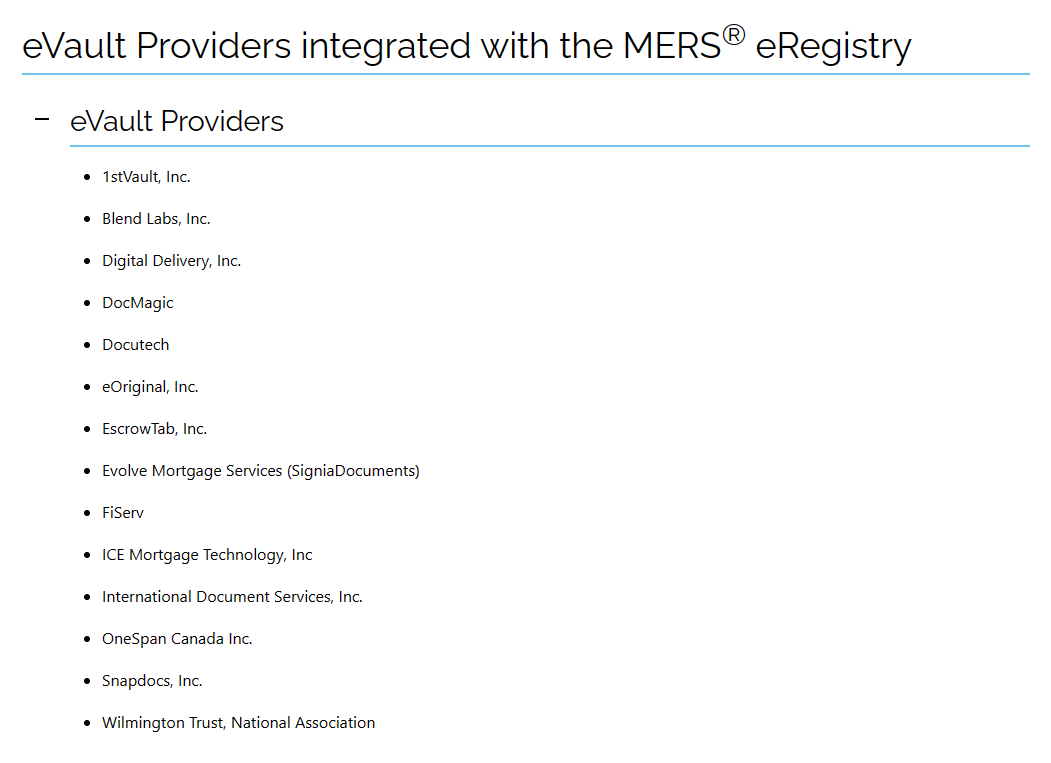

Its closest peer would be the Wolters Kluwer owned ‘eOriginal’, the digital vault for the largest buyers and insurers of asset-backed securities in the U.S. As of January 2022, 92% of all eNotes registered with MERS were created and registered with Wolters Kluwer technology. This software add-on for Smartvault is exceptionally exciting given the rapid growth in eNote adoption over time. Data from Intercontinental Exchanges’ MERS eRegistry states that as of June 1 2023, there was 1.95m eNotes registered, which given that just 2 years ago there was 500k, is substantial uptake quite obviously.

Certified Vault however, is yet to register with the MERs eRegistry, and you can see here that there is only a handful of providers that actually are. The question is, to what extent is Getbusy, with its minimal capital, able to carve out any meaningful market share in this market segment. That remains to be seen.

The Tailwinds of Data Protection Regulation

The General Data Protection Regulation (GDPR) is a regulation of the European Union (EU) that became effective on May 25, 2018. Under the terms of GDPR, not only do organisations have to ensure that personal data is gathered legally and under strict conditions, but those who collect and manage it are obliged to protect it from misuse and exploitation, as well as to respect the rights of data owners - or face penalties for not doing so. These penalties in the EU are steep with fines of up to 10 million Euro or 2% of global annual revenue from the previous year.

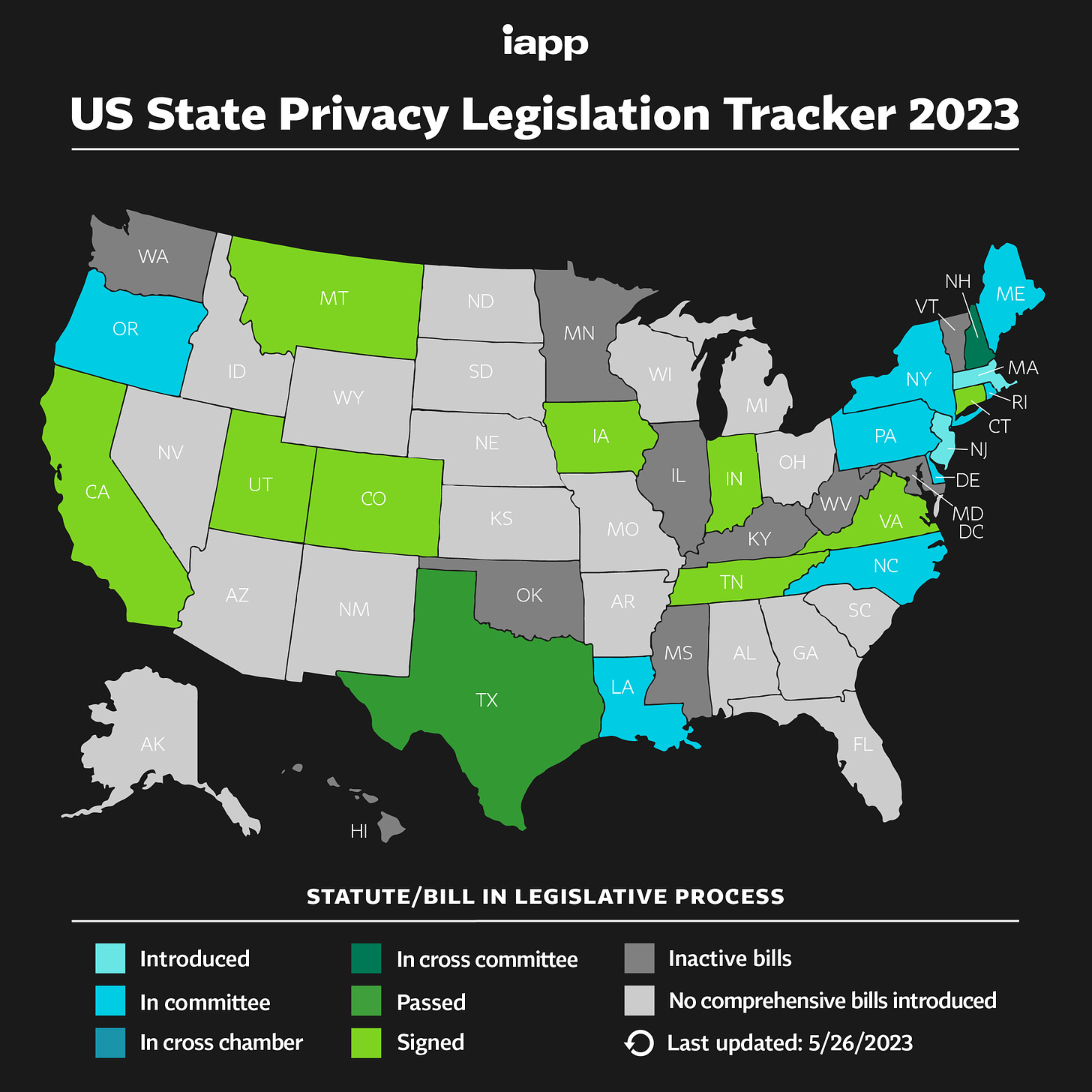

Notably, the GDPR regulation was brought into place for the EU in particular. As readers would know, the UK exited the EU in 2020 as a result of Brexit, but before doing so brought into force their own legislation for the GDPR regulation called the ‘Data Protection Act’. In the US the only response to the GDPR regulations is the California Consumer Privacy Act (CCPA) and several state privacy acts are soon to become law. But there is still NO Federal legislation in the US which would be much more efficient. The progress of state act’s is shown below.

Given that Getbusy’s US business ‘Smartvault’ deals with predominately small and medium sized accounting firms, which are largely domestic in nature, there is a notable lack of data protection enforcement in place at this current point in time.

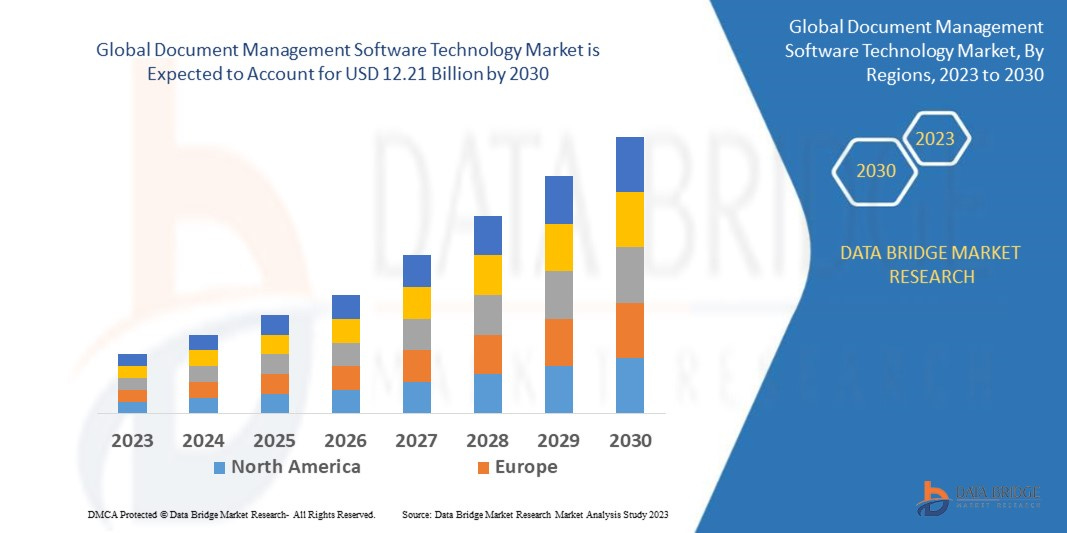

There are multiple research providers forecasting significant growth in size document management software market globally. Take for example, this report from Data Bridge Market Research which is modelling the market to reach USD $12.21 billion by 2030, from USD $5.18 billion in 2022, a CAGR of >11%.

Income, Expenses and Cash Flow

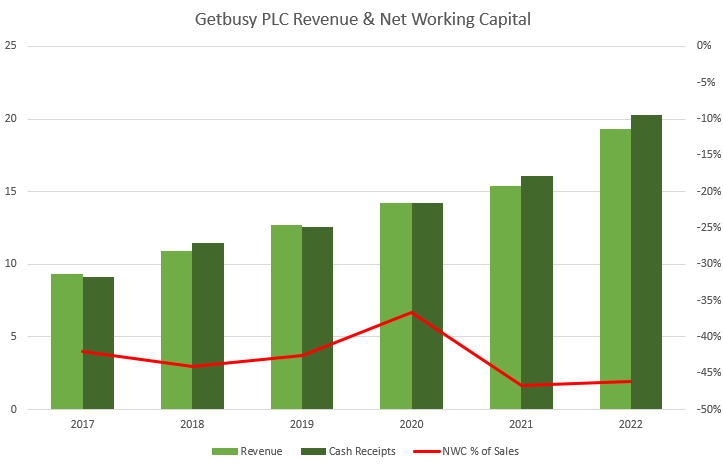

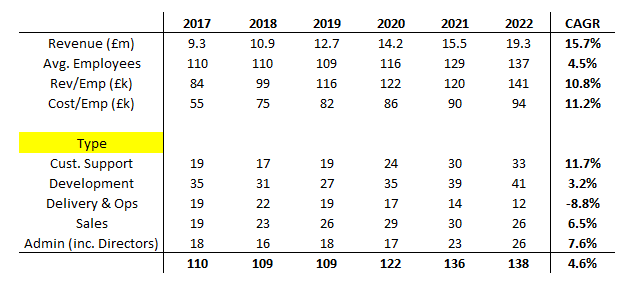

As i’ve highlighted previously, Getbusy operates a SaaS business model where they receive cash in the form of monthly and annual subscription payments. Given the reasonably large discounting available for annual cycles, it is unsurprising to hear that some 70% of Getbusy revenue is received annually in advance. That means that cash revenue is consistently higher than reported revenue as a result, and the more growth they report, the wider that the gap should be ordinarily.

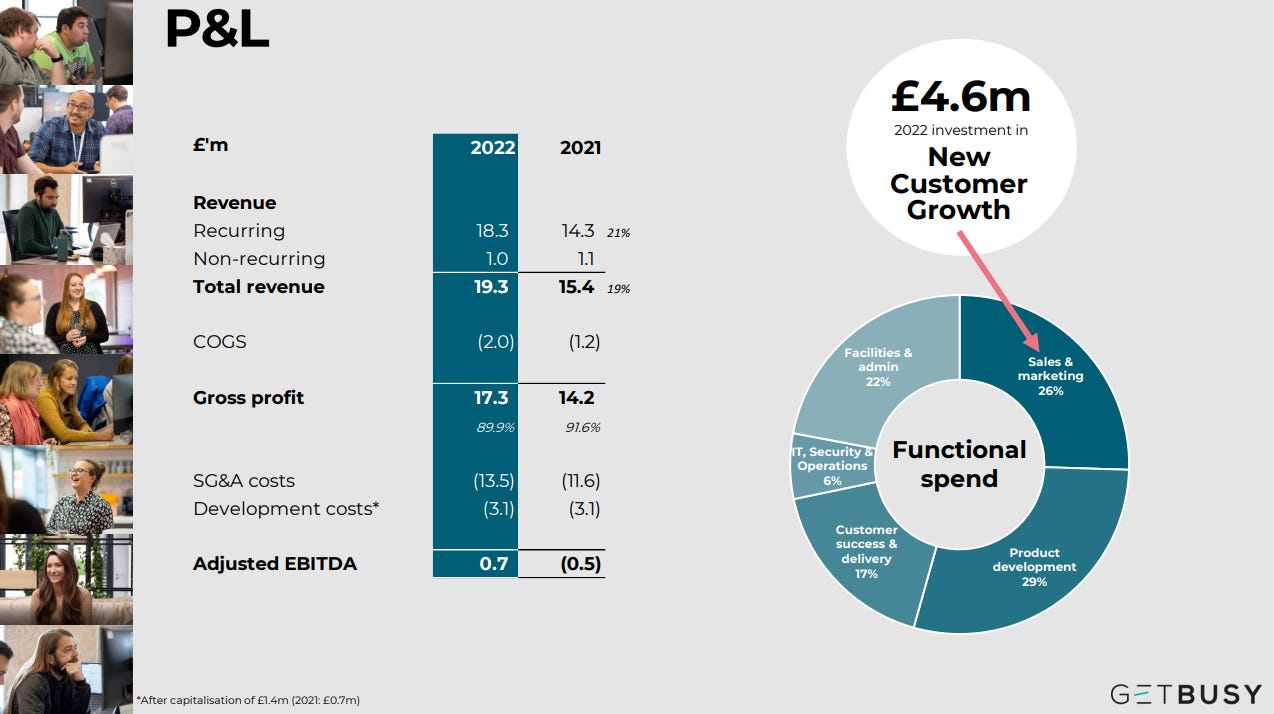

As for their cost base, the group highlights that they spent £17.7m on “Functional Spend” in the 2022 calendar year and £4.6m exclusively on customer acquisition. Given the spend on Workiro in previous years and the development of Certified Vault, it’s reasonable to assume that atleast another £2m could be classed as growth related R&D spend on pre-revenue products.

Furthermore, the development of their employee mix is encouraging, with the majority of their headcount growth going towards customer support roles, which should help improve customer retention and hence take some pressure of growth-related costs.

On the flip side of the positives, the ‘Adjusted EBITDA’ figures is exclusive of capitalised R&D spend (Another £1.4m) and some other non-underlying costs. In my view, it’s best to simply ignore their Adjustments and go off their statutory figures +- the working capital swing.

Lastly, the group benefits from eligibility for the UK R&D tax credits, more than offsetting the corporate tax they have paid on Virtual cabinet profits. Smartvault is obviously loss-making so there is no tax on that division.

On a high level, the group deliberately operates on a cash neutral and slight accounting loss basis. This is due to them focusing on both Smartvault customer acquistion and the development of Workiro & Certified Vault.

Acquisitions

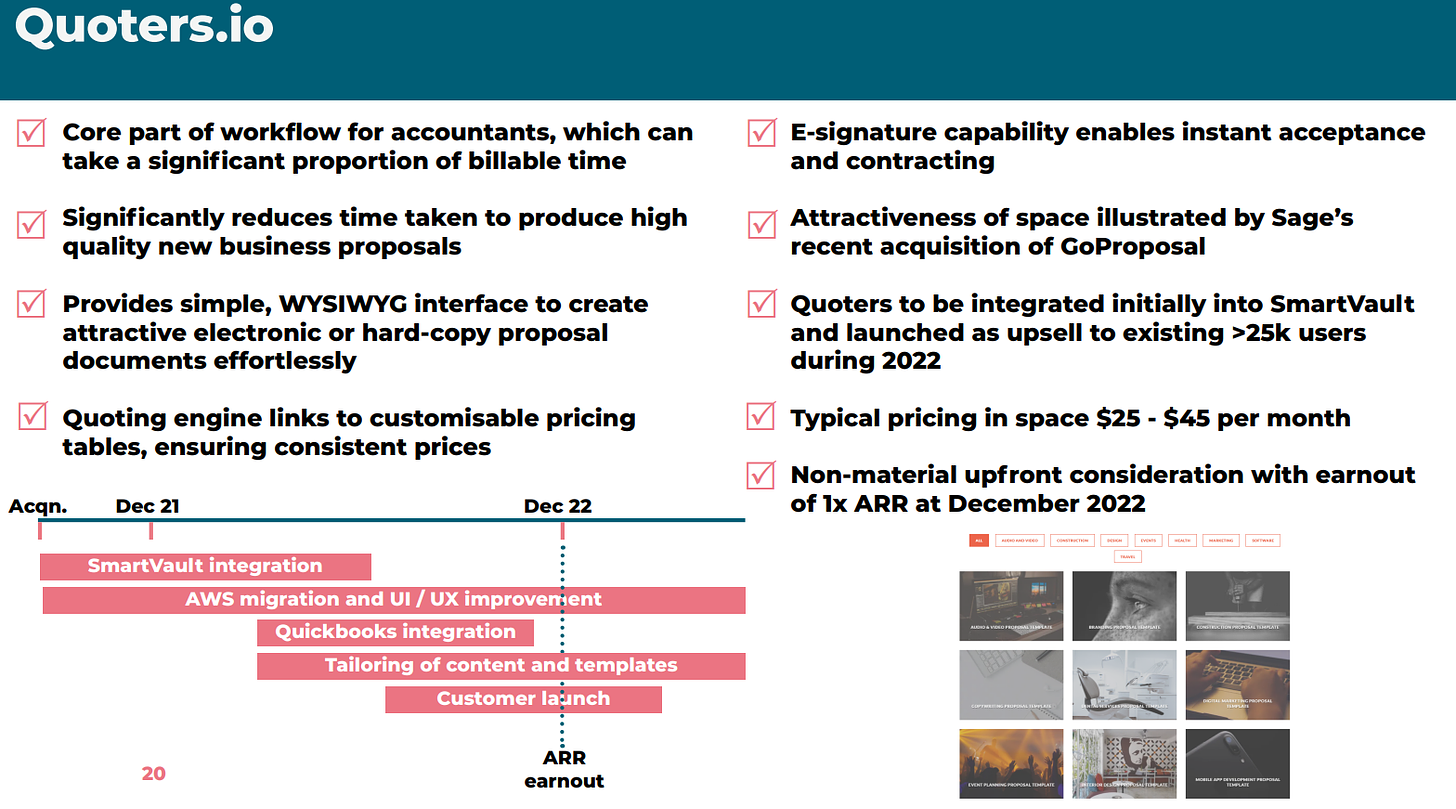

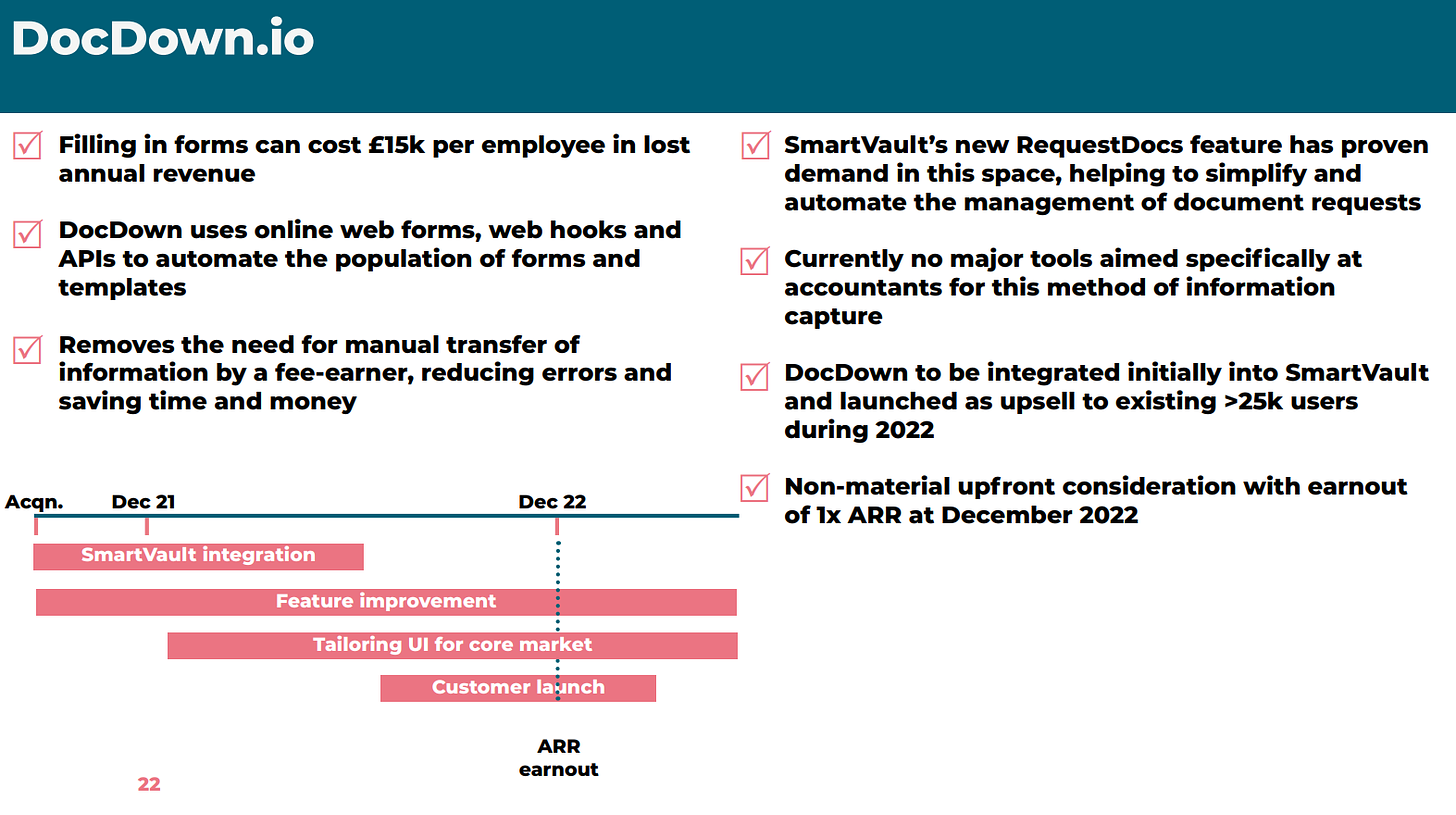

Getbusy for the most part is entirely organic in it’s growth trajectory, but it did buck that trend in 2021 through the bolt-on acquisition of Quoters and Docdown.

Interestingly enough, both of these acquisitions cost a total of just £82k in cash, with 1 year earn-outs on both of them subject to a USD $500k cap. However, as revealed by the 2022 financial report, no earn-out was payable in respect of either of the acquisitions.

These have both since been implemented into the Smartvault product and launched in 1H 2023 (Later than scheduled). You will see a box in the demo picture within the Smartvault section above with an upsell for these add-ons. The premise here is to further improve ARPU simply enough, and they basically got the functionality for free due to no earn-outs.

Valuation & Cash Distribution Incentive Plan

In February 2023, Getbusy implemented a CDP incentive plan with the following terms

Awards under the CDP vest if the Company makes a gross cash distribution to shareholders in excess of £70million and up to £150 million within a 7 year period from the implementation date of the plan. An adjustment is made to the value of any award under the CDP to take account of any vested share options that have previously been exercised by the participants, thereby preventing participants benefiting from both the CDP and a distribution in respect of any exercised share options.

At a gross cash distribution of £70m (the “Entry Point”), the award paid to Daniel Rabie under the CDP, the VCP and the EMI Chare Option Plan would be £5.0m and the award paid to Paul Haworth would be £1.75m. These amounts are based on the approximate values that, absent the CDP, would otherwise be paid on the participants’ fully vested and exercised share options.

Above the Entry Point to a gross cash distribution of £120m (the “Target Point”), the participants earn a linearly increasing share of the incremental distribution above the Entry Point. Daniel Rabie’s share increases from 7.0% at the Entry Point to 15.0% at the Target Point. Paul Haworth’s share increases from 2.5% at the Entry Point to 10.0% at the Target Point. Above the Target Point, the share of the incremental gross cash distribution earned remains at 15.0% for Daniel Rabie and 10.0% for Paul Haworth up to a maximum award payable at a gross cash distribution of £150m (the “Stretch Point”).

However, Getbusy also has the "EMI Share option plan" and the "Value Creation Plan". The EMI is fully vested in full but the VCP will vest in January 2024. For the purposes of comparing the Cash distribution plans as per the first paragraph above, the CDP supercedes the previous plans so the % shown above is correct.

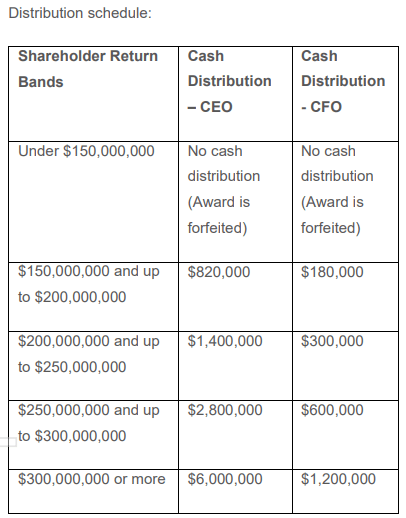

Notably, Reckon also announced a similar plan during the AGM with the following terms.

The payment of cash under the plan is contingent on the following Payment Conditions:

The participant being an employee of Reckon at 31 December 2029

the cumulative total of the following payments in respect to Reckon shares paid or received by Reckon shareholders from 24 May 2023 to 31 December 2029 (Shareholder Return) being at least $150,000,000:

Dividends

Distributions

if there is a change of control transaction occuring whereby 100% of the issued capital of Reckon Ltd is acquired by a third party (control transaction), the consideration received by Reckon shareholders under the Control transaction.

If the shareholder return includes shares or securities in another entity unrelated, whether in addition or instead of cash, the board may determine the value of the shares that will be factored into the calculation, in its discretion.

The shareholder return will not be reduced for any tax payable by shareholders and will be adjusted upwards for the effect of franking credits.

If the payment conditions are met, the amount will be calculated by the board based on the following distribution schedule:

Variation to Shareholder Return Bands and Cash Distribution (Potential amendments)

Reducing the cash distribution for a participant by any amount paid to the participant under a reckon long term incentive plan

Making changes to the shareholder return bands and/or the cash distribution amount to take into account any capital raising activities

Reducing the thresholds under the bands in the event of early testing

Increasing the cash distribution amount if the highest band is materially exceeded.

Comparing these 2 plans side by side it is very obvious that Getbusy is significantly more distribution to management. Well, it's clear that this plan is much better for Reckon shareholders than it is for Getbusy shareholders.

I much prefer the Getbusy business as I think Virtual Cabinet and Smartvault are much better products than Reckon One, Accounts Hosted and nQ Zebraworks etc.but I much prefer the incentives at Reckon as opposed to Getbusy.

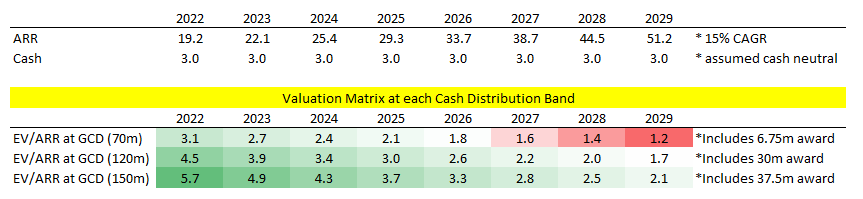

If the company were to maintain their target of doubling every 5 years, and maintain a cash neutral position, then overlaying the incentive plan at each possible year, we get a valuation matrix as shown above. Obviously, it’s most appealing to get a higher price sooner rather than later, because they haven’t built up ARR. But in a worse case scenario the group could actually get taken out at a similar valuation to the current 1.5x EV/ARR price tag. I find it highly unlikely however.

For valuation purposes ignoring the existence of the incentive plan it is reasonable to just add some ~£5m to the breakeven statutory result to approximate steady-state free cash flow. The group claims potential medium-term EBITDA margins of 30% at maturity are possible, and given the above, it’s not unreasonable to agree with them. This means that the current EV/ARR multiple of ~1.5x looks extremely promising, with a steady state EV/EBITDA of ~5x if you believe the margin upside is realistic. Deferred revenue and R&D offsets could offset a reasonable amount of the expenses below the EBITDA line meaning a mid 20s FCF margin wouldn’t be too farfetched either. But I’ll let you decide if that assumption is reasonable or not.

I hope you enjoyed this write up, let me know in the comments your thoughts.

This is a reminder that currently, the Hurdle Rate Substack is offering subscribers a 50% discount through to 30 June 2023 on an annual subscription at a rate of AUD $75 per year (USD $50), down from AUD $150 per year (USD $100).

Very interesting. Do you know the degree to which Virtual Cabinet or SmartVault need to adapt their functionalities/work-flow from country to country? Are there country-specific regulations on how to handle documentation at corporate level or the core of the software can be re-used and broadly shared regardless of the customer location?

Hi Tristan - Thanks for the write up. What do you know about the company's gross retention rates for their core products? How have those churn rates trended over the last couple of years?