Investing & Personal Finance Tips & Tricks

What Resources do I use in investing & some Personal Finance tips & tricks

Hi everyone,

Today’s post is an ad-hoc post covering a bit of a discussion about the various ways I find and monitor companies along with portfolio management, note taking etc.

Investing - Searching

“So I think it was just looking at different companies and I always thought if you looked at ten companies, you’d find one that’s interesting, if you’d look at 20, you’d find two, or if you look at hundred you’ll find ten. The person that turns over the most rocks wins the game.”

~ Peter Lynch

In investing, ideas are crucial to success. The quote above succinctly summarises the importance of increasing the flow of ideas. You have to turn over rocks to see what’s on the other side, that much is obvious. And the more you turn over the more chance you have to find something truly valuable. There are various tools that assist in this process.

Stock Screeners

There is no shortage of Stock screeners on the internet, a tool used to filter stocks based on key parameters such as fundamental business data, industry, size and more…

The best free screener out there is hands down Koyfin, which allows for global screening. Other honorable mentions include TIKR & Investing.com among various others.

I can’t add much here except some of my favorite things to screen for that may not be apparently obvious including:

Negative Enterprise Value (Indicates Cash in excess of Market Cap)

Negative Cash Conversion Cycle (cash flow > earnings)

Amortisation of Goodwill (Potentially favourable accounting)

SBC = $0 (Indicative of non-promotional management)

No Goodwill + Growing earnings (Organic growth only)

Low free float (high insider ownership/strategic stake)

Newsletters/Social Media

Many investors, both professionals and amateur post their research online through forums and social media. They do this via. many means but some examples include:

Substack

Investment Managers

Many Professional investors either opt to or are required to report their holdings on a regular basis, some resources for this include:

Admittedly I don’t really use these much, so feel free to suggest additional resources where one can find letters compiled.

Serendipity/Real World Observations

This one is a bit of a fluff topic, but just consider what you as an individual are using most day-to-day or what others are raving on about. You will be surprised with the outputs that self-indulgence can get you. Some of my most successful investments have come from Serendipity.

Kelly+Partners was a case of serendipity where I would never of been as interested in the business relative to what I was if not for my background knowledge of small business accounting.

Similarly, there is several other investments that came from the fact I used and appreciated the product/service including:

Class SMSF software & Nowinfinity (Bought by Class)

Virtual Cabinet (Owned by Getbusy, which spun off from Reckon)

Applecheck (Previously owned by Chantwest)

Enzumo (Owned by Chantwest, but acquired by Centrepoint Alliance)

Xplore Wealth (Frequent user of peer platforms and noticed acquisitive value of Xplore)

GPS Wealth (Licensee I used to work for, owned by Diverger) & Knowledge Shop (Tax training I have utilised many times, owned by Diverger)

Yowie (Jumped out at me on a net net screen only because I used to eat the chocolate)

Smartgroup (Interested due to knowledge of tax - FBT EV Exemptions)

Investing - Monitoring

Monitoring your investments is as crucial as searching for additional investments. This includes ongoing fundamental evaluation. For this my primary method is to set up frequent reminders as highlighted below, but there is more things of importance which I will touch on:

Email Alerts

I find these prompts to be the most useful thing I have set up. The hard part is finding websites that allow for it. Here is a list of sites I use:

Hotcopper (Australia)

Conference Call Transcripts (US & Canada)

Euronext (Italy, Norway, France)

EQS News (Germany)

Cision (Sweden, Denmark, Finland, Germany, France, Netherlands, Norway, Portugal, Global)

Dividends.sg (Singapore)

Maya/Tase (Israel)

NZX (New Zealand)

Follow that Page (Catch all - measures changes in web page)

RSS Feeds (Where IR Page allows)

IR Page Email Subscriptions (Where IR Page allows)

Company/Industry Publications or News

It is important to look beyond just regulatory filings for company news as much may be broadly applicable to the industry or not material enough by itself to justify an announcement.

This is highly dependent on the companies you are watching but just as an example for some companies I own I monitor like so:

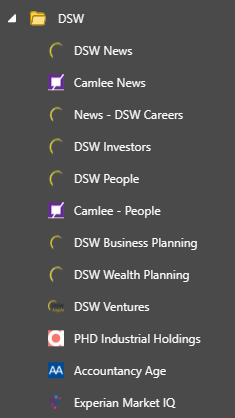

DSW Capital - Write Up

I have a list of sites favorited which I like to check for updates periodically including new hires, interviews, industry data and so on…

Diverger & Sequoia

These businesses both have large contributions from their Licensee businesses, as such I like to monitor changes in the Financial Advisers Register (FAR) and do so via. an aggregator of information website called Wealth Data.

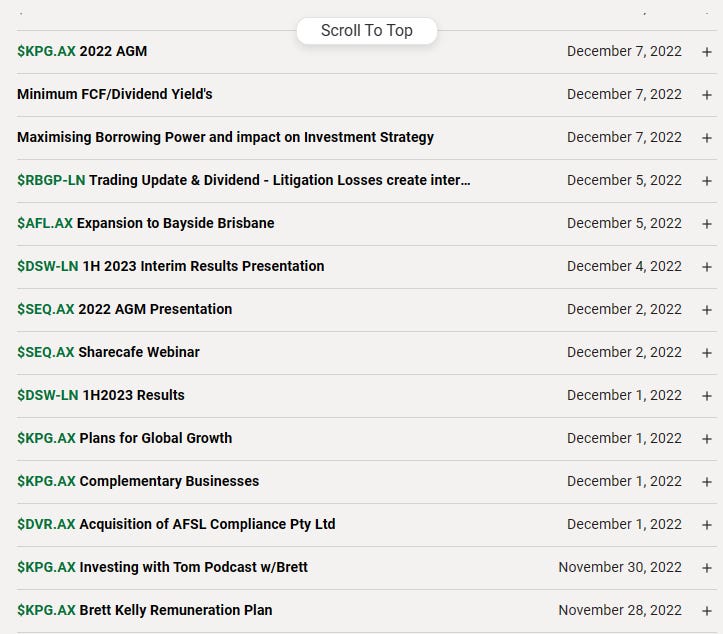

Notetaking

Tracking your investment to your initial thesis, and clarity of thought is crucial in avoiding the many investment bias’s along the way. Namely, there is an excellent tool for investors that was recently launched called Journalytic. Personally, I am using Substack as my source of truth for the time being, as Journalytic in its current form leaves some to be desired, predominately that being real-time data for global companies. A snapshot of my notes below.

Personal Finance

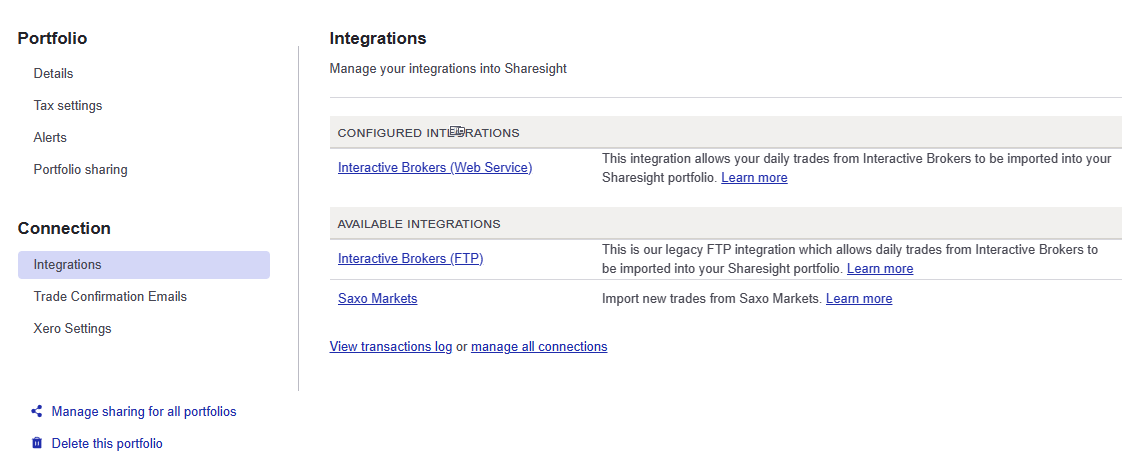

There is various different portfolio trackers out there. Personally, I use Sharesight as It also allows for me to automate effectively and integrate with other software.

I will allow you to peruse the website yourselves, but what I like most about it are the breadth of markets. Rarely is there a stock I can’t add in as an investment with pricing data. This is important as I am researching stocks in very obscure areas of the market constantly, and often very small stocks such as those listed on Poland’s new connect exchange and even OTC listed companies. In the odd time there isn’t a listing, users can add in manual investments. This data also allows for automated dividend tracking, tax components and corporate actions such as splits, capital returns and takeovers to name a few.

Tax time is a breeze with Sharesight (speaking for Australian Investors anyway) as they provide realised (and unrealised) capital gains tax reports, ability to use different CGT methods, taxable income reports and even a historical cost report for balance sheet reconciliation.

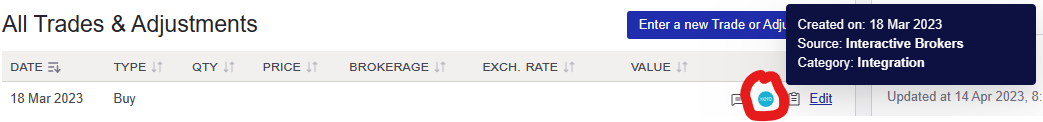

Lastly, perhaps the most valued part is the ability to automate, with a native integration to Interactive Brokers which pulls in trade data on a daily basis (as shown above). I also use the trade confirmation emails feature which allows for investors to set up the ability to have trade settlements forwarded to a special email address to which Sharesight reads and creates the relevant trade with OCR technology.

I personally have also set up a personal Xero Cashbook Ledger which Sharesight also integrates with allowing me to have Xero talk to Sharesight for automatic reconciliation both ways. In practice as shown above this means that a trade comes into sharesight from the integration as mentioned above and then goes out into Xero from sharesight as shown below. Then inside Xero all I have to do is match it to the cash transaction that is imported through either statement imports or bank feeds.

By sharing data with Xero, I can take care of the investments portion of my family’s balance sheet & profit & loss automatically. I use this to feed in both SMSF activity and Discretionary Trust activity. I am not a fan of having multiple subscriptions, so I have tried to cut duplicate costs as much as possible.

Xero also allows for both direct and Yodlee bank feeds, making it a breeze to import transactions automatically on a daily basis. This is helpful for me as I am often optimising my affairs by taking advantage of various banking promotions and credit cards to accelerate my personal net worth.

Before you chastise me for suggesting this as a personal finance tool. It pays to note that the Afterpay business model is one where a) costs are borne by the retailer in the form of merchant fees and b) for Australian’s Afterpay is not considered credit.

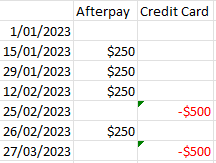

This is crucial as Afterpay also allows for one to link cards, including credit cards. Which if you are completely in control of your spending, means up to a 55-day interest free period can be extended meaningfully by utilising fortnightly instalments offered by Afterpay. Generally, this means you’ll have 3 instalments fall into the first statement period and another 1 in the following period. Although for regular users of Afterpay they step this back another 2 weeks meaning only 2 instalments fall into the first statement period, 2 in the following and 2 in the following. To illustrate this, I have stepped out a theoretical $1,000 purchase on the 1st of January 2023:

In this example, you can see here half the purchase is paid 55 days after purchasing and the other half 85 days after, meaning an effective creditors cycle of 70 days. I have been exploring ways to further extend this low-cost leverage, but in its current form I believe it is an incredibly attractive method of purchasing.

Thus, in effect I use Afterpay solely as a tool for improving personal cash conversion. If I was to include my own affairs, I predominately receive a salary on a monthly basis in accruals but am extending much of my budgeted expenses out 2-3 months, with the exception of bank transfers such as rental costs. Therein my personal budget is in a situation of negative cash conversion, a desirable trait.

Credit Cards & Other Promotions

Credit Cards are both very dangerous and very lucrative depending on who you ask. Of course, they are compounding in nature as such are not for those without strong control of their financial position. But these also are the land of substantial opportunity.

First, credit cards often come with interest free periods of up to 55 days. And some cards allowing for a 0% interest rate for years for specific purchases. As such utilising credit cards is a form of low-cost leverage if used intelligently. One that may rival the low-cost insurance float of Berkshire Hathaway.

For Australians in particular, frequently monitoring websites such as Point Hacks and OzBargain for bargains is a no-brainer to boost your budget.

The one thing I would say is that consecutive credit applications does not look good for your credit score, but unlike US etc. these scores matter little in the context of the Australian market. Anyway, from my view I won’t be getting a mortgage any time soon with asset valuations through the roof in property.

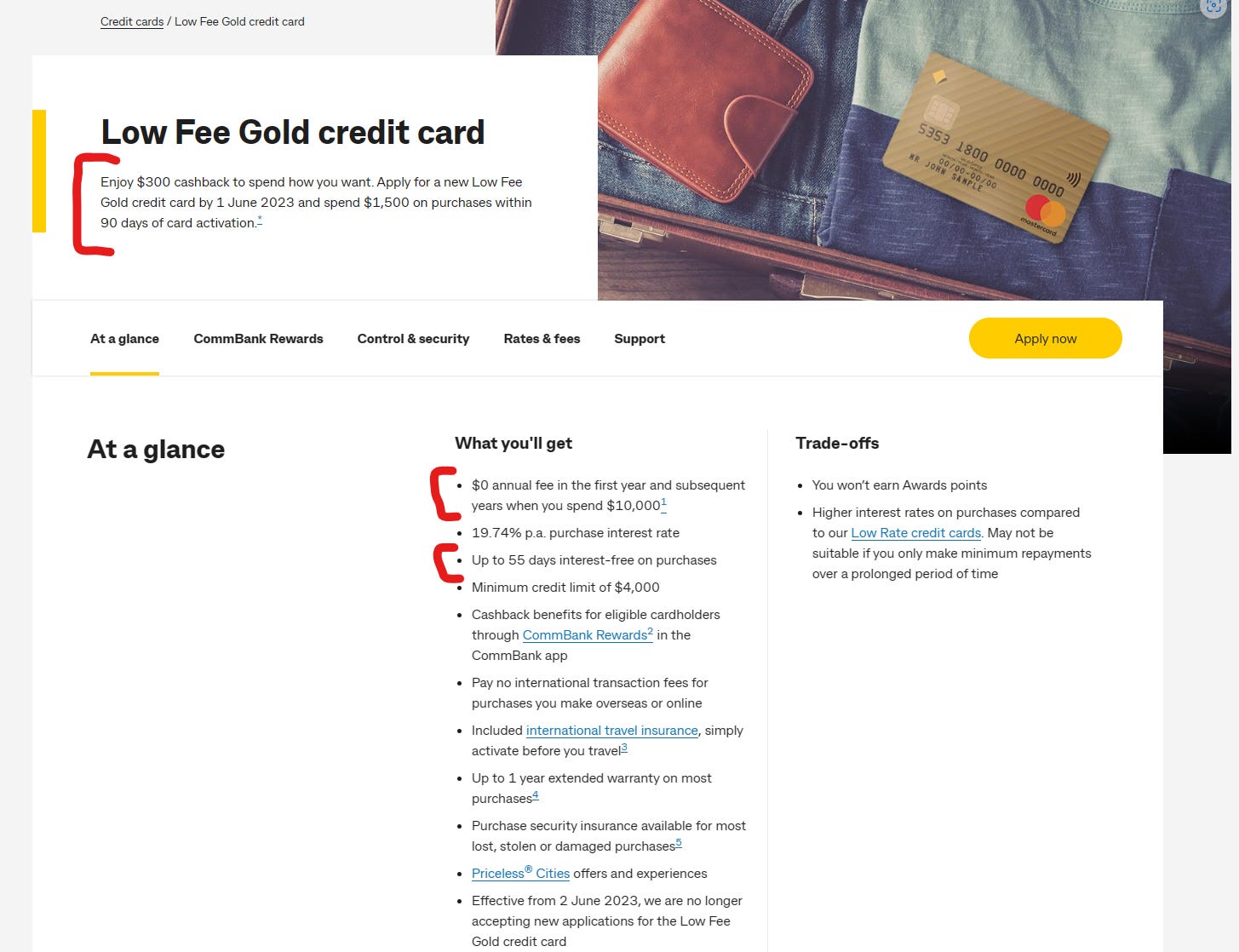

Take for example this cash back offer I did just last month where I received $300 for just spending $1,500, no catches via. fees or anything.

Another hot personal finance tip from yours truly… try Gambling!

All jokes aside, Matched Betting is a purely mathematical method of betting which you guessed it, also takes advantage of promotions. This involves taking advantage of the fragmented nature of betting websites and the competitive nature of customer acquisition costs (namely, promotions). You are in effect, profiting from the customer acquisition costs of these bookies.

How it works is that these betmakers generally have various promotions such as sign-up bonuses, bonus bets and periodically increased odds. You are arbitraging a bet across 2 different brokers by placing a bet on either side, which you may make a slight loss on or even profit. But then the idea is to clear the bonus bet conditions and receive the bonus bet in return which can often be many multiples of any cash loss you take.

To make this simple, websites such as Bonusbank have what they call an ATM which automatically calculates this for you. When I was in university with a paltry 4-figure net worth, I was generating thousands of dollars exerting little effort by utilising this method.

For those interested, here is an interview of the creator of Bonus Bank sharing more information.

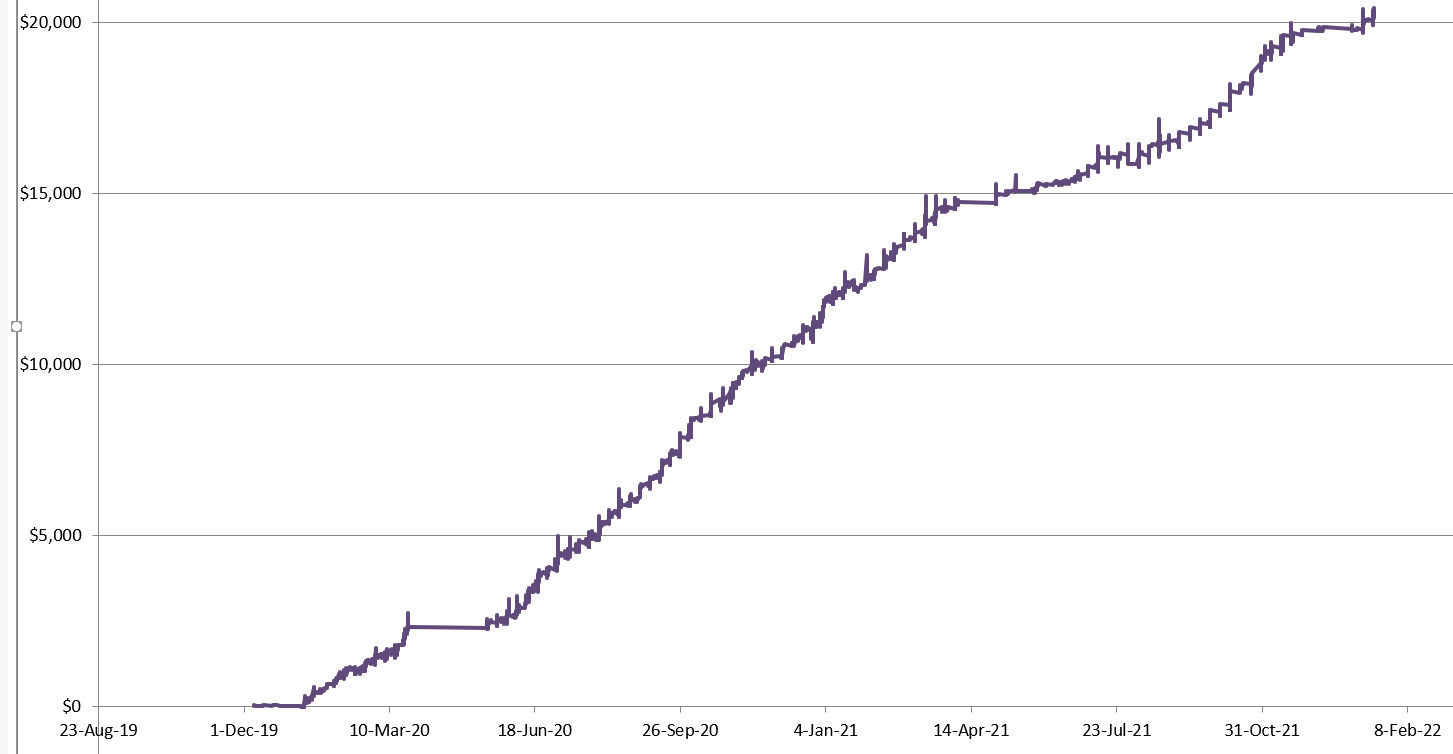

Looking into some MB forum’s you can find some impressive track records, such as this fellow who did 2 years of just 1-2 hours on a saturday afternoon ‘dutching’, an advanced strategy used in horse races, which are significantly faster pace and prone to error if you aren’t careful.

There is nuance to this as well of course. Whether to do on sports or on horse racing, whether to lay (short) or no lay etc. But that extends beyond the scope of this post, all I wanted to do was share some intriguing side income sources I have used to get where I am.

Personal finance is an area where you can get extremely deep into, I have mentioned just a few methods I have personally use to rapidly build my net worth, particularly for the first 6 figures these tips are crucial to be aware of as Charlie Munger would say…

“The first $100k is a bitch, but you gotta do it. I don’t care what you have to do – if it means walking and not eating anything that wasn’t purchased with a coupon, find a way to get your hands on $100,000. After that you can ease of the gas a little bit”

Well, there are some of my favorite personal finances and investing tips. I hope you enjoyed this out of the ordinary ad-hoc post. Let me know if you enjoyed this and would like to see more along these lines.

Regards

Tristan

We buy them in $500 lots and have one card for groceries and another for discounts in all other Woolies divisions notably Dan Murphy and Big W. A dollar saved is a dollar not shared with the Tax Man.

Think about buying Woolworth gift cards. You get around 4% discount (used to be 5%). Then use the gift cards to buy groceries at Woolies and Dan Murphy etc.