Today I cover a Hungarian Accounting Software business founded in 1989 by its founder, Tibor Kulcsár. At first, the software was built custom to order to address specific customer problems but has built into a more standardised program over time as they grew their customer base.

*Note: I did once own shares in Kulcs-soft (per my Q1 2023 Review), which you can read about my reasons for buying and selling there.

Tibor owns >90% of the company. He has shown exceptional stewardship and even the foresight to recognise that as he has aged, he is less able to keep up with the pace of change and therefore chose to appoint the current CEO, Ervin Szabo in 2016.

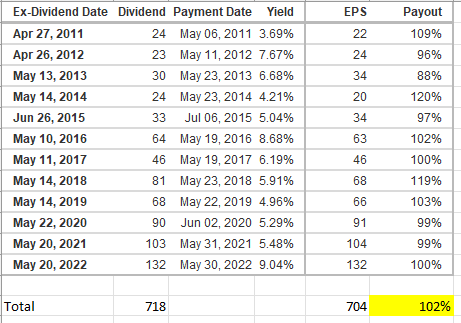

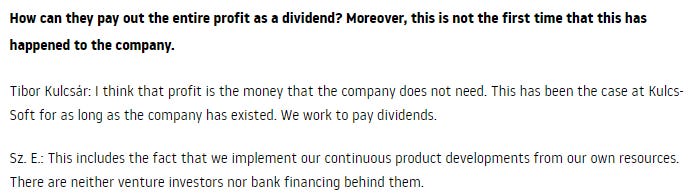

It was listed on the Budapest in 2009 and has grown it’s EPS from HUF 22 per share in 2011 to HUF 151 in 2022, a CAGR of +19.1%. What makes this more impressive is that it has paid out every cent of that profit to shareholders as dividends and has not utilised debt or capital issuance in it’s history. In other words, that growth is ALL organic, very impressive. When asked about this, Tibor and Ervin answer with the following.

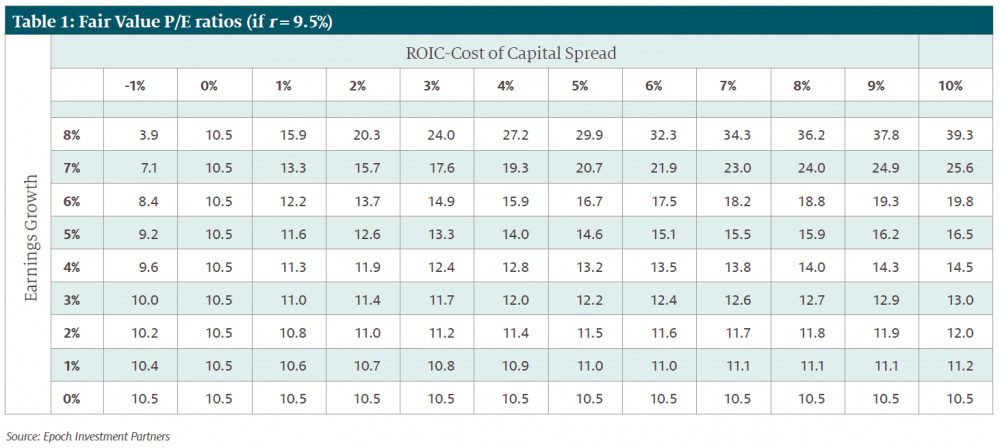

Many investors are losing sight of the value of dividends, with the advent of ‘compounders’ and ‘serial acquirers’ and so on. In my view, a company should get as much growth as possible, but use the least amount of capital possible. This is the formula of ROIC/Growth, the best combination leads to a more 'valuable company’.

But in the case of Kulcs-soft, there is NO capital (Net cash of 1.33m exceeds the 0.93m in equity), so it’s impossible to value on this basis, right? Well, the company provides some useful context to this in some public interviews. Based on jointly established principles, their goal is to maintain an annual growth rate of 10% and a profit margin of 25% per year. In addition, they do not plan to modify the profile of the company, they will remain in the development and sale of business management software. If you are assuming this level of growth, the company is infinitely valuable when compared to the overall US stock market, but it’s not US based…

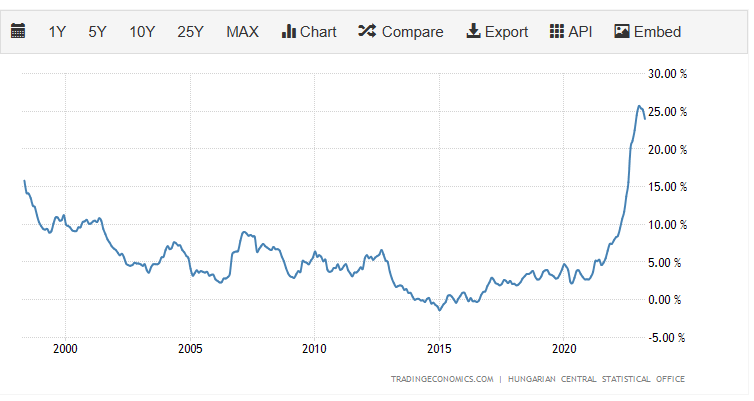

This gets us into the main issue with Kulcs-soft, the Hungarian economy. Currently as of May 2023, the National Bank of Hungary set it’s cash rate at 13% to combat the bloating inflation, meaning you can get deposits that yield in the mid-teens. So Kulcs-soft as a result, should be a very low multiple as it comes with all the risk of an equity instrument, does its trade all in HUF.

To account for this, you need a much higher required return, or Kulcs-soft needs to be able to pass on economic pressures in the form of increased pricing. To be conservative on their pricing power, consider a 20% discount rate to be appropriate for now. If Kulcssoft grows 10% a year and achieves a 25% NPAT margin (current 35%), it would give a current DPS of 108 and you basically need that to be a 10% yield as well, so a stock price of 1080. Half the current price, but we’ve used some pretty conservative assumptions.

If you continue on our typical basis, the PEGY of the business with a current dividend yield of ~7.5% and the 19% EPS CAGR since 2011 is just tipping over 0.5x which is our hurdle. But buyer beware, of the Hungarian economy.

Nice find, thanks for sharing! Few things make me as happy as a company consistently paying out 100% of earnings.

> When asked about this, Tibor and Ervin answer with the following.

Can I ask, where did you find this? I couldn't find conference calls on their IR site, or anywhere really :)

Random question what brokerage are you using for Hungarian equities?