Commentary

For the Quarter ended 31 March 2023 the portfolio returned -1.8%

This is the first portfolio update behind closed doors (ala. Paywall) so I decided that I would up the frequency to quarterly to sweeten the deal. Rest assured this is still a long wealth creation journey and it’s predominately achieving financial goals that matters, and these portfolio figures pertain solely to long-term goals.

With that said, there is quite a bit to talk about this quarter so I will go ahead and start. You will note that the biggest development from my own POV is that I have established a self-managed superannuation fund (SMSF) which you can read more about here. For future reference when I am doing these updates, the performance is on a consolidated basis. As within the tax advantaged SMSF or not, my money is still my money, even if I can’t touch the SMSF money until my 60s (current laws).

Of course other notable changes include the increased commitment to the substack with the creation of a fortnightly one page stock pitch cycle along with a deep dive every second month. And now the increased cadence in portfolio updates to quarterly instead of Annually.

Personally, I started a new full time job as a manager in a Sydney based Accounting firm and have been very busy leading up into the 31 March ITR due dates, and only now taking a step back to rest. Lastly, I will be on a podcast with

in the next few weeks so look forward to that, if you have any questions for me you can ask here, or if you want to you can ask on his twitter post here.

Before we get into portfolio changes and results etc. I wanted to share a few general posts I did during the quarter which new readers may find of interest.

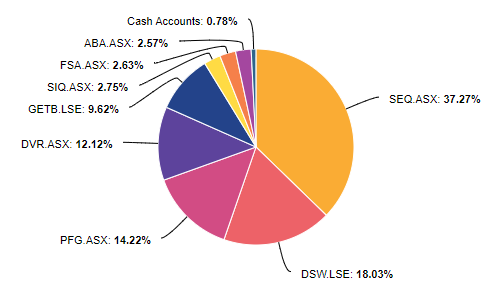

Now onto the position commentary (in order of size).

Sequioa Financial Group (ASX:SEQ) - 37.3% Weighting

I have not spoken about Sequoia on the Substack much yet (besides this short management call), but as you might see above I increased the position a LOT to the point it is my largest position at cost ever.

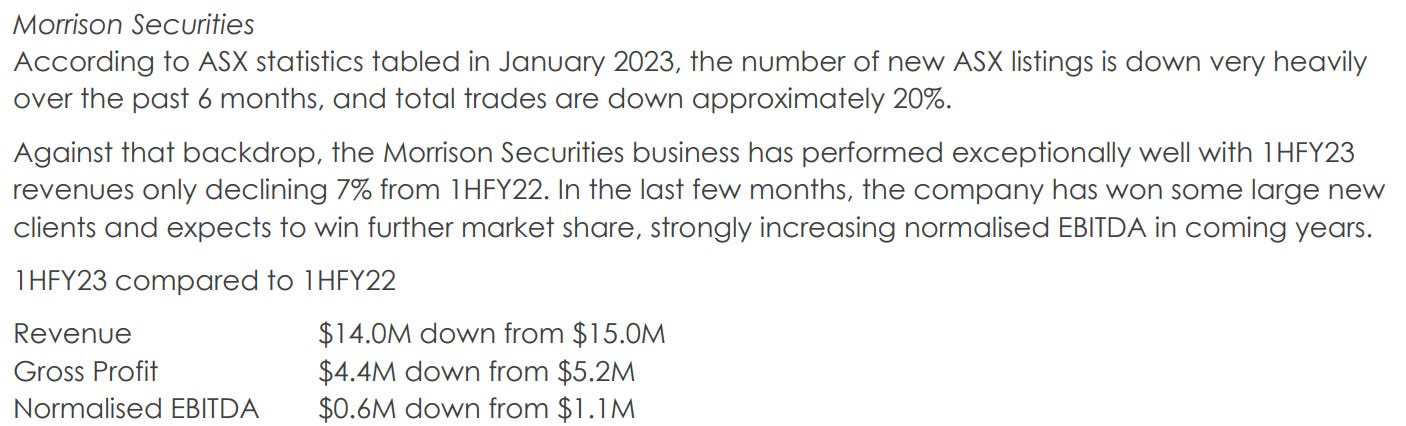

Why? For a few years Garry Crole (CEO) has been throwing around the idea of the attractive multiples that clearing businesses have been going for in private sales, and it just so happened that Sequoia owned one in Morrisons Securities, and they just so happened to announce a sale at an attractive valuation point. The market responded with a muted response (~10% up) despite the consideration totalling close to 60% of their pre-deal market cap and the Morrisons EBITDA accounting for just ~15-20% of the group bottom line (as seen below).

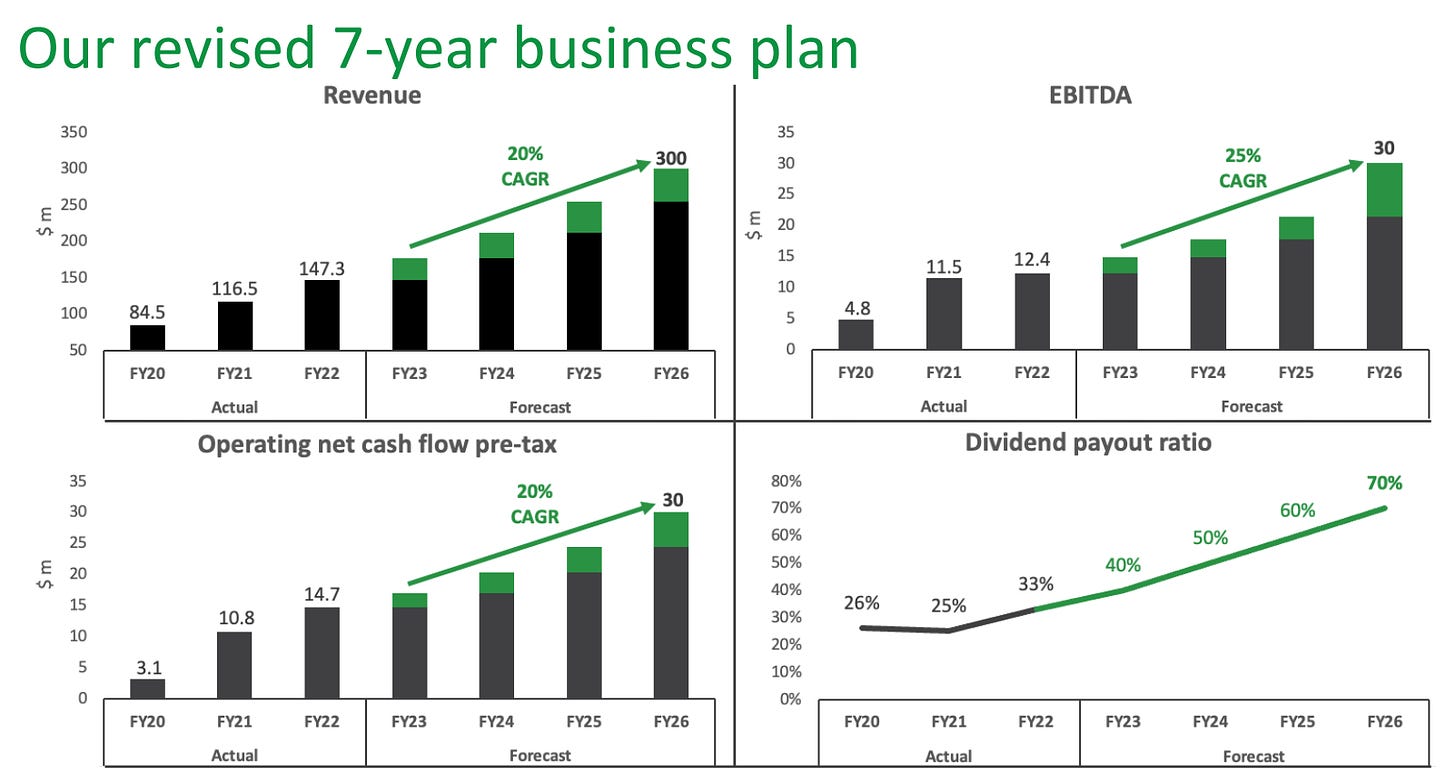

After all is said and done, Sequoia should put up free cash flow in excess of $6m in FY2024, and the current EV is valuing Sequoia at just over $30m, a FCF yield of 20%. To put the icing on the cake, Garry intends to move to a 100% payout ratio, increase the cadence of share buybacks and is looking to acquire small companies at 4-5x pre-tax earnings. This means that the forward grossed-up dividend yield might be around 11% funded by ongoing earnings and they still maintain a 7-year business plan which if achieved suggests a EBITDA of ~$25m in FY2026, or FCF of ~$15m if achieved.

All this and a suite of services well inside my circle of competence left me feeling very comfortable taking a much larger position post-deal settlement. Finally, it’s likely that Sequoia becomes a future deep dive so look out for that.

DSW Capital (LON:DSW) - 18.0% Weighting

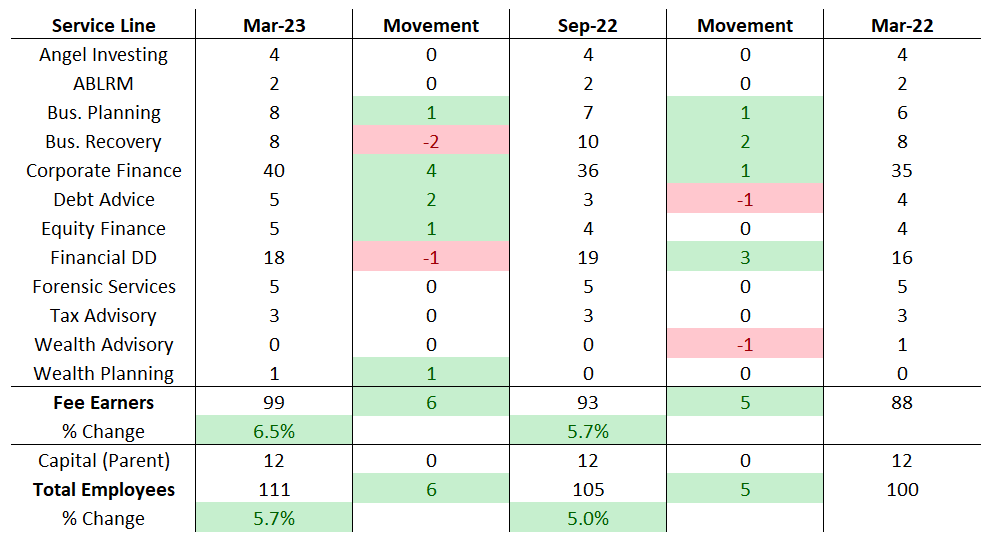

DSW Capital put out a trading update in early January highlighting weaker M&A activity and increased likelihood of missing full year analyst expectations. You can read more about my thoughts here to which I highlighted an initially optimistic view on the profit share that DSW would get. To my surprise, the group has been doing much better on hiring than I expected, which is the most important metric to track.

The above chart is taken from compiling various information sources on employee hires. The group gives rather useful information about new hires through their website and also have a directory for every employee which can be filtered by service line. To note is that DSW operates under the main Dow Schofield Watts brand, but also operates under the Camlee Group brand, which i have linked with each respective teams page.

To save you time the data has been compiled above, of which September and March 2022 are from the official reports and March 2023 is my own estimate. I am expecting the group to close the year with 99 fee earners, 12.5% higher than the year prior, which is halfway between my base and bull case cadence of hiring which is certainly good to see.

Where we fall short is a flat revenue base on revenue per fee earner likely to clock in around £190k p.a. where I expected a slower more measured decline to a trough of £200k p.a. in 2024. And this is important in the context of DSW which is pulling in roughly 15% of that as a license fee (£28.5k license fee/FE estimated) and the cost per fee earner which has gone in the opposite direction, putting a huge crunch on margins in the current year. In 2022 Admin cost per FE was ~£11k in 2022, whereas they have hired a number of new corporate staff and suffered some wage inflation leading me to believe that cost might be closer to £16k, meaning that costs have gone up £5k and revenue down £1.5k, losing £6.5k in profits per FE, or >£600k in operating profit which is close to the variance to market expectations, noting that the figure excludes any SBC which I expect based on James' and Nicoles’ issue earlier in the year will amount to ~£500k pre-tax.

Because of this information, and the large stock re-rate, I decided to double down and buy a lot more shares as a result given that the group holds over 1/4 of the market cap in liquid cash raised from the IPO. With an enterprise value of £11m and myself expecting £1.4m as a base case rate of FY23 earnings (although more likely to be slightly over half that this year) I was confident to add materially to my position using the proceeds from sale of the Begbies Traynor position I made at the end of last year.

Prime Financial Group (ASX:PFG) - 14.2% Weighting

Shortly before releasing this I released a long-form piece on Prime so I will hold on the details here besides for the half year. The headline figures were +31% revenue (+24% organic) & +33% earnings per share. This is despite a minor decline in operating margin due to their investments in headcount and lower transactional revenue in wealth management (high incremental margin revenue). The net margin expansion came from the extinguished lease in the PcP that they didn’t show this year (other comprehensive income).

You can read my full deep dive below:

Diverger (ASX:DVR) - 12.1% Weighting

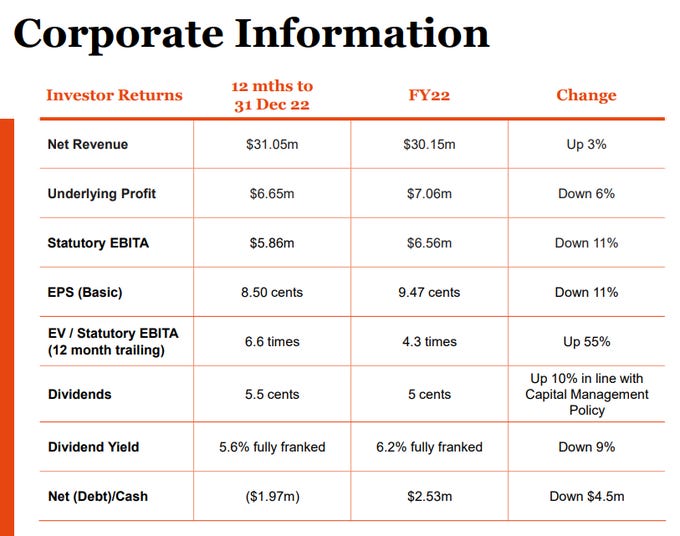

Diverger saw it report it’s half year results in February and they saw net revenue +6% along with -11% EPS. The positive is they have increased the dividend and are currently yielding ~9% on the stock price. Margins took a hit due to increased BDM staff hiring and the upfront impact of wage inflation, which revenue pass on to clients lags.

Late last year they outlined the intention to grow to 18-22c EPS (NPATA) by FY2025. To do this they intended to front load M&A then focus on organic synergies for the next few years, so we have seen them already meet their lower target on M&A just in the first half-year alone. These should contribute some ~$0.5m to the bottom line in the 2H.

All up Diverger had a pretty poor 2H but is cautiously optimistic going forward, and expects an improved 2H but flat full year. Hopefully that momentum carries through to the following years.

Getbusy (LON:GETB) - 9.6% Weighting

Getbusy reported strong results for their full year with +16% ARR (constant currency) and an uptick in cash balance due to their negative working capital model despite statutory losses. Digging into more detail there is a few points to note here that I found important.

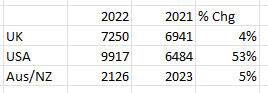

First is the segmented growth by country. We saw the vast majority of the growth come from the US (Smartvault) which implies their marketing spend ($4.6m during the year) is paying off well. To be more specific Smartvault added 53% to their top line which is incredible growth, subsidised by the higher margin virtual cabinet which saw mid-single digit growth despite that division having high 40s EBITDA margin, great progress.

Secondly, during the year they extinguished their undrawn Silicon valley loan facility (mere days prior to the blow up) and replaced it with a loan provided by Clive Rabie (Director). At initial glance and some back of the envelope calculations this added 90k GBP of costs to the business so of course it was queried in the earnings call, to which they provided the below graphic and an explanation for.

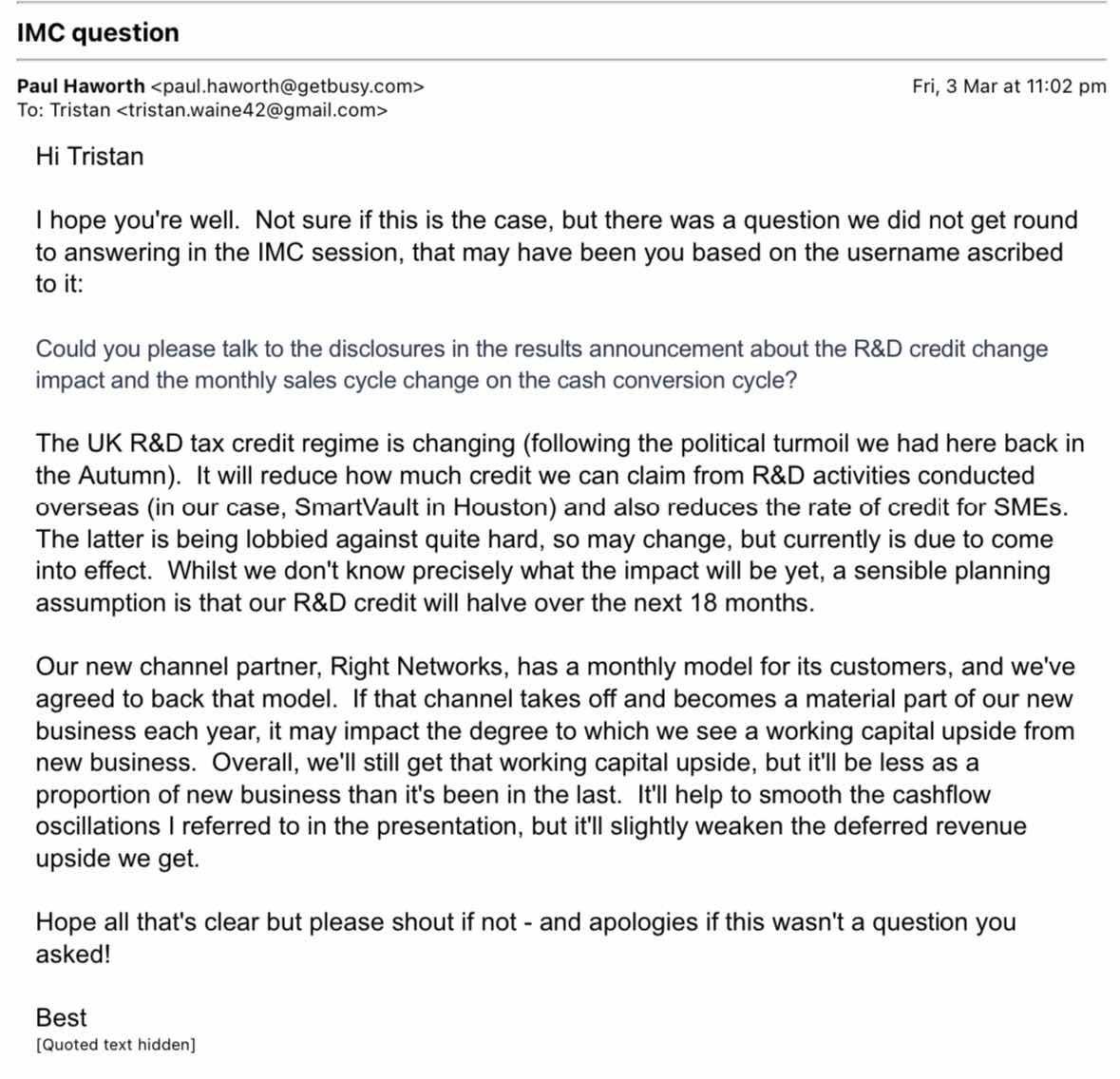

Thirdly, there is an important note about changes to the UK R&D Tax credit regime and also monthly cycle revenue, in effect this would cut the working capital cycle negatively so I definitely wanted to get in and ask paul about this.

You can see our correspondence below.

Lastly, there was the introduction of a new ‘cash distribution’ incentive plan of which is detailed below:

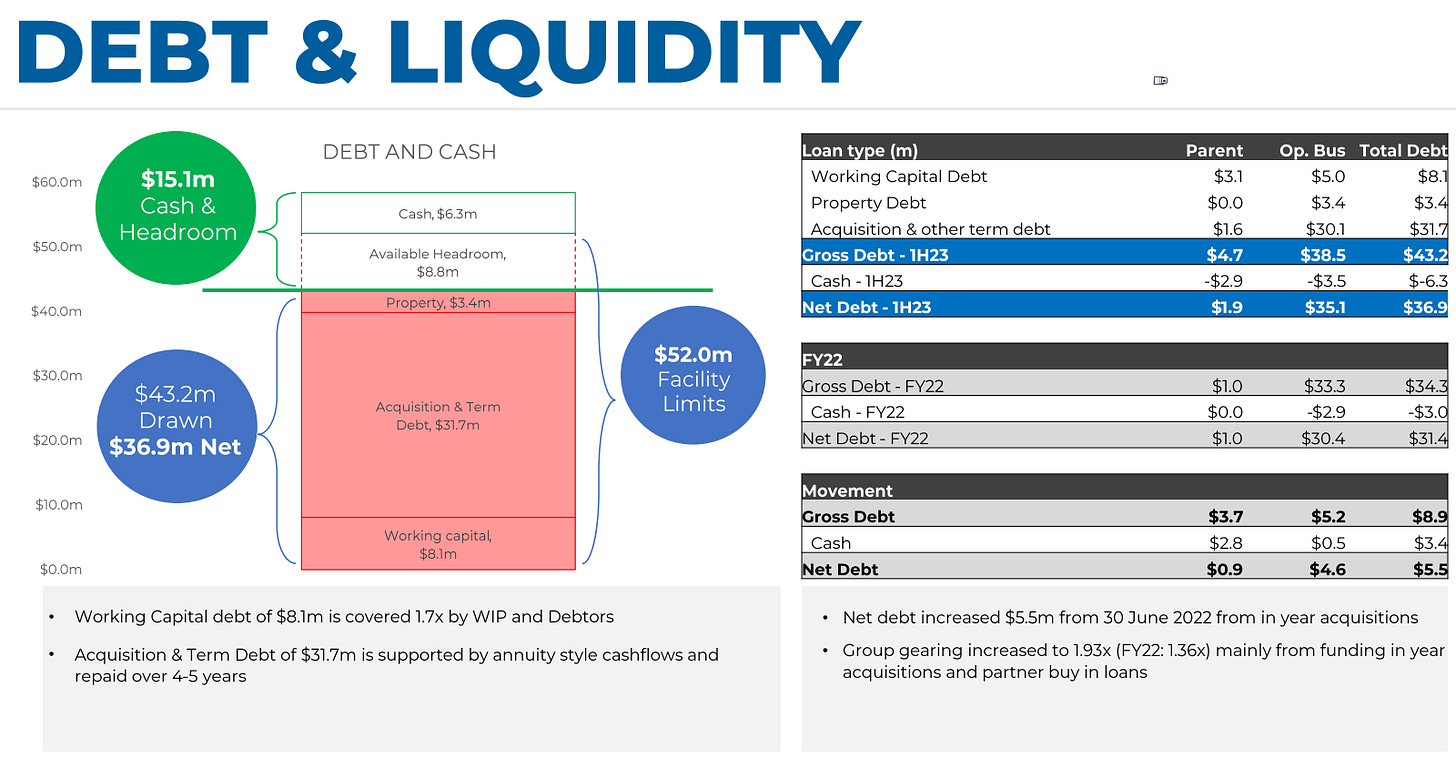

Awards under the CDP vest if the Company makes a gross cash distribution to shareholders in excess of £70million and up to £150million within a 7 year period from the implementation date of the plan. An adjustment is made to the value of any award under the CDP to take account of any vested share options that have previously been exercised by the participants, thereby preventing participants benefiting from both the CDP and a distribution in respect of any exercised share options.

At a gross cash distribution of £70m (the “Entry Point”), the award paid to Daniel Rabie under the CDP, the VCP and the EMI Chare Option Plan would be £5.0m and the award paid to Paul Haworth would be £1.75m. These amounts are based on the approximate values that, absent the CDP, would otherwise be paid on the participants’ fully vested and exercised share options.

Above the Entry Point to a gross cash distribution of £120m (the “Target Point”), the participants earn a linearly increasing share of the incremental distribution above the Entry Point. Daniel Rabie’s share increases from 7.0% at the Entry Point to 15.0% at the Target Point. Paul Haworth’s share increases from 2.5% at the Entry Point to 10.0% at the Target Point. Above the Target Point, the share of the incremental gross cash distribution earned remains at 15.0% for Daniel Rabie and 10.0% for Paul Haworth up to a maximum award payable at a gross cash distribution of £150m (the “Stretch Point”).

~ 2022 Annual Report

Again, this was very curious so I had to reach out to Paul to ask about this and here is the response he provided:

So Getbusy is plugging along very nicely, and now there is SUBSTANTIAL optionality on a divestment/sale in the future that is well in excess of the current market capitalisation, so I believe I’m in a nice position, despite already being up +27.5% on the position since making it in August 2022.

Smartgroup (ASX:SIQ) - 2.8% Weighting

The next 2 positions I have taken a smaller weighting in my new SMSF as I believe they have tailwinds along with a very high Grossed-Up dividend yield. For SmartGroup I did a thread on twitter which covers the basic thesis. You can read it below.

Smartgroup is paying an exceptional double digit dividend yield despite me thinking that their EV numbers will escalate significantly, which should result in strong organic growth over time as well.

FSA Group (ASX:FSA) - 2.6% Weighting

Another smaller SMSF position, FSA group I did a one page stock pitch on back in late january you can read below:

Effectively, FSA I believe to be a well balanced business that is positioned to benefit through the cycle from separate divisions of their business.

FSA reported their half year results in February with EPS down 18%, split out by a 9% decline in the lending segment and 35% decline in their services segment. Due to support provided by the government over the past few years, personal insolvencies have taken a backseat, so their usual countercyclical line is being impacted by government support. The lending side is suffering from an increased cost of funding and a growth related increase in staff numbers to support their loan pool. The group still maintained a 3.5c dividend, putting this on a near 10% dividend yield, meaning that any growth should result in above average results over time.

Auswide Bank (ASX:ABA) - 2.6% Weighting

Lastly, I bought a bank! Auswide bank is a QLD regional bank that like the above 2 stocks is paying a double digit dividend yield, but is also looking to grow their loan book by 50% over the next 3 years (15% CAGR), and in addition reduce their costs. Should they do this in a non-dilutive fashion we should see very impressive returns.

Historically Auswide has had low arrears and high credit quality. The obvious risk here is that they are majority exposed to personal mortgages. However, this doesn’t carry the same level of risk in my view as larger or international banks because:

Auswide has applied a policy of maximum debt-to-income ratio of 6x. Less than 5% of their loans are outside this ratio with no loans above 7x DTI. In comparison, according to regulatory data, more than 18% of the big banks' loans exceeded 6x DTI at September '22.

Arrears greater than 30 days past due of $3.9 million is just 9 basis points of the total book while greater than 90 days past due are at 5 basis points. There is no evidence of stress in the loan book at this point. These arrears do compare favorably with peers with the SPIN index for greater than 30 days for other banks at 53 basis points and for regional banks at 101 basis points.

Auswide is competing on low comparison rates as opposed to cashback marketing offers, and they have won a number of Mozo awards for low cost home loans. Due to this, they have been benefiting from a strong refininancing market driving loan flows as customers look to minimise their repayments.

Closed Positions

Kelly+Partners (ASX:KPG)

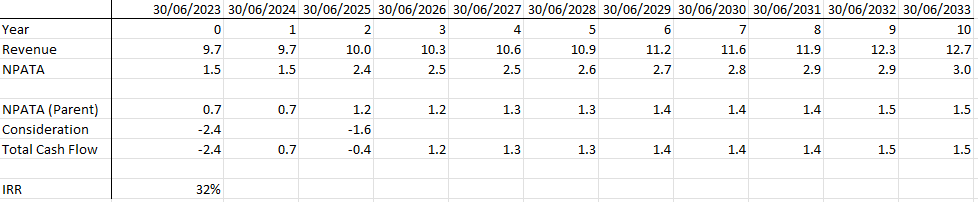

Probably the most important change during the quarter was that I sold the remaining Kelly+Partners shares I held, after cutting the initial holding by 3/4 during the 2022 year. Alternatives presented a much more compelling use of capital which was the primary reason for the switch. I could not justify remaining a shareholder at a ~30x multiple of earnings with peak debt covenants where there was things with most of their market cap in cash and significantly lower entry multiples on earnings to invest in.

Nevertheless, I remain a keen follower of any and everything Kelly+Partners and will consider reinvesting at the right price. At this stage however, you’re probably sick of hearing about it so I’ll keep it brief. There is extended thoughts here and here. The one thing missing from these is the first transformational deal the group has done since the CBD deal back in 2017.

The acquisition is a top100 firm doing $8.2-$11.7m in revenue, which would put it somewhere between the #58-75 ranking of FY22’s top 100 accounting firms. A subsequent announcement notes that a) the firm is based in the Riverina Region AND Sydney NSW and b) the firm has 2 accounting and tax businesses and a single workplace relations business. With this information in hand I am certain the firm is PinnacleHPC which did north of $11m in revenue in FY22. The firm has 10 Principals, 2 of which are consultants, which are typically what older partners move to after semi-retiring. Aside from the principals I count ~60 fee earners per the financial review list. Therefore the group is doing c. $1.1m in revenue per partner (including consultants) and c. $183k in revenue per fee earner (excluding partners), indicating perhaps 10% margin you can potentially extract out of the fee earners by pushing budgets up.

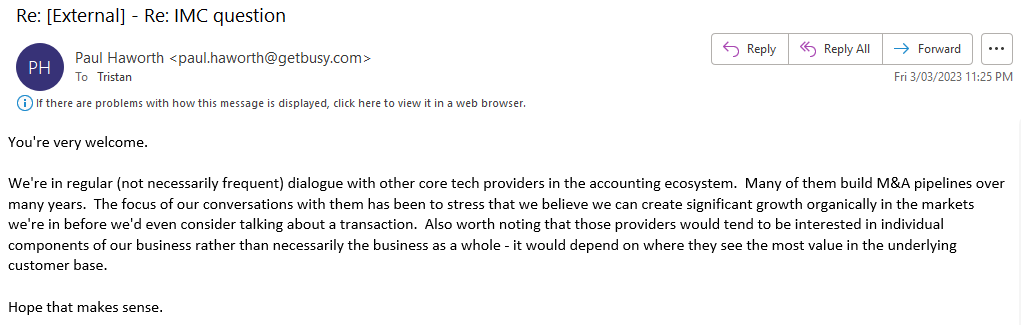

The group intends to use leverage to finance this deal and had $15m of headroom at 31 December 2022. But note that 60% is upfront so only $4.8m is going out this year on a consolidated basis. Given cash flow during the half to date is likely to of been ~$2m since this gives them still $12m+ of headroom to play with.

Lastly, the staggered payment dates and low entry multiple are likely to result in an IRR in the low 30’s for shareholders assuming all cash flow is pulled out by the parent, the firm grows at a modest 3% p.a. and that they successfully integrate the group to the targeted. See my crude model above. Nevertheless, the group is now pushing past $100m in revenue which is a nice milestone for those involved, at ~$240m EV it is valued at 2.4x Fwd EV/Revenue which given NPATA margins in the high SD to low DD yields a 4-5% earnings yield going forward. prior to this deal that was more like 3-4% but the 6.5:1 multiple arbitrage they can get on public/private acquisitions is so strong that it can quickly become reasonably priced again in due time. I will watch carefully with keen interest as before mentioned.

AF Legal (ASX:AFL)

Ah AF Legal has shown it’s ugly face again. After extinguishing the uncertainty I had about AF legal due to the trading update in early February I decided to buy back in (at double the size of my original position), which didn’t last long as I decided to consolidate my holdings down to 5 (not inc. SMSF) in the latter part of the quarter and this was still one of the most uncertain positions I owned so got put on the chopping block, but I did so at a handsome short term profit.

Nonetheless, AFL saw minor growth in the top line for the year, but was left with some pains left by previous management to clean up including a large goodwill impairment entry, aggressive debtor provisioning, aggressive useful life accounting and some golden handshakes for our useless outgoing management.

Going forward it won’t be an easy task to fix but I am confident in the team of Peter Johns & Chris Mcfadden (CFO). I will not write off investing into AFL again in the future as things play out as admittedly I did put a lot of effort into this analysis over time and was hard to reverse.

Kulcs-Soft (BUD:KSOFT)

Early on in the year I made a pretty silly tweet expressing my excitement on a little known Hungarian Accounting Software business seen below:

Whilst I do still believe to this day that KSOFT is an excellent business, due to it’s hungarian based revenue source, political instability, high inflation rate despite very high interest rates… the stock wasn’t nearly as cheap as suspected. Nevertheless I took a modest position and saw a very nice short term gain as a result. I paid HUF 1780 per share and subsequently sold for HUF 2200 just a month later, netting a 23% gain (inc. Currency).

The background here is that KSOFT was 95% owned by it’s founder, Tibor Kulcsar. Tibor no longer operates the day to day but remains heavily vested in it’s success evidently and has been frequently buying shares in the open market, which became the primary reason for my success here. The day to day is operated by Ervin Szabó (CEO) who came on in 2016 and put the business into overdrive

Begbies Traynor (LON:BEG)

Begbies was a position that I took in late December in an effort to hedge the impact of a weak M&A market, of which the latter came into fruition much sooner than anticipated with DSW Capital’s weak market update. However, the stock price of DSW adjusted accordingly and I had decided to cut my small losses on Begbies and double down on DSW. Nevertheless, I discussed this hedge in the DSW Capital (LON:DSW) - 2H23 Trading Update which you can go ahead and read. I will continue to monitor Begbies as I am curious as to how my initial expectations pan out over time.

PeopleIn (ASX:PPE)

PeopleIn is another one page stock pitch which i took a small position in my SMSF, however once I had seen what happened with Sequoia I rolled this into that and significantly increased the size of that position. In saying that, PeopleIn did release their results to market of which they generated +89% revenue (+21% organic) and +41% EPS (NPATA) and reaffirmed a ~$66m EBITDA result. With a ~13.5c dividend the yield is ~7% and the group intends to grow 10% organically over the following few years with acquisitions on top (historically 15% inorganic contribution).

Abak SA (WAR:ABK) & Euro-Tax (WAR:ETX)

Abak SA & Euro-Tax are 2 more one page stock pitches that I invested into, but not for long as I consolidated my holdings part way through the quarter into a more concentrated portfolio. Which is a quick 180 on what I said below

To which I followed up 6 weeks later with

So i’ve reversed my decision, bite me…

Nevertheless I reversed these decisions at minor profits.

Conclusion

Thank you for reading, these long form portfolio reviews are part of both my diligence to stay on top of my positions and the value for my paying subscribers, so I hope you get as much out of this as I do, thanks very much for reading.