Kulcs-Soft is a Hungarian Accounting Software business I have covered before on my Substack. It was founded in 1989 by Tibor Kulcsár. At first, the software was built custom to order to address specific customer problems but has built into a more standardised program over time as they grew their customer base. A good overview of the company from its inception through to 2013 is shown on their youtube channel (Beware of the cringe).

Kulcs-soft provides its software to small and medium-sized companies across both desktop and cloud channels, allowing it to effectively service businesses in both domains. Given the group’s age and predominately entrenched customer base, it has sparingly introduced cloud functionality in the interest of cost-effectiveness through bringing ‘only those functions that businesses really need into the cloud environment’. The business also operates a schooling program with training on payroll and GL preparation in both in person and online environments. Those who attend the academy get the benefit of not only CPD but also future discounts on their product offerings etc.

A word of caution, Tibor owns >93% of the company as of the time of writing, despite this I believe he has shown strong attention to the creation of shareholder value, as evidenced by the group’s strong earnings growth and commitment to paying all its earnings as dividends. On Tibor, He has shown exceptional stewardship and even the foresight to recognise that as he has aged, he is less able to keep up with the pace of change and therefore chose to appoint the current CEO, Ervin Szabo in 2016. Since Ervin’s appointment the group has particularly accelerated with a rapid improvement in margins since his appointment as CEO.

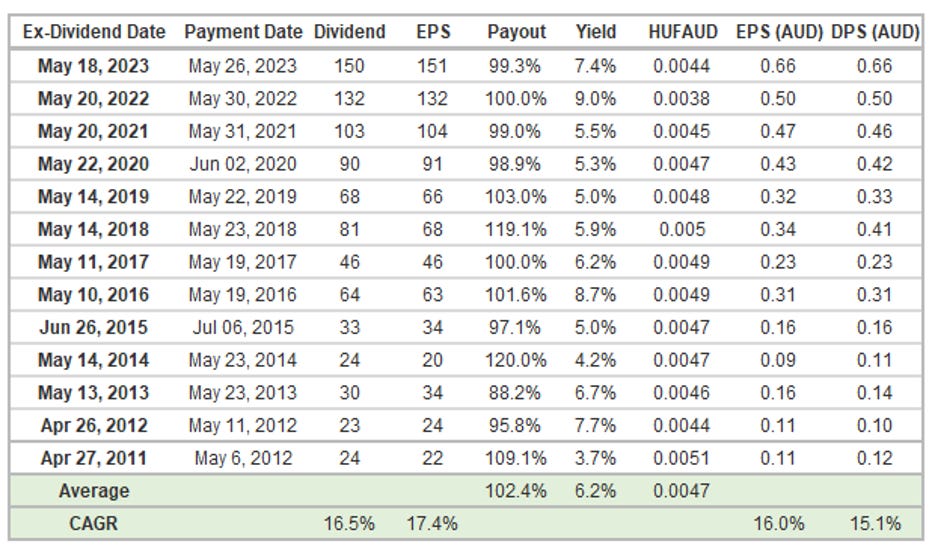

In the 12 years we have observable earnings have compounded at 17.4% p.a. with an average dividend yield of 6.2%. Therefore, an investor would have received a hold-return of 23.6% before the impacts of multiple or currency. Unfortunately, that return would have been diluted a bit by the gradual devaluation of the Hungarian Forint relative to the Aussie dollar to 22.2%.

In my initial write up I covered the Hungarian economy as an issue, particularly it’s 13% cash rate and mid-20s inflation rates as of May 2023. As of September 2023, the inflation rate has declined to 12.2%, relative to its long-term average of 6.3%. Meanwhile its cash rate has been at 13% since September 2022, but they have just recently as of October reduced it to 12.25%. This was off the back of cutting its overnight rates consecutively 100 basis points each month since May 2023. I am by no means an economist, but these are early signs of an improving economy which may assist the florint, my primary yardstick is the purchasing power parity of the currency, when this is declining it represents a strengthening of the florint. In the chart shown there is a minor strengthening of the florint between 2007 and 2010m and in this period whilst volatile, the florint saw strength against the dollar. A good outcome would be that this was to occur once more, and any devaluation would be halted by a good Hungarian economy.

Currently the group last paid a dividend of 150 Forint, a yield of 7.8%. In the year to date the EPS has grown from 151 in FY2022 to 170 in the LTM. It appears likely that the group may reach up to 190 in the current year, so I expect a forward dividend yield of 9-10%. Given the group is highly successful at compounding it’s earnings without capital, I am confident as well that the group can grow its earnings at high rates as well, such that any devaluation of the currency is well covered by what I believe to be an absurdly low valuation multiple for a business of this calibre. The group has a complex offering, no expected protection for minorities given the country and ownership, and the fact that all their material is in Hungarian it is of course difficult to have a strong understanding of the business, therefore it is prudent even if I think it is cheap to not size this so large. Nonetheless, I think that they have shown unprecedented quality of earnings and growth since their listing so I do want some shares in Kulcssoft.

Thanks Tristan, good update as always. Tibor was increasing his stake from 91.38% to 93.32% during the H1'23, I guess he was picking shares around these prices or a bit less (1600-1800). I really wonder what are his plans, with this increase in his stake he shows that he does not want to distribute shares to the free float, but does he want to take it private eventually? I mean if you already have a 91%, for what do you want 2% more?

On the other hand, the 100% payout is pretty nice with the minority shareholders.

Pre-pandemic prices went up to 3,300 HUF, so it could re-rate to higher multiple eventually...

Well, let's see, thanks again for the work and the writeups!