Praemium is one of the leading investment platforms in Australia for private wealth advisers with over $43 billion in Funds under administration across it’s various platforms on offer. It was founded in 2001 by Arthur Naoumidis, who left the business in 2011 to go on and become the founder of ASX listed DomaCom (ASX:DCL). For a primer of what Praemium does please watch the below product demo.

Several years ago I posted a quick pitch on Xplore Wealth (ASX:XPL), which was focused Moreso on acquisitive value than ongoing earnings power. Which proved to be a hit pick, receiving a takeover over at slightly above 3x the price at the date of posting just 10 months later. The core of that thesis was that the Funds under Administration (FUA) were significant relevant to the market cap (752x greater) and that peers were all trading at significant premiums to Xplore. Also, at the time I had estimated Praemium to be the next most attractive target at 92x the market cap. Furthermore, Onevue which was the 3rd most appealing was also acquired by IRESS (ASX:IRE) in June 2020, which represented a valuation of $119m or ~90x it’s FUA (super + platform) excluding it’s managed fund admin business.

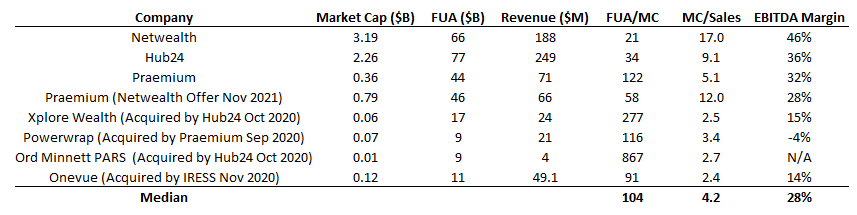

These days, Praemium trades at an market capitalisation of $358m and has total FUA of $43.7b as at 31 March 2023, representing a multiple of 122x. This is undoubtedly attractive from the perspective of an acquirer, especially when compared to peers. Using the Xplore Wealth approach we can see peers trade at multiples as shown below.

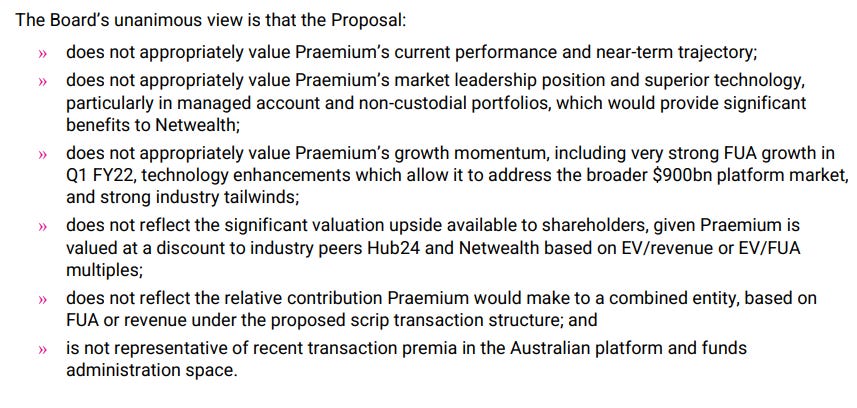

As shown in the chart, Praemium has had an offer from Netwealth in the past, at a stock price of $1.50 in November 2021, which at the time the Praemium board stated the following points. Notably, we can see here Praemium references the use of a FUA multiple, which I think is the most appropriate multiple for acquirers in this space.

Whilst there is appealing acquisitive value for Praemium, there is a risk as the Praemium board declined an offer at over double the current market price when the business was slightly smaller with lower margins. The board remains unchanged from that time, so they are unlikely to accept a lowball bid. Nevertheless, due to this I think it is necessary to consider the return you may get from simply holding the business.

With the sale of it’s international operations last year, the group has adopted the approach of a likely future dividend policy and an ongoing share buyback (which has seen it return $7.9m since September 2022 at an average price of 61.5c per share). The group has no carry foward tax losses ($11m in Hong Kong though…), and $3.8m in Australian franking credits ($14.9m at 30 June 2022 less the credits on the Special Dividend), meaning it is in the position to adopt a policy.

Furthermore it has a $15m regulatory cash requirement and holds $38.2m in cash, meaning $23.2m of distributable cash on hand. This puts it on an enterprise value of $335m, with a run-rate NPAT of ~10m this doesn’t scream cheap and of course, I wouldn’t blame you for thinking so. But would revert back to how high quality these business models are and what peer comparatives are willing to pay. Furthermore, with 5-year growth in Australian FUA per share of +570% (+46% CAGR) of which 80% was organic and 20% from the acquisition of Powerwrap. When considering the superior unit economics of the platform business, which benefits from both inflows from their distribution channels and market linked performance, these deserve to trade on premium valuations. Nonetheless, if you assume a comparable payout ratio to Netwealth and Hub24 of say ~60%, Praemium would offer a dividend yield of ~3% fully franked. A 5-year PEGY of ~0.68x is above the One-page stock pitches hurdles, albeit with an in-play asset I think Praemium is interesting.

Nice one mate.